When was the last time you closed a relationship with a bank or credit union you have used for an extended period of time? If you’re like most people, probably not for decades, if ever.

When was the last time you opened a new account with a nontraditional digital provider like Chime, Varo, PayPal, Acorns, or Robinhood? Possibly several times in the past few years?

Though traditional banks still claim the majority of primary relationships with consumers, a growing number of younger consumers have their primary relationships with digital-only banks. Increasingly, older consumers also are opening accounts with neobanks and other direct banks.

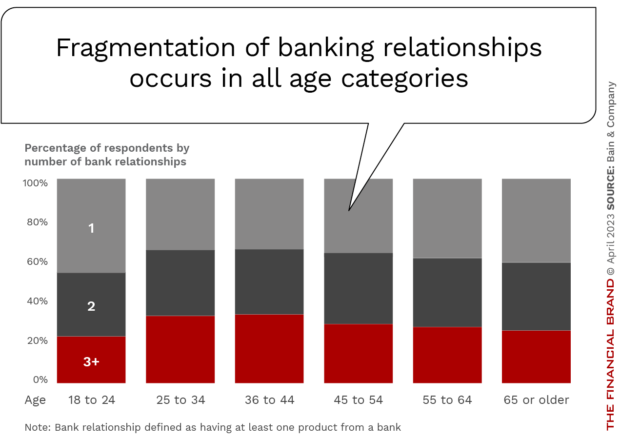

In fact, consumers in every demographic group – and in every country – tend to have accounts with more financial service providers than in the past. This fragmentation of banking relationships has accelerated due to changes in customer preferences, dissatisfaction with service offerings and quality, and competition from alternative banking providers. Regardless of the cause, the financial impact of unbundling of banking services is significant, especially where a bank or credit union is unaware of this trend playing out with their own customers or recognizes it but is slow to respond.

To combat silent attrition, financial institutions must monitor customer activity across internal and external channels. This includes flagging and responding to changes in transaction histories, along with monitoring social media for complaints where the institution is referenced with an “@” or a “#” so that it can use the opportunity to resolve the issue. Additionally, banks and credit unions can proactively engage with customers using customer feedback mechanisms, addressing concerns before unbundling occurs. By monitoring customer activity, improving customer service and product offerings, and leveraging data analytics and machine learning, financial institutions can better identify and retain customers who are at risk of leaving.

Read More: The Future of Loyalty in Banking is at Risk

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Degradation of Loyalty in Banking

According to a study by Bain & Company, customer loyalty in banking continues to decline, with only 29% of customers saying they are loyal to their primary bank. This decline in loyalty is driven by several factors, including the rise of digital products and channels, increased competition from fintechs, and changing customer expectations.

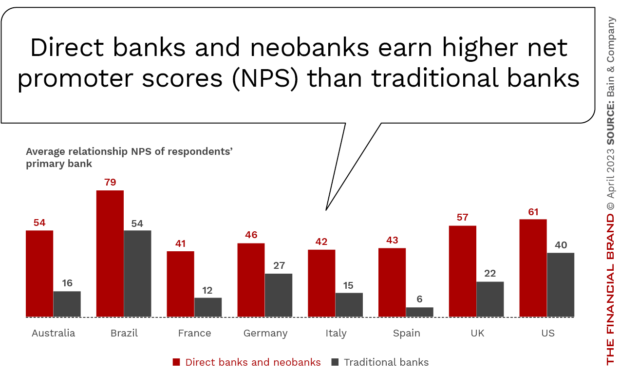

One concern for traditional financial institutions is that the net promoter scores for direct banks and neobanks in every market globally are significantly higher than theirs are. In the U.S., the net promoter score was 40 for traditional banks among those who considered one of these banks to be their primary financial institution, compared with 61 for their digital competitors, according to the Bain study.

When loyalty erodes, customers tend to disengage by maintaining fewer products at an institution and going elsewhere when the next financial need arises.

The Power of a Great Personalized Customer Experience

The Bain report highlights the importance of customer experience in driving loyalty. Customers who rate their bank’s customer experience as excellent are four times more likely to be loyal than those who rate their experience as poor. An important component impacting the experience is the level of personalization across channels, during interactions and within products. Customers expect their banks to understand their individual needs and preferences and to offer tailored products and services that meet those needs.

