If you are like most people, you have grand personal and business related aspirations for 2018. Maybe you want to lose weight, achieve a better life balance, or change a bad habit. Or maybe you want to help your organization create a better experience for your customers or members, measure results better or leverage new technologies for success.

Unfortunately, unless you’ve planned carefully, your journey towards success will be impacted by hurdles and challenges that may quickly derail your best intentions. With any resolution, you need a very detailed and specific plan with action steps already thought out. Your goal(s) need to be realistic and you should start your journey as soon as possible.

Other keys to success with a resolution are that you need to set time aside to focus on your goal, find a community of people/organizations with similar objectives, measure your progress and have a strategy in place if your initial goal gets sidetracked.

Becoming a Digital Bank

Over the past year, The Financial Brand and Digital Banking Report have covered dozens of major initiatives organizations need to consider to become a digital bank. The importance of becoming a digital bank has also been covered in numerous articles that have been read by thousands of banking executives worldwide who understand that there is no option but to change the way we conduct business.

The confluence of massive data availability, new digital technologies, an expanding competitive landscape and consumer expectations that are increasing exponentially, makes it clear that no organization can sit back hoping that we can relive the past. Every person who works in the banking industry must personally commit to digitizing their domain. This includes front-office, back-office, senior executive, managerial and administrative personnel.

Below are some of the most important resolutions organizations need to consider in 2018. The priority of importance depends on how far from optimal an organization is in becoming a ‘Digital Bank.’

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Fractional Marketing for Financial Brands

Services that scale with you.

1. Commit to the Application of Data and Advanced Analytics

Creating advanced internal reports using customer insights and advanced analytics is only the first step. Customers or members must benefit individually from what you know about them. Offers and communication must be personalized, in a contextual manner, in real time.

Consumers are no longer satisfied with you telling them what has already occurred. They want their bank or credit union to know them, look out for them and reward them for events that you believe will occur in the future. Imagine the difference between a rear-view mirror and a GPS system. Consumers want to be advised about the best actions they should take for their specific journey.

Achievement of this resolution is different for each organization, based on where an organization is on the data analytics continuum today. Some organizations still deal with consumers in mass or in broad segments when they communicate or do marketing. Other organizations are already applying advanced analytics (including artificial intelligence (AI) and machine learning) to improve the consumer experience.

There is no resolution that is more fundamental or foundational than the ability to use data and advanced analytic tools for the streamlining of internal operations, measuring of results and the creation of an improved consumer experience. Without a commitment to this resolution, all subsequent resolutions are doomed from the start.

Read More:

- Digital Banking Transformation Begins With Quality Data

- Digital Banking Transformation is a Journey, Not a Destination

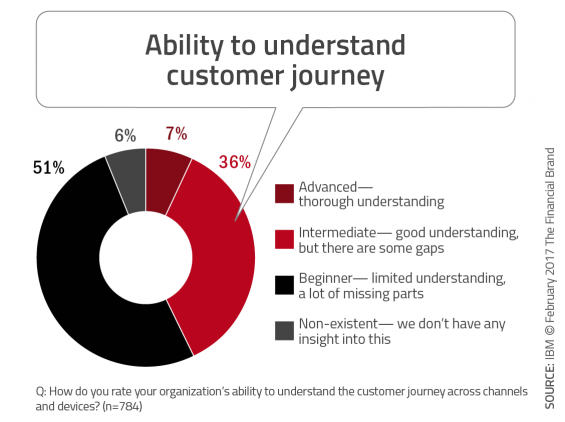

2. Digitize the Customer Engagement Process

Consumers want to interact with their financial institution where, when, and how they want. This requires the ability to open new accounts or complete applications through any channel, and to be able to switch from one channel to the next without starting the process over. The customer or member should also be able to initiate relationships seamlessly, without leaving a channel if they prefer.

Beyond the ability to open or apply for new accounts digitally, consumers want their financial institution to get to the point of “know me” as quickly as possible, so it can “understand me” and “reward me”. Therefore, digital onboarding is also an expected capability.

The overlap between acquisition and onboarding must be kept in mind. In reality, acquiring a deposit account should be the first step in the onboarding process. Influencing account usage as well as recommending additional solutions is part of building engagement and trust. All of these steps can be done using digital technology and digital channels.

