A rare positive impact of the Covid-19 pandemic is that it accelerated digitization beyond all imagination. As Microsoft CEO Satya Nadella said, “We’ve seen two years’ worth of digital transformation in two months.”

Digital consumerism is at an all-time high: it is estimated that U.S. online sales gained an additional $107 billion from the pandemic between March and August, according to Digital Commerce 360. From online education to telemedicine, there has been a substantial increase in every sphere that can be straightaway attributed to the pandemic. Banking is no exception. A BAI survey conducted in August 2020 reports a significant increase in both digital banking users and usage.

Clearly a lot of this change is permanent. In the BAI study, 87% of users say they will maintain digital banking usage levels even after the pandemic is over. This means that the industry’s digital laggards that fell further back as digital adoption increased, will not recover lost ground anytime soon. But even digitally progressive institutions have their challenges.

Digitization has leveled the playing field, nullifying many of the traditional advantages of incumbents, especially reach and distribution. With all players, great and small, having easy access to customers, it is the quality and scale of engagement that makes them stand out.

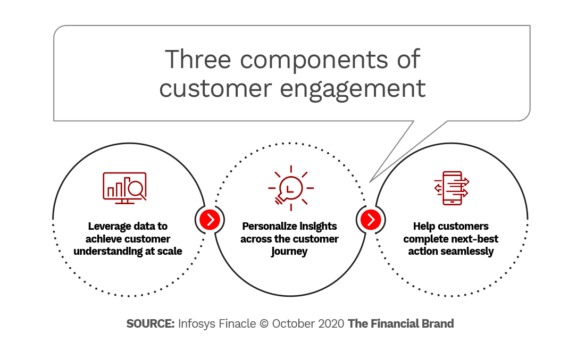

Engagement is a three-step process of understanding the customer, gleaning personalized insights and completing the next-best action. Leveraging the power of various digital technologies, a bank or credit union can replicate this process endlessly in any given population.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Step 1. Leverage Data to Achieve Customer Understanding at Scale

It’s no longer necessary to sit across a table to know a customer. Banks and credit unions have access to an abundance of information, including but not limited to a customer’s financial relationships, personal data including demographic and life stage markers, immediate context like location and activity, and preferences and behaviors gathered from both internal and external channels. By using this data effectively, financial institutions can get to know a customer intimately for a fraction of the time and money they would have spent in a branch, at a scale and depth that was unimaginable even a few years ago.

A great example is U.S. Bank, which tracks major life events to forge new customer relationships. Some time ago, the bank discovered through analytics that in many cases, it did not have a relationship with a deceased client’s beneficiaries, who would move the account to their own institution, according to Forbes. It then began to proactively reach out to such beneficiaries to explore how they could continue the engagement.

Step 2. Personalize Insights Across the Customer Journey

As far back as 2006, 80% of banks in the U.S. offered online banking services. Since then, digital channels have become the primary mode of banking around the world. When all financial institutions offer pretty much the same services on the same channels, however, it takes a special effort to stand out. This is where personalized insights come in.

Banks and credit unions that employ a variety of insights to personalize interactions engage customers better even though they have the same channels and services as everyone else. By using descriptive insights to apprise customers about the happenings in their financial lives (e.g., categorized credit card expenses); diagnostic insights to explain the happenings (you saved less because you spent more on entertainment); predictive insights to point out what is likely to happen (you may face a penalty for missing a loan installment); and prescriptive insights to recommend a path of action (rebalance your investment portfolio with debt funds), banks and credit unions strengthen engagement across the customer journey.

Read More:

- Data and AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

- How Banks Can Begin to Catch Up with Amazon’s Personalization Genius

- Finding Your Financial Institution’s ‘New Normal’ CX

- Banking Needs 360-Degree View of Customer Journey

Step 3. Help Customers Complete Next-Best Actions

After recommending a certain action, a financial institution must make it easy for the customer to follow through. This means eliminating friction from the customer experience, providing the necessary resources (data, tools, links, helpdesk) to support the decision and, where possible, automatically triggering the action. For instance, if a bank or credit union recommends a mutual fund, it should provide links to the offer document and rating agencies. If the recommendation is to sweep excess funds into a high yielding deposit, the institutions should monitor the checking account balance and automatically trigger the action.

The focus should not only be on digital self-service but also on assisted channels. Financial institutions should digitally augment call center agents, relationship managers and customer-facing staff to enable them to have productive conversations. This is what Commonwealth Bank of Australia is doing through its Customer Engagement Engine, which suggests to staff on any channel — branch, mobile, online — the “next best conversation” they can have with every customer.

Begin With Your Purpose

All this may seem like a tall order for institutions that are already struggling during the Covid-19 pandemic. It may also be difficult to think clearly when volatility, uncertainty, change and ambiguity are at their peak. At such times, it is best to go back to the basics and approach the situation with first-principle thinking. Banks and credit unions should be guided by the purpose of their organization and of their customers.

Customers usually want only one thing — to pay, borrow, save, invest and manage their overall finances better. And so every engagement should be about helping them fulfill this primary purpose. With the help of digital technology, incumbent institutions can achieve this at population scale.