Covid-19 turned 2020 into massive stress test for retail banking providers. In many ways the industry as a whole did well, rushing out digital alternatives to in-person banking services as well as making spur-of-the-moment changes to terms and conditions.

Given that, it’s all the more surprising that the institutions that in many ways were made for this situation — online-only banks — didn’t shine. In fact they stumbled.

As a new J.D. Power study reports, “Despite what seems like a perfect environment for online banks to excel,” their satisfaction sank compared to the year-earlier survey. “The consumer-driven shift to digital channels should have created the perfect environment for direct banks to excel,” the company said, instead, satisfaction declined significantly.

Consumers who were hit hardest economically by the pandemic — many of them younger adults — expressed the most dissatisfaction, the research found. Yet even customers who did not suffer financially reported a less satisfying experience.

Not a single large direct bank escaped a decline.

Disconnect:

It’s more than a little surprising that the institutions that specialize in digital banking didn’t perform better during the pandemic.

By “direct bank,” J.D. Power is referring to online-only (or digital-only) institutions that offer checking accounts. Many also offer savings or money market accounts and CDs. Some large direct banks, however, such as Marcus and American Express, only offer savings products, and were not included in the rankings. Neither were neobanks.

As John Cabell, Director of Wealth and Lending Intelligence at J.D. Power explains, neobanks such as Chime, Varo Bank and Dave, despite having added many users during the pandemic period, don’t have enough market share yet to qualify. The study focuses on the largest direct banks, including Ally Bank, Discover, Charles Schwab Bank, Capital One, and E*Trade Bank.

So why did satisfaction plummet? And what does this bode for the future of these online-only institutions?

Read More: Satisfaction ‘Cheat Sheet’: How the Best Banks Earn High Scores

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Main Reasons for the Surprising Decline

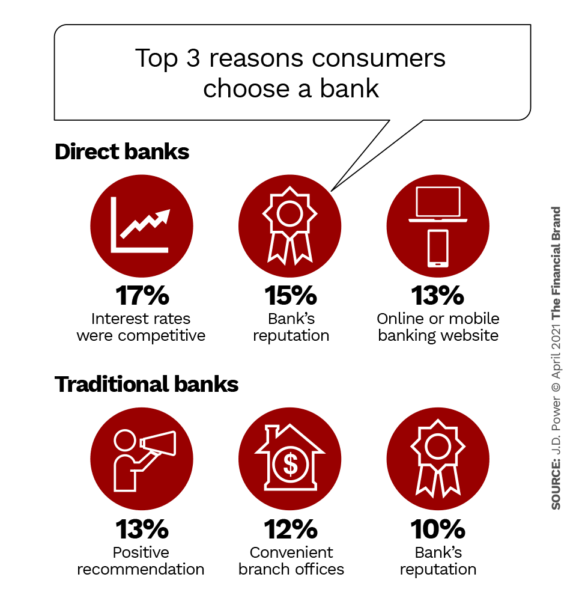

The reasons why consumers opt to use an online-only bank to begin with is at the heart of the satisfaction issue. While an institution’s reputation is among the top three reasons for choosing either an online-only or traditional financial institution, the number one reason consumers choose direct banks is “competitive interest rates.”

Not surprisingly, given where rates have been in the U.S. since the end of the first quarter of 2020, the lack of rate competitiveness was the biggest factor behind the drop in satisfaction. But not the only factor. More on that below.

Even though the deposit rates offered by direct banks are still higher than traditional institutions in many cases, rates overall are so low that consumers are not impressed. They miss the higher savings rates that existed prior to the pandemic.

A major consumer survey by Accenture, released in late 2020, found that “value for the money” is now the single most important factor to consumers in regard to dealing with financial institutions. 37% of a global sample chose value, moving it up from fifth place on the list in 2018. “Competitive pricing” was the third most chosen reason at 29% (also up), just a hair behind “Able to manage my account in a way that suits me” (31%).

Key Point:

Switching primary banking providers was low in 2020, says Accenture, but consumers who did switch were likely to say a better price or value was their main reason for doing so.

“The rising importance of price is partly a consequence of the sudden shift from relatively buoyant macroeconomic conditions to the economic stress and uncertainty associated with Covid-19,” Accenture states. “It is also due to the growing digitalization of the consumer banking experience, which causes customers to increasingly view it as a commoditized product.”

The consulting firm believes the focus on price will diminish as the economy improves. However, it recommends financial institutions demonstrate how they can assist consumers to improve their financial well-being. Personalized savings tips offered proactively through a mobile banking app, for example.

Pandemic Exposes Digital Channel Weaknesses

John Cabell points out that while direct banks continue to set the pace for online and mobile channel functionality, the pressures of the Covid year led to significant satisfaction declines with the digital experience. These related to clarity of information, ease of navigation and the appearance.

