Financial services organizations realize they have the potential to apply advanced analytics for both internal and external benefits since they have large data sets and experience with analytical tools. From payment services to everyday banking, insight is captured that can make machine learning more powerful.

The good news is that banks and credit unions state that they are going to apply the data at their disposal to improve the customer experience, first and foremost. Unfortunately, most institutions – and the industry as a whole – have not kept pace with consumer expectations around digital capabilities or digital engagement compared to other industries or what the large technology companies are providing. As a result, there is a significant amount of lost revenue and weakening of trust due to mismanaged relationships and the inability to know the consumer.

In research done by the Digital Banking Report, we found that 35% of financial organizations have deployed at least one machine learning solution. This number is quite a bit higher than other recent studies done in the industry and by the Digital Banking Report. For instance, in a survey done by the Digital Banking Report in the Fall of 2017, only 15% of financial services organizations globally had implemented an AI solution. Part of this variance may be that the size of organization skewed smaller in the earlier study.

Machine learning has potential to make banks exponentially smarter. “Smarter” in this case means delivering better customer insights and intelligence, and thus a better customer experience — something most in the banking industry now believe is the key to differentiation, growth and increased profits.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Use of AI in Financial Services

For those organizations that have yet to deploy a solution, 23% believed they would have an AI solution in place in the next 6 months to a year, with another 13% believing they would have a machine learning solution in place within 18 months. While 17% indicated a machine learning solution was on their roadmap in the next 18 months, 12% of organizations surveyed had no plans to implement any artificial intelligence solution in the next 18 months.

Given that almost half of executives surveyed in another report thought that AI would be mainstream in the next 2 years, many organizations may be caught off guard from a technology perspective.

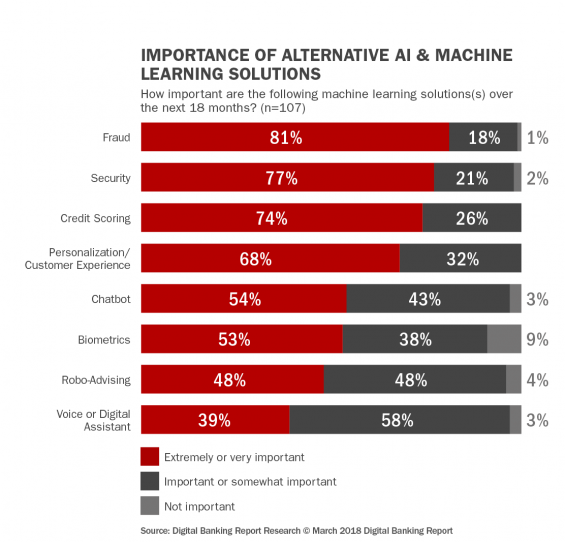

When we evaluated the state of AI deployment by the size of organization, it is not surprising that significantly more of the largest financial institutions (over $50B) have deployed at least one AI or machine learning solution. When we asked financial organizations which AI or machine learning solution they have deployed or were planning to deploy in the next 18 months, fraud and credit scoring solutions were the most likely to be in place or on the short-term horizon. In fact, the category of fraud, security and biometrics represented 3 of the top 5 solutions in place or being considered. This is not surprising given that these are traditional uses for machine learning and AI deployment.

The next most likely functionality to be in place, or in near-term plans, were related to chatbot implementation (3rd place in the survey) and personalization solutions. Interestingly, of all of the solutions listed, chatbots had the lowest ‘no plans’ response.

Importance of AI in Banking

In previous research, it has been found that many of the implementations of AI and machine learning in the banking industry has been related to evolutionary solutions (credit scoring, fraud and security) as opposed to revolutionary purposes (personalization, proactive alerts, etc.). When asked whether implementation of AI and machine learning solutions has been evolutionary or revolutionary, 61% of survey respondents believed most solutions to date are more evolutionary.

One of the most effective methods of managing risk and fraud is through artificial intelligence and machine learning technologies. Some of the most robust developments that have occurred in the financial services industry have been in the risk and biometrics category.

“When you have a large data set and people can’t see the signal for the noise, machine learning capabilities will sift out and provide you with the top five things that are worthy of further investigation,” stated David Whiting, chief information officer at the Commonwealth Bank of Australia.

The key is to provide security safeguards and authentication processes that are rigorous enough to combat fraud, while delivering the speed and reliability modern-day consumers expect. This is why machine learning has such potential, and why it was ranked highest in importance by our survey respondents.

Just over 80% of respondents found the use of AI and machine learning for fraud and risk to be extremely or very important with only 1% saying that AI was not important for this purpose. In fact, fraud and security were the top two functionalities found to be important to organizations. The fourth most important functionality for AI and machine learning was for improved personalization and customer experience. Personalization was considered to be extremely or very important by close to 68% of organizations while chatbot customer support was extremely or very important for 54% of bankers.

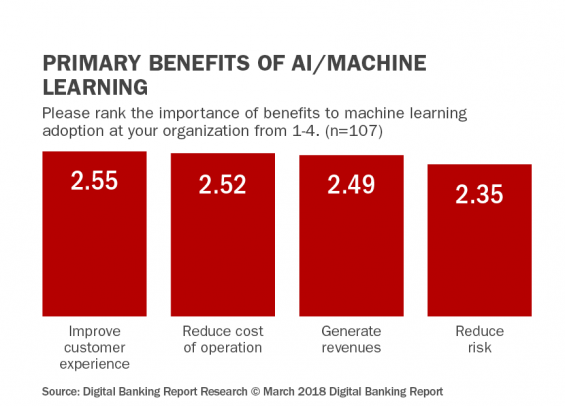

When survey respondents were asked about the importance of business drivers for AI and machine learning implementation, the desire to enhance the overall customer experience was the most important driver, with almost 90% of the organizations stating that this was either “extremely’ or ‘very’ important. These findings correlate with the findings from the 2017 Retail Banking Trends and Predictions Digital Banking Report, where enhancing the customer experience was the number one trend mentioned.

The next most mentioned business drivers in the AI in banking research were the desires to reduce costs (79% ‘extremely’ or ‘very’ important mentions) and improve back-office speed and efficiency (78% extremely or very important). On a weighted average basis, increased product/service use was the fourth most important business driver followed by decreasing fraud.

Benefits of AI in Banking

As far as the financial services industry is concerned, machine learning and intelligent systems are being deployed by more organizations every day. As our research shows, AI is being used to reduce risk and fraud, improve the targeting of messages and provide customer support. When asked about the primary benefits of AI and machine learning, the answers were in alignment with the business drivers.

The challenge for banking organizations is that, while they realize the future is in the more ‘revolutionary’ functionalities of personalization and customer experience, they are still using these new technologies for ‘evolutionary; purposes related to fraud and security. The question is just how fast will AI and machine learning technology be implemented in the areas where the greatest benefit can be realized? Being a ‘fast follower’ is not a good option.