For years, financial institutions have leveraged internal insight they have on their customers to manage risk and fraud, as well as to improve product development, and (of course) marketing and customer communications. Today, however, new and enhanced technologies coupled with the availability of a vast pool of structured- and unstructured external “Big Data” allows for real time multichannel decisioning that can save money and increase revenues. At least that’s the theory.

The question is: Is now the time to embark upon a Big Data strategy?

What is Big Data?

“There were 5 exabytes of information created by the entire world between the dawn of civilization and 2003. Now that same amount is created every two days.”

— Eric Schmidt, CEO/Google

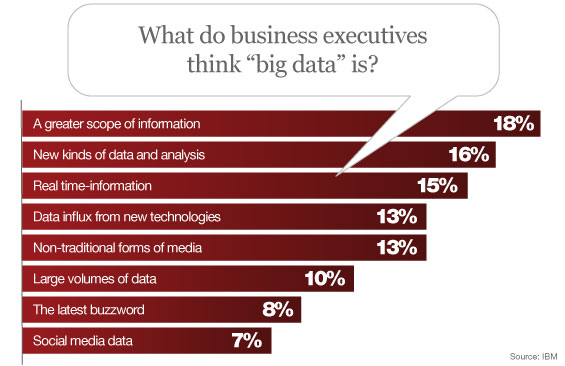

Much of the confusion around big data stems from a misunderstanding about the definition itself. Rather than any single characteristic clearly dominating the view of big data as part of a recent poll by IBM, respondents were divided in their views on whether big data is best described by today’s greater volume of data, the new types of data and analysis, or the emerging requirements for more real-time information analysis. One in 12 dismissed it as nothing more than the latest buzzword.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

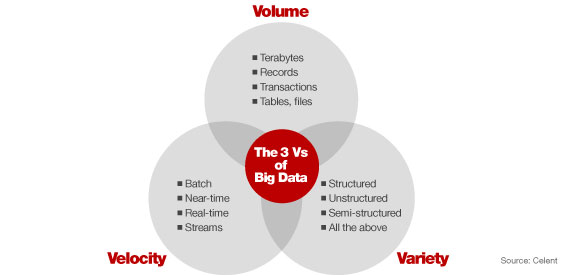

While there are several definitions of big data, the most common reference focuses on data that reflects added Volume (terabytes, records, transactions), additional Variety (internal, external, behavioral, social), and increased Velocity (near- or real-time assimilation).

Understanding the “Three Vs of Big Data” is important, since understanding the value of data being created today allows a bank to understand their businesses, customers, channels and the marketplace dynamics, including new sales and service opportunities.

“Analytics, customer-centricity, and multichannel technologies are major trends across the market,” says Bart Narter, SVP of the analyst firm Celent, and co-author of a recent report, Core Banking Solutions for Midsize Banks: A Global Perspective.

“Banks increasingly want a core system that utilizes data analytics in order to provide a more complete view of the customer, which then allows for better customer-bank communication,” Narter writes.

In the financial services industry, while there is a great deal of discussion around big data, many banks are just beginning to consolidate and utilize many of the internal data elements at their disposal, such as debit and credit transactions, purchase histories, channel usage, communication preferences, loyalty behavior, etc.

In the financial services industry, while there is a great deal of discussion around big data, many banks are just beginning to consolidate and utilize many of the internal data elements at their disposal, such as debit and credit transactions, purchase histories, channel usage, communication preferences, loyalty behavior, etc.

In the context of big data, banks would expand their current structured insights to include the gathering and analysis of data from sources including web click streams, social interactions (Facebook and Twitter), geo-locational insight, and other similar new wells of information.

What Are the Potential Benefits of Big Data?

The areas within the banking industry that present the strongest near-term opportunities for tangible performance improvement include risk management/fraud detection and improved customer communication and loyalty.

Risk Management/Fraud Detection – With the financial crisis of 2009, risk profiling and fraud detection became top priorities. Expanding the use of alternative channel insight and increasing the velocity of data capture, the use of data beyond the institution’s firewalls provides an enhanced snapshot of household finances and spending behaviors.

For instance, with the addition of alternative device transactions and the ability to track changes in behavior beyond what is occurring with a client’s credit account, banks can isolate new fraud or risk triggers. This added insight and enhanced algorithms provides advantages in effectively reducing risk, managing credit exposure and allowing for timely intervention where necessary.

“We have been looking at how technologies around big data can help us make data analytics faster and more agile.”

— Greg Nichelsen,

ING Direct Australia

Targeting – The ability to better understand consumers, seamlessly matching “right-time” offers to a customer’s or prospect’s needs, allows a financial institution to optimize the management of profitable, long-term customer relationships. The addition of a vast amount of relatively unstructured online insight provides an enhanced view to this end, potentially improving both effectiveness and efficiency of marketing efforts.

