Organizations in every industry are trying to determine how to leverage advanced technologies to improve efficiencies and effectiveness, while improving the customer experience. In banking, the pressure to perform is intensified by new competition that is impacting every traditional line of business, using targeted solutions to attack revenues in payments, lending, investments and small business banking.

Research by the MIT Sloan School of Management’s Center for Information Systems Research in both 2015 and 2017 examined the capabilities needed for becoming a top performer in the digital economy. Not surprisingly, the research found that organizations prepared for the future performed the best. What was interesting is that there wasn’t a single path to success.

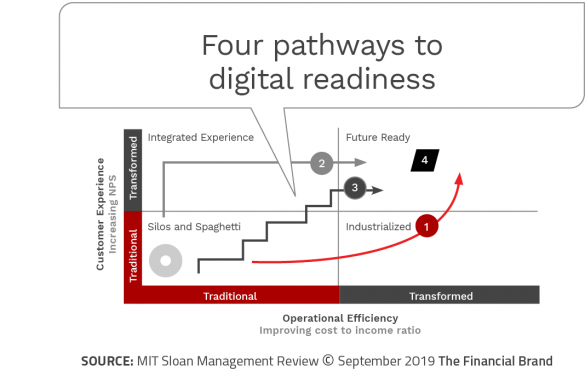

While oversimplified to an extent, the MIT Sloan research found that becoming ready for the digital future requires improving the organization along the dimensions of customer experience and operational efficiency. The overarching goal: To move from a “traditional state” (traditional customer experience and traditional operations) to a “transformed state” where net promoter scores or similar experience metrics and net margin or cost-to-income ratios improve.

The research found that 51% of organizations did “business as usual,” with product silos, fragmented sources of data and legacy systems. Improvements in either experience or efficiencies were an exception, as opposed to part of the overall plan at these organizations. At 15% of the organizations, customers receive a better-than-average experience, despite a back office that remains mostly analog in design. In these organizations, the customer experience culture overrides organizational flaws.

Alternatively, some organizations have found a way to improve operational efficiency, but have all but ignored the customer experience. Slightly more than one in ten (11%) organizations have transformed the back office without impacting the traditional customer experience. Finally, MIT Sloan found that close to a quarter of the organizations (23%) have used data, advanced analytics, new technology and a transformed culture to become “future-ready.” Organizations in this preferred quadrant perform 16% better than the industry average.

Read More:

- Financial Institutions Aren’t Prepared for the Digital Revolution

- How Bank of America and Chase Get Mobile Account Opening Right

- Becoming a ‘Digital Bank’ Requires More Than Technology

Fractional Marketing for Financial Brands

Services that scale with you.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Paths to Digital Readiness

So, assuming your organization has not optimized either your customer experience options or your operational efficiency, what are your options available to become digital-ready? The authors of the research, Peter Weill and Stephanie L. Woerner, provide four alternatives for successful digital transformation (moving from the bottom left to the top right quadrant above). Each option requires significant change and disruption within the organization.

Pathway 1: Standardization. The first pathway moves to the future-ready state by building API-enabled business services, getting rid of legacy systems to improve efficiency, and then focusing on improving the customer experience. This pathway is usually slow and very complex because it impacts the entire firm as part of the transformation. One of the major benefits of this pathway is that it moves the focus of the organization from products to customers.

Pathway 2: Customer Experience Focus. If an organization wants to focus on improving the customer experience across the entire organization before improving the company’s efficiency, this is the path to take. With this pathway, new products are developed, contact centers are improved, apps are updated, etc., all with the focus on improving customer satisfaction.

As the customer focus improves, the concentration shifts to building a new operating platform that will improve efficiency. The challenge with this pathway is that the focus on the customer experience can increase complexity initially before the new systems are built to improve efficiency.

Pathway 3: Stair Step Approach. This pathway moves to a future-ready state by alternating the focus from customer experience to improving operations. This pathway is made more possible today because of the ability to replace components of a legacy platform versus the entire back office, and by the availability of APIs.

This pathway requires a very structured approach where the entire organization is aware of the projects underway and the impact of each component to the overall strategy. This pathway has less risk that the other options since each change is smaller. Alternatively, changing the focus from step to step can add confusion to the organization as to the organization’s focus at any point in time.

Pathway 4: Build a New Organization. This option focuses on building a completely new subsidiary organization that is future-ready. By separating the new organization from the existing entity, many of the challenges around legacy systems and creating a customer focus are eliminated.

Two of the challenges include how to avoid embedding some of the old legacy thinking (or systems) in the new organization as well as how to integrate the new and old organizations. Sometimes, there is an internal battle against allowing the improved organization to ‘steal’ business from the less efficient, product-focused organization.

Read More:

- Digital Future of Banking Requires New Leadership Model

- What Makes A Great Digital Banking Transformation Leader?

Choosing the Best Path

For most organizations, the decision as to the correct pathway revolves around what part of the organization requires the most amount of improvement (customer experience or efficiency). Another factor in the decision is the level of urgency caused by the marketplace. The further from market norms an organization is, the more radical the pathway selected.

While any pathway is difficult to execute successfully, the process is made simpler because of current solutions available that allow a “plug and play” implementation instead of requiring massive back-office overhauls. Alternatively, the risk of doing nothing or moving slowly has never been greater. In most instances, the authors of the report found that strong, highly focused leadership is the key to success.