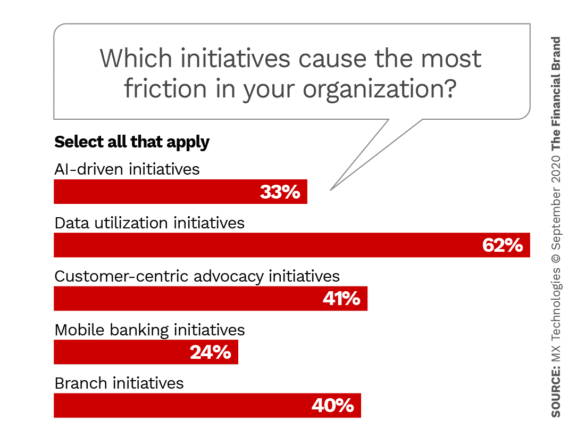

Which one of the following strategic priorities do you think produces the most conflict at banks and credit unions: branch initiatives, advocacy initiatives, mobile banking initiatives, data utilization initiatives, or AI-driven initiatives?

The answer is data utilization initiatives. A survey of industry leaders at a mix of financial institutions ranging from less than $500 million in assets to more than $10 billion found that respondents overwhelmingly said such initiatives produce the most conflict in their organization. This is among finding in the “Ultimate Guide to AI, Data, and Personalized Financial Automation.”

What’s particularly surprising is just how much more these initiatives around data utilization produced conflict compared to the other options: More than 20 percentage points higher than conflict around branch initiatives and nearly 40 percentage points higher than mobile banking initiatives.

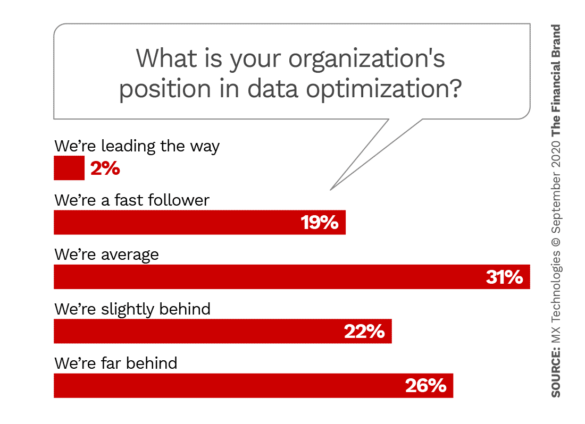

Perhaps this conflict is partly why only 2% of respondents believe that they are leading the way when it comes to data optimization, with nearly 80% saying they’re either average or worse than average on this front.

It’s hard to feel like you’re leading in an area where you’re simultaneously experiencing a lot of conflict. And yet, this information doesn’t mean that financial organizations should move slowly on data initiatives or disregard them altogether. Quite the opposite.

As is the case with so many aspects of business, areas of industry-wide conflict and doubt are a sign of opportunity. There’s room for cutting-edge organizations to double down on data analytics and take the lead — if they can push through the conflict and put a plan in place.

Here are three ideas to help you do that.

1. Normalize Conflict By Changing the Script

If you show your organization that 62% of leaders in banking say that data utilization initiatives produce internal conflict and 98% say they’re not leading the way on data optimization, then you can change the script.

Start by acknowledging that data initiatives almost certainly come with inherent conflict. By acknowledging this across your entire organization, you set yourself up to successfully navigate that conflict. When it surfaces, it will be exactly what you expected — and it doesn’t need to derail the initiative.

Normalizing conflict in this way will change the culture where you work, which is pivotal to your ongoing success. In fact, when asked what they need to address their data challenges, respondents overwhelmingly said that more than anything they need to create a company culture that makes data-driven decisions.

The truth is that if everyone at your organization believes that you’re behind the curve, that belief can become a self-fulfilling prophecy. So this perception is something worth addressing with your team. You’re almost certainly doing better than you think.

2. Let the Technology Do the Work

When given a list of five common data challenges, respondents listed “Not having the right technology” as the top barrier, closely followed by “Needing more employees with expertise in data analytics.”

