Over the last seven years of research by the Digital Banking Report on the “State of Financial Marketing,” the banking industry has moved from talking about the power of data and advanced analytics to actually beginning to use AI-powered tools in day-to-day tasks. Although the technology is still rather new, the list of tasks it can complete is growing steadily.

Based on the research, AI will usually augment, as opposed to replace, traditional marketing functions. But it will still have a disruptive effect on the industry. We are already seeing shifts in media used and marketing talent being sought as organizations try to find ways to drive costs down and performance up through AI-powered solutions. These shifts have only accelerated as a result of COVID-19.

Artificial intelligence allows marketers to process large amounts of data from a wide variety of sources quickly, helping to boost campaign performance and marketing ROI. This gives marketers more time to focus on other important tasks. More importantly, according to Salesforce, even before the pandemic forced everyone to use digital solutions to manage their day, 76% of consumers expected companies to understand their needs.

Despite the power of AI, the banking industry continues to lag most other sectors in the use of data and advanced analytics in marketing. More concerning is the fact that, except for the largest banking organizations, confidence in being able to leverage AI tools has actually decreased since last year, according to the Digital Banking Report.

Read More: Artificial Intelligence, Algorithms, Big Data & The Future of Banking

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

AI Maturity Only Resides With Biggest Banks

One of the more fundamental uses of artificial intelligence in marketing is using customer data and machine learning to anticipate offers and solutions that will enhance a customer’s journey. Marketers can also create profiles of customers to facilitate ongoing personalization and to determine who is interested in a product now, who may consider the product in the near term, and who will not be interested. This can help with targeting, channel selection and messaging.

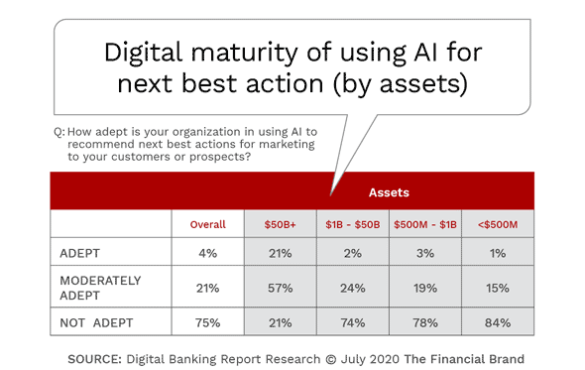

Unfortunately, when we surveyed financial institutions globally for the State of Financial Marketing 2020 report that will be released in early August and is sponsored by Deluxe, we found a significant gap in digital maturity between organizations of different asset sizes.

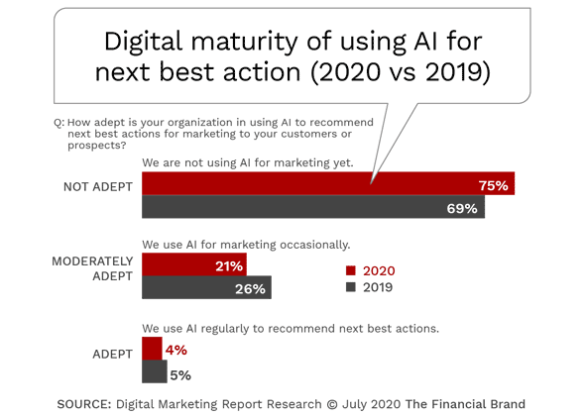

When we asked how adept financial institutions were in using AI to determine next best action/offer for customers or prospects, more than 75% of all banks and credit unions said they were “Not Adept.” While it was not surprising that 78% of the largest organizations thought they were either “Adept” or “Moderately Adept” at determining what to proactively offer customers using AI, it was surprising that organizations with assets between $1 billion and $50 billion consider themselves to be so much worse.

COVID-19 highlighted those digital-first organizations in all industries that have the capability to proactively help consumers during their entire customer journey. Beyond Amazon and Google, firms like Netflix, Rocket Mortgage, Facebook and even Instacart and other educated consumers as to what is possible when data and advanced analytics are put to use.

This awareness by financial marketers may explain why, when asked about the level of adeptness in using AI for proactively offering solutions, the numbers went down rather significantly since last year’s research.

AI is Still Not a High Priority … Really??

As with the findings in other research done by the Digital Banking Report around digital banking transformation, there is a significant awareness of the rise of innovation in marketing. With advanced tools and exciting new trends being proven across industries, financial marketers are challenged to determine what priorities need to be addressed.