As the chart illustrates, there’s a 123-point difference in NPS between respondents who strongly agree that their bank interacts based on knowing who they are and those who strongly disagree. (It exceeds 100 points because the NPS is negative for those who disagree.)

There are several ways that financial institutions can provide personalized interactions, with the foundation being the use of data and analytics to gain insights into customers’ behaviors and preferences, then using this information to offer tailored recommendations, product offerings, and service options. An additional strategy includes the use of digital technologies, such as chatbots or virtual assistants, to provide instant personalized support, contextual assistance and even financial wellness education.

“To excel in personalization requires several critical capabilities. The bank must understand an individual’s needs, form a strategy to actively engage them at the right moments, adjust the content of communications based on the customer’s actions, and measure the effect of each action.”

— Bain & Company

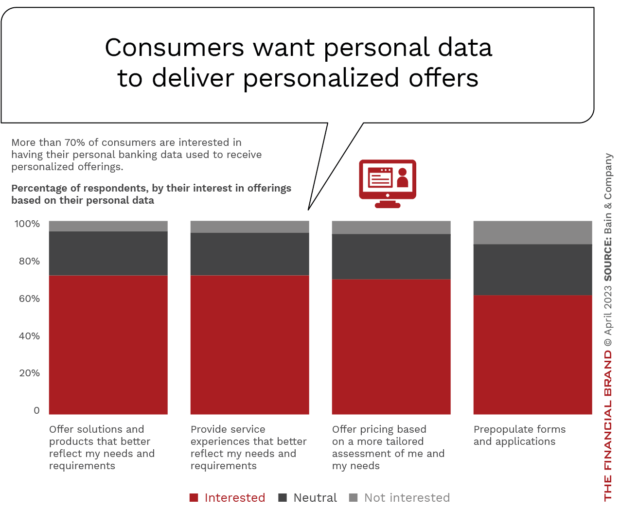

The good news is that more than 70% of consumers say they want their banking data used by their financial institution to craft personalized offers. Such personalization could occur with products offerings, the service experience, pricing, and pre-populated forms and applications.

According to McKinsey, banks that deliver a personalized experience for customers generate benefits throughout the entire sales journey, including higher revenues and lower friction in service journeys (resulting in lower cost to serve). Similarly, Accenture finds that customers are willing to pay more for a better experience, with banks having the potential to boost revenue from primary customers by up to 20%.

Read More:

- 7 Proven Ways to Deliver Exceptional Customer Experiences in Banking

- Mobile Banking Apps Must Personalize Experiences to Keep Customers

- Better Banking Experiences Require Real-Time Data Insights

Improve Customer Experiences by Reducing Friction

Speed and simplicity of engagement are additional components of a positive customer experience. Customers are more likely to be dissatisfied with their banking experience if they encounter friction, such as long wait times, complicated processes, or poor customer service, according to the report from Bain. In fact, the report found that customers who encounter friction are three times more likely to switch banks than those who don’t.

