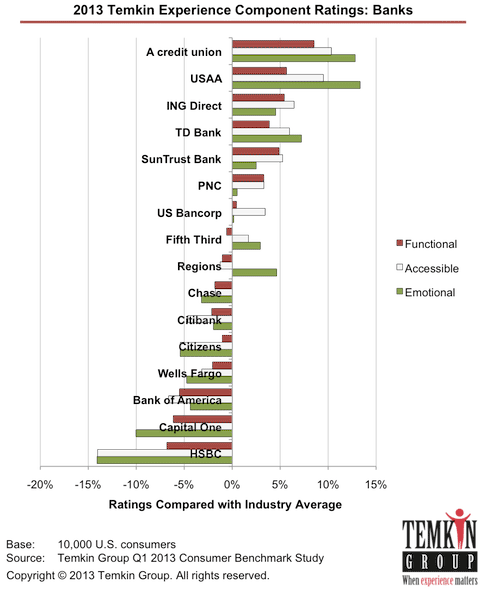

The 2013 Temkin Experience Ratings rank the customer experience of 246 companies across 19 different industries. In the survey, 10,000 U.S. consumers evaluate three areas of customer experience: functional (can customers do what they want to do), accessible (how easy it is to work with the company), and emotional (how consumers feel about their interactions).

The ratings include 16 banks: BofA, Capital One, Chase, Citi, Citizens, credit unions, Fifth Third, HSBC, ING Direct, PNC, Regions, SunTrust, TD Bank, US Bank, USAA and Wells Fargo.

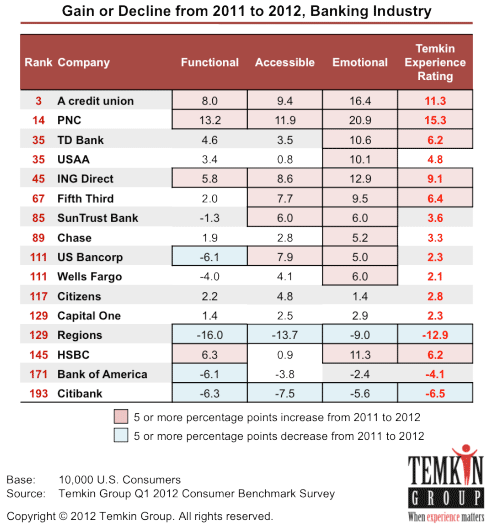

The banking industry has been steadily improving over the last three years, from an average Temkin Experience Rating of 62.0% in 2011 to 68.6% this year. Banks also made the largest improvement of any industry between 2012 and 2013, gaining 3.4 percentage points.

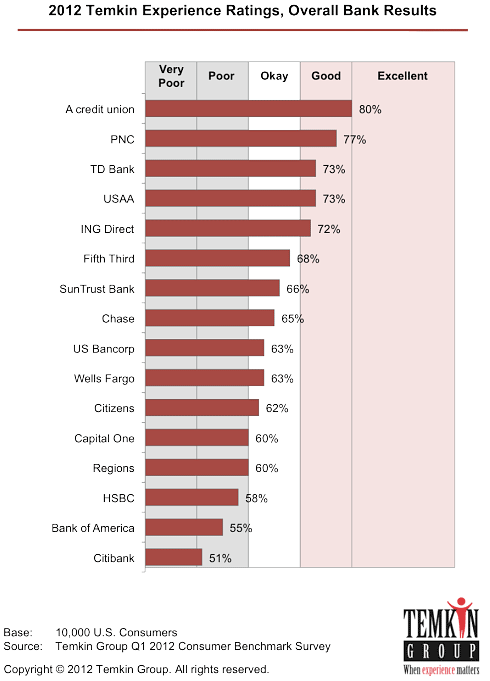

The banking industry received the fifth highest average customer experience rating, falling behind grocery chains, fast food restaurants, retailers, and parcel delivery services. Compared with 2011, banks increased their ratings by three percentage points, an improvement that was only outdone by insurance carriers and personal computer makers. Thirteen of the 16 banks improved their customer experience ratings between 2011 and 2012.

Credit unions, which are ranked third across all industries, as a group were the only bank to receive an excellent rating. Four banks earned “good” ratings: PNC, TD Bank, USAA, and ING Direct. Eight banks received “okay” ratings while three banks received “poor” ratings: Citibank, Bank of America, and HSBC.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Read More: Just Because Banking Customers Are ‘Satisfied’ Doesn’t Mean They Won’t Switch

Credit unions take first place in the banking industry for the second straight year with a rating of 79%. USAA is the topped rank bank with a rating of 78%, followed by ING Direct and TD Bank tied for third with ratings of 74%. Credit unions lead in the functional and accessible components while USAA leads in the emotional component.

Citibank improved by 15 percentage points between 2012 and 2013. This gain represents the largest improvement by any company across all industries. Regions also had a significant improvement of 10 percentage points over the last year.

The lowest-ranked bank is HSBC, earning a score of 57%. It also earned the lowest functional, accessible, and emotional ratings. The two next lowest banks are Capital One (62%) and Bank of America (63%).

PNC had the worst decline since last year, experiencing a loss of six percentage points. HSBC was the only other bank with a ratings drop since last year.

“The bottom line,” notes Bruce Temkin, principal author of the study, “is that some big banks are heading in the wrong direction.”

Read More: Customer Service Champs: JD Power Ranks U.S. Retail Banks

How Do Credit Card Companies Compare?

The average rating for the credit card industry increased from 61.5% in 2012 to 63.6% in 2013.

USAA and American Express are tied at the top of the industry, ranked #89 across all industries with a Temkin Experience Rating of 70%. That represents a three percentage point decline for USAA and an increase of two percentage points for American Express.

The lowest-ranked credit card company is HSBC, earning a rating of 54%. It remains in last place for the third straight year after a two point decrease between 2012 and 2013. The company also earned the lowest score for all three of the underlying components: functional, accessible, and emotional.

Capital One was the only other credit card issuer to earn a “very poor” rating, earning the next to lowest score in the industry, 59%,

American Express earned the top functional rating, Discover earned the top accessible rating, and USAA earned the top emotional rating.

Citigroup showed the largest improvement, gaining eight percentage points between 2012 and 2013. The financial behemoth remains near the bottom of the industry, however, because of its very poor emotional rating.