The coronavirus pandemic have reshaped consumer’s money management and banking behaviors in dramatic and historic ways.

Consumers have sharply cut travel and entertainment expenses during the pandemic, sending the personal savings rate soaring to a historic 33.7% in April, for example. One in five Americans saved at least $1,000 during the pandemic, according to a survey by MassMutual. Money app Qapital reports a fourfold increase in the number of people setting up savings goals for emergencies.

The pandemic has created a class of new super savers. However, as we emerge from this global health crisis, at some future point, how many consumers will continue to save? What savings and money management features will consumers want in what will likely continue to be uncertain times?

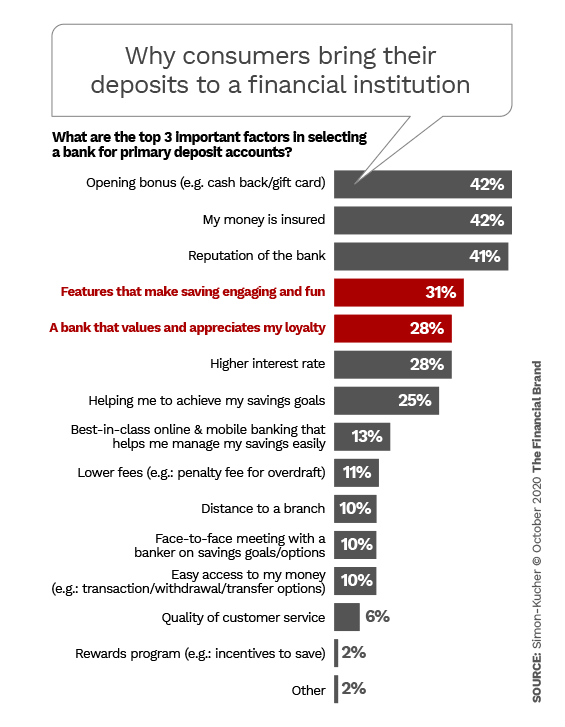

The pandemic has also changed what people expect from their banks and credit unions. Preferences for one financial institution over another is increasingly influenced by how the institution makes them feel. In a survey conducted in September 2020, Simon-Kucher & Partners found factors such as the extent the institution had features that made savings engaging and fun or if the institution values their loyalty, have risen in importance from past surveys. These emotional factors now rank among the top five reasons driving decisions to switch banks.

Banks and credit unions must accelerate efforts to tap into their treasure trove of data and leverage data analytics and predictive intelligence to uncover emerging and fundamental shifts in banking behaviors and preferences. This deeper understanding will prove critical in retaining high-value consumers, preventing attrition, deepening relationships and increasing client acquisitions.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Fractional Marketing for Financial Brands

Services that scale with you.

Flow of Funds Mapping Can Improve Understanding of Consumer Motivations

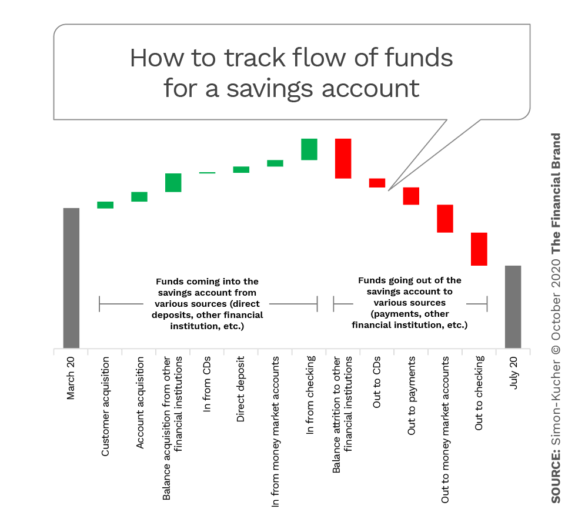

An interactive flow-of-funds model that maps and analyzes the movement of funds in real-time can provide insights and intelligence into how consumers’ banking and savings behaviors are evolving and changing. A flow-of-funds model based on your institution’s consumer behave will track funds movements internally between various deposit, lending and investing accounts, and externally involving accounts held outside the institution.

