To be competitive in the evolving financial marketplace, banks and credit unions must provide mobile and online banking solutions that exceed customer expectations. According to an online survey conducted by The Harris Poll on behalf of Computer Services, Inc. (CSI), while consumers are increasingly satisfied with basic digital services, there are higher expectations around how financial institutions can help people reach their financial goals.

The good news is that, similar to Amazon Prime, meeting higher digital banking expectations could provide a way for banks and credit unions to monetize financial solutions. The key will be to provide an enhanced level of value that digital consumers crave.

Consumers Satisfied — for Now — With Basic Digital Banking

According to the 2018 Consumer Poll, an average of 86% of all Americans said they were happy with their financial institution’s current digital banking offerings. Interestingly, there was only modest variation of responses when delineated by age or socio-economic status. Respondents age 65+ having the highest satisfaction level (89%), while the youngest consumers (age 18-34) had a similar satisfaction rate (82%).

Part of this satisfaction level could be the result of how consumers select banking partners. In other words, research shows that younger consumers are increasingly selecting bank and credit union providers based on digital capabilities. They may be satisfied because they selected organizations with the best digital capabilities in the first place, while older consumers (with lower expectations), are satisfied without switching.

“When it comes to their banking relationships, consumers expect to have easy-to-use digital banking services as well as consistent experiences across all channels,” said Steve Powless, CSI’s Chairman and CEO. “While the majority are satisfied with their current digital services, that doesn’t mean banks can rest on their laurels.”

To this point, customer satisfaction with digital services is a moving target, changing quickly as new innovations are introduced and as industry leaders set new benchmarks.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

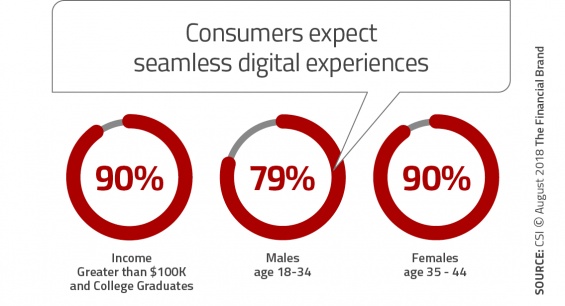

Consumers Expect Seamless Experience Across Channels

CSI’s poll found that nearly 9 of 10 consumers (86%) expect a seamless experience across all devices and channels. In the study, higher-income households and females are less accommodating, while younger males have lower expectations. Consumers want the look and feel to be the same even if they switch between channels midway between the beginning and end of an engagement with their financial institution.

Unfortunately, the gap between expectations and reality is huge. According to the 2017 Account Opening and Onboarding Digital Banking Report, less than half of financial institutions surveyed can complete an online opening process without visiting a branch. The ability to complete a mobile account opening on a smartphone is less than 25%. Less than one-third of organizations surveyed allowed a stop-and-resume capability during account opening.

Consumers are used to a much better experience through most digital partners in retail, travel, hospitality, etc. Seamless integration between channels is no longer optional in banking, representing “table stakes” for any digital consumer. Despite the importance, CSI found that only 48% of bankers put developing a positive omnichannel experience as a top priority in 2018.

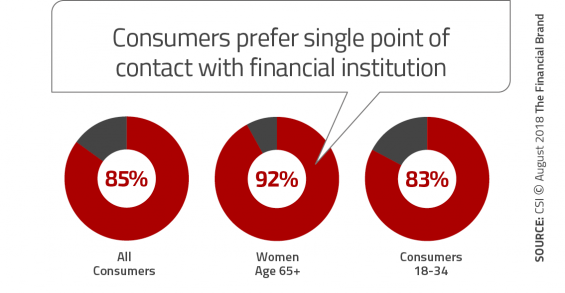

Consumers Want a Single Point of Contact

The ability to integrate consumer data with advanced analytics and machine learning has increased expectations around advice and problem resolution. The Harris Poll/CSI study found that 85% of consumers want their questions to be answered by a single banker. Not surprisingly, older consumers have higher expectations, while younger consumers have set the bar lower.

