There are a range of trends impacting payments and transaction servicing culminating in radical changes to the whole way we think about banking and money. In part, these changes are being forced on the industry through regulatory agendas of politicians but, in larger part, these changes are being required by customers and corporates as technology changes relationships with their financial providers. This paper looks at the outcome of such changes and finds that financial institutions will be radically restructured around data assets within the next decade to cater for these new world needs. During the past five years, almost every conference on banking and payments talks about mobile and tablet computing. This is because everyone thinks mobile is the hot space today, which it is, but it won’t be in the near future. Very rapidly, the device focused dialogue will move on to the Internet of Things as everything gets Intel inside. This is the major disruption on the technology landscape, and here are the facts:

- The volume of internet traffic doubles every 18 months and is currently running at around two zetabytes, which is a trillion gigabytes, and most of it is video

- The actual size of the internet doubles every 5.32 years

- By 2020, there will be 50 billion devices connected to the internet, compared with 17 billion today

- By 2020, there will be 6.58 devices per person using the internet, compared with 2.5 today

- Nanotech is already here, with computers and cameras at sub-1mm sizes

- Over 100,000 telephone masts are being built every year

- The number of wifi units shipped has quadrupled in the last five years

- Under IPv6, everyone on the planet can have up to 52 thousand, trillion, trillion web addresses

So what? The so what is that the mobile device focus was signalled as important to banking and payments over a decade ago. Now that mobile is here, we need to look for the next signal and that signal in the Internet of Things. The Internet of Things is the idea that the vast majority of our electronics will be connected to the Internet and/or other nearby devices. A refrigerator, for example, may have a touch screen on the door and be connected to the Internet, allowing you to remotely access information such as what is in the fridge, its temperature and whether or not you have what you need to cook that spaghetti bolognaise this evening.

Another example is the Nest thermostat, which is a thermostat that allows you to remotely manage your house room temperatures from an app. In years past, this idea was just an idea — something we said was coming. This year, however, was the first year when we could actually see the Internet of Things on display and it is clear that, within the next five years, we will be living in a world where almost every electronic device we own will be connected to something.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What does this mean for transaction banking?

It means that the world will be augmented, such that wherever you go and whatever you are doing, your world can be supplanted by relevant, proactive, predictive, proximity based information. This concept was proposed many years ago when technology firms made a play for banks to deploy data warehouses to perform predictive analytics based upon consumer propensity models of their data-based behaviours. It may sound a little complex, but basically it was meant to use data patterns to predict what the customer would do next and whether they might need some new financial service.

A good example was analysis of purchases that would show more frequent visits to a store the client had never used – Mothercare and the Early Learning Centre – indicates the imminent arrival of a new family member and, for the bank, would provide an opportunity to promote baby bonds for future education savings. An alternative analysis might show behaviours that would indicate a house move, such as regular visits to a new town, and therefore a home buyers and movers package would be sent out in the post. Obviously these approaches need to have the customer’s permission, as promoting contextual services without permission is a breach of law, but the concept of contextual marketing has been bubbling within the payments industry for at least two decades. Twenty years ago these predictive services were crude, and based upon delayed responses that lagged the customer’s behaviours, but were far ahead of their time as a concept.

Today, this form of marketing combined with transaction is imperative as predictive marketing is the battleground of Big Data, and Big Data allows payments processors to be far more proactive rather than reactive. A good example is shown with Google. When Google knows that someone’s searches are ideas, aspirations and needs, they can predict what is relevant to that person and target them precisely. If you search for headache tablets side effects, they might recommend that I switch to paracetamol and direct me via Google maps to my nearest pharmacist. If you search for pricing TVs, they might offer you a special deal with a retailer’s discount code. If you don’t think that Google Analytics are the key to predictive, proactive marketing, just checkout the results of research of three academics who find that Google predicts stock market movements pretty accurately: “Debt” was the most reliable term for predicting market ups and downs, the researchers found. By going long when “debt” searches dropped and shorting the market when “debt” searches rose, the researchers were able to increase their hypothetical portfolio by 326 percent. (In comparison, a constant buy-and-hold strategy yielded just a 16 percent return.)

In the same way, banks can use transaction data combined with search trends and other data to predict and then proactively offer service in real time. That service might be offering car loans as a customer drives past the showroom of the BMW dealership they were Googling last night or mortgages as they drive towards the real estate office of the broker found via search this morning. Now that’s all well and good, but it goes further than this as the prediction marketing can now be embedded into the Internet of Things.