For example, leveraging its flow-of-funds model, one leading bank was able to detect large outflows of funds from mutual funds to more liquid savings instruments within the institution at the peak of the lockdowns in March. The bank also saw less movement of funds out of the institution during this period, confirming a flight to safety and not a sign of bank-switching behavior. There were also distinct differences in savings behavior across consumer segments based on age, region, account balances and tenure during the pandemic. For example, younger people were more likely to “park” funds in checking accounts, while older customers tended to prefer savings accounts or short-term savings instruments.

This bank has been able to capitalize on these insights to produce personalized messages, tailored offers and specific rewards to match consumer segment preferences.

Read More: Tectonic Shifts in Consumers’ Life Views Financial Marketers Must Grasp

Accurate Segmentation and Analysis Will Be Essential

Flow-of-funds analysis can also help banks refine customer segmentation efforts and identify changing segment characteristics early. Using a flow-of-funds analysis, another financial institution noticed these behaviors early during the coronavirus pandemic:

- Mass market customers were parking funds in checking accounts.

- Consumers with assigned financial planners moved money out of mutual funds into savings accounts.

- Private banking customers were moving funds out of the institution into alternative investments.

Leveraging a daily flow-of-funds analysis, banks and credit unions can also uncover geographical differences in savings preferences between urban and rural regions, or between customers in the Atlantic Coast versus Pacific Coast, for example.

Banks and credit unions can leverage these insights to improve rewards, retention efforts and cross-selling programs. A nimble marketing department can ramp up fresh approaches in response to such data — where the institution is keeping track of flows.

Read More:

- Data and AI Must Play Bigger Role in Financial Marketers’ Growth Strategies

- How Personalization Strategies Can Backfire on Financial Marketers

- Personalization in Banking Can’t Be Disguised as Cross-Selling

Better Analysis of Flow-of-Funds Data Can Predict Attrition Possibilities

At one institution, flow-of-funds data analysis revealed customers who had been with it for one year or less were more likely to move funds out of the bank when long-term CDs came due during the pandemic. Noticing that some high-value customers preferred more liquid, shorter-term savings products, the institution was able to respond quickly with the introduction of savings products with more flexible terms during the pandemic.

In a world constantly reshaped by emerging technologies, pandemics and demographic shifts, having a more granular and frequent view on consumer banking behaviors enables an institutions to detect and accurately predict shifts in consumer priorities and preferences.

Instead of knee-jerk reactions based on “gut feel” or anecdotal information, bank and credit union promotional programs can be more precise, targeted and informed by the most current consumer behavior patterns. Analyzing weekly and even daily fund movements at the individual consumer level can improve retention because people exhibiting attrition behaviors can be quickly identified for targeted offers.

That is a tactical use of funds flow data. More strategically, insights on emerging preferences can be used to improve product innovations and personalize communications to accelerate acquisitions.

Read More:

- Three Hurdles to Personalized Banking CX (and How to Remove Them)

- How Financial Institutions Can Help People Gain Economic Peace of Mind

- How Financial Marketers Can Prepare for the Next Switching Surge

Most Institutions Have the Raw Data and Just Need to Refine It

Banking behaviors, preferences and priorities are continuing to evolve as the pandemic upends lives and disrupts spending habits. With the right data tools, financial institutions can analyze their customers’ evolving behaviors at a more granular level. This goes beyond savings deposits to include internal and external funds transfers, savings patterns and demand for loans. This data can assist in setting realistic goals, rather than engaging in strategic planning in a vacuum.

Most institutions mistakenly believe that achieving these advantages this involves huge financial outlays. That’s not true. In fact, it’s a matter of leveraging capabilities that many banks and credit unions already possess to translate the immense store of transactions and funds-movement data that all institutions already have into actionable intelligence.

Wei Ke, Ph.D. is a Managing Partner, Rohan Shah is a Director, and Kartik Vyas is a Senior Consultant at Simon-Kucher & Partners.