One of the most important components of digital transformation is the ability for machines and analytics to work together to deliver more intelligent solutions than humans alone can deliver. The foundation of this transformation leveraging internal and external data sources, placing the customer – instead of products and solutions – at the center of customer experiences. The success of these efforts will define the winners and losers in the future.

In an effort to determine how frontrunners are deploying AI, the Deloitte Center for Financial Services surveyed more than 200 financial services executives who were already using AI technology. Their research identified three key characteristics of those organization who have seen the best results from the perspective of financial returns from AI and the number of AI deployments.

- Integrate AI into Strategic Plans: To enable an enterprise-wide deployment of AI capabilities, leading organizations embed advanced analytics as part of the overall strategic plan. Deloitte found that the greater the importance within the strategic plan, the higher the investment in big data and AI solutions.

- Use of AI for Revenue and CX Initiatives: In addition to using advanced analytics for cost savings, the leading AI organizations are tracking how advanced analytics can be utilized for revenue and customer experience opportunities.

- Looking Outside the Institution: Rather than trying to build all AI applications internally, leaders are leveraging outside partnerships that provide access to talent and solutions. This improves speed to market at a time when available talent is in short supply.

To support the deployment of enterprise-wide AI solutions, many of the frontrunner financial institutions have created AI centers of excellence (CoE) that oversee all innovation initiatives (including AI). This structure allows for centralized experimentation that can be deployed in multiple areas of the organization.

When Deloitte looked at where investments in AI were being made, a major emphasis of investment was to secure talent and technologies necessary for digital transformation. It was also found that most organizations had success starting with smaller projects that provided the greatest opportunity for scaling across business functions.

Read More:

- Data and AI Power the Future of Customer Engagement in Financial Services

- Study: Building an AI-Powered Financial Institution

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

What is AI?

The term “artificial intelligence” was first used in the mid-1950s, With AI growing much more popular as data volumes have increased, the ability to analyze data has improved and the costs of computing power and storage has decreased.

AI makes it possible for machines to recognize patterns in data, learning from experience and improving over time. According to SAS, some of the reasons AI is important includes:

- AI can automate frequent, high-volume, computerized tasks reliably with learning over time. While certain human-driven tasks can be automated, human interaction is still required to set up the desired queries.

- AI can add intelligence to existing products. Voice-first hardware, chatbots, etc., are made better with AI.

- AI can process additional data, find new patterns, and learn and improve over time.

- AI can analyze many more layers and types of data than was previously possible.

- AI can achieve levels of accuracy never before possible.

Used correctly, artificial intelligence can improve our ability to recognize patterns, anticipate future events or behaviors, assist in making good business decisions, enhance communication, find new revenue and cost saving opportunities and reduce risk.

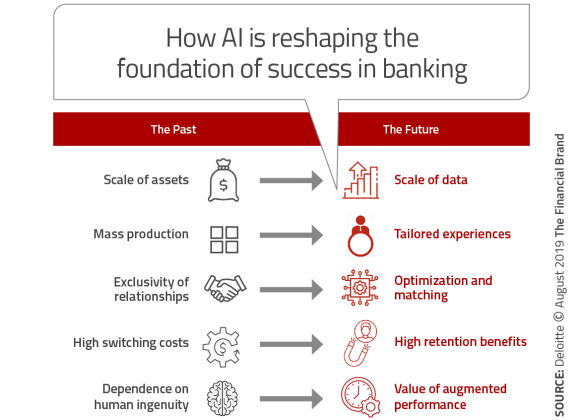

Most importantly, AI changes the path to industry dominance in financial services. No longer will unfair strategic advantage be automatically granted to the bank or credit union with the most assets. Scale of data will be increasingly important, with the ability to create unique, contextual experiences driving value and market share.

Retention of relationships will not be the result of “friction in switching” from one bank to another, but from the value derived from intelligent engagement and the ability to make a consumer’s life easier. Potentially most important will be that relationships will be made stronger as data sharing will be leveraged for improved delivery of financial and non-financial solutions.