This is well illustrated by the retail experience in grocery stores, and has been built conceptually by Metro in Germany. Metro built a prototype of the grocery outlet of the future using NFC and RFID technologies. The concept store included the idea of dynamic pricing as you walk through the aisles, based upon your loyalty, shopping habits and more. Your smartphone would send your preferences to the store’s database as you entered such that you get special discounts on the items you buy most regularly. As you walk past these items, they change prices dynamically and your phone beeps a special discount deal today to alert you to these offers: Just for you, buy one get one free (this offer is not available to anyone else instore). So you get the idea, but it goes one step beyond this.

As the Internet of Things means that everything has intel inside and intellisense becomes the competitive battleground using predictive, proactive marketing, you get combinations of deals coming together. The internet service provider, mobile carrier and bank create a partnership with BMW where they are incentivised to encourage visits to BMW. As a result, you keep finding adverts, offers and deals all around you, as you are intellisensed for business in the virtual and physical world. It is the world evoked by that vision of Tom Cruise walking into the shopping mall in Minority Report, and everything recognises him based upon his eye biometrics. But forget the biometrics. We have this intellisense thanks to mobile wifi combined with RFID and NFC. This sensing of the presence of the payer and payee through the network can be seen in the use of mobile networks and apps.

For example, the Square Wallet and PayPal Instore apps are good examples of the evolving shape of retail payments, where transactions no longer involve any physical exchange of tokens, cards or paper, but purely a confirmation of the payment via the mobile network. We are already living in a world where the Internet of Things is intelligently sensing our buying habits and, if we’re buying, we’re paying for things.

This means the bank that ties itself into the value chain of intellisense, is the bank that will be at the heart of the next generation of retail payments. And that means being the bank that mines data to provide predictive, proactive, proximity based payments. As mentioned, this is the world of the very near future, and is driven by the unrivalled momentum and rapid worldwide adoption of devices and a world where all hardware will be made smarter through not just the use of connected chipsets and next-generation parts, but rather through the applications that add to their value.

The net of all of this is that banks and all firms will soon be focused upon wireless transaction processing through the net. In other words rather than mobile payments and mobile banking that we talk about today, we will be talking about augmented payments and augmented banking tomorrow and, in that world, money is meaningless.

Money is meaningless

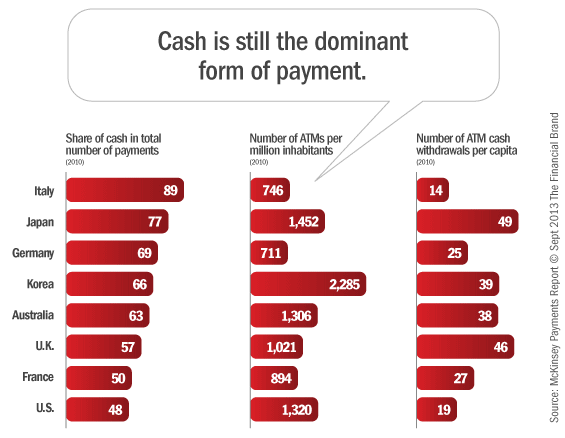

Money is meaningless because we no longer deal in money. We deal in data. The word money, is usually associated with cash and, as most of us know, cash is no longer king, queen or even key, as all banks and card processors have a war on cash. We have a war on cash because we want to replace it with electronic processing that is cheaper and easier, and electronic processing means that cash becomes data. Money becomes meaningless because the data is what is important. The problem with this view is that there is still a lot of cash around, with cash still representing over half of all payment volumes in most developed nations and increasing in usage. For example, even with all of the advertising for mobile and contactless in the UK, the Cash and Cash Machines Report 2013 shows that cash usage increased by around 10% for payments in the UK in 2012, with the number of cash payments (by businesses and individuals) up from 20.6 billion transactions per annum to 20.8 billion, representing more than half (54%) of all payments.  But cash in the economy is going to decrease in importance over time if, for no other reason than that the processors and financial institutions are all determined to displace cash with other forms of electronic payment In fact, the value of cash payments has been remaining steady in many economies, whilst the volume of cash transactions has been decreasing as alternative payment forms, such as contactless and mobile payments, take over.

