The era of “big data” is upon us, especially in the financial services industry where there is a wide range of products are delivered in a variety of channels and marketed through multiple media. Financial marketers have been caught a bit flat-footed regarding how to best capture, understand and utilize the rich and abundant data available to them, but are quickly making up ground.

The evolution of sophisticated technologies that enable identity matching — coupled with limitless storage capacities and improved analytics capabilities — gives financial institutions the power to leverage data in ways that can fuel highly relevant conversations with both their customers and their prospects.

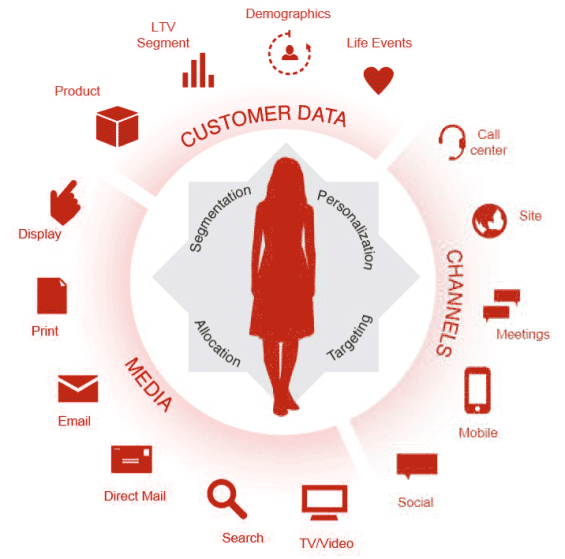

Achieving a new level of consumer insight is crucial. As marketing budgets are more heavily scrutinized and increasingly require more justification, it’s essential that you collect the right data and use it appropriately. These are the three major categories of data that you should focus on: customer data, channel interactions, and media habits.

1. Customer Data

The most powerful and predictive data for financial marketers comes from data provided by customer interactions and behaviors. In general, banks and credit unions have done a reasonable job building a marketing database that collects and incorporates demographics, balances, and product utilization. Other data points, however, may be overlooked:

- Length of Relationship – Where are they in the lifecycle of their relationship with the bank?

- Life Stage – Where are they in their lives?

- Expanded Demographic Data – What are other preferences and propensities can be correlated to financial service product needs?

- Lifetime Value – What kind of long-term potential for revenue do they represent?

- Net Worth – What is the value of their total wallet, not just what they have at your institution?

- Location – Physical proximity to a branch.

- Abandoned Application Data – Important for follow-up marketing.

Basically, banks should be capturing everything possible in relation to the customer and their banking relationship. Appending your marketing database with external information can help identify consumer wants and needs, properly prioritize and segment customers based potential value, and improve the overall relevance of marketing messages and offers.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

2. Channel Interaction and Disposition

Because of the vast amount of detailed transaction data distributed across multiple channels and product categories (i.e., silos), retail financial institutions have not generally been able to tap into their transactional data. The optimal approach is some kind of “operational data store” (ODS) that captures transactional data and summarizes it for practical applications. This data can help your various business lines identify previous interactions with your institution that may indicate either a potential problem or need. Some examples of the types of data that could be captured include:

- Transactional Channel Usage – Branch, online, mobile, ATM, and call center transactions (type, frequency, dollar amount, geo/locational information).

- Single vs. Multiple Channel Users – Understand “traditional” and “digital-only” groups.

- Contact and Problem Resolution Preferences – Whether identifying via preference center information or previous behavior, it is important to understand how customers want to interact with their banking provider. And keep in mind: their preferred touchpoint may be different for problems versus marketing or general contact.

- Customer Dialogue Disposition – What were the results when you made contact (the call, email, or chat session) for sales or service dialogue?

- Social Media Identifier – If someone ‘Likes’ your Facebook page, they are likely to be highly engaged and have a favorable attitude towards your institution. It could be both important and valuable to know who these people are.

- Frequency of Interaction – Are they rarely interacting with your institution? Or interacting with it daily?

