Artificial intelligence is still a somewhat new technology, but it already has the capacity to offer real-world business outcomes for financial institutions in the form of productivity improvement, cost savings and happier customers.

Despite all of AI’s potential, banks and credit unions remain cautious when it comes to this technology, mostly because they misunderstand the process, investment and outcome. As experts in banking AI, we know that AI has come a long way and can dispel even the ardent disbeliever. Today, conversational AI can be:

- Launched quickly, with near-immediate cost and efficiency savings.

- Financially and technologically accessible to institutions of all sizes.

- A competitive advantage for institutions looking to compete with fintechs and large banks in delivering a superior customer experience.

- A platform for expanding your digital service offerings.

All of these advantages explain why Gartner found that, throughout the COVID-19 crisis, many organizations have actually increased their investments in AI. Yet, banking institutions still want to better understand all the factors at play when making a decision.

Here is a primer for banking leaders who need to be in on the AI conversation.

1. AI Starts With No Knowledge And Must Be Trained

The simplest AI chatbots were originally designed to serve up answers to Frequently Asked Questions, based on pre-configured knowledge systems tied to a limited set of specific keywords. Banking answers for each question needed to be programmed in, and the bot followed a fixed decision path to generate an answer.

More recently, Natural Language Understanding emerged to create intelligent chatbots. Here the AI chatbot “learns” to understand a question the same way a human does. After millions of repetitions and broad coverage of questions, the bot has learned enough to be useful. This process is called “AI Training.”

The challenge with this approach is that the bot starts with no knowledge. The generic AI systems used by Google, Amazon and others have tremendous learning capacity, but they start out with no banking knowledge. It all has to be trained, at great time and expense.

- Huge datasets of questions are required to train pre-launch.

- Training continues with live customer conversations.

- Bank-specific training is required for a chatbot to know that a “branch” means a building, not a tree part.

Virtual assistants must be taught to understand the context of a question. A banking-specific proprietary dataset starts with thousands of questions and answers related to the products and services offered by the institution and with those questions customers actually ask.

The key to success is starting with a chatbot pre-trained on understanding the banking-specific questions, not trying to build the knowledge from a general purpose AI platform.

2. Building Versus Choosing A Managed Service

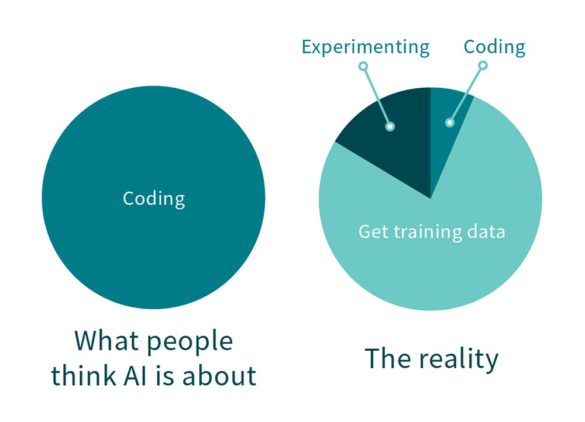

AI is unlike traditional enterprise software. Yes, it includes the expected software lifecycle development and maintenance, but it also requires constant Machine Learning training to teach the system banking subject matter. Thus, the investment never gets smaller but increases with the scope of the AI project.

Developing from a general purpose AI foundation puts the entire training burden for the life of the project on the institution.

An alternative is using a managed service, specifically one built for banking. Unless the institution plans on being an AI pioneer, such as Bank of America with its Erica chatbot (and has hundreds of millions of dollars to invest), a managed service is by far a more cost-effective answer throughout the project lifecycle.