As seen, our research illustrates that there is still a strong divergence between the desire to improve marketing capabilities and the confidence of financial marketers to be able to help their organization adapt to the power of AI for industry leading marketing programs. So why is there a significant gap between hyperbole and activity regarding the use of data and advanced analytics?

First of all, and rather disturbing, is that in spite of the rhetoric around how artificial intelligence can “change the world” in marketing, efforts to do so remain a relatively low priority … especially for smaller organizations.

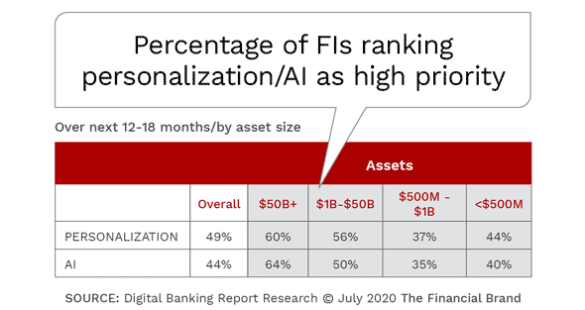

When banks and credit unions worldwide were asked about the most important marketing trends for the next 12-18 months, only 44% of organizations believed advanced analytics was a high priority for the future. A slightly higher percentage of firms (49%) believed personalization was a high priority. As a point of reference, “Integrated Marketing”, “Social Media Marketing” and “Mobile Marketing” were the top three marketing priorities.

When broken down by asset size of respondents, it is clear that the largest organizations placed a higher priority on both personalization (60%) and AI (64%) compared to smaller organizations. In fact, the gap between the prioritization of these two major components of using data for improved results paints a rather bleak picture given the importance consumers place on these capabilities.

Organizations of all sizes need to remember that artificial intelligence provides the foundation to process data and insights at a much faster rate compared to any marketing run only by humans. Finding insights that can affect consumer behavior, and being able to recognize purchaser trends, are needed by all financial marketers to develop content and impact strategy for those priorities that were ranked higher in the report.

Beyond marketing strategy enhancement and response improvement, research has found that brands that have adopted AI for marketing strategy have seen a 37% reduction in costs along with a 39% increase in revenue. This is because correct targeting creates less waste.

Read More: Rethinking Financial Services with Artificial Intelligence Tools

Use of Data Continues to be a Challenge

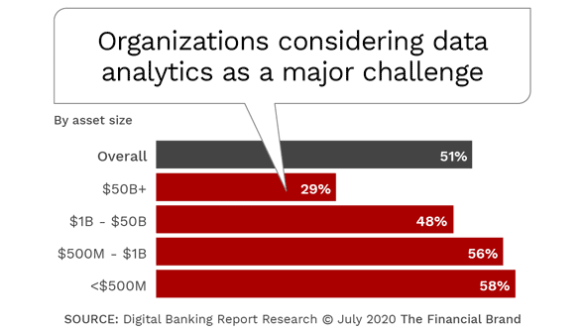

When asked about the biggest challenges for financial marketers globally, data capabilities topped the list as in the past. As was the case in 2019, “Data Analytics Tools and Capabilities” was the mentioned as the most significant challenge (51% “major challenge” mention in 2020). This represented an 8% increase from 2019.

The second and third most mentioned challenges in 2020 were “Data Infrastructure and Data Accessibility” (47% “major challenge” mention) and “Marketing Automation and Personalization” (44% “major challenge” mention). All three of these data related challenges ranked above other challenges, such as “Measurement of Performance” (39%), “Budget Constraints” (33%), “Team Resources” (33%) and “Regulation and Compliance” (13%).

More than any period in the past, larger organizations diverged from their smaller competitors in the concern around “Data Analytics Tools and Capabilities,” with only 29% of organizations mentioning this as a “major challenge.” Over 50% of organizations of $1 billion or less in assets consider this to be a major challenge.

Use of AI in Response to COVID-19

At a time when change is happening in an instant, the use of data and analytics has never been more important. Usually associated with deeper problem solving and the ability to predict future behavior, AI becomes an even more important marketing tool than normal. From determining the potential need to defer a loan payment to the desire to open up a new savings account, the use of customer data is invaluable.

According to McKinsey, many organizations responded to the COVID-19 crisis by “doubling down” on the commitment to AI. “Analytics capabilities that once might have taken these organizations months or years to build came to life in a matter of weeks. This despite organizations simultaneously grappling with the challenge that pandemic-induced behavioral and economic shifts have rendered some historical data useless.”

