Google Trends is a fascinating utility, using the search giant’s vast database to shed light on everything from the spread of flu outbreaks to economic predictions. While initially considered little more than a cool way to visualize search volumes, Google Trends is now regarded as a scientifically respected forecasting tool.

Using Google Trends, you can gauge people’s level of interest in any given topic. The data can be reported globally as far back as 2004, or broken down for a specific country and/or time period.

The horizontal axis for each Google Trend graph represents time, and the vertical axis is how popular a certain search term has been, with “100” signifying the peak activity.

Here is a collection of interesting Google Trends for bank and credit union marketers. All graphs reflect Google’s worldwide data for 2004 through the present.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

New Delivery Channels Gaining Steam

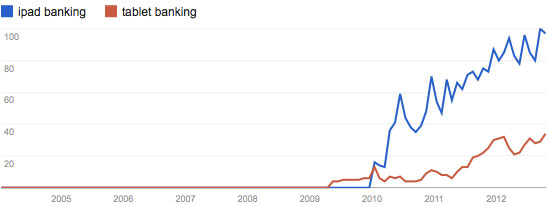

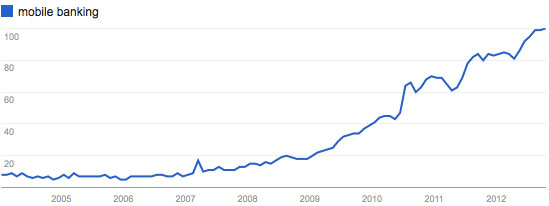

Mobile banking had been a hot topic in the banking industry years before Apple rolled out the iPhone in June 2007, however consumers expressed limited interest in SMS text-based solutions. As you can see, the concept of mobile banking really took off when smartphones were introduced the world. And in March 2010, Apple’s iPad burst onto the scene, opening up a whole new delivery channel for financial institutions: handheld tablets.

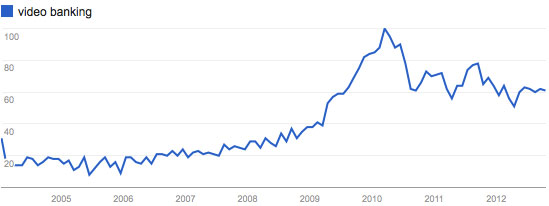

Video banking lulled along until it enjoyed a brief surge between 2009 and 2010, when search volumes spiked 150% before settling at a more modest level. Video banking has been the focus of much attention in recent years, with many banks running tests in branches and in social media channels, so it’s a bit surprising this touchpoint hasn’t continued an upward Google trend.

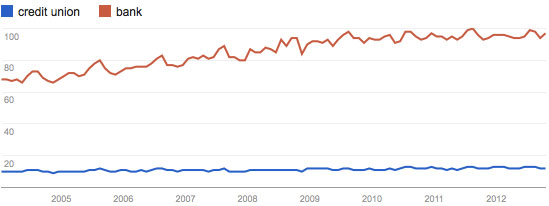

Bank or Credit Union?

This Google Trend graph brings into sharp focus the branding and awareness issues facing credit unions. People search for banks nearly 10x more frequently than they do for credit unions. While searches for banks have increased around 40% since 2004, searches for credit unions have limped along a nearly flat trajectory. Credit unions may be admired more than banks (at least among those consumers familiar with them), but they are clearly not top-of-mind.

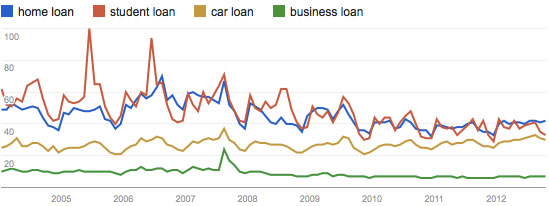

Fewer Consumers Interested in Loans (of any kind)

Search volumes for just about any kind of loan you can think of are down, illustrating consumers’ disinterest (or economic incapacity) in taking on long term credit. The only exception is car loans, with search volumes edging up ever so slightly since 2009.