Layering upon this added insight, the ability to leverage precisely timed geo-locational and event-based targeting at the point of sale (either at the bank or an offer delivered to a smartphone by a merchant partner) provides both marketing and payments advantages that few industries can match. The impact can break through the wall of promotional noise, leading to improved revenues along with an enhanced customer experience.

For example, if a customer has a habit of going to a certain area for shopping or lunch on a regular basis, analyzing the data could provide the foundation for offers that are highly personalized even to the type of food the customer prefers, with a knowledge as to the likelihood of offer acceptance. Adding device specific capabilities, the offer could be delivered by SMS at the most logical time for decisioning. This is the same type of model used by Amazon and other retailers.

Another example is the combination of Zillow functionality with an augmented reality home lending app that could allow a customer to use their smartphone to find values of houses in a neighborhood and seamlessly apply for a loan using a handheld device. The insight captured during this shopping process combined with credit bureau information would allow a bank to better target messages around a potential pre-approved loan.

“I think the biggest benefit is that it takes you an enormous leap forward in analytic capabilities.”

— Greg Nichelsen,

ING Direct Australia

From a foundational level, big data could provide the insights to develop segmentation strategies based on transactional, behavioral and even social profiles. This would allow the organization to provide a highly personalized, consistent experience regardless of the channel selected by the customer, eliminating traditional silos that create a challenge today.

More Data = Better Decisions?

As with the claims surrounding the value of CRM in the 90s and social media more recently, many of the stated benefits of big data for banks are — at the present time — little more than vendor fantasies. There is a glaring lack of concrete case studies, and those that are cited are based on broad, often incorrect interpretations of what “big data” is. In searching for evidence of big data’s potential, you’ll find that much has been written about its application in theory, but specific success stories are scarce indeed.

“The idea that you need to store, mine and analyze every scrap of the customer data they collect is not practical.”

— Penny Crossman, American Banker

It is indisputable that using data more effectively can lead to substantial benefits, including monetary improvements in risk management and marketing, but the jury is still out as to whether these benefits provide an adequate ROI compared to the investment required.

Key Question: Is more data actually better? Does it lead to better decisions? Or just muddle the waters?

Best Data Strategy May Be to Start Small

As opposed to jumping into big data with both feet, it may be best to test the waters first, prioritizing investments and using a test-and-learn mentality to determine how fast — and deep — to go.

According to new research by Capco, 62% of banks believe that managing and analyzing big data is important to their success. However, only 29% say they are currently extracting enough commercial value from data.

These challenges are all too familiar to bankers. Saddled with legacy, siloed technology platforms, they lack analytical expertise and structure, and can only support “traditional” approaches to data utilization. According to Capco’s study, this is why most financial institutions will find they’re woefully unprepared for a big data transformation.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Learn to Walk Before You Run Away With Big Data

According to a recent Novantas report, most banks are best served by using a building block approach to big data, only layering in additional complexity (and investment) after establishing a strong data foundation. This philosophy seems especially relevant for those banks that don’t currently have a unified view of their customers; many banks have created data silos with no linkage between checking, small business, retail, mortgage and credit card customers.

The illustration below shows how Novantas believes banks can build an enhanced customer profile.

Doing Nothing May Not Be an Option

While moving cautiously in the world of big data is a viable strategy, doing nothing is not an option. With many institutions building a big data strategy, the ability to pick off your best customers from a current competitor is an increasing threat. Beyond that, there are many alternative providers that are building pseudo-banking strategies, collecting vast amounts of insight that can be used against you in the future. Google, PayPal, Amazon and other organizations are building a wealth of data on purchasing patterns.

While the data within your firewalls provides a distinct competitive advantage, the unstructured insight available online, through mobile channels and through social media are equally valuable. In the new world, knowing that a purchase was made may not be enough. Knowing what was purchased may be the incremental difference needed to create loyalty.

As with most investments, a financial institution needs to determine if the added volume, variety and velocity of data brings measurably better results. As Richards J. Heuer, Jr. argued in the Psychology of Intelligence Analysis (1999), the primary failures of analysis are less due to insufficient data than to flawed thinking. To succeed analytically, we must invest a great deal more of our resources in training people to think effectively and we must equip them with tools that support that effort.

The question, though, is that most banks are already dealing with data overload and aren’t very good at consolidating and using the data they have now. What are the odds we’ll get better with more being piled on?

More data doesn’t fix bad analytics.

Maybe, many financial organizations should focus on perfecting the ‘small data” first.