Many financial services organizations are in the process of trying to increase the level of digital engagement with their customers. They hope to use this enhanced digital engagement to deepen the understanding of their customers, thereby improving service, strengthening relationships and increasing retention.

The foundation of this digital engagement is the collection and use of data from existing corporate systems, external insights and data associated with digital engagement. Organizations that have the ability to use data and advanced analytics to improve personalization, contextuality of communication and business processes will build the most business value.

Data Analytic Maturity Low at Most Institutions

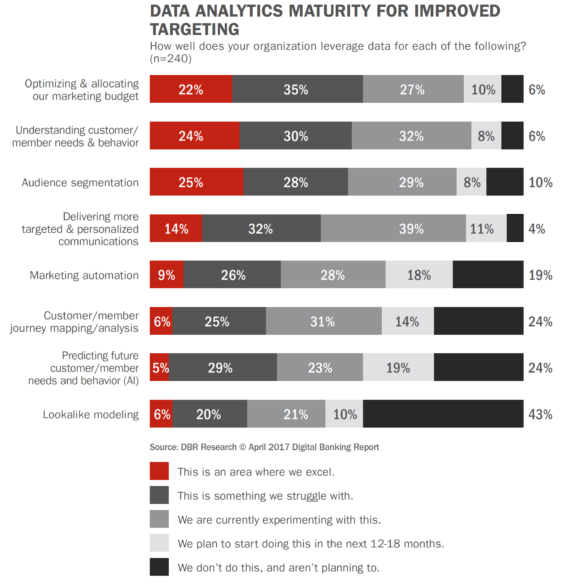

As part of the 2017 Financial Marketing Trends survey, we sought to determine where financial institutions were in their big data and advanced analytics maturity. As might have been expected, the use of data is strongest when we look at traditional applications, such as budget allocation, understanding needs and basic segmentation. In each of these categories, 50%+ of organizations either excelled at using data (22%-25%) or were experimenting with the tools (27%-32%).

Interestingly, these three categories were also where organizations struggled the most. In fact, 25% of organizations felt they excelled with advanced segmentation, 29% were experimenting, while 28% struggled with this application of data.

Data analytic maturity quickly dropped when firms were asked about personalization, marketing automation, customer journey mapping, needs analysis (AI) and modeling. In fact, except for trying to improve personalization, there were between 19% and 43% of organizations that don’t even plan to move to this level. This complete rejection of advanced analytics and marketing automation is not a good recipe for success in the future for banks and credit unions.

This type of analysis should help organizations assess their current capabilities in order to generate value from big data investments in support of strategic business initiatives. This can occur by forming a considered assessment of the desired target state, identifying gaps, and providing guidance on the steps required to realize the end state desired.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Largest Banks Committed to Advanced Marketing Strategies

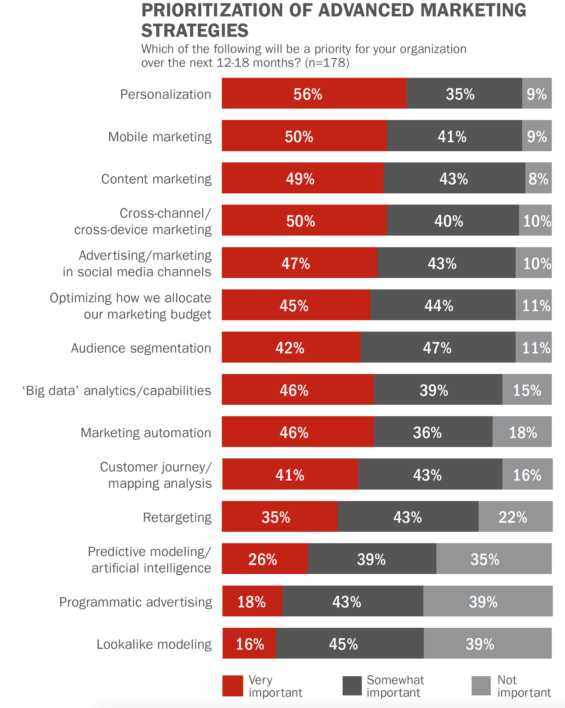

When we asked financial marketers about the prioritization of their efforts, we found great alignment with what most industries believe to be the difference between success and failure in the future of marketing. Of greatest importance were strategies such as personalization, mobile marketing, content marketing and cross-channel marketing.

