Consumers want to be treated ‘special’ in every business relationship. No longer is it acceptable to place customers or members in segments that are defined only by age or income, or lack differentiation based only on the length, depth, value or lifestage of the relationship.

Consumers know organizations have enough insight to know them, look out for them and reward them. They expect nothing less, especially when the relationship is digital in nature. According to the 2017 Global Consumer Pulse Research, published by Accenture, 48% of consumers expect specialized treatment for being a good customer, with 33% of those consumers who abandoned a relationship doing so because personalization was lacking.

Despite firms across all industries stating that ‘improving the customer experience’ and ‘delivering customized experiences’ is a top priority, only 22% of global consumers acknowledge that the companies they do business with tailor experiences based on their needs, preferences and past interactions.

The Age of Hyper-Relevance

Consumers can see through weak, automated communications that are mass delivered based on time-dated metrics. While ‘Thank You’ messages and ‘next most likely’ product communications are still more effective than doing nothing, this type of personalization is anything but ‘personal’ from the perspective of consumers.

Predictive analytics, artificial intelligence (AI) and machine learning have combined to provide a hyper-relevant capability that is delivered in real-time using digital devices. Financial organizations can use internal and external data to achieve new levels of insight, with a greater contextuality and timeliness than ever possible just a few short years ago.

According to Accenture, companies need two important things to deliver the level of personalized services and experiences expected, at the speed and scale required

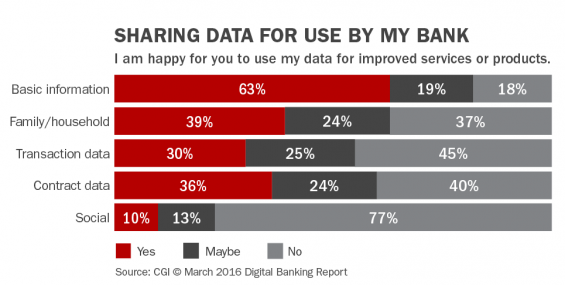

Customer Insight. To achieve the level of personalization and customization required, organizations need much more than the traditional data points of age, income, services held, length of relationship, balances, etc. Financial institutions much understand purchase behavior, social interactions, lifestage and even insights like health and key life events. The good news is that almost two-thirds of households are willing to share highly personal information in exchange for perceived value, according to the 64-page Digital Banking Report, The Power of Personalization in Banking, sponsored by Personetics. Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand. Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

The Financial Brand Forum Kicks Off May 20th

Customer Trust. Underlying the ability to capture in-depth insights is the prerequisite of establishing trust. Trust is built over time and requires constant and continuous interaction. As in human behavior, trust in business takes time to establish and can be broken with a single misstep. This is important to understand, especially as we create digital interactions based on algorithms and artificial intelligence. This is why firms are taking more precaution than ever to protect personal data.

“Companies that heed their customers’ concerns and shore up their trust quotient are more likely to persuade customers to share personal information. That, in turn, helps to inform the design of game changing hyper-relevant experiences.” – Accenture

Read More:

- Personalization in Banking: From Novelty to Necessity

- Banking Needs Deeper Customer Insights to Remain Relevant

The Risk of the ‘Personalization Gap’

Now more than ever, consumers expect their financial institution to understand their needs and deliver personalized solutions similar to what they receive from new financial providers (Fintechs) and the large tech firms (Google, Amazon, Facebook and Apple). Unfortunately, even with enviable stores of data and advanced analytic capability, most personalization expectations remain unfulfilled.

As consumers become increasingly demanding around their expectations for an intelligent personalized experience, significant “personalization gaps” are appearing between what consumers want and what financial firms are delivering.

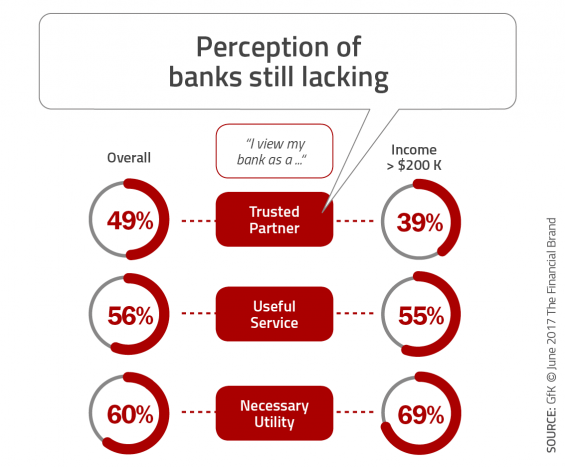

The financial services industry may not understand the impact of not keeping pace with consumer expectations. For instance, GfK research found that the strength of relationship between the consumer and banking industry has deteriorated in the past 2 years.

When asked to describe the relationship they have with their bank, consumers who viewed their financial institution as a ‘trusted partner’ decreased, while those describing their relationship as a ‘necessary utility’ went up. The findings were even worse for households with higher incomes.

Moving from Personalization to Hyper-Relevance

The development of an enhanced personalization strategy supports the top business priority of financial institutions for the past four years. But basic personalization is no longer enough. Going forward, contextual, real-time and hyper-relevant interactions are required for survival in a marketplace that is becoming more competitive and where consumers are more demanding.

These expectations come from Uber, Best Buy, Amazon as well as other retail, travel and hospitality leaders who are applying expanded data, artificial intelligence (AI) and digital tools to offer the same experience across channels and devices. They focus on the customer in real-time to demonstrate they are looking out for the consumer’s specific best interests.

According to Accenture, there are three things companies must do to move from traditional personalization to hyper relevance:

1. Look Beyond the Customer Journey. While there is no minimizing the importance of understanding the customer journey in financial services, differentiation will be achieved by providing value that goes beyond expectations. For instance, instead of being in lock step with the consumer, can we look ahead and provide recommendations on what has yet to occur? Not just in financial services, but in daily life situations (especially as we move to open banking ecosystems that may include non-financial services).

2. Look Beyond Traditional Data. There needs to be a move from traditional sources in insight and descriptive analytics (what has happened), to predictive analytics (what will happen). As data is collected and analyzed from outside traditional sources, security will be even more important. It will also be imperative that there is transparency of insights for the consumer and that data is continuously used to remove friction from the customer experience (pre-fill, fewer steps, etc.).

3. Look Beyond Basic Trust. Financial institutions are still one of the most trusted industries. Financial organizations should leverage and expand this trust to potentially being the protector of a consumer’s identity across platforms and daily interactions. As quickly as this level of trust can be built, it can be lost with a single mistargeted communication, irrelevant offer.

At a time when most organizations are just beginning to move beyond mass communications, the bar is being set higher by the ever demanding consumer. Leaders in the financial services industry will leverage data, advanced analytics and digital technology to deliver more personalized offerings that can result in higher trust.