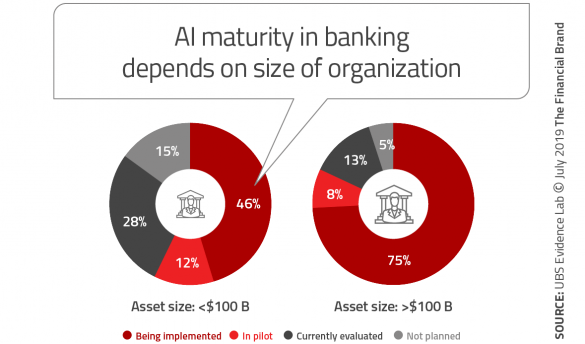

For most organizations, the discussion of the benefits and potential of artificial intelligence is much more widespread than the actual deployment of these technologies there. In fact, most of the use of advanced analytics and AI continues to be centered in areas of traditional use, such as risk, compliance and security. In other areas of the organization, most financial institutions are still only running pilots or tests in the most rudimentary ways.

The inability to understand and deploy AI is further evidence of the challenges experienced at most financial institutions around digital transformation. With leadership and culture not buying in to the power of AI, it is difficult to build business cases or integrated solutions that can take advantage of AI’s opportunities.

The possibilities being missed by not fully embracing the power of AI include massive back-office cost savings, vastly improved customer experiences, enhanced risk and fraud detection, as well as other implementations done independently or with strategic partners. In other words, AI and machine learning can have a significant positive impact across the entire banking organization at a time when the risk of not using AI is greater than ever.

It’s time to move from talk to action regarding AI in banking – no matter how large or small your institution is.

Read More:

- Artificial Intelligence: The Financial Marketer’s Secret Weapon

- AI Could Destroy Traditional Banking As We Know It

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

AI is a Long-Term Play

In an industry where quarterly financial results drive energy and investment, advanced analytics and artificial intelligence require a long-term perspective. In addition, for the deployment of AI to have the greatest impact, there needs to be an integrated process perspective as opposed to a limited project view.

Required energy and financial investment in data, advanced analytics, machine learning and AI, while less than in the past, is still not insignificant. Therefore, performing modest tests of these capabilities will never bring the big wins promised by AI advocates. This underscores the importance of leadership, culture, willingness to change organization structures, and the scope of AI testing.

AI is at the foundation of the digital transformation process. It takes more than just technology to work. It requires new talent, new thinking, and the willingness to reimagine banking.

The beauty of AI is that it supports data-driven decision making over time … across the organization. It has the best impact when it is developed and deployed using cross-functional applications, as opposed to solving small challenges. It also is the most effective where all levels of the organization support the results of AI. This tends to flatten the organizational structure since insights are available to more people.

The results of AI deployment must always be tested, with improvements made in an agile environment. This test-and-learn perspective allows for constant and ongoing improvements in the shortest amount of time. This propels pilot cases to larger deployments faster than in the past.

Read More:

- The Use of AI in Banking is Set to Explode

- 15 Applications of AI and Machine Learning in Financial Marketing

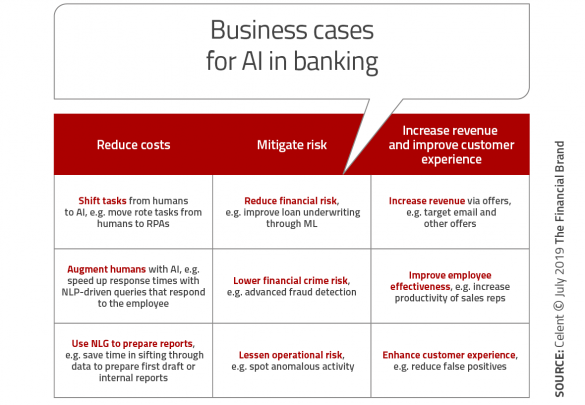

Reducing Costs with AI

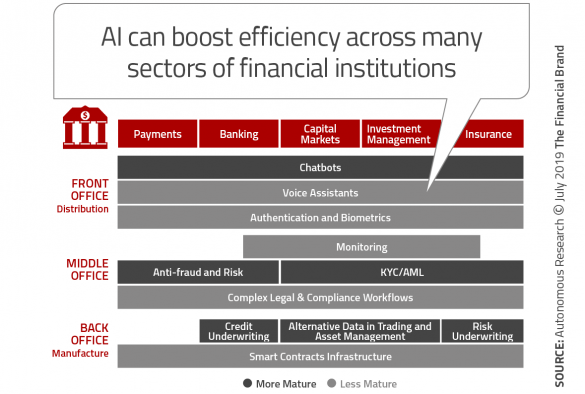

By 2030, front-office and middle-office AI applications have the potential to cut operating costs in the financial services industry by 22% — which represents $1 trillion in total savings, according to a report by Autonomous Next. The report predicts that $490 billion of the $1 trillion overall impact will happen in the front-office sector through technologies, including authentication and biometrics, voice assistants, and conversational interfaces.

