Any company that provides a service to consumers is often judged more harshly when things go wrong as opposed to when everything is running smoothly. For example, I have been a client of State Farm Insurance for both auto and homeowners insurance for more than 20 years. During that period, I have had only minor claims, and for the most part, the firm has lived up to their motto, “Like a Good Neighbor, State Farm is There.”

Unfortunately, all of this changed a bit more than a week ago, when I had an auto accident that required some significant repairs (no body work). My experience since the accident provides an excellent lesson plan for any organization trying to build digital customer care capabilities.

The challenges encountered over the past 10 days include:

- Living up to a 1:1 customer-centric legacy

- Broken promises and missed commitments

- Outdated silo structure

- Hidden paper-based systems

- Underdeveloped social channel strategy

- Timing of digital retargeting

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

1. Living up to a 1:1 Customer-Centric Legacy

State Farm has a legacy of being a leader in customer service. They are consistently near the top of many consumer rankings and have a strong agent network, where humans historically have had a hands-on ability to serve. Like many financial services companies, the internal and external move to digital channels may have changed many of these dynamics.

State Farm has a legacy of being a leader in customer service. They are consistently near the top of many consumer rankings and have a strong agent network, where humans historically have had a hands-on ability to serve. Like many financial services companies, the internal and external move to digital channels may have changed many of these dynamics.

According to the 2015 Temkin Experience Ratings, an annual customer experience ranking of companies based on a survey of 10,000 U.S. consumers, USAA and State Farm deliver the best customer experience in the insurance industry. USAA has been the top-rated insurer for five years in a row, earning a 75% rating (52nd out of 293 companies across 20 industries). State Farm has been in second place for four years running, earning a 71% rating and placing 100th overall.

In these ratings, a score of 70% or above is considered “good”, and a score of 80% or above is considered “excellent”. With the insurance industry averaging an unimpressive 66% rating in the 2015 Temkin Experience Ratings, and being one of the 14 industries whose ratings declined in the past year, maybe State Farm’s rating is an example of being ‘the best of the worst’ compared to other industries.

Or maybe the Temkin evaluation isn’t done with people who have had a recent claims experience. Up until my accident, I would have given State Farm a very good rating as well. Looking deeper into other people’s experiences, I found that many others have had issues with claims.

On the Consumer Affairs website, there were more than 1,000 relatively recent complaints registered against State Farm, the majority having to do with the poor service during the claims process. Many were similar to my situation, where the claims process was slow and it was almost impossible to get in touch with anyone with answers.

Lesson: Before the ‘digital revolution’, most customers were used to 1:1 interaction and being able to connect with a single person for a response to their question(s). As industries moves to digital, it becomes imperative that the customer experience doesn’t suffer. Moving to digital should actually improve the customer service experience, with more contextual data, improved customer insight and enhanced analytic capabilities.

For State Farm, all of the power has left the local agent. That can’t see client records and all of the insight is in the hands of other departments, with the objective of standardized (and hopefully better) service. When the system works, all is good. When a situation like mine occurs, the normal contact point for the customer is left powerless.

According to Dimensional Research, among internet users who said they had had a positive customer service experience, more said it was because they received a quick resolution to their problem, rather than a desirable outcome. In addition, the customers who had a poor experience most often cited talking to several people to achieve a resolution as the cause of their unhappiness. But about two-thirds of respondents said that they either had to speak to someone who was unpleasant, or that their problem took too long to fix. A local agent would not let this type of situation to occur.

2. Broken Promises and Missed Commitments

The ‘death blow’ to a customer service experience is when promises are made and then missed. In my experience, I called into a centralized claims hotline immediately after my incident and agreed to provide responses to a long series of detailed questions. While some of the questions seemed redundant and others covered information that should have already been on file, this was not a problem since the service agent set expectations up front about the Q&A process.

After the information was completed, the agent let me know that, since it was a holiday weekend, the adjuster may take 2-3 days to do an estimate. This set an expectation that would soon be the foundation for frustration.

