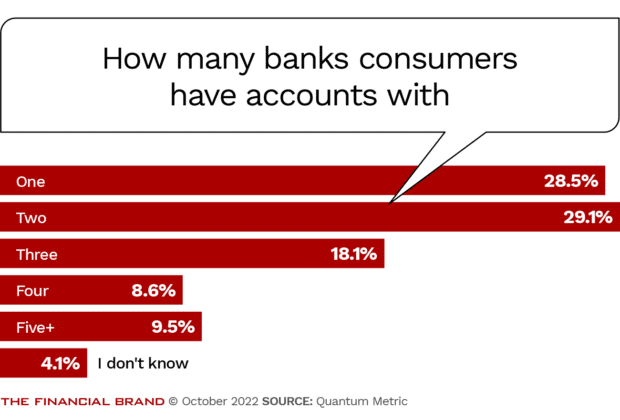

Most people (62%) can’t rely on a single financial institution for all their needs in banking and are looking for more than one provider.

Read that again: three out of five people are looking for more than one banking provider.

What are they looking for? Personalization and digital tools, according to a Quantum Metric survey.

If customers aren’t getting those two elements in their banking experience, they’ll likely turn to Google to find better bank options. A quick search sparks results encouraging consumers to seek out a financial institution with better resources and customizable experiences. One Experian article, for example, advocates consumers switch their bank if it has a low APY, high fees, lack of digital capabilities, a faltering branch footprint, poor customer service or not enough products and services.

Indeed, the Quantum Metric report confirms that many people are already taking Experian’s advice. As noted, three out of five people are seeking out multiple financial institutions to bank with, primarily because they “prefer to diversify where their money is kept and opting for banks with different services, interest rates and ways to build their wealth.”

Quantum Metric — a customer experience software company — surveyed 1,500 American adults for its report, released in Q3 2022.

Learn More: Why Consumers Love Mix-and-Match Patchwork of Banks

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Why Consumers Leave Their Current Banking Providers

When people forsake their banks or credit union, it’s often because their banking experience isn’t fast – or digital — enough. In fact, Quantum’s survey found over a third (36%) have already closed an account from 2017 to 2022. Almost half of these consumers (47%, and 57% of Gen Zers) say they’ve closed an account because they either had a poor experience with customer service or found a bank with the same offerings, but better service.

Another quarter (23%) said they had moved to different banks “because they didn’t feel their primary bank offered all of the services they needed.”

Speed and efficiency are also critical factors. A Lightico consumer survey found 35% believe they should be able to fill out and submit a personal loan application in under two hours and another two out of five people (39%) say it should take less than a day. The software company found few financial institutions achieve either.

The trend is most prominent amongst Gen Z and Millennial consumers. Interestingly enough, their most significant complaints aren’t always about their bank’s conglomeration of digital errors or slow mobile apps and websites. When Quantum asks consumers what their No. 1 priority is when searching out a new financial institution, people resoundingly answered easy access to accounts online.

Resolve the Friction:

People are most frustrated — more than anything else in banking — when they can't resolve financial questions on their own.

This isn’t to say that people don’t want to talk to a representative or a banker when they need assistance. Rather, few people want to rely on physical channels for their day-to-day banking activities. 37% of consumers will be less likely to follow through on a banking task if it means taking a trip to the local bank branch, the Lightico study found.

“This reiterates the need for banks to be more proactive with their digital banking experiences,” the Quantum report reads. “A good experience is not just about the bugs, but the opportunities to continue to enhance and innovate to meet customers’ changing needs.”

Meanwhile, the neobank Chime had amassed an estimated 12 million banking customers as of 2021 — and over half of them identified the neobank as their primary banking provider.

Competing with nonbanks can seem daunting for any bank or credit union — especially small or regional institutions. But it is critical. “Each instance where a consumer leaves a bank in search of a better offering is a missed opportunity to build loyalty and retention,” the Quantum Metric report reads.

Read More: The Gap Between Products Banks Offer & What Consumers Really Need

The Banking Solutions Customers Are Looking For

Those missed opportunities come from ignoring what consumers are emphatically asking for.

Some of these can be resolved with a solution as simple as a high-interest CD or as complex as cryptocurrency. (For context, a quarter of people would be interested in digital currency and crypto services if their bank or credit union offered it.)

In other cases, it means making the mobile app easier, user friendly and fast. Roughly one out of three people say their banking provider’s website or app are a shortcoming of the institution, lacking the features they’re seeking out, Quantum found.

Tracking the Trends:

The percentage of people checking their balances daily:39%

A highly effective retention opportunity may be found in banking tools like P2P payments. Venmo doesn’t monopolize the space like one may think; in fact, most people will adopt whatever P2P software their bank uses. Although some banks and credit unions are integrating services like Zelle or other P2P software into their digital banking solutions, many have yet to do so.

Yet three-quarters (72%) of consumers use P2P to pay friends and businesses, says Quantum, making it a key product offering for financial institutions — increasingly so, as consumers get used to it for big-ticket items.

Dig Deeper: Mobile Banking Is Now the Primary Delivery Channel: What Now?

Four Steps Forward for Banks & Credit Unions

Few financial institutions can afford to lose consumers, neglect to attract new ones with the right banking features, or even fail to be customers’ primary banking provider. And as Vince Lombardi said, those mistakes only take a second to make.

Becoming the provider that satisfies the consumer takes a lot longer. But it may be the only way banks and credit unions can compete in a market that is primed to switch. These are a few steps Quantum recommends to keep customers interested:

1. Balance “tech-pertise” with building out new services for customers. People hate buggy apps and websites, but they also want the features that fit their daily needs.

2. Nail down security protocols. Too many banks use outdated identity verification methods that dissuade customers from staying.

3. Customers are looking for a representative to talk to. Learn when people need help across various touchpoints and where they turn when they can’t figure out a problem on their own.

4. Prioritize mobile banking. Consumers today are checking their accounts from a number of channels, but research shows mobile has become the “center of the customer experience.”