COVID-19 has become a digital banking ‘reality check’ for both financial institutions and the federal government. Despite all of the talk over the past several years about becoming a ‘digital banking ecosystem’, many basic digital banking deliverables are falling far short of expectations at a time when the consumer has few options.

From the opening of a new account, to the application for a loan, or even the cashing of a check or authorizing identities, the system is woefully inadequate to support banking without branches. Of greater concern is that the internal policies of many financial institutions will be tested over the next several weeks as desperate consumers try to get access to their government support funds, only to find out these funds may not be available.

“In conditions of social distancing raised by COVID-19, consumers may now divide financial institutions into ones they can use without leaving home, and those from where it is better to close their account,” states Alex Kreger, founder of financial UX design agency, UXDA.

The good news is that there is still an opportunity to fix a broken system that has been built around branches and physical identification as opposed to a true digital consumer experience. In every instance, a great opportunity is available for banks and credit unions to be proactive in their response to an unprecedented global crisis.

Read More:

- 7 Essentials of Digital Banking Transformation Success

- Digital Transformation Is About New Business Models, Not New Tech

- Will Cash Wither Once Central Banks Support Cryptocurrencies?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Be Prepared for a Check-Cashing Backlash

The vast majority of consumers are used to direct deposit with few physical checks needing to be cashed. For those receiving a physical check over the past few weeks, many have become indoctrinated into the world of mobile deposit capture. But what happens when millions of checks are delivered to consumers who have completely depleted their checking and savings accounts buying staples?

While consumers will have the expectation of immediate access to their funds from a government payment, most institutions will place a hold on the funds for several days … especially if there are not enough funds already in the account to cover the amount of the check. This delay for access to funds could be up to 10 days (or potentially longer for mobile deposit capture).

How do financial institutions reconcile the logic of promoting mobile deposit capture and then penalizing consumers who use the service more than those who don’t? And what happens if the consumer has an overdrawn account because of the current strain of unemployment? Do they only get access to the funds remaining after covering the overdraft?

We can assume that the situation for consumers without a current bank account will only be worse. All of these scenarios must be resolved in partnership between the government and the banking community before government payments are sent. Alternatively, financial institutions can review all of their security and identity protocols before checks arrive to ensure PR nightmares don’t occur.

Read More:

- Financially Stressed Consumers Turning to Digital Wellness Tools

- 3 Ways to Use Data to Build an Impactful Financial Wellness Strategy

Fix Your Digital Relationship Opening Process

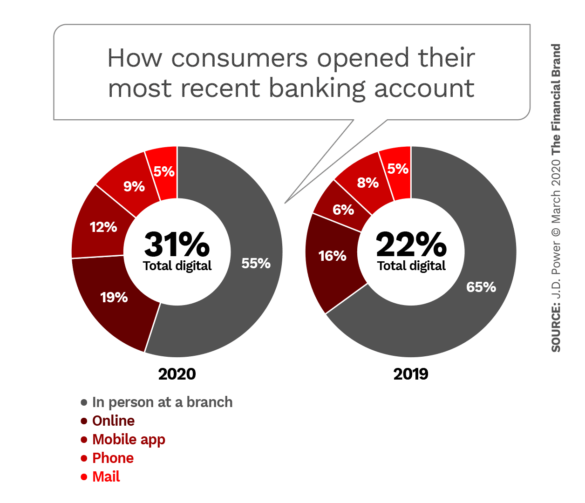

Before COVID-19, the majority of consumers used the branch to open a new account according to J.D. Power. The same was true of consumers and small businesses who wanted a loan. With most branch offices closed, this is obviously not an option. Unless your organization is prepared to not open another new checking, savings account or loan relationship for the foreseeable future, now is the time to:

- Reassess policies that prohibit the establishment of a new checking, savings or loan relationship of any type without branch engagement.

- Simplifying the digital relationship establishment process by removing steps and improving customer-facing design.

- Convert all back office operations to support new digital relationships using digital technologies and seamless integration.

Flaws in today’s processes are being exposed especially with the new small business government benefits program. Those firms not already set up to handle digital lending have been placed at a significant disadvantage, creating delays which impacts relationship growth. Many firms are doubling down on efforts to support digital small business lending as a result of the PPP initiative.

Flaws in today’s processes are being exposed especially with the new small business government benefits program. Those firms not already set up to handle digital lending have been placed at a significant disadvantage, creating delays which impacts relationship growth. Many firms are doubling down on efforts to support digital small business lending as a result of the PPP initiative.

According to Kreger, “The demand for remote services and e-commerce has rapidly grown, which has provided a window of opportunity for banks and fintech firms providing or willing to offer a solution in this area. In the context of global quarantine, this area of business is going to provide a huge growth opportunity.”

Communicate with Consumers as Individuals

Now is not the time to send a consumer to your website or deliver a general message that doesn’t recognize that you appreciate their relationship. The consumer needs to understand that you know them, are looking out for them and that you will reward them for their loyalty. This must be done with highly targeted communications. The message must be timely, specific and easy to understand. Like you, the consumer is under immense pressure. They need clarity and transparency.

This is an opportunity to identify micro segments of consumers with unique challenges that need quick attention. Some of these situations will allow your organization to provide proactive solutions. Using your call center to identify these opportunities that most likely exist elsewhere in your organization provides a springboard for broader communications.

“We’re seeing so many banks realizing we need to accelerate the notion of representing a single consumer across the entire bank,” stated Rohit Mahna, SVP and General Manager of Financial Services for Salesforce in an interview with the Banking Transformed podcast. “I’m hoping out of these hurdles and challenges related to this crisis, we’re going to see the industry really accelerate things that we’ve been talking about for a long time.”

Enhance Digital Identity Solutions

Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) requires that financial institutions use all possible technologies to verify a transaction and/or engagement. Many organizations still use legacy methods such as a government issued ID. Some simplify this process by allowing a photo of the ID to be used in conjunction with a selfie.

Neither of these methods are acceptable going forward. During this time of upheaval, fraudsters will take every opportunity to undermine legacy security processes, especially those that try to ‘look digital’. In addition, many existing processes of digital identification and onboarding are cumbersome and create added friction.

According to Deloitte, 38% of customers say user experience (UX) is the most important factor when choosing a digital bank. Using processes that require so much from the consumer impede a strong customer experience.

To address these issues, many organizations are increasing the investment in advanced digital authentication technology, according to Infopulse. This goes beyond physical biometrics, to include transaction monitoring in real time, machine learning and even behavior recognition.

It is expected that, as a result of COVID-19, the use of facial recognition will quickly supplant passwords and fingerprint recognition. This option, in conjunction with other digital tools will alleviate concerns around spreading of viruses via touch.

“Americans are turning to mobile banking as a way to take control of their finances and plan for their economic future,” states Ryan Caldwell, founder and CEO of MX. “With increased consumer engagement across mobile banking applications, financial institutions have the opportunity to not only deliver a great user experience, but also to provide meaningful advice and guidance that’s critical to the financial well being of consumers … especially during times of economic uncertainty.”