As a companion to the highly read article published by The Financial Brand, the Digital Banking Report entitled, 2015 Digital Banking Trends & Predictions has expanded the examination of the most important changes expected to impact the financial services industry in the next 12 months. The 63-page report includes 27 charts and graphs illustrating many of these trends.

As a companion to the highly read article published by The Financial Brand, the Digital Banking Report entitled, 2015 Digital Banking Trends & Predictions has expanded the examination of the most important changes expected to impact the financial services industry in the next 12 months. The 63-page report includes 27 charts and graphs illustrating many of these trends.

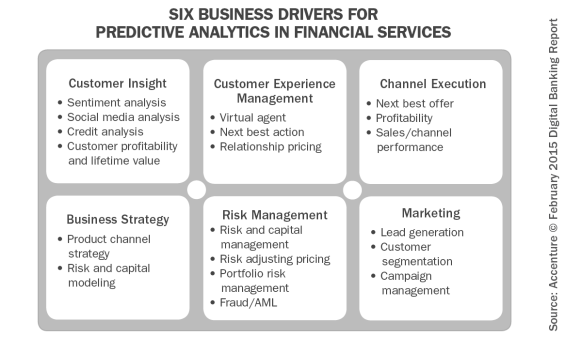

As mentioned in the crowdsourcing article, improved use of customer analytics was the banking industry’s #1 expectation for 2015. It should not be a surprise that greater integration of digital technologies cut across all of the trends and predictions offered by the more than 60 global industry leaders.

The good news is that many of the banks and credit unions we have talked to have already adjusted their strategies to reflect the 2015 trends and predictions. The bad news is that most organizations have a long way to go to move ahead of the digital curve from the consumer’s perspective and in response to an increasingly competitive environment.

Top 10 Digital Banking Trends and Predictions

The top ten digital trends covered in the Digital Banking Report (in no particular order) include:

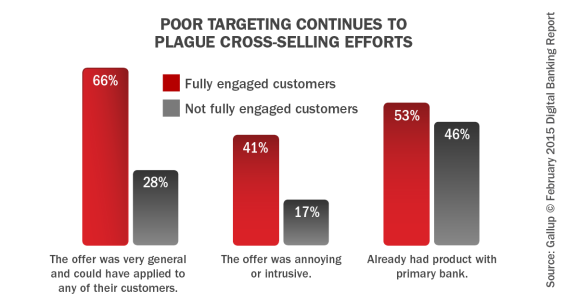

1. Increased Use of Customer Analytics. Our crowdsourcing panel overwhelmingly agreed that understanding customers/members is the foundation to a sustainable competitive advantage in banking. As a result, organizations can no longer wait to embrace the power of advanced analytics to gain insights and evaluate opportunities that will improve cross-selling, increase up-selling and enhance customer value.

2. Expedited Deployment of Digital Delivery. Digital banking is more than getting consumers to use online or mobile banking or building a new app – it is a way to run an entire organization. In 2015, digital technology will touch product development, distribution, front and back office operations, marketing communication and the entire customer experience.

3. Focus on Mobile-First Design. It will be harder than ever to meet the increasing demands of the mobile banking consumer in 2015. As opposed to accepting mobile versions of online banking applications, the digital consumer wants the simplicity, contextuality, time savings and entertainment value offered by Amazon, Uber, Waze and their favorite retailer’s mobile app.

4. Increased Digital Selling. The process of establishing a new banking relationship is changing, with consumers using multiple channels to research and open new accounts. The financial services industry has not kept pace, using old school methods to reach shoppers and customers. Understanding the the needs of consumers and the new path-to-purchase will be the key to success in the coming year.

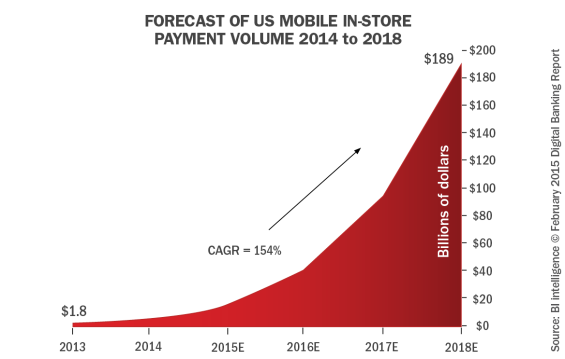

5. Acceptance of Mobile Payments. Despite all of the attention on mobile payments in 2014, the use of mobile devices to make in-store payments is still extremely rare, and done mostly by millennials. Our crowdsourced panel believes 2015 will be the year that Apple Pay, CurrentC, Softcard and other mobile initiatives make mobile POS payments a much more mainstream occurrence.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

6. Focus on Security and Authentication. Malware and hackers have become an increasing threat. In response, voice biometrics, fingerprints, iris scans, and other authentication options will begin to replace passwords as a means to verify a user’s identity and simplify the online and mobile login process in 2015. The key will be to provide enhanced security against hackers while improving the overall user experience.

7. Industry Consolidation. Being challenged by escalating costs to comply with new regulations, acquire new digital technologies and combat new competitors, more financial institutions will grow their business through increased M&A activity in the next 12 months.

8. Enhanced Customer Incentivization. In a constantly connected, mobile world where everything is at our fingertips, consumers have a new expectation of wanting things quickly, easily and in the moment. This expectation will challenge banking to look for new opportunities to engage consumers. Instant “on-the-go” rewards will be an approach that will combine the benefits of points, merchant-funded rewards and geolocational in-store incentives.

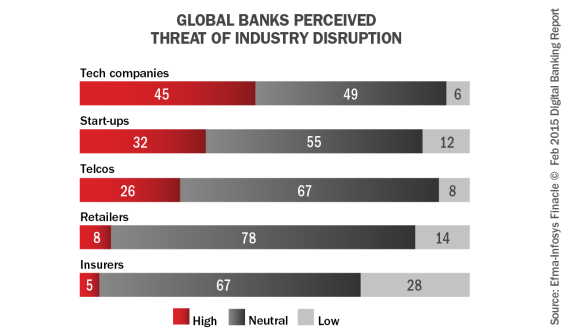

9. Investment in Innovation. To respond to increasing demands from consumers and to combat the threat from financial industry entrants such as Google, Apple, Facebook and hundreds of smaller firms, more financial institutions than ever will continue to increase their investment in innovation in 2015.

10. Increased Impact of Digital Disruptors. According Accenture, 35% of banks’ market share in North America could be in play by 2020 as traditional branch banking gives way to new digital players. To combat this shift, institutions will take a radically new approach to distribution, combining a simpler yet more comprehensive branch offering with integrated digital services. In addition, some firms will acquire some of the new technology start-ups to improve agility and reduce risks.

Digital Banking Report Order Information

The 2015 Digital Banking Trends & Predictions was available at a single issue price of only $395 but is now offered at no charge compliments of Kony, Inc.

Annual subscriptions to the Digital Banking Report are available for individuals, teams and entire enterprises. Annual subscribers not only save hundreds of dollars compared to buying reports individually, but also have online access to more than 150 reports in our digital archives.