Digital transformation isn’t new – it’s been happening in different industries over the past 20 or 30 years – with different waves occurring across various industry segments. In the 1990s, music, retailing, photography and video were all impacted by new entrants who used digital capabilities to change the way services were delivered and consumed. In the 2000s, TV, travel and recruitment were impacted, with the advent of YouTube, online travel sites and job posting boards. The 2010s find industries like retailing experiencing their second wave of digitization (first seen in the 1990’s) while financial services finally begins to discover the opportunities and challenges of digitization.

Beyond simply making current processes digital, today’s transformation is dramatically impacting the way in which customers interact with brands. Instead of visiting physical facilities, consumers in all industries are beginning their shopping and buying experiences online or with a smart phone, altering all phases of the traditional customer journey.

A new report, produced by Efma and Oracle Financial Services Global Business Unit, entitled ‘Digital Transformation – The Challenges and Opportunities Facing Banks’ looks at the current and future impacts of digitization within the banking industry. This report is the culmination of a series of three ‘Think Tank’ sessions hosted by these organizations.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Impact of Digital Transformation

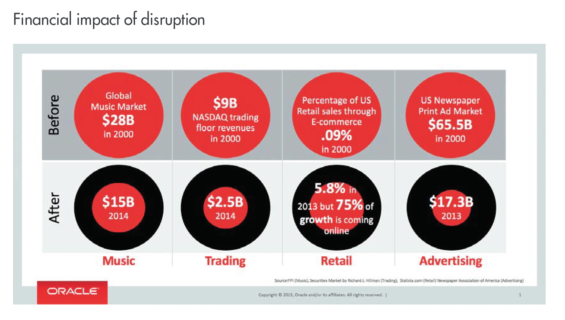

While a great deal of attention is given to the individual players that are impacted by digital transformation (Kodak, Blockbuster, Borders, etc.),there is often quite a large financial impact on overall industry segments. As stated in the Efma/Oracle report, “A clear example can be seen in the music industry, where the global market now is only worth about half of its value in 2000. Another example is with the newspaper print advertising market, which is about a third of what it used to be.”

Not only is there a major financial impact to digital transformation. The report also found that digital transformation occurs significantly faster at a much lower cost than transformations of industries in the past. In addition, because of the lower cost of entry, more players can be informed in the process (enter fintech start-ups). The consequence is a more rapid pace of change.

For example, as mentioned in the report, in Brett King’s book, ‘Banking 3.0’, he chooses a level of 50 million users as the definition of a target figure for a market. For planes and cars to reach this level took over 60 years. Credit cards took 28 years but more recently, contactless credit cards took only four years to reach 50 million users, while Facebook and Twitter took only 3 and 2 years respectively. “So, the pace of change is getting much faster and the financial services industry has to adapt if banks are to succeed and survive,” states the research.

Role of Fintechs

It is well documented that there is a mass influx of new competitors in the financial services space globally, with massive funding of both new start-ups and innovations by large, established technology companies like Google, PayPal, Facebook and Amazon. According to the research study, fintechs have primarily focused on three segments of the financial services industry: payments, lending and personal finance. The two main reasons why these are the primary segments that the fintechs are pursuing include:

- They are areas with significant fees and that also have a strong push towards a digital interaction.

- Fintechs want to be able to work cheaper, faster and clearer and to provide a better transparency of what’s happening.

Despite the aggressive competitive environment, the vast majority of fintech firms lack scale and market awareness. While part of this can be attributable to a lack of successful marketing by all but a few of the new entrants, the major hurdles for fintech firms include a lack of capital, no legacy customer base, the trust level afforded legacy financial organizations and the understanding of regulatory and compliance issues by traditional banking firms. As a result, many fintech firms (and legacy banking organizations) are pursuing partnerships.

“The fintech companies have the advantage in terms of speed, agility, and the capacity to understand and quickly build a very good user experience. However, they don’t have the legacies that banks have and they have a completely different mindset – and with the lack of scale and trust, it’s not as easy as it might seem for fintechs to move forward without banks,” says the report. Ultimately, some fintechs will obtain a banking license, others will partner with larger banks or perhaps later will be acquired by larger financial institutions, while others may do a bit of both.

Key Digital Strategies for Banking

Oracle has observed different approaches that banks have been using to help to drive a digital strategy as well as to react and deal with some of the fintech companies. The report explores four key digital strategies that banks have been using with varying success. These are:

- Launching a digital brand – This might involve positioning a new brand differently from the existing one, or developing a set of processes that enable the new digital brand to compete in a different way. Many different banks have done this across a lot of different markets. Examples include Fidor Bank in Germany, UBank in Australia and mBank in Poland. Digital brands focus on simplicity of design and ease of use through digitization. They also compete on price because as digital-only players, they can become more aggressive in this area, as they have much lower costs than traditional banks. Many of these brands have achieved relatively modest scale.

- Digitizing processes – This is a key area where traditional banking organizations can compete with fintech firms. To do so, legacy banks must digitize both front-office and back-office processes based on the expectations that have been set by all of the other digital brands (not just financial services). The key digital processes from the consumer’s perspective include customer onboarding, originations and relationship pricing.

- Modernizing the digital experience – The development of a digital enterprise is based around the four ‘Ps’ – Product, Price, People and Place. Place (which can be physical or virtual) refers to the need to enhance the digital experience at the point where the customer is. Unfortunately, the digital experience of many financial services companies tend to be rather dated. Key customer-facing digitization includes use of HTML5, responsive design, the ability to fully support all mobile devices, the integration of the Internet of Things, and even open APIs.

- Launching new digital capability – When looking at a new capability, organizations may want to deliver something completely new outside their overarching mobile app, such as money movement apps, mobile wallets or the use of data as ‘currency’.

Oracle also believes banks need to start thinking more seriously about how they can take advantage of innovations such as virtual reality, FitBit or the Internet of Things, as all of these will play an integral role in the future lives of consumers. They believe banking organizations also need to reexamine and transform the role of the branch, so that it becomes more focused on customer service and advice rather than transactions.

The Time to Take Action

It is clear that differentiation – and competitive advantage – is occurring based on the ability of financial institutions to embrace and implement digitization. The firms that aggressively pursue the digitization of both back and front-offices will be in a better position to compete for the increasingly digital consumer and will be able to reduce costs (and increase revenue) based on this transition.

As stated in the Efma/Oracle report, “Overall, although the financial services sector isn’t unique in terms of suffering from the effects of disruption, banks can no longer afford to sit back and do nothing. There are numerous new technologies that they should be taking advantage of – and they could learn a great deal from other industries who have already had to face disruption. Despite the problem of regulation, there are also still countless valuable insights that they could can gain from different sources of customer information that would enable them to sell more and also to provide better advice.”

It is becoming abundantly clear that becoming a ‘digital bank’ is quickly becoming ‘table stakes’ as opposed to a nice benefit or feature of today’s banking experience.