Financial institutions must change the way they collect, process and leverage customer insight as part of their digital transformation journey. More than simply building a unified perspective of the customer for marketing purposes, the delivery of an exceptional customer experience will require all business units to have access to customer insight and to support all decision making with real-time insights.

Banks and credit unions that recognize the value of competing with data and analytics across the entire organization will be the best positioned to realize the full benefits of digital banking transformation.

In March 2021, the Digital Banking Report surveyed financial institutions globally on the state of their customer information management, including the use of data insight for decision making and providing enhanced customer experiences. The purpose of the research, sponsored by OpenText, was to measure the maturity of information management. More specifically, it sought to understand the benefits and challenges of overarching information management systems within banks and credit unions, as well as how organizations are progressing beyond customer data management platforms (CDPs) to more robust systems of collecting, analyzing, sharing and deploying data across business units.

Key findings include:

- Financial institutions continue to be saddled with a plethora of disconnected sources of data and systems to deploy insights across business units. Only a fraction of respondents have a central system for collecting, processing, analyzing and deploying insights organization-wide.

- Satisfaction with current data platforms and overall customer information management is extraordinarily low given the amount of data available to financial institutions. This highlights the challenge of disparate sources of data, and a lack of uniform strategy for the deployment and use of insights.

- Financial institutions are still using customer data systems for the basic requirements, focusing on collection of data and building a unified view. Most of the deployment of insights continues to be for marketing purposes as opposed to broader uses across business units. Use of expanded data sources and applications such as predictive modeling, content management, cross-channel attribution and customer care are less common.

- Until organizations establish an overarching data-driven culture, the optimization of data for revenue generation and cost containment will not be achieved. More importantly, the application of insights for improved customer experiences will not be achieved.

Read More: Digital Transformation Is About New Business Models, Not New Tech

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Current Structure of Customer Data Systems

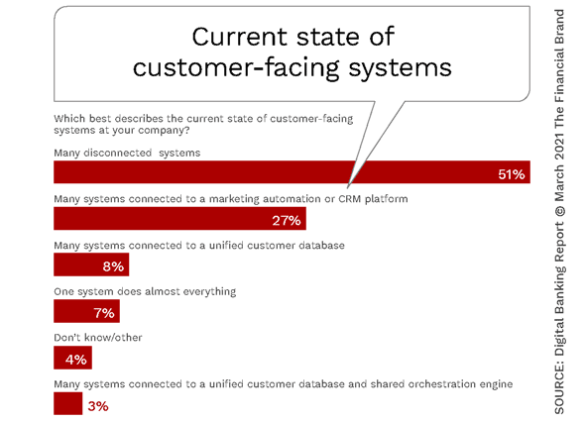

Nearly all financial institutions have multiple customer-facing systems, with most being supported by multiple silos of data. As a result, banks and credit unions have the challenge of creating a single, complete view of the customer that can be deployed across the organization. While over a quarter of organizations surveyed referenced that their systems connected to a marketing automation or CRM system, this does not serve the organization as a whole. Only 8% of organizations had multiple systems connected to a unified database and 7% had a single system that ‘did everything’.

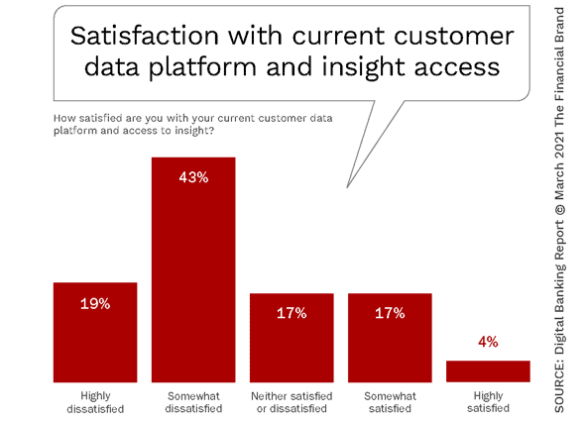

The lack of data unification has a direct impact on satisfaction with the availability of insights, and creates challenges in making use of the data that is available. The research found that 62% of organizations were either ‘highly dissatisfied’ or ‘somewhat satisfied’ with the platform used and the access to insight. Those ‘highly satisfied’ were only 4%, with ‘somewhat satisfied’ responders representing 17% of banks and credit unions worldwide.