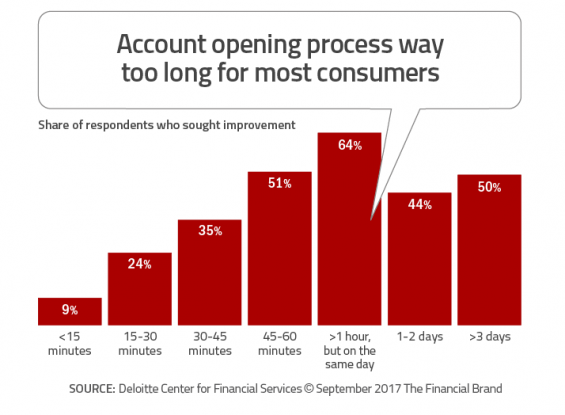

With most consumers doing their shopping for new banking products and new financial services providers using digital channels, there is an expectation that they should be able to complete the purchase process online or with a mobile device. Making the prospective customer change channels (usually by coming into a branch), creates an opportunity for frustration and eventual account opening abandonment. This results in lost revenue, broken trust and negative word of mouth.

Providing a seamless, simple and engaging digital account opening and onboarding process should be a top priority at all banks and credit unions in 2018.

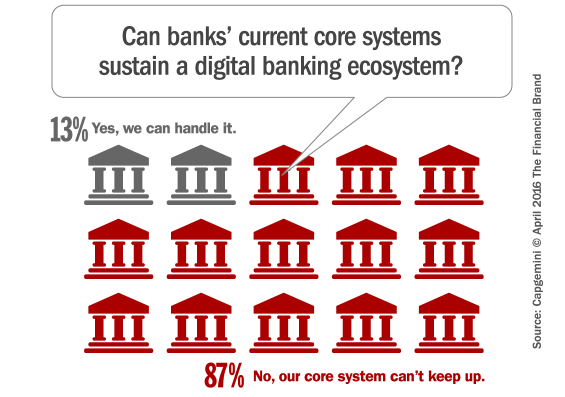

3. Digitize Back Office Processes

Early investments in providing better digital banking apps has resulted in a significant shift in customer channel preferences. Unfortunately, not updating core systems has resulted in more complex back offices and an inability to provide a seamless, real-time digital experience overall. The fact that 87% of organizations do not believe their core systems can keep pace has resulted in 80% telling a Finextra study that they hope to replace their core systems in the next 5 years.

Most organizations are still using technologies and systems from fifty years ago. In most cases, the only difference is that we are accessing these systems through digital devices. This is not a road to success.

Chris Skinner, financial industry futurist stated, “Digital is not a channel or function, but it’s a fabric and foundation of the new bank. The new bank needs one common digital infrastructure that underpins the whole organization. The new digital bank will have buildings and humans layered upon that digital infrastructure, but it needs to convert thinking from having a physical foundation with channels on top, to a digital foundation with access through physical and digital media.”

Everyone is talking about automation, digitization, robotics, etc. – but not about preparing for automation. According to Bill Heitman, Partner and Managing Director at The Lab Consulting, “Installing new digital banking technology doesn’t help much unless the routine task processes that are being automated are first closely examined and streamlined – applying the principles of ‘industrialization’ and efficiency management to white-collar jobs as blue-collar work was industrialized over 100 years ago.

Without a review and revamping of these underlying processes, any digital banking initiative will fall short of full optimization and, at worst, simply automate already dysfunctional processes.

Read More: Emphasis on Digital Banking Demands Changes to Onboarding Rules

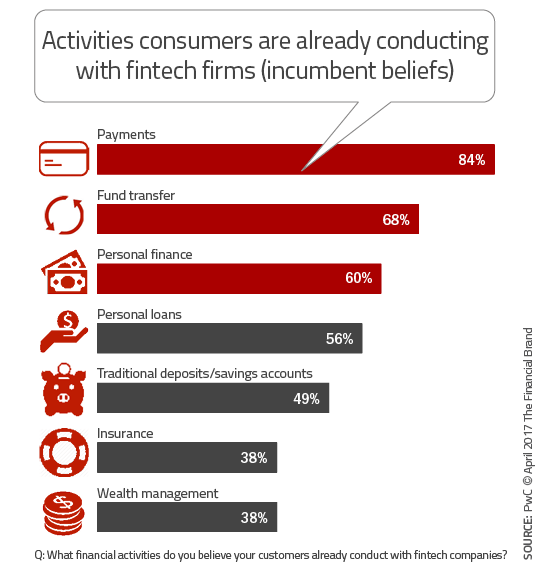

4. Work With New Digital Providers

In the Global Fintech Report, PwC found that 88% of legacy banking organizations fear losing revenue to financial technology companies in areas such as payments, money transfers and personal loans. The amount of business at risk has grown to an estimated 24% of revenues.

