The COVID-19 crisis has accelerated the use of digital technologies and has increased the application of artificial intelligence (AI) into all aspects of the consumer experience. As the pandemic continues to impact the way consumers interact with financial institutions and with each other, the demand for contactless or non-touch interfaces, such as chatbots, increases. This has forced organizations to find new ways to integrate advanced intelligence into the entire customer journey.

According to an Economist Intelligence Unit survey from March and April of 2020, 77% of bank executives believed the the ability to extract value from AI will sort the winners from the losers in banking. AI platforms were the second highest priority area of technology investment, behind only cybersecurity, according to the survey. The importance of AI adoption is only likely to increase in the post-pandemic era.

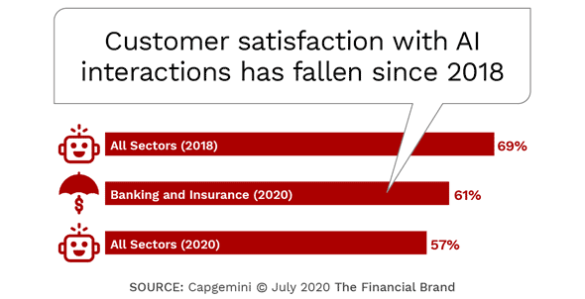

Unfortunately, the increased focus on the potential and use of AI has not been reflected in higher levels of satisfaction. Instead, satisfaction levels with AI have actually decreased since 2018.

Read More:

- Exceptional Customer Experiences Depend On More Than Data Alone

- Artificial Intelligence in Banking: More Hype Than Reality

- 5 Cultural Shifts Needed to Achieve a True Customer Experience Mindset

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

AI Interactions Increasing

According to a Capgemini study conducted in April and May of this year, more than half of consumers (54%) have daily AI-enabled interactions with organizations, including chatbots, digital assistants, facial recognition or biometric scanners. This was a significant increase over 2018 (21%). Even after lockdowns are lifted, consumers say they will still be looking to make increased use of touchless interfaces, including voice interfaces, facial recognition, or apps.

From a sector perspective, automotive (64%) and public sector (62%) were strong performers, followed by banking and insurance (51%). According to the research, close to half (45%) of consumers prefer voice interfaces when engaging with organizations followed by 30% who prefer chat interfaces and 15% who prefer AI systems built in websites/apps. But the choice of AI interactions varies during different stages of the customer journey.

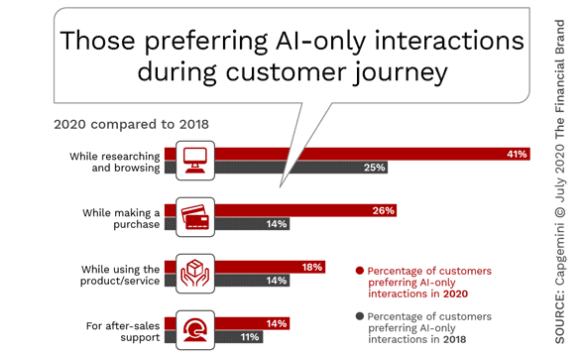

The Capgemini research found that 41% of consumers prefer AI-only interactions for researching and browsing, up from 25% in 2018. As a consumer moves forward in their journey, AI is preferred less, with more humanized experiences gaining favor. Part of the reason for the drop in AI preference is caused by the drop in trust in AI later in the journey.

Read More:

- Digital Future of Banking Requires New Leadership Model

- What Makes A Great Digital Banking Transformation Leader?

Trust in AI Overall is Improving

Without trust, the acceptance of artificial intelligence by consumers will lag. The good news is that trust in AI interactions is increasing overall. In fact, according to the Capgemini research, more than two-thirds of consumers (67%) trust personalized recommendations. In addition, the share of consumers who do not trust machines with the security and privacy of their personal data has dropped to 36%, down from 49% in 2018.

Part of the improvement in trust can be attributed to enhanced regulations, such as GDPR. In addition, trust has been positively impacted by an improvement in fairness and transparency by organizations. For instance, in 2018, only 13% of organizations informed consumers about the presence of AI, compared to 66% in 2020.

The Importance of Humanizing AI

In many research studies conducted around AI and improved customer experiences, including the research done by the Digital Banking Report in 2019 and also in 2018, consumers indicated that they wanted AI to display human-like capabilities – including human-like voice. personality or understanding. If interactions were more human-like, consumers stated they would be more likely to use these AI applications and have greater trust in the company.

While 64% of consumers believed that their AI interactions are more human-like (compared to 48% in 2018), the bar for satisfaction has gone up as well, indicating that consumers are increasing their expectations from AI engagements.

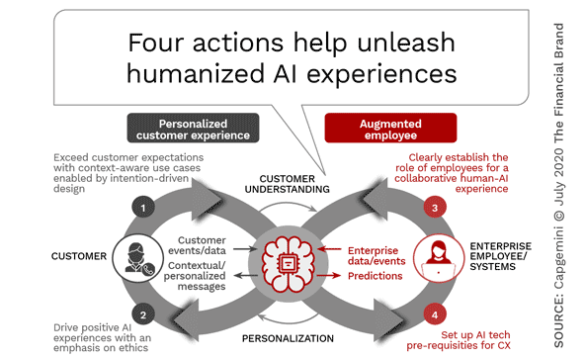

According to Capgemini, the four actions that are required to improve the humanization of AI experiences include:

- Personalize the experience. Use consumer data to better contextualize experiences and improve predictions of next actions.

- Emphasize ethics. Focus on privacy, security, bias and transparency in building and deploying AI solutions.

- Augment the employee. As opposed to replacing humans, use AI to create collaborative experiences, especially later in the customer journey.

- Build an AI technology infrastructure. The engagement platform must connect seamlessly with a data hub that can provide a singular 360 degree view of the consumer.

AI Expectations Outpace AI Experiences

Despite higher levels of trust and humanizing capabilities, Capgemini found that customer satisfaction with AI interactions has actually decreased in the past two years. According to their research, 57% of consumers were satisfied with AI interactions in 2020, compared to 69% in 2018.

Most of this shortfall can be explained by an increase in consumer expectations as they become acutely aware of the potential of AI across all industry sectors. Some consumers mentioned the lack of a ‘wow factor’ that was expected. In several instances, consumers did not feel there was a tangible benefit from AI.

While banking and insurance performed better than the average of all sectors, the two financial services industries, looked at together, also fell from higher levels in 2018. Only 36% of consumers believed that AI reduced effort, with the same percentage believing that AI provided faster resolution of support issues. And, while banking and insurance did better than any other industry in the areas of privacy and security, other benefits were lacking.

Consumers Must Receive Tangible Benefits From AI

To move to the next level of AI deployment, consumers must realize tangible benefits beyond expectations. This equates to moving beyond the basics of privacy and security (table stakes) to value propositions that include predictive solutions that save money, time and effort. These solutions also must be scalable to be meaningful to the consumer and the financial institution.

To deliver an AI experience that delights customers beyond their expectations, they must be humanized at the appropriate stage of the journey and contextualized for each consumer and interaction. It will not be easy to rise above consumers’ increasing expectations, but the outcomes will increase engagements, trust, loyalty and relationship value.