“Most fintech innovation starts with the retail customer interaction. Whether that’s putting payments into an app, a bank into your phone, a robo-advisor into a skill for a conversational assistant, or your bank into the chat channel inside of Facebook messenger. All of that is thinking about how to replace the customer interaction,” said Lex Sokolin, Global Director of Fintech Strategy and Partner at Autonomous Research.

The middle-office, which includes compliance, security and risk applications is expected to have a cost reduction impact of $350 billion by 2030. In these areas, financial services organizations are using AI technology to replace repetitive processes that can most easily be replicated and improved. AI is already helping digital lending firms save money (and positively impact the customer experience) by making real-time credit decisions.

Improving the Customer Experience with AI

In an article written by Danial Newman for Forbes, he provides five key ways customer experience can be positively impacted by artificial intelligence. These include:

- Empowering self-service

- Improving personalization

- Enabling 24/7/365 real-time availability

- Making everyday life easier

- Providing consistent customer care

Each customer experience benefit depends on the level of AI maturity and data being utilized to deliver a product or service. It also depends on the culture of the organization and the ability of leadership to embrace the internal change required to deploy these solutions.

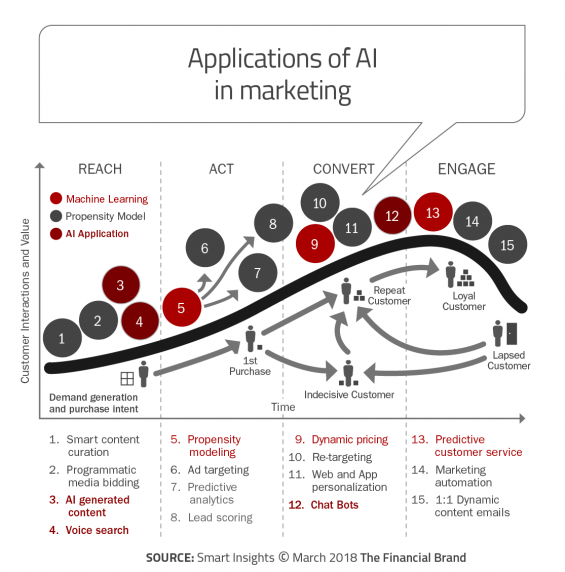

From chatbots and voice assistants, to biometric integration and personalization, the power of AI can dramatically impact the customer journey and level of satisfaction. One of the unique characteristics of AI in the area of customer support is the ability to learn about each individual consumer with each interaction.

In much the same ways that Google and Amazon are able to improve experiences based on an individual’s use of the platform over time, banks and credit unions can improve the advice provided, offers made and channels used to communicate based on engagement over time. These type of learnings can even assist with budgeting and financial recommendations based on how a person manages their money over time.

Read More:

- 9 Digital Marketing Trends Banks and Credit Unions Can’t Ignore

- 94% of Banking Firms Can’t Deliver on ‘Personalization Promise’

Mitigating Risk with AI

As mentioned at the outset, early deployments of AI in most financial institutions have been in the areas of compliance, fraud and risk. Using financial models and transaction patterns, organizations are better able to identify anomalies that can indicate potential risks. This is an important area of deployment because of the sophistication of cyber threats and fraud schemes.

“Banks are investing in AI to streamline their Know Your Customer (KYC) processes and to analyze criteria that humans can’t detect when fighting against money laundering fraud, states Business Insider Intelligence, in a recent report. “AI can help banks conduct real-time checks on all transactions, improving both reliability and speed compared with batch processing of sample transactions, as well as stay on top of any regulatory changes to ensure compliance of the undertaken AML regulatory checks.”

Deploying AI Across the Organization

According to the Harvard Business Review, educating the entire organization on the use and benefits of AI cannot be over-emphasized. From top leadership to the teams, it is imperative to make sure that everyone is on the same page and that the processes are standardized across departments and areas of responsibility.

Just as importantly, AI implementation must be reinforced on an ongoing basis to avoid the loss of momentum or the misconception that AI is simply “another program.” Role models are important to the success of the program and internal training needs to be done to allow all partners in the process to be transformed.

Finally, as with any major initiative, the impact of AI must be monitored, measured and reported. Accountability over time across divisions is needed to support and justify the human and financial commitment to AI.

“The ways AI can be used to augment decision making keep expanding,” states the HBR. “New applications will create fundamental and sometimes difficult changes in workflows, roles, and culture, which leaders will need to shepherd their organizations through carefully. Companies that excel at implementing AI throughout the organization will find themselves at a great advantage in a world where humans and machines working together outperform either humans or machines working on their own.”