Over the past seven years, we have conducted global research on the state of financial marketing. Every year, we find new challenges and opportunities in this rapidly evolving field, and 2019 was no exception. What we found in the 2019 Financial Marketing Trends report, sponsored by Salesforce, was that digitalization of marketing is more prevalent than ever. In other words, banks and credit unions can’t rely on traditional marketing tactics that have dominated past efforts.

Digital marketing strategies are changing faster than ever, with new technology, apps, social media platforms, and search engine updates impacting the ways you can capture a larger portion of your target market. And while financial marketers are allocating more of their budgets to digital tools and innovation, most of those surveyed by the Digital Banking Report rated themselves as relatively low in digital marketing maturity … despite having high ambitions for their ability to reach the digital consumer.

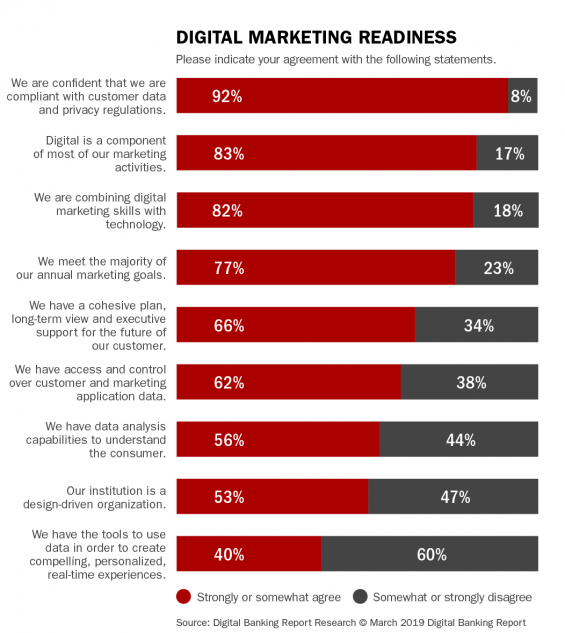

For instance, while marketers we surveyed felt comfortable in meeting regulatory and basic marketing needs, just over half (56%) believe they have the data analytics capability to understand the consumer. More concerning, only 40% have the tools to provide “compelling, personalized, real-time experiences.”

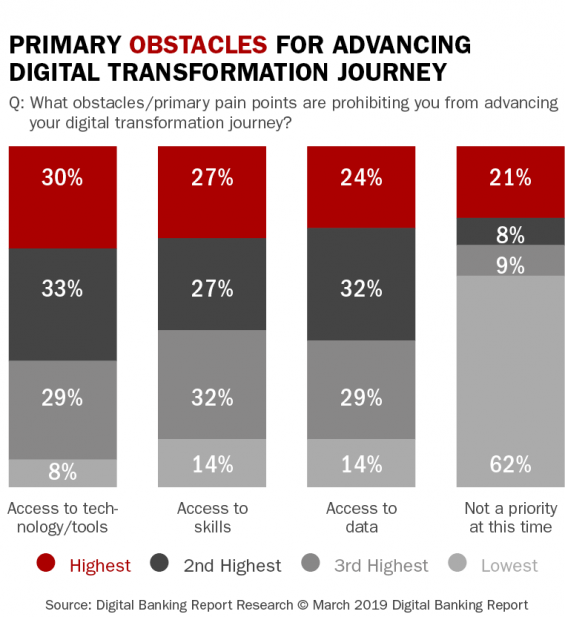

Most challenges revolve around the digital marketing transformation that is occurring in the banking industry. While some organizations have embraced the changes required, many more organizations struggle with many of the components of this transformation.

Brian Solis, principal analyst at Altimeter Group and best-selling author, defines digital marketing transformation as “the realignment of, or new investment in, technology, business models, and processes, to drive new value for customers and employees, and more effectively compete in an ever-changing digital economy.”

When looking to address the need for digital transformation, financial CMOs we surveyed provided insights into the challenges they face. Fortunately, most of the challenges found in this year’s report can be addressed and overcome with the marketing tools and technology that are available to financial institutions today.

Here are some of the challenges and ways we believe they can be overcome.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

1. Data Management and Insight Deployment

Effective management of big data is crucial for digital marketing transformation. This includes the ability to collect, assimilate and analyze data, as well as to deploy solutions in real time for each targeted consumer. This challenge is compounded by the reality that most banks and credit unions manage multiple siloed systems that contain only partial perspectives of customer relationships, interactions, behavior, etc.

While the collection and analysis of data has always been at the forefront of the marketing process, financial institution CMOs now need to absorb more data, faster and with more accuracy than ever before. Consumers are increasingly aware of how much information their financial institution captures about them and the potential to use this insight for their benefit.Bottom line, the effective management of consumer data is increasingly defining an organization’s success.

Some financial institutions are working to gather and centralize customer data into one platform. The benefit of this strategy is that all teams can access a single view of the consumer whenever they need to. This enables better management and processing of data.

Other organizations are leveraging the power of their solution providers to pull from disparate data sources to improve the quality and accessibility of data and to support marketing and back office operational activities. This solution bypasses the need to replace legacy platform systems immediately, while leveraging the reliability, scalability, security and flexibility of the cloud.