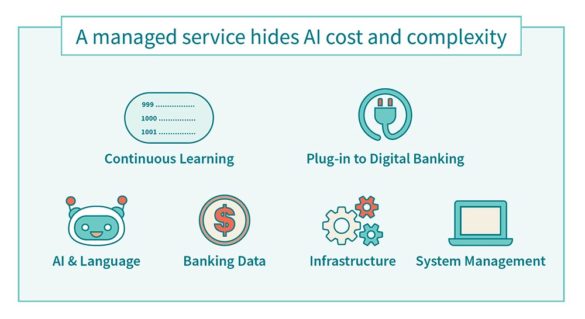

A managed service combines all the technical components of a full AI solution into a subscription package, eliminating the need to invest in AI training, infrastructure, ongoing learning, and integrations to systems like digital banking.

For small and medium banking institutions without resources for a major AI investment, use of a managed service will hide complexity.

3. How Much Can You Automate with AI?

Today’s financial institutions and the people they serve waste too much time on routine queries. When COVID-19 hit, customers waited on hold, sometimes for hours, trying to speak with an agent. This should not have to be the case.

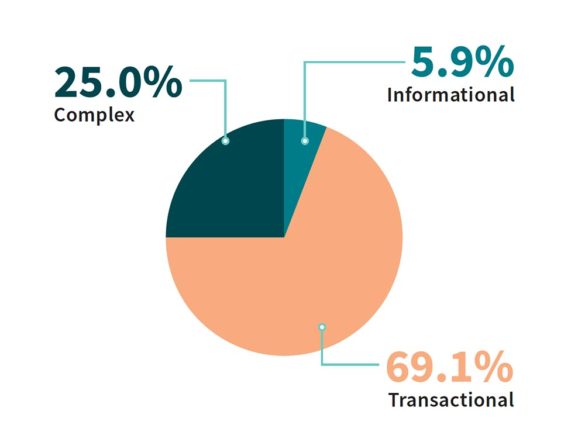

Most customer service interactions queries are basic and transactional, making them ripe to be answered quickly by a chatbot.

- 75% of customer service requests are routine requests for information and action.

- The other 25% of requests are complex. These are customer-specific problems or special cases.

- The complex requests are where your team should be spending their time.

This benefits the bank in two ways: Customer wait times are reduced, and call center human workload (and associated costs) are reduced, especially during the COVID-induced remote banking surge.

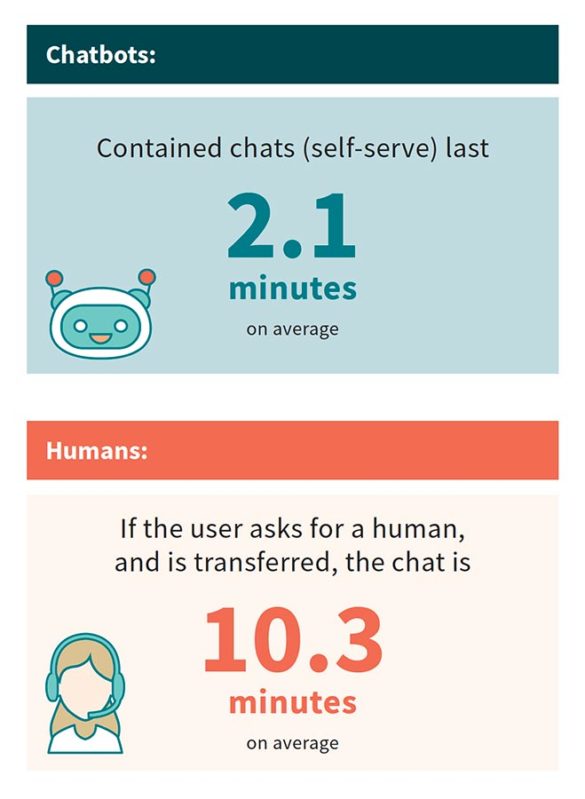

Chatbots: Bots are good at high-volume, low-complexity tasks — which human agents don’t actually like dealing with.

Humans: Higher-complexity questions require the support of a human agent. Examples include troubleshooting an issue with linking accounts or getting a certified check for the down payment of a mortgage.

The goal is to use AI to automate and speed the routine requests, freeing up experienced people to handle the smaller volume of more complex requests.

