Messaging platforms that include voice and text-based interfaces are being increasingly used by digital consumers as their preferred method of engagement, according to a research study from Accenture. Conversational interfaces already exist. The Amazon Echo, Google Home and Apple HomePod (as well as other devices) all use technologies including AI, machine learning and natural-language processing (NLP) to enable voice engagement. An increasing number of financial organizations are beginning to take notice.

“Why should people learn to use technology interfaces when we can simply make the technology more human?,” asks Fernando Lucini, managing director, Accenture Digital. “A human-first approach would be built around natural conversation: we would do away with the keyboards and touchscreens that currently intermediate our interactions, and instead simply talk to digital technology as we would to a human.”

Conversational technology can use real-time data analysis to create contextual conversations leveraging previous interactions much the way humans do normally. This allows for individualized engagement by a machine using big data stored in the cloud. From providing rudimentary support to advising on more complex matters, conversational AIs will be able to replicate much of what a human customer service agent does … only faster and more accurately.

With these capabilities, ‘conversation’ could become the third pillar of a financial institution’s distribution network, joining mobile banking and a smaller branch network, according to Accenture.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

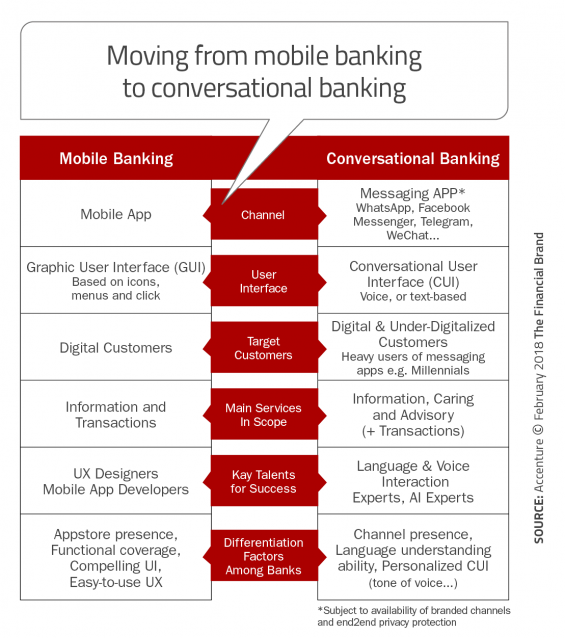

From Transactions to Interactions

Conversational User Interfaces (CUI) based on voice and text are becoming a preferred way to access digital services across industries, including financial services. Using stored data, this type of engagement introduces a new level of personalization, where historical interactions are combined with current internal and external data. This represents a shift in how we think about mobile services – a transition from transactions to interactions.

This transition is made possible by the vast number of devices that we are buying that listen and learn over time. These devices process more and more interactions every day, as we we share information about ourselves. These interactions create data and insights about how we live, what we buy, what we like and who we interact with. This insight has the potential to provide value-added benefits – proactively – like never before.

The potential to humanize digital banking is on the horizon.

Three Trends Impacting Growth of Conversational Banking

According to Accenture, three trends are coming together to support the transition from transactions to interactions.