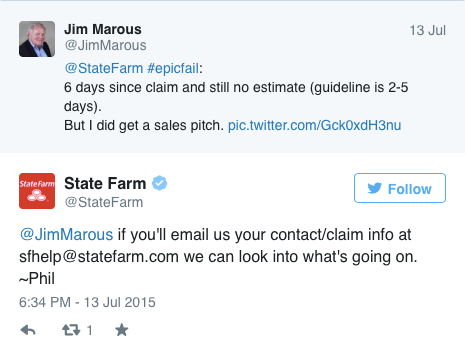

Not only did State Farm not start the estimate process within the three days promised, they did not see my car until 12 days (8 business days) later. Adding insult to injury, during a subsequent phone call to the central customer service line and my agent, both said, “the first person was wrong to commit to 2-3 days and our policy is 2-5 days” … on day 6!

Much of this delay was caused by the fact that the location of my car was incorrectly inputted into the system at the outset of the process. Unfortunately, since this was not shared with me when State Farm sent the recap data (by PDF), there was no way to catch the error. In addition, this error should have been noticed and inquired about in the first day after the claim was made.

There was another missed opportunity on the day the estimate was finally made. The adjustor finally saw my car and proceeded to provide me a very generous offer for repairs. Unfortunately, I heard this first from the repair shop and was not contacted by State Farm.

Lesson: Schedules and tickler files are a great example of where a digital customer care database can be invaluable. Not only can such a database monitor commitments made, but it can also provide a reminder to internal parties who may need to help live up to commitments made by others. In addition, a customer service database can help with proactive communications to customers when schedules get derailed, when data needs to be validated or when processes move forward. During my entire process, there was not a single proactive email, call or alert regarding the status of my claim.

Again, with proactive alerts and notifications and sharing of insight, inbound phone calls are eliminated, the customer feels in control and informed and there are resultant cost savings.

3. Outdated Silo Structure

Organizational silos are part of virtually every legacy financial services organization. A truly digital bank (or insurance agency or investment firm) eliminates the organizational friction of silos, providing a flatter organization where all customer insight is shared.

At State Farm, it quickly became clear that my personal agent had no informational advantage over what I could find out on my own. They had to call the same number, get the same response and fight the same battles as I had to. In my situation, it became very apparent that the central customer care organization, claims/adjuster organization and agent network were at least three separate entities without shared databases.

Lesson: One of the foundational components of a truly digital organization a shared 360 degree view of the customer. Each potential customer touchpoint should be able to easily monitor the customer relationship as well as any communication stream from a central database. The result of a siloed organization is frustration when the insight about the customer resides further from the ‘owner’ of the relationship. With State Farm, this seemed to be a case where operational efficiency trumped customer experience.

The customer is still used to calling their banker, agent and/or investment advisor for information about their relationship. Taking insight away from these points of contact can be disastrous if not supplemented with a robust system of proactive alerts and notifications through email, robocalls, SMS, etc.

4. Hidden Paper-Based Systems

Getting rid of paper is one of the most difficult challenges for legacy financial services organizations. Everyone agrees that digitizing paper-based systems cuts costs, improves accuracy and allows for improved data analysis, but paper still exists in abundance in many organizations. At State Farm, the confirmation of my claim came via email (acceptable) with the communication with an attached PDF file (bad).

This type of communication is both outdated and a terrible experience for a mobile customer (eye chart test). Worse yet, State Farm requests that any follow-up communication be done via email with attachments as opposed to digital interaction.

Using a paper-based system (and not sharing all of the data taken when the initial claim was filed) led to the long delay in the process. As mentioned, the location of my disabled car was inputted incorrectly. Since the PDF did not show this information, and because no digital file was available to verify, the process flow was at a standstill.

Beyond the initial claims process, State Farm provides their final claims estimates to customers via DIRECT MAIL. This is somewhat amazing in an era of mobile devices and computers that something as important as a claims estimate is delivered using the slowest channel available. Despite having my cell phone number and my email address, no communication is done with this channels.

Lesson: All communication and data should be compiled and shared through digital communications. If desired, the customer can always print the data in a PDF format, but communicating with word documents, PDF files, etc. is both outdated and expensive. Without digital files, data can’t be analyzed for trends by State Farm or corrected by the customer if there is an error.