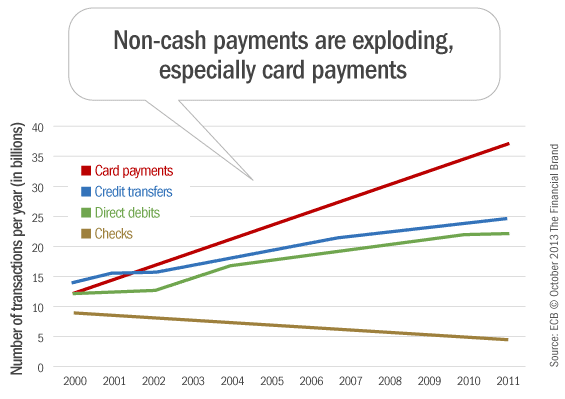

But cash in the economy is going to decrease in importance over time if, for no other reason than that the processors and financial institutions are all determined to displace cash with other forms of electronic payment In fact, the value of cash payments has been remaining steady in many economies, whilst the volume of cash transactions has been decreasing as alternative payment forms, such as contactless and mobile payments, take over.

Mobile payment user by region (in thousands)

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|---|---|

| W. Europe | 2,015 | 4,519 | 9,471 | 18,451 | 29,243 | 41,310 | 56,139 | 73,915 |

| North America | 748 | 1,905 | 6,641 | 13,135 | 20,792 | 29,206 | 38,923 | 50,167 |

| As/Pac | 26,418 | 41,865 | 55,265 | 69,091 | 83,327 | 97,896 | 112,784 | 127,804 |

| EMEA | 9,119 | 16,823 | 25,127 | 34,250 | 44,289 | 55,471 | 67,473 | 80,899 |

| Latin America | 3,005 | 4,012 | 5,578 | 6,186 | 7,063 | 9,099 | 12,319 | 16,654 |

| Total | 41,305 | 69,124 | 102,083 | 141,112 | 184,714 | 232,983 | 287,638 | 349,440 |

This brings us to the core point that we all believe cash will decline over time, replaced by electronic, digitised transactions. This is why money in the form of cash is less meaningful and demonstrates the importance of banks as secure data processors of money, rather than money transmissions processors. It means that the regularly quoted comment from gangster Willie Sutton “why do you rob banks”, “because that’s where the money is”, is very last century. Willie Sutton robbed banks physically, taking the cash out at gunpoint. Today, the gangsters take the money out byte by byte.

This is why money is meaningless, because the data is meaningful. It’s the data that gangsters need to rob, not the money. Data is where it’s at. That’s why the majority of cyberattacks target financial institutions. According to RSA’s December 2012 Online Fraud Report, 284 brands were targeted in phishing attacks during November 2012, marking a 6% decrease from October. Of the 284 brands attacked 45% endured 5 attacks or less. Banks continue to be the most targeted by phishing, experienced nearly 80% of all attack volumes. Sophos regularly report details of bank cyberattacks, and McAfee Labs researchers recently debated the leading threats for the coming year and show that it’s only going to get worse:

- Mobile worms on victims’ machines that buy malicious apps and steal via tap-and-pay NFC

- Malware that blocks security updates to mobile phones

- Mobile phone ransomware “kits” that allow criminals without programming skills to extort payments

- Covert and persistent attacks deep within and beneath Windows

- Rapid development of ways to attack Windows 8 and HTML5

- Large-scale attacks like Stuxnet that attempt to destroy infrastructure, rather than make money

- A further narrowing of Zeus-like targeted attacks using the Citadel Trojan, making it very difficult for security products to counter

- Malware that renews a connection even after a botnet has been taken down, allowing infections to grow again

- The “snowshoe” spamming of legitimate products from many IP addresses, spreading out the sources and keeping the unwelcome messages flowing

- SMS spam from infected phones. What’s your mother trying to sell you now?

- “Hacking as a Service”: Anonymous sellers and buyers in underground forums exchange malware kits and development services for money

- The decline of online hacktivists Anonymous, to be replaced by more politically committed or extremist groups

- Nation states and armies will be more frequent sources and victims of cyberthreats

So when we talk about our wonderful new internet age, the key is to realise that it’s the data where the money is, not the bank, the branch or the cash machine. This brings me to my core point: if data is valuable, what data is of most value and what role should banks take in this?

