Financial marketers can sometimes be obsessed with customer data, and rightly so. Data — the right data, rightly used — makes so much possible. Before digital technology, it was difficult to assemble a true customer profile that consisted of data beyond basic address information and what accounts they held (if that). Now, of course, tools are available that allow banks and credit unions to finally see a complete picture of a customer, including what people want (and don’t want) from their banking provider.

In today’s fast-paced world, this is an indispensable concept. Yet, somehow, many financial institutions are still behind the curve when it comes to actually utilizing the data they see on a daily basis.

“The online activity is replacing the traditional in-store and the face-to-face experiences that customers have had in the past with brands,” says Dan Renner, a marketing, sales and service transformation specialist at PwC. “As the digital landscape layers in complexity and evolves, competition for customer attention will continue to increase.”

Renner and PwC partner Brian Morris spoke with eMarketer about the ways in which banks and credit unions should be maximizing their customer data instead of collecting it haphazardly. One of the biggest themes they emphasized is the use of a customer data platform — or a CDP. Not wholly new, the CDP is the creation David Raab, who founded the CDP Institute in 2013.

What Is A CDP?

A customer data platform is a marketing software that uses first-party data from multiple sources to create a single customer profile.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

“A customer data platform will allow you and your organization to make them most of your customer data,” Renner explains. “How do we capitalize on the fact that we have a tremendous wealth of data? We need to be able to rationalize that to understand our customers across demographics, preferences, online and offline behaviors attitudinal behaviors.”

However, it’s not as simple as other fintech integrations, which are straightforward plug-and-go’s. There are nuances to each kind of CDP as well as the vendor who is looking to deliver it to your marketing team. Morris and Renner explain what the leading financial marketers stand to learn from these programs and the best way to roll them out without getting stuck in the mud. And, perhaps, one of the most crucial questions marketers may be asking — how much is a CDP going to take out of the budget?

Read More:

- What Banks Should (and Shouldn’t) Put Into Next Year’s Marketing Budget

- How Banks and Credit Unions Are Rethinking Marketing

Reasons to Try Out a Customer Data Platform

A CDP is a tool, not a substitute for a deep understanding of customer values and needs. It’s more about how to use that information along with other data.

For any marketing executive that finds themselves rolling their eyes at this point, Morris says he understands. He jokes that “I hate the term customer data platform almost as much as I hate the term, DMP or data management platform.”

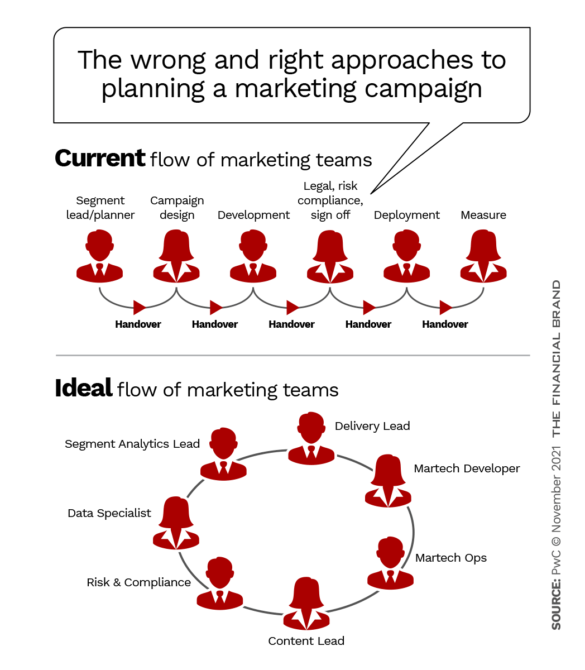

However, customer data platforms can bring the data to life, helping banks and credit unions build efficient marketing campaigns. Right now, most financial marketers move in a single line from one big strategy to the next. It’s ineffective and marketing campaigns are rolled out en masse instead of in small chunks, which allow for financial marketers to get a campaign right.