In related DeNovo’s research from PwC, it was found that 30% of consumers plan to increase their usage of nontraditional financial services providers, with only 39% planning to continue using solely traditional service organizations. This is an additional wake-up call to legacy organizations to determine how they will retain the key components of an existing banking relationship.

In response to this threat, 82% of traditional financial organizations stated a plan to increase collaboration with fintech companies in the next three to five years. Similarly, almost 50% of financial services firms are planning to acquire fintech startups over the same period.

Mainstream financial institutions are rapidly embracing the disruptive nature of fintech and forging partnerships in efforts to sharpen operational efficiency and respond to customer demands for more innovative services. Bottom line, fintech startups need capital, experience and customers. At the same time, banks and credit unions need new approaches to drive change and deliver innovation.

Fintech collaboration is not about grabbing for the ‘next shiny object’ — it’s about intuitive product design, ease of use, and 24/7 accessibility. Embracing fintech is as much about different ways of working and problem-solving as it is about deploying new technology.

It will be close to impossible for incumbent financial organizations to ‘go it alone’ given the speed of technological change and customer expectations. Even with the benefits of fintech partnering or acquisition, there are still challenges with legacy IT architecture, operational silos and an outdated leadership culture. To succeed, organizations will need to move quickly to embrace a future that will be significantly different than the past.

Read More: What the Surge in Fintech Launches Signals for Banking’s Future

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

5. Rethink Your Distribution Model

Today, the vast majority of shopping for financial services (or virtually any consumer product) is done using the keyboard on a computer or mobile device. As consumers in all age categories become more comfortable with digital technology, the shopping experience may even include voice commands. The question is – are financial institutions prepared for this shift in shopping and buying behavior?

According to Novantas, “The majority of U.S. shoppers are now in segments that either don’t use bank branches, don’t care much for branches … or both.” This seismic shift in preference will have profound implications for the way banks and credit unions acquire and service customers in the future.

Bottom line, as transactions start to shift away from bank branches, the emotional attachment will follow. And as the emotion around branch banking changes, so will the criteria for selecting a financial institution. In fact, the correlation between a dense branch network and the propensity to acquire a higher share of deposits has weakened significantly. Of special note, the correlation weakened the most for older age segments and higher income segments.

The industry is deluged with research on the importance of branches. Study after study proclaims that consumers want branch access and they don’t want their favorite branch closed. While there are indications that physical locations still are needed, the importance of banking branches in relation to digital capabilities has seen a continuous decline.

In fact, with the growth in digital technology and the increased acceptance of online and mobile banking, access to banking products and transactions is no longer tethered to a physical location, resulting in a redefinition of convenience. Today, while convenience is still the primary driver of initial consideration, the importance of branches in that definition has gone down.

As a result, the importance of investing in digital capabilities has never been greater. With consumers only considering two banking organizations in their shopping process, and doing their shopping on digital channels, coming in third is not a viable long-term strategy. To be considered, a bank or credit union must not only have a strong digital banking offering, but promote this offering as well.

Setting Your 2018 Resolutions and Sticking to Your Plan

In providing some examples of key areas in need of improvement industry-wide above, it is hoped you can determine some specific, realistic and actionable resolutions for yourself and your organization. As with any resolution, you should begin your journey immediately and get as large a community to support your efforts as possible.

Each step you take is important to your future and the future of your organization. You will be faced with doubters and naysayers around your mission, but the need to become a digital bank is not optional. If you need to see what happens with inactivity, you only need to use the retail industry as an example.

If you need encouragement in your journey, continue to read The Financial Brand and subscribe to the Digital Banking Report. Both resources will provide continuous research to support your efforts and case studies of organizations that have succeeded in their efforts to become digitalized.

Good Luck.