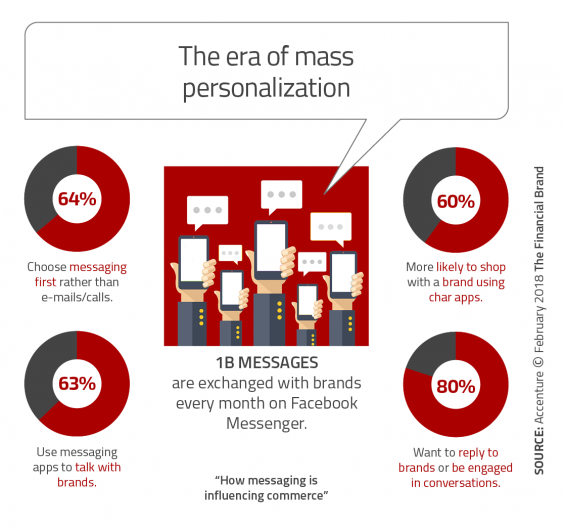

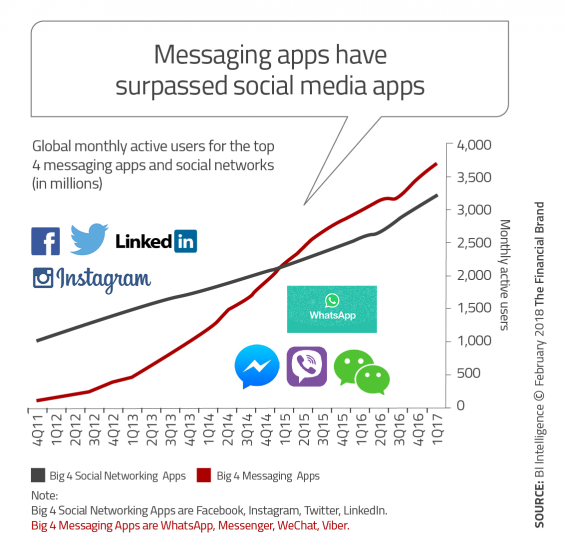

- Messaging is now the preferred method of interaction: WhatsApp, Facebook Messenger, WeChat, Telegram, Snapchat, etc. have overtaken social media as the preferred way of communication on mobile devices. They are both simple and intuitive, leveraging text or voice-based interfaces. These apps also are AI-ready, offering easy integration with chatbots and cognitive agents.

- AI is now accessible to all organizations: The decreased cost of data storage, analytic tools and development in machine learning and deep learning enables the automation of repetitive customer support tasks, and lower level advisory services. Over time, AI will enable more advanced interactions at even lower costs.

- Mass personalization is now possible: The intersection of big data, advanced analytics, and predictive models is enabling personalization at a mass level. This supports vastly improved consumer experiences while increasing expectations of all financial services providers based on the delivery of services across industries.

Challenges to Transitioning to Conversational Banking

There are already more than 33,000 bots on Facebook Messenger and more than 100,000 bots offered by Chinese digital giant WeChat. These bots offer customer support, e-commerce guidance and other interactive experiences.

While a good first step, most bots today have limited capabilities. Some simply replicate already outdated FAQ experience, while others simply replace low level human-based customer service capabilities. The ultimate goal is to move more interactions to voice, supporting sales, advanced customer care and advice, with greater personalization, a better UI, less friction and more automation.

This is a unique example where the technology and consumer acceptance is already out there, but strong use cases have yet to come. Many voice capabilities have had initial success, only to have growth stalled due to lack of value-added capabilities or consumer education. Organizations will need to use education and value-added benefits to ‘sell’ them on new ways of interaction. Without education and consumer-centric benefits, it’s unlikely consumers will use a chatbot, let alone digital assistants as opposed to current human channels.

Another barrier to transition to conversational engagement is the siloed nature of banking. Conversations interactions will not move forward if the experience is not seamless, with all insights, from all areas of the organizations arranged around the consumer. Traditional segmentation or product ownership silos will only inhibit natural and successful dialogue.

Six Keys to a Successful Conversational Banking Strategy

When building a strategy for conversational banking there are six components Accenture believes are necessary for success. Many will require a complete restructuring of current back-office processes, whil others are less daunting.

- Acquire Needed Talent: Advanced capabilities and skills including neuro-linguists, voice recognition experts, AI developers, and CUI designers are some of those most in demand today. Talent will continue to be a barrier for many years as demand is far outstripping supply.

- Understand Technologies: Understanding and acquiring new technologies will require a move to real-time back-office processing and ongoing monitoring of advances in text and voice-based technology.

- Improved Privacy and Security: The collection and application of expanded consumer insights requires a greater focus on securing this insight. Voice biometrics will also need to be utilized for conversational interfaces.

- Transparency: As chatbots and conversation interfaces better replicate human interactions, it will become more important to let consumers know they are interacting with new technology … and not a human.

- Consistency Across Channels: It will be important to allow for consistent experiences across channels. Selection of what channels to support may revolve around security as much as anything.

- Consider a Hybrid Model: Since AI-based interactions are not perfect and a great deal of testing will still be required with conversational interfaces, a hybrid model including technology and humans is recommended.

Conversational Banking is the Foundation of Future Customer Experiences

According to says Mark Sherwin, managing director, Accenture Interactive, “Advances in voice recognition technology are slowly filling the world with talking machines. As the technology gets more and more sophisticated, we are going to get used to chatting with our devices, in increasingly seamless and connected conversations. More importantly, we are going to take those conversations for granted.”

Forward-thinking financial organizations will be thinking how to better engage with conversations, knowing that this capability will be an important component of the overarching brand. Success will be determined by those institutions who can best integrate and automate conversations across new channels – contextually – and with real-time insights.

The financial services industry must be prepared for this transition to conversational banking, developing capabilities with a foundation in voice and text interactions. To the digital consumer, pushing buttons is as frustrating as making a call on a rotary phone, with latent friction and inefficiencies. The best-in-class organizations will enable interactions by voice that extend well beyond rudimentary transactions, to include advanced advice and contextual engagement.

The future of conversational banking will require new talent, new technologies, changes to back-office processes, organizational commitment, and an education of the consumer to be successful.