Debit or Credit? Or Prepaid?

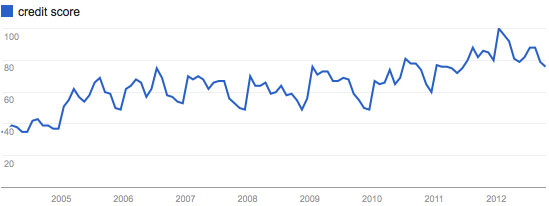

While long-term lending is trending down, short term debt is another issue altogether, with interest in credit cards moving steadily upwards since the onset of the Great Recession. Consumers are also much more acutely aware of their credit scores, quite likely another consequence of the economic downturn.

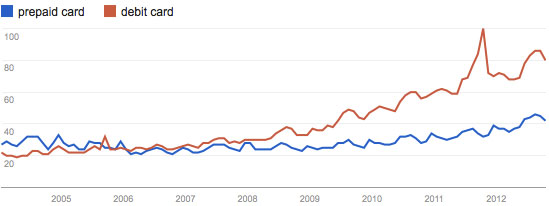

For the last four years, interest in debit cards has remained nearly twice the volume as that in prepaid. Even though the massive growth forecast for prepaid cards might not be reflected in Google’s search data (yet), you can see a steady upward climb.

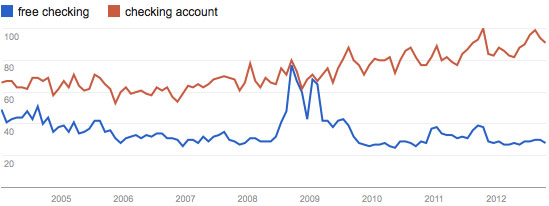

Looking for Checking Accounts

Consumers seem to be increasingly using Google to search for checking accounts. While there was a brief (albeit significant) spike in searches for free checking between mid 2008 and mid 2009, people aren’t looking for fee-free accounts in numbers like they once were.

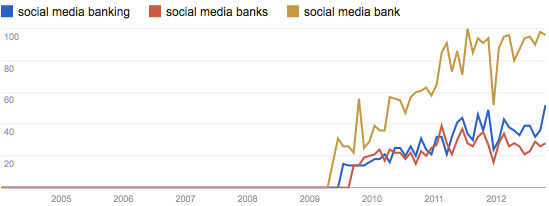

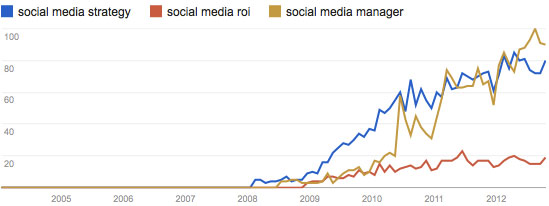

Social Media Sends Everyone Scrambling

Starting in 2009, banks started searching for social media advice with growing enthusiasm. The industry’s interest in the subject has doubled since mid-2010 and the data suggests no slowdown in this uptrend. Managers and marketers are struggling to figure out what relevance social media has in banking, and how it could be used.

These days, everyone is searching for a social media strategy and someone to manage it, even if they aren’t all too clear about social media’s ROI.

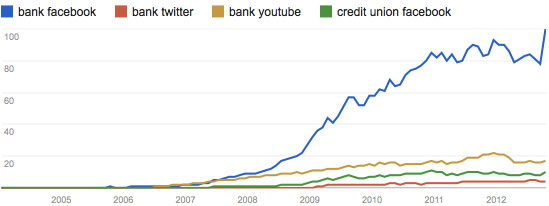

Banks, Facebook Dominate in Social Searches

You can clearly see Facebook’s dominance in the banking industry. Search volumes for bank Facebook are five times greater than they are for bank YouTube, and nearly 25x greater than bank Twitter. This same trend in relative magnitude is also seen with search volumes in the credit union industry, although at much lower levels. Interest in credit union Facebook is 10x less than it is for banks.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