3. Media Viewing and Response

Marketers — particularly in banking — have basically dropped the ball with respect to capturing response data and using it for remarketing. Those consumers who have previously responded to marketing offers are generally more likely to respond to subsequent campaigns, so it is important to capture this information and to be able to utilize it for other programs. There are at least five media channels that provide great opportunities for what’s called “response capture”:

- Online Display Advertising – Using cookies and behavior data

- Online Search – Using cookies and behavior data

- Direct Mail – Using “responder” identification

- Email – Click throughs and conversions

- Outbound Telemarketing – via captured disposition

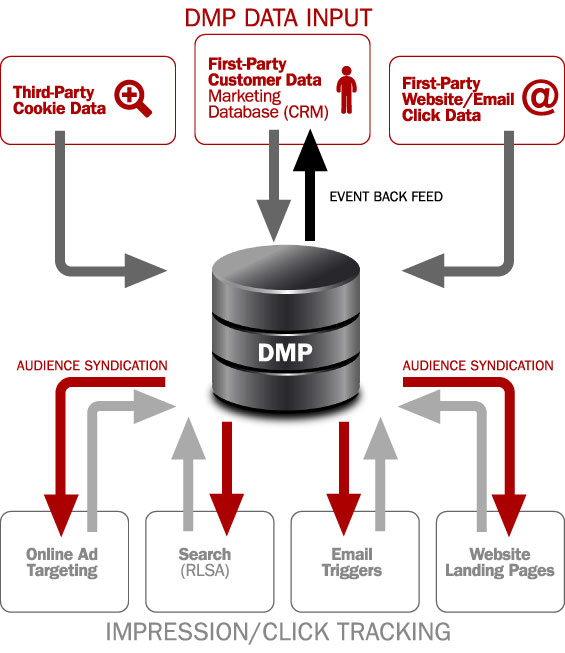

Stitching It Together With a Data Management Platform

Because all these various data streams involve a mix of addressable and non-addressable information, you’ll need an “identity management system” to tie it all together. Cookie data does not contain traditional information like name and address, so you need some sort of bridge to link this data to known, addressable, data. This is where the data management platform (DMP) comes in.

Quite simply, a DMP works across channels and media execution to capture “first-party data” (e.g., data provided by the customer or your IT systems) and “third-party data” (e.g., online cookies). Utilizing an effective identity management system to match offline and online data, a DMP can help you formulate better strategies for online ad targeting, paid search campaigns, email triggers, customized landing pages, etc., with greater personalization and relevancy for increased sales and an improved customer experience.

“Personally identifiable information” such as name, address, or SSN cannot be stored in a DMP, so it is simply an engine to gather information from various interactions in digital media channels. When you bridge this information back to your database, you can measure results and refine your approach. This process also allows for more accurate measurement of marketing spend across channels, giving you a clearer picture of ROI and which channels work best for particular customer segments.

A data management platform gives you the mechanism you need to link online digital media programs with offline conversion information — an element that most financial marketers have never had. It lets you fully understand what consumers are actually purchasing through digital channels, and how they use your products/services. Ultimately, you can use this intel for look-alike modeling to reach even further.

What Does It All Mean?

In the Digital Age, your database is the core of your marketing program. It should be driving your strategy, which requires advanced data capture and integration. The number of data points you can collate is what will determine your level of success. The good news is that the banking industry now has the technology, tools and expertise to yield good integration of both online and offline data that can truly revolutionize your approach to multi-channel marketing.

It starts with the proper context of the customer. Who are they? What do they want? How and when do they want it?

The effectiveness of your database hinges on connectivity — the ability to appropriately capture and utilize data across multiple channels — which will require effective identity management and a strong DMP.

Lastly, all of this culminates in feeding the content that goes back into the dialogue with the customer. How do you differentiate the message or offer to a particular customer for relevancy and increased interaction?

Tools available today can help financial marketers finally harness and utilize “big data” strategies like these to significantly increase their sales and retention rates. And this is something that has been sorely in demand for a very long time.