The least pressing of the problems in the list was having enough data on hand. In other words, organizations generally have a sufficient amount of data; they just need help to do something with it.

With a combination of the right tech and the right people, your bank or credit union can quickly get up to speed with data initiatives. The trick is to find technology that will do the heavy lifting and automate many of the processes you want to initiate.

3. Remember that the Point is to Help Your Customers

At times, data initiatives might seem abstract, distant from real-world problems. If this is the case, it might be a sign you need to refocus.

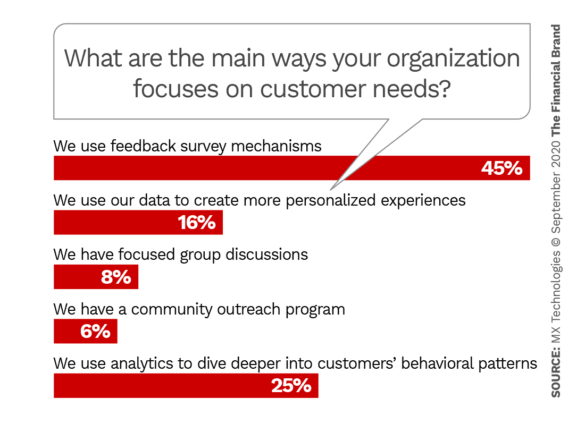

The survey in the “Ultimate Guide to Data, AI, and Personalized Financial Automation” shows that organizations have a range of goals and priorities for data initiatives. The most common goal has to do with using data to better understand their customers, followed by reaching customers on the right channels. This likely means that companies are looking for a way to quickly visualize data about their customers and then couple that data with the ability to target specific customers with the most appropriate message.

On this front, financial services companies are mostly using feedback surveys to gather information about their customers.

This leaves plenty of room for organizations to find the right marketing strategy, technology and partner in order to take the lead when it comes to using data to drive marketing and product decisions.

What might this look like? Organizations that offer the ability for customers to aggregate their accounts in one place have the opportunity to then use that data to see a 360-degree view of their customers’ financial lives.

With the right marketing technology, these organizations can then use that data to create hyper-personalized solutions geared toward improving the financial wellness of each person.

For example, say you’re a marketer at a financial services company. You can see that one of your customers has a mortgage with a competitor. The right technology enables you to create retargeted ads that show this user that they can refinance with you and obtain a lower mortgage rate. In this way, you start to rapidly outperform the market as you meet the needs of your customer, further cementing a long and mutually prosperous relationship.

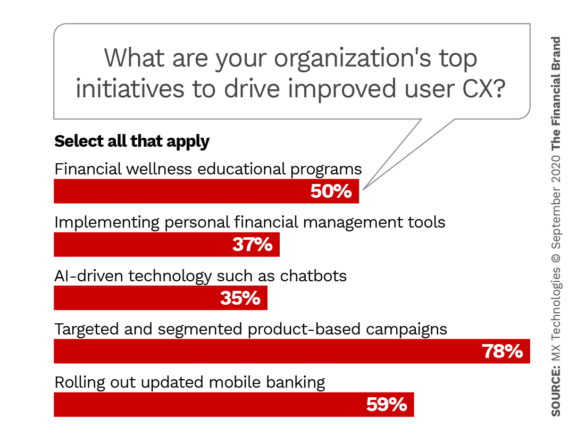

It’s no wonder then that 78% of respondents listed targeted campaigns as one of their organization’s top initiatives to improve user experience and engagement.

Data Is the Foundation of the Future of Banking

While data initiatives produce internal conflict and while it’s easy to feel like you’re far behind, it’s critical to get these initiatives in place now.

After all, almost without exception, the technology of tomorrow — from voice assistants, chatbots and personalized financial automation — will hinge on getting the right data in place as well as making full use of that data.

Regardless of the specifics, today’s digital banking innovations all rely on a foundation of connectivity and data. Without that foundation, the latest digital initiatives at financial services companies will offer less meaningful experiences. And that’s why data matters.