It can be safely assumed that financial institutions with multiple disconnected systems are less satisfied than organizations with unified insights. Organizations with both unified data and a single platform to collect, analyze and distribute insights are the most satisfied. It is also safe to assume that banks and credit unions that have limited their focus to only marketing uses have a higher level of dissatisfaction since the potential for data and insights extends far beyond marketing uses.

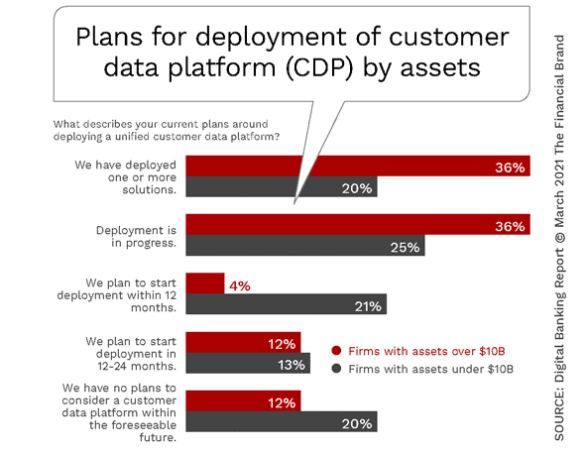

Not surprisingly, there is a sharp contrast in plans to deploy some form of customer data platform by size of organization. Not only have firms over $10 billion deployed more solutions, the larger firms are also further along in the deployment process. What is surprising is that there are some banks and credit unions of all sizes saying they have no plans to consider CDP deployment in the future.

Key Insight:

Larger organizations illustrate a much more mature positioning for the collection, analyzing, sharing and use of real-time data for business decisions and customer support.

It is possible that some of this hesitancy is caused by the financial stress brought on by the pandemic, causing investment deferrals. However, the increased need for insights to drive improved customer experiences should cause an escalation of deployments going forward.

Read More:

- Digital Banking Transformation Begins With Quality Data

- How to Avoid Digital Transformation Failures in Banking

- Digital Transformation Requires More Than Technology Upgrades

Functionality of Customer Data Platforms

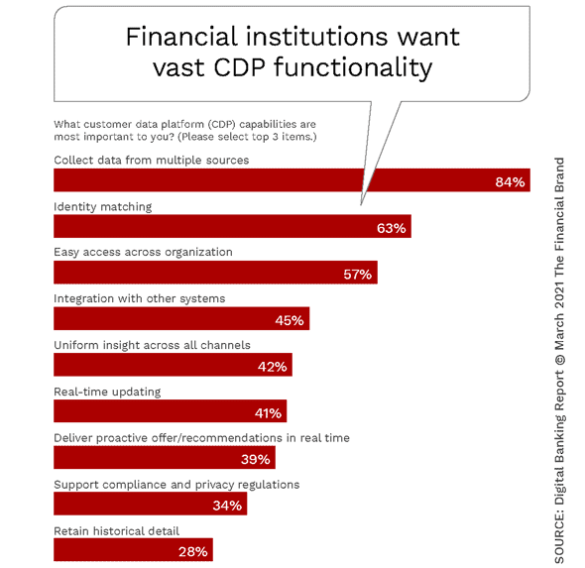

Financial institutions are uniform in their assessment of what they want a customer data management platform to do. The vast majority (84%) of respondents cite data collection from multiple sources as a top requirement, followed by a uniform identity capability and easy access to insights across the organization. While these top rankings are not surprising, they are somewhat biased toward primary functionality of CDP use today.

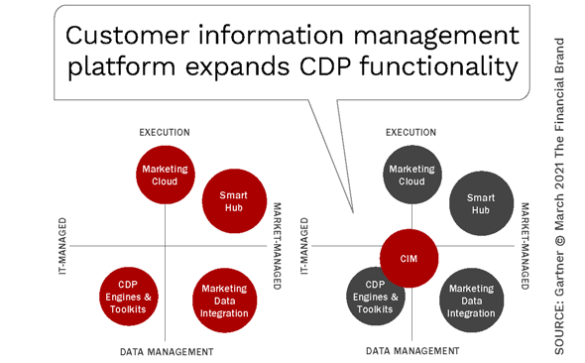

The real value of more robust insight platforms and customer information systems includes real-time insight updating; the functionality of proactive recommendations; cross-channel customer treatments; the ability to support customer call centers, compliance and privacy regulations, and even the support of content management.

