The rapid transition to digital and mobile banking has fostered a mindset that borders on technological utopianism among banks – at least when it comes to what many presume to be the future of customer service and sales.

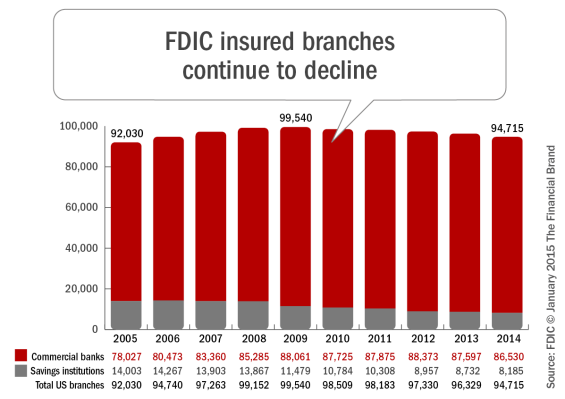

Listening to the commentary on this subject, one can only think that many of the traditional tools are dead – whether you’re talking about branch banking, the helpful representative, or the free cup of coffee. After all, according to FDIC data, the number of bank branches has fallen to its lowest level since 2005 and their prominence as a customer sales and service tool will continue to be reduced as online banking becomes easier and more widespread.

But in accepting the current wisdom, one should not also assume that somehow, magically, customers will no longer need help with their personal finances, or that they will in every case pick and choose products and services themselves, with no personal touch needed.

Nothing could be further from the truth.

Fractional Marketing for Financial Brands

Services that scale with you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Digital Banking Changes the Rules of Engagement

Financial services are an inherently complex arena. The critical point to keep in mind is that the transition to online banking does not eliminate the customer’s desire for benefits such as better service or financial guidance. Rather, it changes how these benefits will be delivered. The challenge for banking, in the face of rapid technological innovation, is to find new ways to continue providing these benefits – in part so customers and members don’t defect to a competitor, but also because smart, personalized guidance is one of the best ways to sell more products and services. Why? Because focusing on someone’s individual needs builds trust.

“The consumer wants suggestions based on their personal financial situation, yet banks often pursue aggressive selling instead.”

The foundation for building this trust comes in the form of Big Data (capitalized here for the almost unquestionable reverence some have for data to solve their problems). The increasing ease of access to, and growing proliferation of, data no doubt provides insights into customer behavior, yet the mere existence of such information is no salve. For, while it seems almost banal to say, it never stops being true: Data alone is not the answer. Using it effectively to create a valuable experience from the customer’s perspective requires careful consideration about what the client and the banking organization need and want. Unfortunately, financial institutions and consumers are not always in alignment on the use of data. For example:

- The consumer wants suggestions based on their personal financial situation, yet banks often pursue aggressive selling instead. Individuals are suspicious, if not hostile, when they feel they are being sold something purely in the interest of a bank. Financial institutions should not confuse the need for business results with consumer needs. To complement existing customer acquisition programs, firms can use the data and technology available to them to serve up guidance that identifies the right moment to introduce a customer to a new product or service.

- Customers expect online applications to “know them”, yet experiences with banks and credit unions often feel institutional … lacking personalization. Marketing campaigns, even when brilliantly applied and segmented, don’t always make the customer feel as if the bank knows them or understands their needs. Financial organizations need to find new ways of establishing and maintaining a personal and helpful relationship that benefits the customer, particularly as technology makes it easier for customers to take their business elsewhere.

- The potential for Big Data overload. Financial institutions have more access to structured and unstructured insight than ever before, but they are not always sure how to harness it, or even how to deal with it as more and more comes in.

It’s Not About the Data, It’s About What You Do With It

The misalignments noted above make it clear that simply having access to more data is no panacea. According to the Harvard Business Review, WalMart collects more than 2.5 petabytes of data every hour from its customer transactions. One petabyte is equal to about 20 million filing cabinets worth of text. The power comes in knowing how to synthesize this data, both so that financial institutions can respond to customers and customers can respond to financial institutions.

Within every financial institutions’s vast data universe of customer interactions, transactions, behavioral quirks and purchase history lies a treasure trove of insight that can help organizations quickly zero in on customer pain points, problems, opportunities, and goals.

Consider, for example, that sinking feeling we’ve all had when we pause for a moment to wonder if we transferred enough funds into the checking account to cover the automatic withdrawal for, say, the monthly car payment. It’s an unpleasant visceral experience … the sound of your heartbeat, the scramble to a laptop or banking app to check balances and, in the worst case scenario, the frustrated disappointment to learn we’ve incurred an overdraft fee simply for forgetting to transfer funds.

Now, imagine that same scenario when your bank or credit union is smart enough to use what it already knows about your withdrawal and transfer history to keep track of your upcoming commitments. If your financial institution reminds you online, through a mobile device text or maybe even with an alert on your smart watch to transfer those funds before it is too late, Big Data just helped you avoid a painful financial moment – and your bank is suddenly a quiet hero.

That type of interaction may not fit the traditional definition of marketing, but it goes a long way in helping financial institutions find and keep customers.

Tailoring Your Customer Interactions

How consumers respond to banks is arguably the most important part of the digital transformation currently unfolding in banking. What sets apart a truly personalized solution from a non-customized response is the ability to learn and adapt – to take the established set of topics and features and evolve, not only so that guidance can change as individual circumstances change, but so that the advice offered by a financial institution is able to improve based on the real-time, dynamic needs of each customer.

As the relationship between consumers and banking continues to evolve, financial institutions will likely face the task of needing to offer ever more specific, personalized solutions to consumers. The technology exists to provide such service … what’s needed is a shift in mindset that moves away from using Big Data to sell and toward using Big Data to guide and build trust.