In my case, some of the delay was because they showed the wrong city for where my car was being stored for repair. There was no indication of the dealership on my PDF. In a digital document, I would have been able to see and correct the error as could my personal agent.

If direct mail is going to be used for communication (since some people prefer a paper copy for their records), this should be an additive channel to the faster options of SMS alerts/notifications and email. Even a phone call would provide the information needed to proceed with the repairs desired.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

5. Underdeveloped Social Channel Strategy

More and more digital consumers will use social media to lodge a complaint or voice a frustration. Not necessarily the first channel of choice, social media allows a consumer to catch the attention of organizational social channel service agents as well as getting voices heard in a public setting.

According to eMarketer, when it comes to customer relationship management (CRM), social channels present something of a double-edged sword. They facilitate communication between consumers and businesses, but also provide disgruntled customers with the means to quickly and widely broadcast their discontent with a product or service.

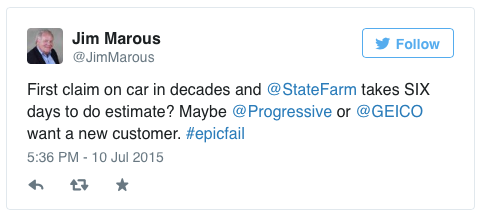

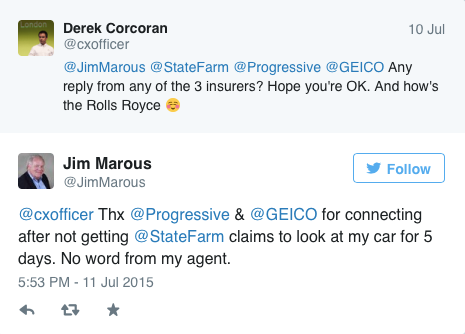

I did not decide to revert to social media complaining (via Twitter) until I realized my claim had not been attended to for 6 days and all efforts to reach a person with an answer had been fruitless. My first tweet was a simple ‘call to arms’ with the intention to determine if State Farm monitored Twitter after hours (or at all).

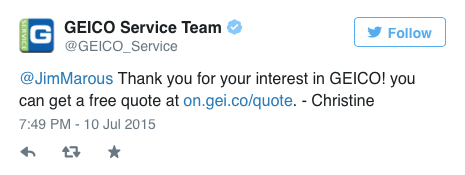

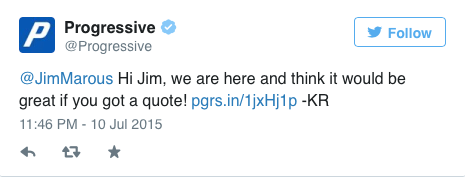

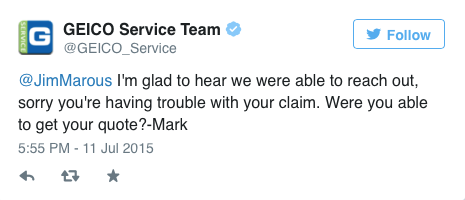

Given the way the week had gone so far with State Farm, I was not surprised by the responses I received … from the competition. While not immediate, it showed … on a Friday … that social media monitoring is alive and well in the insurance industry. I was surprised that no other company responded to the clear need for help.

One of my Twitter followers showed some interest in my experience (no, I don’t have a Rolls), which prompted yet another response from GEICO (but still silence from State Farm).

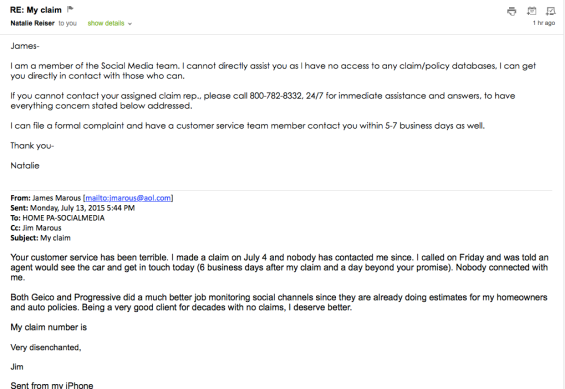

Finally, after one final effort to catch State Farm’s attention via Twitter, they responded to my social media request with a reference to an email location I could further my discussion. Most firms will request the conversation to be taken to the direct messaging capability of Twitter.

