The banking industry is undergoing a major transformation. Evolving regulatory requirements, more demanding customers, and greater competition from new, non-traditional players are among the catalysts driving change. Collectively, these and other factors are forcing banks and credit unions to rethink their business and how they engage with consumers.

That’s because banks are realizing that to be competitive, they not only need to attract new customers, but also work harder to retain the ones that they already have. And, increasingly, they’re discovering that one of the keys to doing so is by raising engagement through high-quality, personalized communications.

In fact, in a 2015 Accenture survey of thousands of bank customers, respondents cited engaging communications as one of the core drivers of their satisfaction with their bank. Not only that, the research revealed that the absence of personalized outreach is one of the primary reasons influencing respondents to switch to another institution.

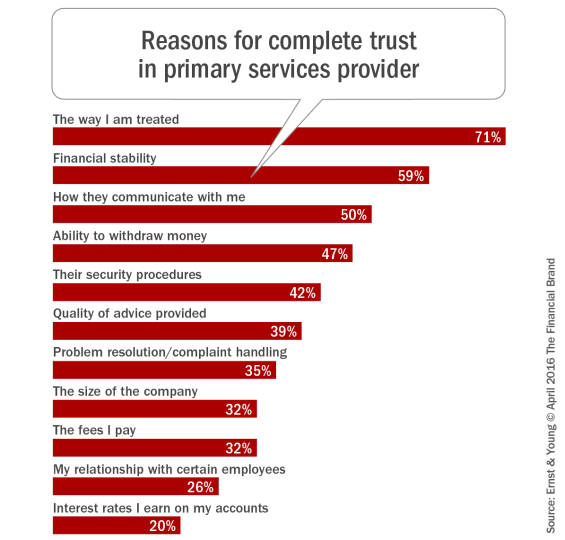

Further making the case is data from an EY report. It found that 71% of customers decide whether or not to trust their financial services provider based on how they’re treated (i.e., their customer experience), while 50% of respondents cited communications as as a major factor that shapes their trust. Plus, an astounding 70% of people surveyed noted that they would be willing to give more personal information to their bank if it led to better services. Clearly customers are hungry for better, more targeted interactions with their bank.

What all of these data points help illustrate is that around the world, banks are realizing they need to pay much greater attention to providing a personalized experience in a digital world at scale. Helping round out the argument for why, McKinsey & Company noted in a report that “The future belongs to banks that give the customer center stage in their business model.”

The key to making this happen lies in large part in creating better, more personalized customer communications.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Bringing Personalized Communications to Banking

Customers expect personalized outreach. They assume their banks understand their needs on a much deeper level than banks traditionally have, and with good reason. Almost every other service provider communicates with them in a highly personalized manner. This isn’t a surprise to banks. Banks know the problem they need to solve, but not how to solve it, as discussed in the article, Personalization in Banking: From Novelty to Necessity and in the Digital Banking Report, The Power of Personalization in Banking.

In reality, most banks’ current engagement strategies are segmented by a particular product or channel without giving further consideration to context or audience. For example, a bank’s efforts to reach their customers aged between 25 to 35 years old will likely consist of sending a templated letter with details on starting a retirement savings account.

The personalized portion of the letter may include a chart showing the recipient’s progress against standard retirement account goals. In addition to being highly generic, communications like these reinforce another major hurdle to enhancing engagement – the recipient is forced to spend time interpreting a chart. While this way of communicating may have been cutting-edge 5 years ago, it’s not today.

Artificial Intelligence Offers a Solution

The good news is that the same technological advances that have increased customers’ expectations also have an important role to play in the solution. For instance, technology companies have already developed algorithms that track a user’s online habits, creating deeply personal online experiences. For example, when searching for information on Google, results are displayed based on a relevancy algorithm. The user sees only what is personally relevant to them.

Advanced analytics and artificial intelligence technologies are now available for all sized organizations to enable personalized outreach at scale. It isn’t about figuring how to hire more people – it’s about figuring out how to help your current team do their job better. In fact, a number of sectors within the banking industry are already taking advantage of these technologies to enhance engagement and improve customer service.

Wealth managers, for example, are utilizing a subfield of artificial intelligence, advanced natural language generation (NLG), to automatically write investment portfolio commentary that informs investors about fund performance. By doing so, they can immediately publish reports to their websites and share with their distribution channels, eliminating weeks of time spent on analyzing raw data and writing.

Similarly, a growing number of wealth managers are using this technology to automatically generate investment portfolio reviews to help advisors and brokers prepare for client meetings. By automating the analysis and communication of the portfolio key positioning and performance, advisors can spend more time on building their existing client relationships and on customer acquisition strategies. Not only that, some wealth management firms are using the technology to correspond directly with customers, specifically to explain how each individual is progressing toward his or her particular goals and offer tailored advice.

In other words, AI and cognitive computing have opened up new opportunities for banks, including narratives about performance that are automatically generated by a computer. The ability to transform raw data into personalized communication turns what machines only previously understood into insight that humans can now easily understand.

Another sub-field of artificial intelligence, machine learning, is enabling banks to undertake predictive customer interaction management. An example is a customer updating his or her profile with information regarding a birth in the family. Based on that data, the bank can offer a savings account to the parents for their new child as well as information on mortgage rates in case the family is looking to buy a new home.

The Future of AI and Banking

As the cost of computing has declined and the power of computing has improved exponentially, AI applications become more and more practical. The emergence of social networks, mobile technology and the emergence of wearables and eventually Internet of Things integration has increased the potential for delivery of new insights. For example, USAA is using IBM’s Watson to provide financial advice to returning vets. Machine learning systems are also connecting the dots that humans might miss to identify fraud and money laundering. Finally, narrative generation will increasingly be used to provide insights to consumers about their financial relationships and changes in financial well being in real time. These systems will make banking more contextual and efficient by freeing people from tasks that can be handled by computers.

Bridging the gap between data and insight, advanced analytics and artificial intelligence have the potential to fundamentally change the dynamics between computers and communication. And in doing so, computers will be able to explain everything they know to anyone who needs to know it, whenever they need to know it.

Banking needs to start by identifying the best place where these new technologies can be easily integrated within current processes and apply them for an increasingly demanding consumer. It’s the dawn of a new era of personalized communication.