Marketing teams too often move in a linear fashion, shifting responsibilities from one team member to the next as the marketing project gets underway.

Instead, designing a financial marketing campaign should consist of short, burst-like strategy sessions that revolve around the data the CDP pulls in. Likewise, teams should strategize together in a circular fashion to ensure that the whole team is satisfied — and helping — with the final project, as shown in the second chart.

Dig Deeper: Banking Must Combine Strength of Humans With Power of Technology

Although how each CDP works for different institutions can vary, there are six key jobs that every CDP should perform.

• Customer data management

• Known identity resolution

• Customer behavior

• Customer analytics

• Real-time activation

• Audience orchestration

How Much Is It Going to Cost?

The cost element can be a loaded question, Renner says. But, once you get down to the brass tacks, Morris estimates that just the CDP can cost somewhere from $200,000 to $700,000 all in. Renner says that even Raab at the CDP Institute has said in the past that the software can range “anywhere from $5,000 to $25,000 a month.”

“It depends on the customization that you’re looking for,” Renner continues, adding that there are tailored programs for niche players and others that are more a one-size-fits-all. “It really depends on what level of complexity your organization has in the in the data challenges, the engagement challenges that you’re trying to solve.”

Keep in Mind:

CDP systems can — and will — look very different depending on the vender that is selling it. Renner recommends talking to at least three to five different vendors about their skills, just to figure out what kind of platform is best.

Financial marketers may have also heard about CIPs — customer intelligence platforms — which collect not just first-party data, but also third-party data, to assemble a customer profile. They can be costly, given the amount of data they collect, but they can be a good steppingstone if marketing teams have not already integrated a CDP into their tech stack.

Read More: Explaining CDPs: What Customer Data Platforms Can (And Can’t) Do For Banks

Pick the Right CDP

“The CDP landscape is very convoluted today and not all CDP’s are created the same,” Renner maintains, adding that to have a scalable customer data platform solution, there are six key steps to consider before officially adding the technology to your institution’s martech stack:

1. Select the right use cases — Although omnichannel experiences are important, banks and credit unions should really take on channel at a time and be deliberate about what is instilled at each channel. Morris says he’s been working with one client who is pushing the omni-channel orchestration and trying to make advanced decisions with each of them, but Morris insists it’s better to take one at a time.

2. Flexibility is key — Institutions can’t expect that the sources of customer data are going to be universal with all CDPs. PwC’s report shows that “Out-of-the-box integrations are helpful, but [the software] also needs to be capable of handling everything from legacy systems to emerging technologies.”

3. Ensure scalability — Scalability is inevitable, but most banks and credit unions don’t take this into consideration. “Most CDPs perform well while ingesting small numbers of data sources, but what happens when you have tens or hundreds feeding in at once?” the report asks.

4. Build bidirectional feedback — Once the campaign is launched, the CDP must be set up so that your institution can easily nab the feedback it needs to successfully launch the next campaign. Morris says that, while many of his clients think the benefit of a CDP is to just push out the marketing message, CDPs are better utilized as a feedback loop. “You can’t just start doing these ‘batch and blasts.’ You have to start thinking about new ways of working.”

Finally, the PwC team members advise financial marketers devise a hearty game plan. Morris, for one, recommends marketing teams plan out how much data their institution is going to need (instead of trying to utilize every data point) and choose a CDP that accurately represents that roadmap.

Learn More: Digital Banking Transformation to Focus on Channels & Analytics

“Do you know the segments that you should be going after and what data you need in order to understand those segments? If you don’t understand the segments, that’s where you start first.” Morris says. “Once you start understanding the use cases, the data sources will start to reveal themselves and then that’s where the CDP comes in. That’s my advice.”

Renner says it will be a lot of work, but it’s the kind of work that needs to be done.

“I don’t want to mislead anybody,” he continues. “There’s a lot of work upfront to getting a customer data platform in place, just like anything else. But once that work is done, they will be able to scale quite efficiently and quickly.”