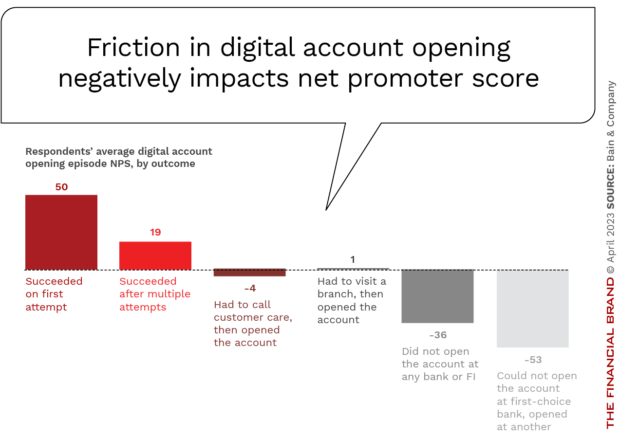

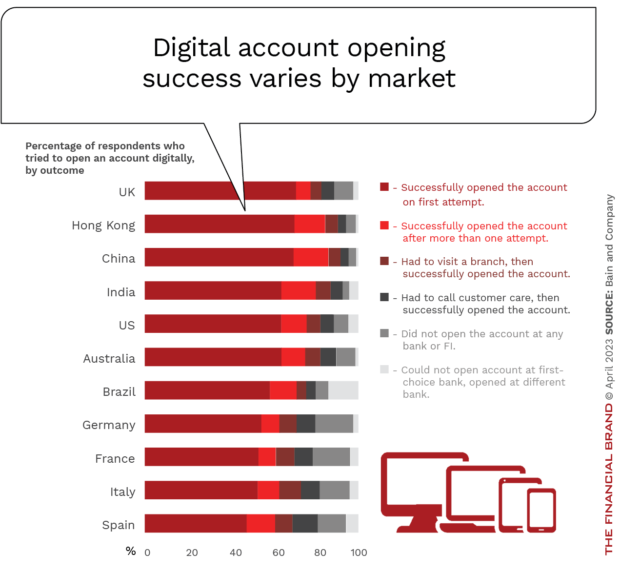

Customers increasingly expect digital engagement with their financial institution to be without friction right from the start, yet few banks have managed to allow consumers to complete the new account opening process digitally on their first attempt. And the impact is significant. There was a 103-point net-promoter-score difference between respondents who could successfully open an account digitally on their first attempt compared to those who could not open the account and ended up choosing a different provider.

Surprisingly, the ability to deliver a positive digital account opening experience still falls far short of customer expectations. “‘Right first time’ has been a tough challenge for traditional banks to crack, because it requires fixing details throughout an episode, crossing many functions within the bank and many underlying processes such as know your customer and anti-money laundering,” the Bain study says. In research from the Digital Banking Report, there is still an abandonment rate in excess of 50% if the new account opening process takes more than 3-5 minutes.

Read More:

- The 5 Top Customer Experience Trends

- Improved Digital Account Opening Must Be a Top Priority

- Virtual Assistants Are the Magic Genies of Mobile Banking Apps

It’s Time to Stop Silent Attrition

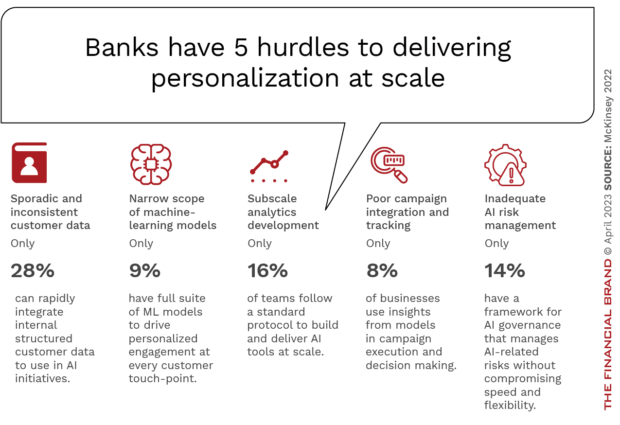

Despite significant investment in artificial intelligence, only 8% of banks are able to apply predictive insights from their machine-learning models to inform campaigns. And, with close to instant engagement now standard with most digital interactions, it is imperative for banks and credit unions to protect and strengthen their customer relationships by responding to every threat and opportunity in real time. The outputs can be individualized, but the inputs and algorithms that produce them should be codified and centralized. Instead of monthly or quarterly campaign releases, many have shifted to a daily or weekly tempo.

“By codifying, unifying, and centralizing key analytics and supporting processes, organizations generate 5 to 15 percent higher revenue from their campaigns and launch them two to four times faster.”

— McKinsey

There are five common challenges that banks face in delivering campaigns and communications at digital speed, according to McKinsey.

By addressing these challenges, initiatives from banks and credit unions can flow across functions, forcing silos to collapse. Insights, tools, and practices can be folded into playbooks that are deployed across successive campaigns, reducing launch times and continually improving outcomes. Financial institutions that have addressed these challenges benefit from outcomes like an increase in customer lifetime value and greater loyalty.

Not surprisingly, senior leadership must also be open to leading the case for change. This is the only way financial institutions can reduce the fragmentation of banking relationships that is silently shifting funds out of traditional banks and credit unions.