There is little argument that the importance of a financial services provider will continue in the future. What is still in unclear, is what role traditional banks and credit unions will play going forward. The threat to the relevance of traditional financial services providers comes from the expectations being set by non-bank digital-first organizations, the burden of legacy systems and organization structures and the impact of new fintech players.

Customers are expecting real-time contextual solutions, outstanding omnichannel service, intuitive design, simplicity, transparency of products and pricing, strong personalization, and a seamless experience across channels. None of this can be achieved without a commitment to using all of the data at an organization’s disposal, and the application of advanced analytics to provide a differentiated customer experience. Unfortunately, many legacy banking institutions have a significant gap in customer understanding, lacking the insights into needs, behaviors and customer journey on a ‘segment of one’ level.

According to the EY Global Consumer Banking Survey, there are four factors that banks should focus on:

- Data to Build and Earn Trust – Beyond the ability to look after a customers’ money, it’s the ability to always do the right thing for the customer and provide unbiased, high-quality advice.

- Data to Better Understand Customers – Understanding behaviors and tailoring propositions to different types of customers.

- Data to Rethink Distribution and Engagement – Analyze the role of branches and customer journeys across channels.

- Data to Innovate Like a Fintech – Improve product offerings and deliver exceptional, simple and contextual customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Data to Build and Earn Trust

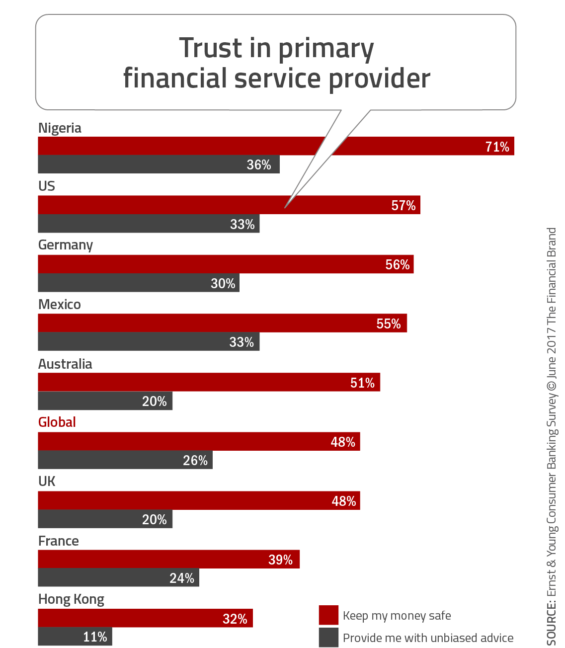

While the majority of financial institutions globally believe that their trustworthiness will be sufficient to retain customers, the reality may not be as positive. Although most customers surveyed by EY indicated that they continue to trust their primary financial institution to keep their money safe, their confidence in traditional financial institutions is not overwhelmingly positive.

For example, on 26% of consumers globally believe banks will provide them with unbiased advice. While the confidence in U.S. banks is a little better (33%), only 20% of consumers in the U.K. believe their primary financial services provider (PFSP) will provide unbiased advice.

A significant reason for this lack of advisory trust is because many organizations still do ‘product-push’ promotions, based on bank portfolio needs as opposed to building sales models based on consumer needs. Without adequate data and analytical models to ascertain customer needs in real time, the consumer perception will continue to erode compared to more customer-centric organizations.

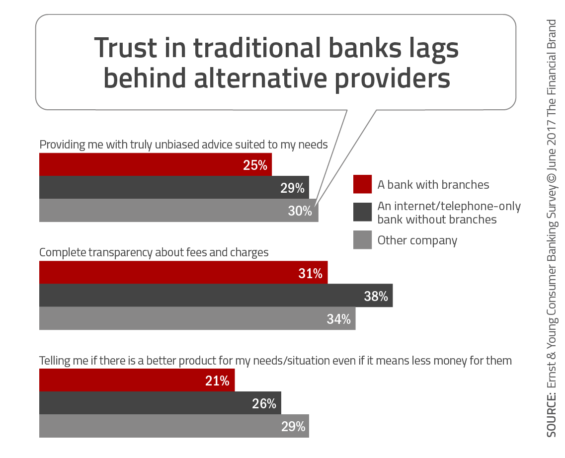

According to the EY research, banks lag behind nontraditional competitors, such as digital-only banks, fintech firms or supermarkets offering banking services. This applies across the three dimensions EY tested: transparency in fees, providing unbiased advice and recommending products that are in the best interest of the customer. The differences were not significant, however, providing the opportunity for traditional firms to regain lost credibility. According to the report, “Becoming a valued partner to customers in major life events will help banks regain customer trust and restore their relevance.”

Data to Better Understand Customers

Customer expectations have increased significantly around what they expect from organizations that collect data. To differentiate offerings, banking organizations will need to deliver the level of customer experiences that other industries provide. This requires a paradigm shift from providing reactive statements of activity after an event to designing and delivering pro-active customer experiences.

Banks need the ability to develop a single customer view, bringing together customer data from all disparate systems. They also need to leverage machine learning and deep learning tools to deliver financial solutions where, when and how the customer desires.

To provide better experience at every step of the customer journey, financial institutions will need to improve the quantity and quality of data held as well as increase the use of advanced analytic tools. According to EY, “Improving the quantity and quality of customer data is only the start. The ultimate goal is for banks to harness customer data analysis to deliver pro-active customer experiences. That means establishing a direct link between raw customer data and the creation of personalized experiences that drive stronger loyalty and higher revenues.”