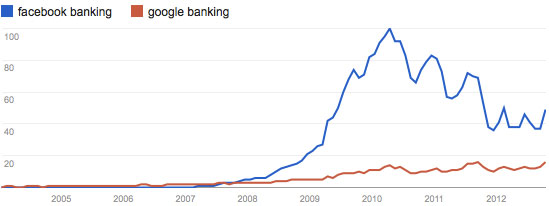

New Competitors Challenge Banking’s Old Guard

The banking industry constantly faces new threats. Every technological advancement seems to bring with it a new slough of startups rising to challenge traditional institutions’ dominance of the banking industry. Much like PayPal revolutionized online payments years ago, there is now increased interest in a more sophisticated and robust model, perhaps coming from Google or Facebook. Rumors have been flying around that either online giant might dive into the banking space, although it’s more likely that they are interested in payments than in offering a full suite of banking services. They are, after all, companies whose sole product for sale is consumer information, and they can get all the data they need without offering full-fledged checking accounts simply by inserting themselves into the payments process.

While interest in Facebook banking has cooled significantly in the last two years, Google has been growing in popularity, specifically with its Google Wallet product.

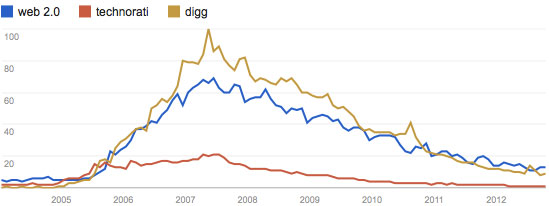

The Death of Web 2.0

Thanks to services like Blogger and WordPress, blogs became wildly popular starting in 2005. Shortly thereafter, internet denizens introduced the world to a new term — Web 2.0 — signaling a new era of shared online activities. Services related to blogging like Technorati and Digg also grew in popularity up until mid 2007 — when the Web 2.0 craze hit a fever pitch. But the term “Web 2.0” has fallen steadily out of vogue, replaced by the more preferable (and descriptive) phrase “social media.”

Interest in blogging and related topics have also slid sharply. Google search volumes for “blog” and “blogoshpere” are also trending down noticeably.

It serves as a reminder that not everything you see in the online space today will be around tomorrow. While it may seem like the world will forever include social platforms like Facebook, Twitter, YouTube and LinkedIn, there are no guarantees. Just ask the folks at MySpace and SecondLife.

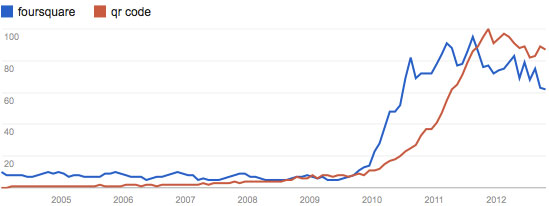

New Social Media Memes Emerge

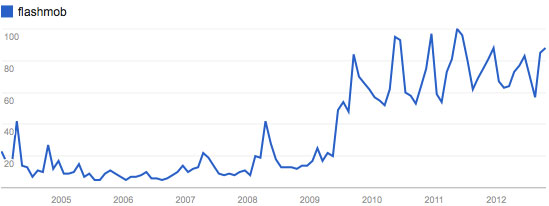

Google Trends can help financial marketers decide if new developments in the social media space are legitimate trends or just passing fads. While services like Foursquare and Pinterest enjoyed an initial surge in interest, both are showing signs of struggling. Have recently popular topics like QR codes and flashmobs reached their peak? Are they viable over the long term? Or has interest plateaued because they have limited purpose and application?

Flashmobs really took off in mid 2009, but interest in them seems to have leveled off. You’ll also notice a definite trend in the seasonality of flashmobs. May and June are the most popular times to hold a flashmob, following by August and September. February and March see the least flashmob activity, presumably because of cold temperatures.