Unfortunately, when I used the method suggested by State Farm (email), below is the response I received in return. Not only does the social media not have access to my claim information (another silo), but they offered me an option to file a complaint … and wait an additional 5-7 business days.

Lesson: Consumers are relying more and more on social media to build a dialogue with their product and service providers. Mobile omnivores are more likely to communicate via social channels and expect a quick response. 8/5 monitoring is no longer acceptable where consumers may need answers quickly. 24/7 is the rule.

In addition, consumers expect the service agents who manage the social channels to have access to the same insight that a call center and their branch/agent has. If this is not the case, another expectation opportunity has been missed.

6. Timing of Digital Retargeting

Digital retargeting can be a very powerful tool if used correctly. By understanding the prospect and customer journey, organizations can reach out to consumers who visit their web site, research a product or service from a competitor, mention the product or company on social media or do searches.

Once the inquiring consumer is identified, they can be retargeted with web advertising, email, phone calls or even direct mail that is personalized to the specific household looking for more information. Like most digital communications, however, when the targeting misses, it can miss by a lot.

In the case of State Farm, it initially appeared that my social media communication mentioning State Farm prompted the delivery of a sales newsletter from my State farm agent. It turns out that this was simply a coincidence, but selling in the midst of an ongoing complaint that has yet to be resolved is fruitless … and potentially damaging to the relationship.

Alternatively, when retargeting is done well, it can become part of the customer journey. In the case of Progressive, once I started mentioning State Farm on social media channels, I began to receive promoted tweets from Progressive asking for my business.

Lesson: Retargeting is a great marketing tool when done correctly. But machines can’t make all of the decisions for the communication targeting without some intelligent monitoring. In the case of State Farm, if the email had been sent as a result of retargeting, the process of selection should be reviewed. If done by the agent, there should be a scrub done for those customers that are in the claims process.

Retargeting by competitors is a common practice as shown by Progressive in my case. If a consumer is disgruntled or shopping for an alternative, retargeting is strong contextual marketing strategy.

The Omnichannel Expectation

When consumers reach out – whether by phone, email, chat or on social channels, they expect the service agents they speak with to have at least as much information as they do. We can debate the definition (and the reality) of omnichannel customer care, but what we can agree to is that service teams are running as fast as they can to stay abreast of the mobile and digital capabilities available.

The other reality is that customer service traffic is shifting as customers embrace digital channels. With this shift, digital contact centers (including social channels) become the ‘go to’ human-based channels. The staff within call centers, social channels, etc. may be the only people some of our customers interact with. If that’s the future, many firms have got a lot of work to do.

A Message to State Farm

As an addendum to this post, I will be staying with State Farm, at least for now, given their long track record of excellent customer service. I will mark this experience up to the agency’s transition from being a 1:1 personal relationship business to one that is working toward be digitally personalized.

Growing pains are tough … but the need to move forward quickly is apparent. At the very least, I suggest that State Farm consider a centralized, shared customer database that can be accessed by all levels of the organization. Customers will never understand the logic that their personal banker, agent or wealth advisor doesn’t have access to their relationship files. In addition, proactive alert notifications throughout the process are imperative as is the elimination of paper. The use of direct mail anywhere in the process should be additive as opposed to being the primary channel of communication.

Remember, the digital consumer is increasing their expectations faster than most organizations can keep up. Loyalty, trust and patience have a limited lifespan that will be tested by consumers who want customer service to be 24/7 with access to insight on their mobile device. Only those firms that can fully integrate systems, processes and communications will survive in the future.

Everyone has multiple options, with alternative legacy and start-up companies ready to steal disgruntled digital-first customers. The goal is to avoid having these firms considered.