Banks are just data vaults

Banks need to think about how they reconstruct themselves for the 21st century as new data management firms from upstart payments processors to internet service providers to mobile carriers all move towards the payments space. The war for all of these firms is to be the best at processing transaction data as people exchange information digitally online. For a bank, what this really comes down to is that banks are becoming pure managers of bits and bytes of data. It is the data that has the value today and it is the data that is the basis of competitive battles in the future.

Data is our greatest asset and raw material, not capital or people. That is what the technology has done for 21st century society and for 21stcentury banking. Most people would be at far more of a loss if they lost access to their online accounts, had their usernames and passwords changed, had their identity copied and compromised online, or similar challenges than if they lost their wallet or card. For some, they would feel their lives were lost if their Facebook or Twitter accounts were blocked or deleted whilst, for others, their World Of Warcraft gold is more valuable to them than their total real world asset base.

The core of all of these discussions is data and data leverage. By the same token, the data is where we have our greatest opportunity and threat. We talk about Apple, Amazon, Google and Facebook with admiration, but the core of these companies is not music, books, search and social networking. It’s data management. That is what Apple, Amazon, Google and Facebook have made of these businesses: massive data mining drones that allow us all to dump, tag, find, update and manage our online experience. This brings us back to the core themes of data being more important than money; that the Internet of Things will have us all drowning in even more data; that data access is our greatest vulnerability.

The themes all have one core point for traditional banks and payments firms, and that point of opportunity is that the bank of the 21st century is not a bank as we would recognise it at all. It’s just a secure data vault. The vulnerability of data, and hence the secure management of data, is where banks and processors can truly leverage their capabilities. If data is more important than money, then the bank that securely manages data is the bank that will win. This is where the radical departure takes place from last century banking. Last century banking was predicated on money, paper and the physical transfer of goods. 21st century banking is predicated on data, context and the electronic transfer of goods and, most of all, 21st century banking is based upon data security.

The biggest fear of corporates and consumers is that transactions will not be processed properly, that their bank access details might be compromised, that their data and therefore their money may be stolen. That is why banks have to step up to a big challenge: guaranteeing data security. 21st century banks need to be bold and guarantee customer data is secure. The issue with this is that it would make the processor or the bank a target for hackers, but that is the exact point.

Banks should beat the hackers at their own game and make bold claims, such as we guarantee your money and your data is 100% safe with us. After all, if banks or their partners don’t do this, who will? According to many in the industry, they do not believe that banks or even their payments processing partners are positioned to do this. In fact, some believe that banks should leave secure data management to people who know how to do this such as Google and PayPal. This is where the biggest future weakness lies if this is the attitude of the financial community.

If you give Google or PayPal the opportunity to become the secure financial data manager or the secure data vault of everything, then what is the role of the processor and the bank in that future? Surely this just gives the whole game away to someone else? This is why the focus upon data and data security is the key to the future. It is not a focus upon money and financial security, but data and information security that will differentiate the future winners and losers.

On the one hand, you have visionary financial services providers – Moven, Simple, Gobank, Bluebird, Fidor, Jibun et al – pushing the envelope of being vaults for secure data. Their premise is that the leverage of data and the knowledge they can gather from your data, allows these firms to improve the value you receive from your shared electronic relationship. It’s context, proximity, location-based proactive servicing of data value that these banks offer, and that is how they will flourish and grow. There are other new models of finance emerging such as Zopa, Friendsurance, eToro and more, that will change the game again. These providers are all seeking to connect people and money through social mechanisms, and base their business upon seeing new niche opportunities for managing the exchange of data value.

Finally, we see a few hybrid banks emerging such as Alior and mBank in Poland, which offer the mixed old and new world capabilities to reach the broadest audience with the deepest relationships. Both of these are traditional banks with branches that have rebranded and relaunched as hybrid banks, incorporating social data security with bank data security. In all of these models, the core financial offers focus upon being the best at offering a remote, digital bank service that is fully secured and private. In other words, the best data vaults for money and more.

Data is the core

In conclusion, and as demonstrated, the future is all about pervasive electronic connectivity. With such ubiquitous connectivity of everything from shoes to walls, doors to cars, windows to fridges, we will see non-stop capabilities for leveraging data assets for sales and servicing. The contextual capability to market and target consumers and corporates at their point of need is going to be the battleground for future transaction processors, and those that not only leverage their data assets effectively but do this securely will be the companies that win.