According to Deloitte, AI will provide the foundation for increased product and service innovation, which will lead to greater financial inclusion and a more personalized customer experience. Of concern for traditional financial institutions is that this seismic shift in the foundation of banking opens the door for alternative providers.

Read More:

- The Use of AI in Banking is Set to Explode

- 15 Applications of AI and Machine Learning in Financial Marketing

Personalization at Scale: The AI ‘Power Play’

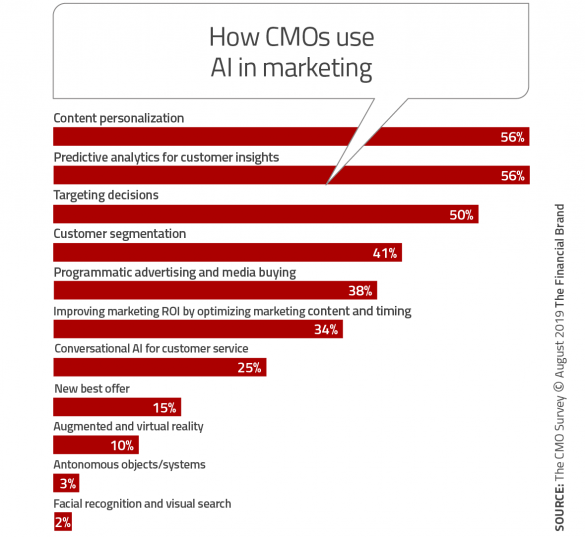

Targeting customers for offers is nothing new for financial institutions. Most banks and credit unions have leveraged available data to improve acquisition, cross-selling and loyalty for decades. What has changed are the tools available to financial institutions to successfully scale personalized real-time communication.

Digital retailers and large tech-savvy companies has set a new standard for personalization. Research has found that more and more consumers are either open to or actively considering moving their relationship to a tech company — such as Amazon, Google, Facebook, etc. — if they could. This indicates that consumers are becoming more and more willing to trade data for a better experience.

Because of mobile technology, many consumers interact with their banks more often than ever before, even if only to check balances. This frequency of engagement provides financial institutions the opportunity to leverage contextual, real-time interactions to provide value unlike anything previously possible.

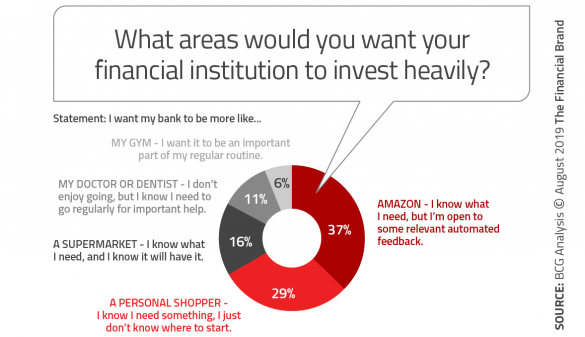

According to BCG, consumers want their banks and credit unions to be more like other types of service providers. In other words, analyzing individualized data constantly in the background, providing proactive recommendations and improving experiences.

“The true potential [of personalization] lies in transforming all of an organization’s customer interactions by using data and analytics to anticipate individual needs, target segments of one, and build deep relationships that stand the test of time,” states BCG. “It’s about providing service, information, and advice, often on a daily basis or even several times a day.”

AI-driven personalization is all about developing a deep understanding of each consumer’s unique needs and creating a set of contextual experiences across all channels – digital and human. This requires breaking down existing channel and product silos and making the customer the center of attention. It also requires a major culture shift and leadership focus that only the best organizations will embrace.

The Future of AI

The combination of data, advance analytics and digital channels are being leveraged to produce insights around operational performance, consumer trends, experience improvements and competitive opportunities. At the consumer level, advanced analytics and new technologies are being combined to deliver personalized solutions that can help customers make better financial decisions.

Using collected insights and financial and non financial behavioral trends, financial institutions will be in a position to leverage application programming interfaces (APIs) and predictive analytics to deliver financial and lifestage advice and recommendations in real time.

Eventually, instead of being Primary Financial Institutions (PFI), banks and credit unions may be looked at as a “Primary Data Institution” (PDI), managing identity assets as opposed to managing monetary assets.