Data to Rethink Distribution and Engagement

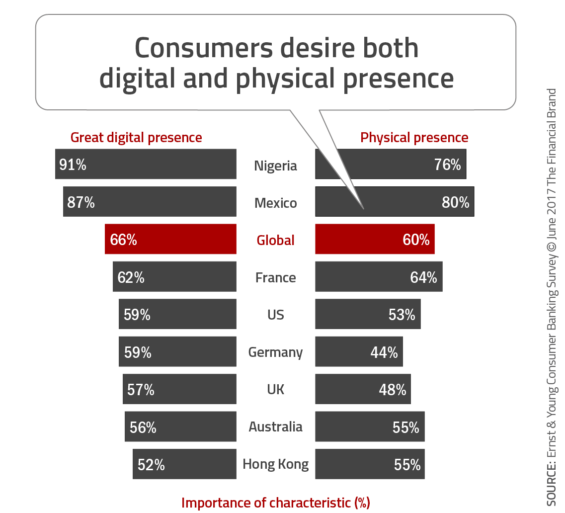

Diversity of customer behavior increases the complexity of the customer experience challenge for traditional banks. Unlike fintech firms – where customers are all, by definition, digitally savvy – legacy banks need to deliver across both digital and physical channels. For instance, the majority of digitally-savvy consumers still like to speak to an advisor on occasions.

For example, while 66% of customers globally think that it is highly important for a bank to have a digital presence, 60% also feel that a physical presence matters. While the requirements are a bit lower in more developed countries, understanding consumer channel preferences is an added dimension that illustrates the need to leverage more data for better experiences.

The research also found that 44% of customers would not trust a bank without branches, with a much higher number in some markets (e.g., Mexico with 63% and Malaysia with 54%). In other words, digital is not completely replacing the human experience at any time soon. That is not to say that physical presence may not be able to be replicated by enhanced digital/video options in the future.

Potentially more important than just understanding the need to provide digital and physical channel options, the research suggests that banks need to think beyond a “multi-channel” approach, where channels are organized in silos to an “omni-channel” organization, where the ability to switch between channels seamlessly is possible. In other words, banks need to allow customers to move from channel to channel depending on their needs and preferences, without having to work around constraints imposed by the bank. The ability to provide this capability is anchored in the deep analysis of available data.

Data to Innovate Like a Fintech

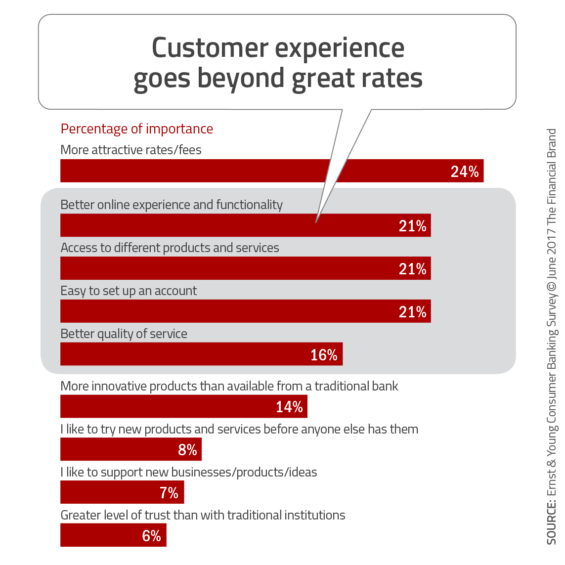

The history, culture and steeped tradition of the legacy financial services industry has resulted in an undifferentiated product and services offering. Most products, and even the way digital services are delivered are more complex (and less transparent) than the customer desires.

Competitive rates and fees matter, but the desire for a better customer experience that simplifies daily life is what digital consumers crave and what many non-bank competitors deliver. According to the research, for consumers in some countries (e.g., Russia, Mexico, Turkey, India or Malaysia), attractive rates/fees are not even in the top three of the reasons why they consider switching to a nontraditional bank.

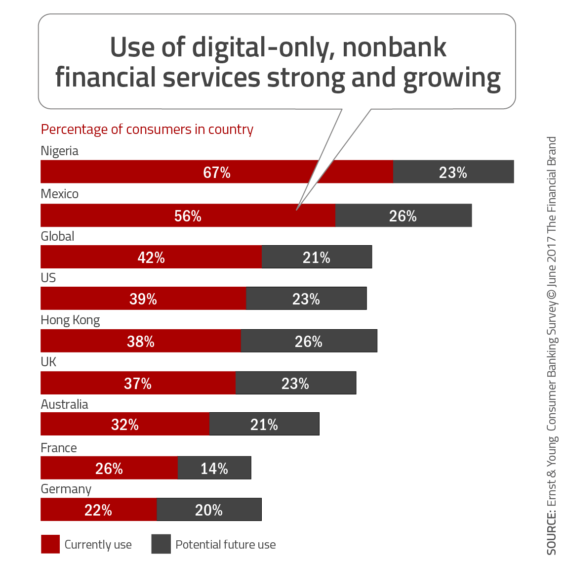

Globally, 42% of consumers have used non-bank providers in the last 12 months, and 21% of the remaining customers who have not yet used them are considering doing so. Emerging markets are ahead of developed economies in terms of adoption of non-bank providers, usually because the fintech firms were the organizations that changed the underbanked and unbanked dynamics.

To be in a more advantageous competitive position, traditional banks need to leverage the customer data advantage they possess, and start innovating not only like fintech firms, but with fintech firms. According to EY, “The fintech world is increasingly being perceived as the innovation engine for the industry, with banks scanning the market for companies to emulate, partner with or acquire.”

EY goes on to say, “Banks that develop the ability to deliver proactive customer experiences will not only reclaim their traditional position at the center of their customers’ lives. They will also be ready to respond to future developments in technology and customer behavior.”