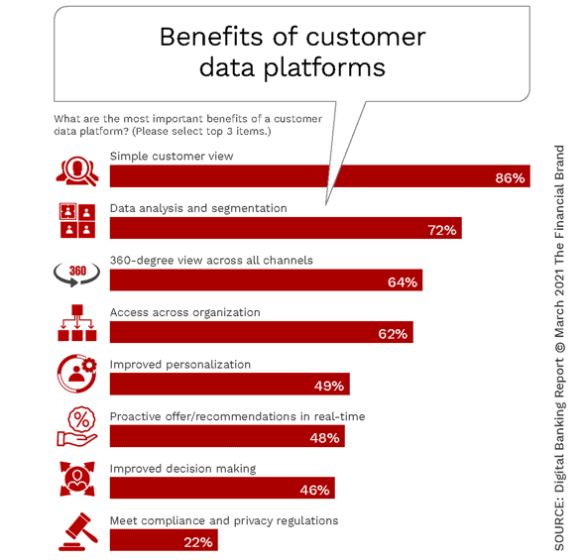

When we asked financial services organizations about the benefits of a customer data platform, the responses skewed towards marketing functionality as opposed to the ability to answer broader organizational questions. The most commonly mentioned benefit was having a single customer view, followed by being able to perform data analysis and segmentation, having a single view across channels and access across business units. While there was a recognition of more robust benefits, such as personalization, proactive recommendations and improved decision making, these were much lower priorities.

Enhancements to Traditional Customer Data Platforms

-

Consent and preference management: Collect and consolidate end-user choices regarding how their personal data should be handled and synchronize these choices across marketing systems.

-

Testing and optimization: Enabling A/B and multivariate tests that optimizes the customer experience based on campaign response.

-

Content management: Support of content being delivered to customers based on identified needs and web/social activity.

-

Data analytics support: The ability to import and manage machine learning alternative data analytics tools.

-

Cross-channel support: A channel-agnostic recommendation engine supporting call centers or live chat agents.

-

Identity resolution and relationship aggregation: Capability to accommodate account or organizational aggregations of contacts who are associated with business enterprises.

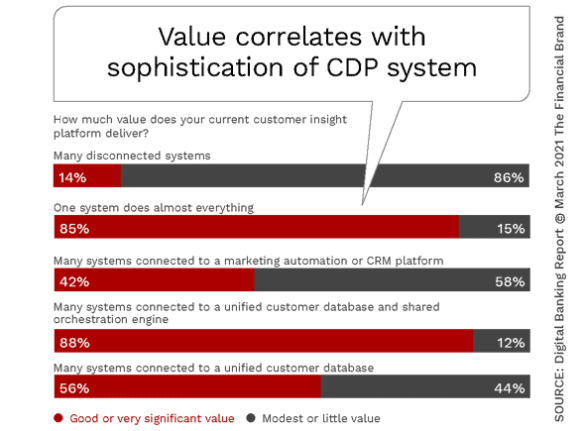

Not surprisingly, the value of a customer data platform correlates to the sophistication of the system, including the unification of customer insights, the power of the platform that the organization uses, and the visibility of the insight across the organization.

Probably the most powerful component to data transformation is the organization-wide accessibility to the insights generated. Transforming data so that it can be used by all business units within an organization, simultaneously, involves a democratization of data access. This is often referred to as a Data-as-a-Service (DaaS) model.

Key Insight:

A Data-as-a-Service (DaaS) model is imperative for digital banking transformation, democratizing data for use across the organization, supporting business decisions and improving the customer experience at each touchpoint in real-time.

In the most data-mature organizations, internal data is blended with other data including second- and third-party data, with the unified view of the customer available organization-wide.

A data information management strategy is central to making data uniform, trusted and actionable across the organization. The result is not only a better customer communication strategy, but better business outcomes. A successful data strategy brings together data, technology, analytics, strategy and delivery services for greater reach, revenue and return. This creates an improved customer experience.