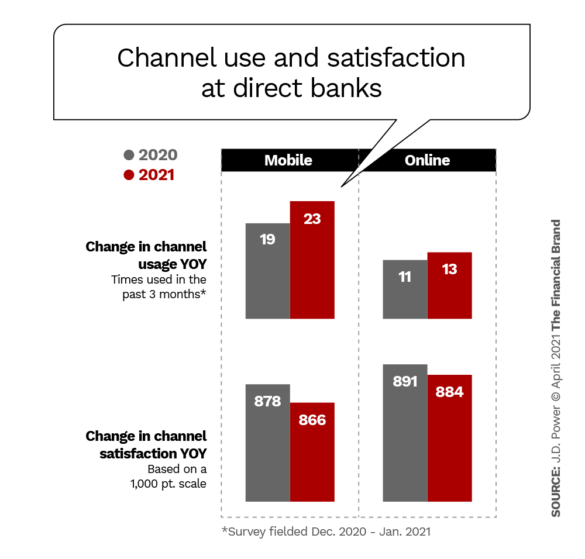

The chart below clearly shows that while frequency of use went up for digital channels at direct banks, satisfaction fell.

In an interview with The Financial Brand, Cabell observes that the financial situation changed for many consumers changed during 2020. “They ran into situations where they needed to know more about rates and fees,” he states. As they tried to find information, they struggled to make sense of what they found online because they haven’t had to dive into these terms and condition before. “People were looking for information on the website or in the mobile app that maybe either didn’t exist or that they couldn’t find,” Cabell states.

For the Record:

Aside from younger adults, for whom rates are a key factor, the digital experience is a much more important driver of satisfaction for most consumers, J.D. Power finds.

Website performance at the direct banks studied by J.D. Power declined in several areas, notably the ability to provide consumers with the information they sought. “We found that they needed more channels to complete whatever they were trying to accomplish,” Cabell explains. “The website alone wasn’t doing it, so they had to try a different channel to get what they needed resolved — social media, online chat and email. And then wait times went up.”

Performance declined in all three of these “assisted online channels,” says Cabell. Not only did response times increase significantly, consumers reported a decline in issue resolution, offers of assistance, and even being thanked for their business.

Cabell believes much of this will normalize as volumes normalize, but he adds that it’s crucial for direct banks to learn from the pandemic experience so that they are able resolve consumers’ issues or questions through these channels more effectively.

J.D. Power sees much the same situation across the board in financial services, Cabell states. And so despite the overall decline in satisfaction of direct banks, he says they have maintained “a pretty solid lead” over traditional financial institutions in overall customer satisfaction.

Read More:

- Data Reveals a Surprise Driver of CX Satisfaction in Banking

- Banking Must Measure Customer Experiences Across Entire Journey

- How to Avoid Sagging Satisfaction Scores as People Bank More Digitally

How the Largest Direct Banks Compare on Satisfaction

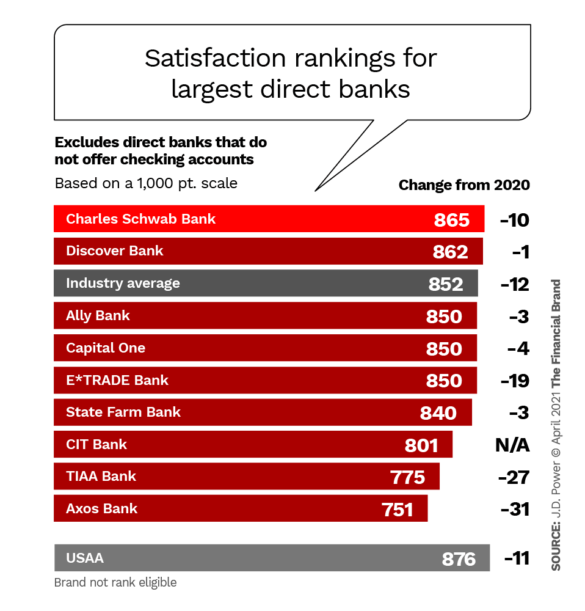

The J.D. Power Direct Banking Satisfaction Study measures satisfaction based on five factors, which are (in order of importance): 1. Activity on: website, mobile, assisted online, call center and IVR (voice response); 2. Communication; 3. Products (features and rates) and fees; 4. Account opening, and 5. Problem resolution. All this feeds into an overall score based on a 1,000-point scale.

As shown below, the entire sector lost ground in the 2021 survey, but Charles Schwab Bank remained on top for the third year in a row. The report notes that Schwab Bank’s biggest issue was problem resolution. Discover Bank, with the smallest decline among the group, moved from third to second place year over year.

For the three direct banks that had the biggest drops in satisfaction, Cabell says that rate competitiveness and frequency of communication “really took a nosedive” for these institutions.

USAA, although included in the study, is not eligible to be ranked. Cabell explains that the institution has a closed membership model (military personnel and their families only), which disqualifies them.

As the chart shows, however, USAA would have been the top performer, despite a double digit decline in satisfaction. “Some of their high performance is due to technical execution,” says Cabell, ” but they also have very strong brand affinity with their members.”