According to consulting firm Accenture, traditional financial institutions are out of sync with the realities of the Digital Age. They can either continue on their current course — hemorrhaging piles of cash on an aged infrastructure and dated processes that are no longer relevant — or they can reduce fixed costs, grow revenues and reinvent the customer experience by adopting the “agile” philosophy.

The “agile” approach may not be widely deployed in the banking industry, but it is not a new concept. It began years ago as an iterative method to develop software, rooted in continuous feedback and speed to market. Other industries like manufacturing and retail have since co-opted this adaptive and nimble strategy. With so many financial institutions drooling over the disruptive power of über responsive fintechs and longing for the CX aptitude of Silicon Valley’s giants, you’d think more management teams in banking would have adopted this approach by now.

So how do banks and credit unions become agile? Accenture says the building blocks of the agile banking provider are customer obsession, unconventional collaboration and an adaptive operational backbone. Within these, there are five distinct characteristics that truly define the agile financial institution:

- Fast Twitch. Dynamically expanding and contracting the distribution model in response to a granular understanding of market demand, making channel decisions quickly and frequently.

- Test, Learn, Tweak. Replacing complex and time-consuming distribution processes with quick wins based on near-term demand forecasts and continually adjusting offerings as the market dictates.

- Right Channeling. Developing a new intelligent distribution engine—a flexible infrastructure that creatively combines the digital and physical to help grow market share without traditional branches.

- Customers First. Creating products and services that deliver hyper-personalized customer experiences to specific segments, offering customers “what they need” not “what the bank has to offer.”

- Revenue Ready. Improving distribution costs by transforming fixed costs into variable costs and investing savings in revenue generation opportunities.

Most traditional banks and credit unions are inward-looking and make decisions based on what’s best for running the operation. Old school financial institutions focus on making internal processes more efficient, not the customer experience.

An agile financial institution, however, shifts its focus from inside-out to outside-in, focusing on what consumers want/demand. The unique characteristics of each institution’s market determines what product features should be offered, which micro-segments should be targeted, how tailored communications should be crafted, and the touch points where CX must be emphasized. For agile institutions, these market-driven change happens fast and often.

An agile institution understands customers deeply, and infuse a disciplined, customer-first perspective into everything they do. Agile banks also must collaborate on a whole new level — changing why they collaborate, with whom they collaborate, and how they collaborate. And they must anticipate and react to market demands at speed, empowering innovation teams with a bias for action.

No matter where you fall on the agile continuum, Accenture says you must go through the following four steps.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

1. Confirm Your DNA

There are two dimensions banks and credit unions should consider when evaluating what Accenture describes as your underlying identity: your level of agility and your level of specialization.

Accenture says you’re less agile if you rely on branches to generate business and have a complex infrastructure. You’re more agile, however, if you have a more flexible infrastructure and rely more on digital channels and social media to generate business

Similarly, you’re specialized if you put customers first, offer a narrow set of products, serve a targeted geography, compete on advice and product differentiation rather than price. You’re less specialized if you compete on price and convenience, focus on the mass-market, and have a legacy infrastructure that slows you down.

Agility is the endgame for all banks and credit unions, says Accenture, but there is more than one business model that supports agility. You can choose to be either “specialized” or you can choose to be “efficient”. Here’s how the two models compare:

A specialized agile financial institution focuses on:

- Personalized consumer advice

- Niche financial products

- Non-financial services by partnering with third-parties

An efficient agile financial institution focuses on:

- Scale and efficiency

- Simplified, low cost, commodity products

- Modular products that can be individualized

2. Release the Oxygen

Accenture says banks and credit union have tied up too many resources supporting aged branch delivery models. Branches are effectively sucking up all the “oxygen” a financial institution has available. The time, energy and money dedicated to branches needs to be released.

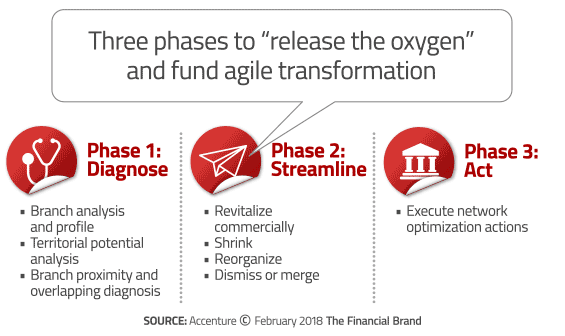

Accenture calls this process “releasing the oxygen”— identifying the true value of out-of-date distribution investments and strategies, then recalibrating them to support agile ways of working. The primary purpose is to help eliminate inefficiencies and selectively cut costs, a process that involves three phases:

You’ll need data to diagnose the performance of each and every branch, including traffic, consumer profits, market share, and proximity to your other branches. Find the underperformers and determine if they can be saved or if they should be shuttered. And if branch closure is on the table, what’s the impact on consumers? If a branch is worth saving, can it merge with another branch or shrink in physical footprint to lower distribution costs?

3. Walking a Mile in The Customer’s Shoes

An agile banking provider is obsessed with the customer experience. They organization makes decisions first based on what’s best for the customer, then on what’s best for the financial institution.

You need to understand what consumers want and feel, and the only way to do that is through empathy. Where’s the friction in your processes that impact consumers? What annoys them about your institution?

Accenture recommends building an agile bank through the lens of the consumer experience and then backing into the technology and products you need. But most banks and credit unions get the order wrong — they decide on technology and products based on what’s best for their institution.

“All touch points must be redesigned through the lens of the customer experience,” Accenture says. “customers do not care what back- end solutions the bank invests in—from customer data management to analytics, content management and marketing automation. They want assurances that the bank knows them, understands their needs and preferences and can suggest the right offers at the right time.”

4. Finding Those Sweet Spots

Agile means the ability to move quickly and easily — to be responsive. So it stands to reason, says Accenture, that the agile banking provider is always in motion.

Agile is a disciplined approach to find, test and change the organization’s “sweet spots” across markets, customer segments and products and services. Agile institutions are always uncovering and testing ideas on both consumers and staff to create a continual, iterative feedback loop.

“Where traditional financial institutions often bristle at change, agile banks thrive on it,” states Accenture. “At the agile bank, no idea is every really finished.”