Read More:

- The Future of Financial Marketing: ‘Show Me The Money’

- Data Analytics Performance Gap Ruins CX in Banking

- Why Financial Marketers Struggle Getting ‘Persona Strategies’ Right

2. Understanding the Customer Journey

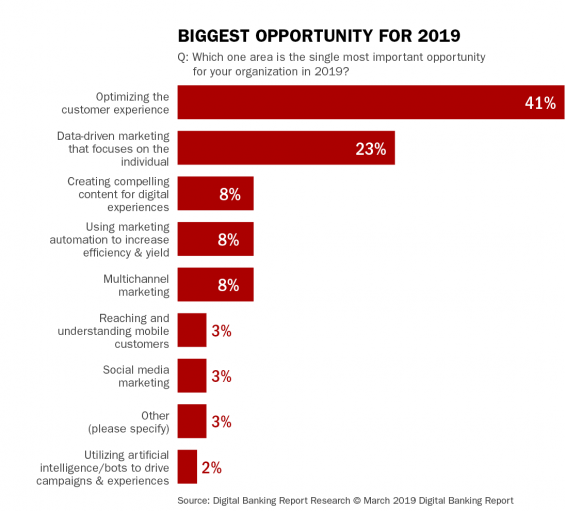

The consumer is at the center of any successful digital marketing transformation. Improving the customer experience has been at the top of every priority list for financial institutions for almost a decade, with the ability to personalize communication and engagement being key to success. The challenge is to understand the individualized needs of the digital customer as well as to understand the customer journey.

What our research found was that, while advanced technology is important to enable digital transformation, it is not the most important factor. More important to the ability to understand the customer journey and respond to consumer needs is a supportive culture and journey mapping that requires evaluation of data and flows and interdepartmental communication.

Optimizing the customer journey requires cooperation between different departments within organizations. Sales, operations, product management, customer service and even finance must work with marketers to understand the path to purchase. Without top-down support, this cooperation is difficult to attain. Management needs to support the marketer’s goal of mapping the customer journey across the organization.

3. Finding Needed Talent

Digital marketing can no longer be assigned to a young intern or a part-time worker who understands social media and blogging. Today, digital marketing is at the center of every effective marketing plan – because the majority of consumers live and work in a digital world where they are connected 24/7/365 to digital interactions.

From how consumers research and make purchase decisions, everything is digitally intertwined. And, because digital communication techniques and channels are constantly evolving, financial marketers need people who understand how to take advantage of opportunities in the marketplace that are increasingly available in real time.

Unfortunately, these people are in high demand and supply is tight (and growing tighter). Adding to this challenge, most experienced digital marketers aren’t actively looking for new employment opportunities – especially not in financial services. Many of the most talented practitioners are in large cities working for some of the most progressive marketing agencies or tech organizations.

Many organizations have found two paths to shrinking the skills gap: internal training and partnering with outside providers. The benefit of working from within is that many of the basic skills of marketing and understanding nuances of your organization already are in place. Your goal is to find a way to train in areas such as social media, coding, digital technology, etc. A warning – trying to make a single person or small team wear all of the hats of a digital marketing expert is almost impossible. Just like with traditional marketing, there needs to be a blend of breadth and depth of knowledge.

Because many of the needs of digital marketing are not always full-time requirements, a relationship with a full-service marketing agency or specialized service provider can be extremely valuable. These type of organizations are often in a better position to attract top marketing talent because they provide a diverse client base and broad creative challenges. Over time, your organization may find the need for full-time specialists, but until then, the partnership alternative may be the best route.

4. Using Advanced Technology

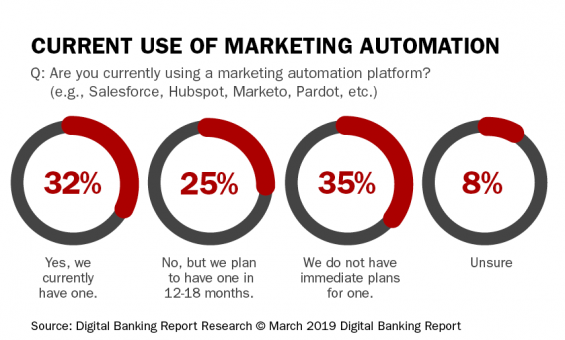

The most significant challenge posed by digital marketing is the amount of time involved in working to the required level of detail. Whether your organization is a top six bank or a community credit union, marketing automation can vastly improve both the efficiency and effectiveness of your efforts. In fact, according to Salesforce, marketing automation has been found to drive a 14.5% increase in sales productivity and a 12.2% reduction in marketing overhead.

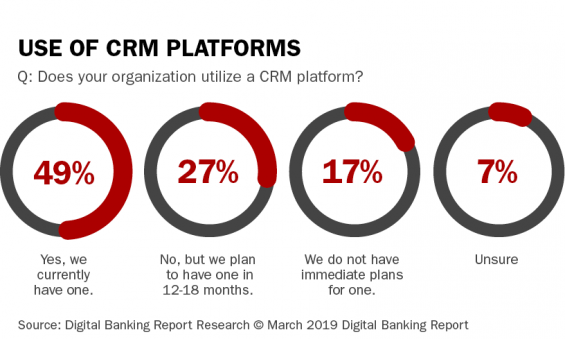

Similarly, CRM technology allows organizations to keep track of where customers and members who are in the sales funnel, what content they are engaging with the most, and other valuable insights to inform your marketing decisions (or automatically act upon them) in the future.

For marketing automation to succeed, organizations must have an understanding of what is expected from the technology. This requires mapping out a clear path that will take each customer from where they are, all the way through your sales funnel. There needs to be a plan for success and a way to get there.

There are many tools available, but making a choice is essential for today’s digital marketer. Not only do these tools free up time, they also allow you to engage with your contacts in a more personal way that would be possible working manually. Effective marketing automation must revolve around your customer or member and provide them with content that meets their needs.