4. Banking Product Knowledge Needs To Be Built In

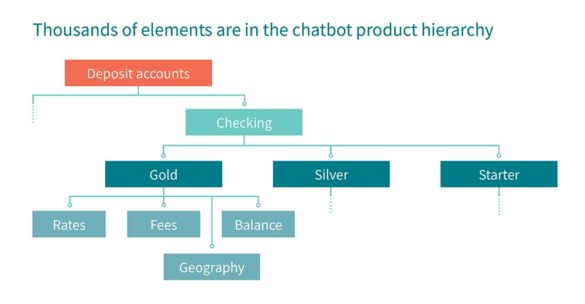

Even with pre-trained data sets, bots still need to be configured to understand banking products and extensive information will need to be pre-established for the AI chatbot to draw upon. If your bank offers multiple types of checking accounts, e.g. Gold and Silver levels, the details need to be cataloged in the AI system and easily changed when new products are launched. A pure machine learning system will not have a predefined structure to accommodate your banking product catalog.

A requirement for banking is a concept called Category User Goals, which groups products into a hierarchy, so products like checking accounts can be asked about directly, and personal and business checking accounts can be specified individually.

A highly functional banking chatbot will combine the concepts of pre-trained Machine Learning, with a pre-programmed hierarchical understanding of the specific product offering at the bank. General purpose or academic AI systems will not have any of this context.

5. Connectivity To Your Digital Banking System Will Deliver Greater Value

Transactional questions, such as transfers, balance inquiries and payments, will require both authentication (to establish the customer identity) and connectivity to the digital banking system, to access account data. While basic questions about issues like interest rates, routing numbers and branch hours can be provided on a standalone and anonymous basis, the real customer service value comes when the AI chatbot has the same access to data in the digital banking system as the mobile app.

A chatbot that is fully integrated will bring about the most value for you and your customers. Authentication and connectivity need not be complex. The same authentication process used for mobile apps and online access can be applied to the bot. For chatbots accessible within the mobile app and online banking sessions, authentication has already been established and the privileges can be passed directly to the chatbot.

6. AI Makes Human Staff More Effective

Many companies have used AI to automate processes, but the firms that achieve the most significant performance gains are those where humans and machines work together. Institutions should design AI to take on repetitive tasks but ready to “handoff” more complex queries where a customer needs a human’s help.

Why is this important? Our research shows that more complex customer service queries are best handled by human agents, but AI must be able deflect the simpler requests from human agents.

To accomplish this, banks and credit unions need to establish handoff procedures with the highest satisfaction rate. Bots can be used to gather information or answer basic questions and/or redirect the question to the right department or workflow. Bots must also provide context to agents, such as identity and chat history, so that the customer and the agent don’t have to start the conversation from scratch.

That’s why today’s most effective customer service chatbots offer an option for customers to “talk to a human” who can pick up the conversation in mid-stream.

To achieve a smooth handoff, the AI chatbot must be seamlessly integrated with the call center:

- Smart routing: The chatbot should be able to direct the customer to the appropriate agent queue, e.g. existing deposit accounts, mortgages or new product onboarding.

- Incoming: Agents must also be able to receive incoming chatbot sessions the same way they would receive a session transferred from another live agent.

7. AI Empowers the ‘Self Server’

Harvard Business Review reports that 81% of consumers try to self-serve before calling a contact center. When it comes to customer support, most customers want to self-service. Yet, many banking institutions still don’t offer customers the ability to answer questions and solve problems on their own.

Banks and credit unions should think of success as giving customers the medium of their choice, not just deflecting customer service queries. One of the most important advantages of an AI chatbot is the overall customer engagement experience. Establishing multiple channels that address the needs of the customer at different times builds the basis for a strong, long-term relationship with customers.

For routine transactions, self-serve chat is five times faster than the human agent sessions.

Practical considerations for introducing a banking chatbot start with understanding your goals and current traffic that could be serviced by AI.