Given the top priorities, it is a bit surprising that data analytics, predictive modeling (AI) and marketing automation fell lower in the ranking, since these are the foundations of some of the higher priorities. While we found relative alignment across asset categories and types of organizations, the level of commitment was lower for credit unions and smaller banking organizations and lowest for community banks.

Marketing Automation Platform Use Remains Low

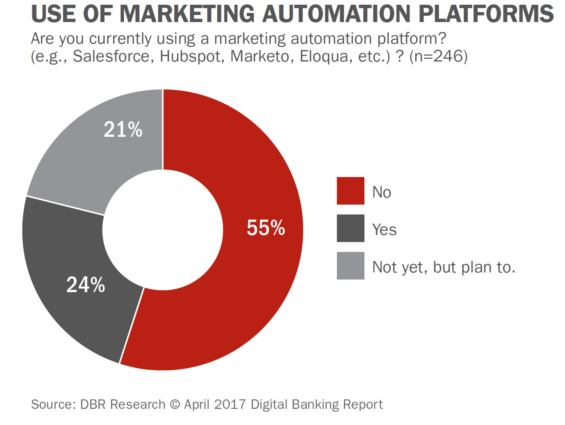

The 2017 Financial Marketing Trends survey also asked whether financial organizations are utilizing marketing automation to improve their marketing efforts. The structure of the question was intentionally loosely defined so that we could better understand the level of commitment to advanced marketing automation.

Only one in four organizations (24%) currently use some form of marketing automation, with another 21% indicating that they plan to use marketing automation software in the future. Of concern is the fact that 55% of organizations do not leverage marketing automation (and don’t plan to in the near future).

When we look at the responses by organization size and type of organization, the largest organizations definitely are further ahead in the utilization of marketing automation. By type of organization, the largest banks are most likely to leverage marketing automation, with the credit unions beginning their use. Very few community banks have embraced the use of marketing automation software.

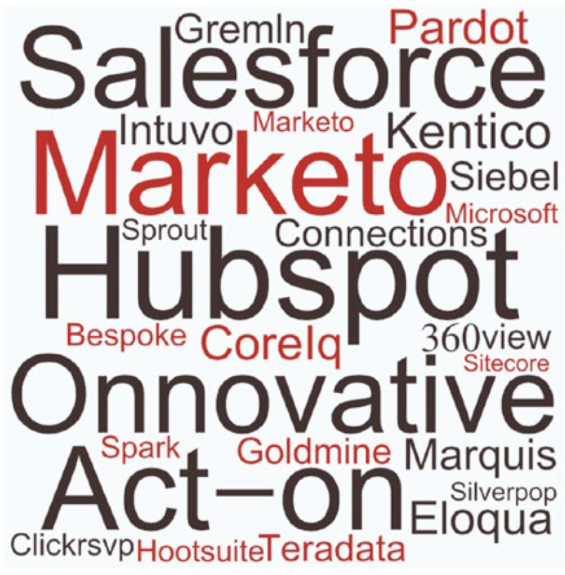

For those organizations that are using marketing automation software, we asked what type of system they were using. We created a word cloud to provide a visual representation of the most used systems.

Improving Marketing Maturity

Financial services organizations must determine how they can collect, analyze and utilize big data. They will have to determine what areas of the organization can most benefit from the application of data and find ways for the output of analysis to impact the customer experience. This goes beyond purchasing great tools and hiring great people. This involves a cultural shift.

Within the next few years, the use of big data, advanced analytics, marketing automation and AI will become the norm, enabling a new level of personalization for both products and services. Financial executives need to embrace the game-changing opportunities that big data and advanced analytics afford and move their organizations to realize the potential.

Those who delay in taking action will pay a heavy price in the marketplace, as consumers will not find their needs adequately met.

Purchase the Report

The 2017 Financial Marketing Trends report, sponsored by Deluxe, provides insight into the strategies, tactics, priorities and challenges of financial marketing departments globally. Beyond a review of what banks and credit unions are focusing on in the coming year, there are comparisons to previous trends and a breakout of results by size and type of organization.

The 2017 Financial Marketing Trends report, sponsored by Deluxe, provides insight into the strategies, tactics, priorities and challenges of financial marketing departments globally. Beyond a review of what banks and credit unions are focusing on in the coming year, there are comparisons to previous trends and a breakout of results by size and type of organization.

The report is based on a survey of close to 300 financial services marketers worldwide and includes 78 pages of analysis and 43 charts.