To satisfy today’s consumer, branch personnel need to be better trained on products, services, financial solutions and even technology, since many consumers have as much difficulty navigating digital apps as they have product questions. This training will not only answer consumer questions but can assist in consumer training on self-service opportunities.

At the end of the day, consumers want their financial institution to know them, look out for them and reward them … as individuals. This requires financial institutions to provide access to consumer data, analytics and potential financial solutions at each point of contact (call center, branch, website and mobile app). It also requires training staff in all customer contact positions to a higher service standard.

Consumers Want Privacy and Data Security

It really doesn’t matter how well your digital apps perform, or if the customer experience is excellent, if you can’t keep consumer information secure. The good news is that consumers who were surveyed believe in their bank’s ability to keep their private information … private. As age and income rise, the confidence in traditional banking organizations increases.

But confidence in the banking industry is only strong until the next cyber breach. Therefore, no financial institution can stop looking for new ways to protect personal data. Consumers appreciate additional authentication capabilities like biometrics, as long as these methods don’t slow down the digital engagement process.

The study found that an opportunity exists in person-2-person (P2P) payments, where almost half of consumers believe mobile-based payments are more secure than card-based transactions. Maybe now is the time to use security as a major selling point for mobile-based payments of all types.

“Banks must make constant strides toward cybersecurity and consumer data protections,” Powless said. “However, the rising trust in mobile payments provides financial institutions the opportunity to not only reinforce their commitment to security, but also move the needle on customer usage of P2P solutions and tokenized mobile wallets.”

Consumers Want Rewards

When consumers were asked about what it would take to increase engagement with and use of digital applications (specifically payments), close to two-thirds of consumers mentioned that rewards would do the trick. The number jumps significantly for younger consumers and males between 35-44.

With mobile wallet use increasing, the ability to move the needle even further will rest with financial institutions’ continued promotion of the benefits of continuous usage. Building this higher level of engagement is the new key to digital loyalty.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

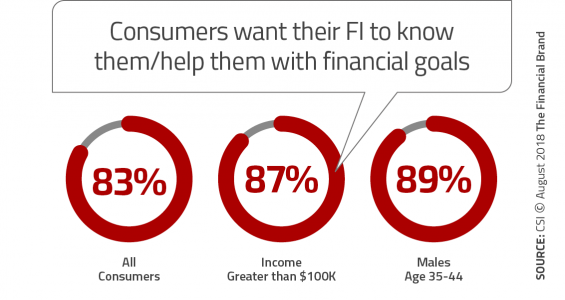

Consumers Want Proactive Advice

It is no longer enough to notify a consumer after the fact about a major change in their financial status or an upcoming financial opportunity or risk. More than 4 of 5 consumers (83%) want their financial institution to assist them with their financial goals and to anticipate financial needs. The number jumps even higher for wealthier households and men aged 35-44.

This is good news for financial institutions that are investing in data collection and advanced analytics, and it should be a point of concern for institution that still look at consumers as part of a large segment as opposed to individuals. Consumers do not want budgeting tools – they want financial recommendations and advice proactively and in real time. In the future, this insight could be a way to monetize digital relationships, as long as banks and credit unions see this opportunity as a ‘value transfer’ as opposed to simply a cross-sell opportunity.

“With consumers expecting banks to anticipate their needs, financial institutions constantly need to innovate and educate their customers on the newest tools available to meet financial goals,” said Powless from CSI.

How Banks and Credit Unions Should Respond

Increasingly, consumers are making decisions regarding which financial institutions to partner with based on a broader perspective of experiences. The combination of data, advanced analytics and new digital technology provides an amazing opportunity to differentiate in the marketplace.

The Harris Poll/CSI research provides many areas where banks and credit unions can improve engagement and increase customer satisfaction. Each of the desires expressed by consumers provides a roadmap for strategic planning, investment, prioritization and tactical implementation. They also provide the opportunity for monetization of digital solutions if value is provided.

Now that several of the ingredients have been identified, how many organizations will take advantage of this recipe for success? How many will avoid the legacy strategy of providing value for free and appropriately price-superior digital solutions?