Obviously, those organizations that committed resources to improving their application of data and insights to improved marketing will be in a stronger position going forward. They’ll be ahead of other financial institutions in addressing both immediate challenges caused by the pandemic as well as being able to take advantage of opportunities going forward.

One excellent example of how an organization pivoted due to COVID-19 through the use of data and analytics was Navy Federal Credit Union. In an interview for the Banking Transformed podcast, Pam Piligian, SVP of marketing and communications for Navy Federal shared how they completely resegmented their member database to find needs caused by the pandemic.

“We quickly implemented a new segmentation study which profiled our members via the lens of who’s ‘pained but patient’ and those who needed help immediately,” says Piligian. “Some of our quick data analysis pivots that really paid off was to determine who might benefit from refinancing their car loans. We broke records in March and April just on refinancing car loans.”

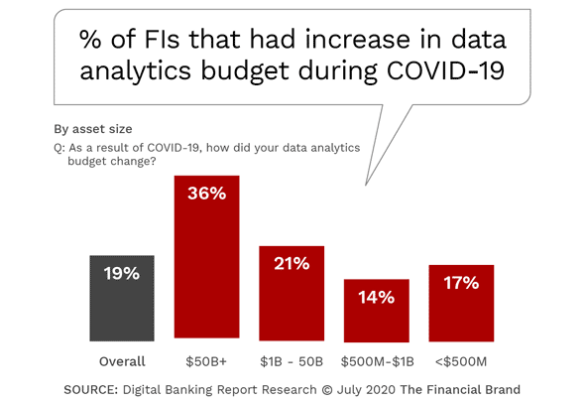

But not all organizations were as proactive as Navy Federal, according to the State of Financial Marketing 2020 research. While 19% of all organizations increased their data and analytics budgets as a result of the COVID-19 crisis, the commitment to data analytics was not uniform across all asset categories.

The largest financial institutions surveyed increased their budgets for data and analytics significantly more than smaller organizations. In fact, 36% of banking institutions over $50 billion in assets increased their budget with 21% of organizations between $1 billion and $50 billion doing the same. Smaller organizations did increase their budgets, but not nearly as aggressively.

The Need to Double Down on AI

Financial services organizations of all sizes recognized the need to increase their commitment to data and analytics in response to COVID-19. While the commitment may not have been equal, the need cannot be ignored. It is clear that financial marketers must continue to invest in key areas of data and analytics or the opportunity to “catch up” to others in the banking industry and to those leaders outside banking will likely be fleeting.

Some of the ways to create or build on the momentum created by the COVID-19 crisis, according to McKinsey include:

- Communicate the New Realities. The move to digital channels by consumers will not revert back to pre-pandemic levels. The availability of valuable insights is enormous as are the opportunities to use these insights for an improved consumer experience. These realities must be communicated to all key players within the organization.

- Re-Prioritize Resources. There needs to be a shift in resources from the deployment of marketing campaigns (media spend) to the development of tools that can improve results of these marketing initiatives. From the development of personalization capabilities to the application of data and analytics for real-time communication of applicable solutions, budgets need to reflect the reality that only the strong (in data insights) survive.

- Hire and Reskill. There has never been a time when analytics skills are more needed or when the availability of talent is more plentiful. While the demand for analytic skills is great, many who have had this role in industries that are currently suffering may be available. There is also the need to reskill current marketing team members on the analytic talents that will be needed in the future.

- Commit to Measurement. More than ever, the need to determine the results of efforts is required. Not only to document the success (or failure) of initiatives, but to build strong business cases for resource commitment going forward. With budgets expected to be decreased in the foreseeable future, financial marketing executives will need to fight for the budgets needed to be a competitive force in the future.

Can Your Organization Compete?

Can you predict what a customer or member needs even before they know it? Can you determine the path of a consumer’s journey from initial purchase, through the relationship-building process to becoming a loyal customer? Can you optimize your media spend and know the message a person wants to hear … when they want to hear it? These are all benefits of using data and AI.

Today, more than ever, consumers react to brands that answer to their preferences and deliver accordingly. With AI and machine learning, financial marketers can use algorithms to help transform customer engagement data to suitable product recommendations. Over time, financial marketers can stay updated on the personal preference of a consumer and create the right recommendations on a real-time basis.

Financial marketers are in the spotlight more than ever as a result of the needs created by COVID-19. There are more demands and less time available to do more with less. Every dollar of budget needs to create more revenue as efficiently as possible. Data and AI need to move beyond concept to reality … especially for organizations beyond the top ten in assets.

The power of using data to create contextual marketing engagement will define the success and failure of banks and credit unions more than ever in the future.