To a greater degree than ever, physical and digital channels are being integrated through data, advanced analytics and modern technologies. Consumers no longer accept being “forced” to use a banking channel they don’t want to use, or to have other interactions be time consuming and difficult. These expectations, combined with the level of personalization provided by big tech and fintech firms, are putting pressure on the marketing departments of financial institutions to catch up.

Banks and credit unions must provide insight and intelligent decisioning in real-time, personalize at scale, and understand the entire customer journey both within and beyond the financial institution. The result will be engagement and communication that will be more intelligent, more customer-centric, and more timely than has been possible before. This will create a level of trust that will result in an improved ROI and an experience that will humanize digital and physical interactions.

The financial institutions that learn to leverage data, advanced analytics, modern technology, and marketing automation will be the winners in a post-pandemic world that has made consumers more aware than ever of the digital customization potential from organizations such as Amazon, Netflix, Instacart, and others that incorporate marketing agility into their business practices, saving consumers time and effort.

Used effectively, marketing automation can provide financial institutions the foundation for finding time-sensitive opportunities, allowing for real-time decisioning and delivery of messaging, while reducing costs of execution and improving trust and loyalty. Most importantly, by sharing the insights created across the organization, employees will feel empowered and digital experiences can become humanized.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Consumers Equate Speed, Simplicity and Personalization With ‘Caring’

In a recent interview with marketing and customer experience guru Jay Baer, he referenced that in today’s increasingly digital world, consumers view firms that provide fast and easy connectivity – and personalize the experience – as being caring. He also mentioned that location is no longer a strategic advantage when a consumer can access almost anything on their phone.

Prior to COVID, the digital revolution was already underway — the pandemic just sped up the transition and broadened the audience of who wants the speed and simplicity of digital engagement. Today, virtually everyone starts their shopping process with a search. When consumers do their own competitive shopping, and find the information they want, without ever visiting a branch or calling customer service, banks and credit unions need to make sure they are using the right technology solutions to accommodate this digital shift.

Financial institutions that believe the majority of consumers prefer to go to a branch to open an account, cash checks, deposit funds or even inquire about products and services are, in most cases, biased by the past and are overlooking or ignoring the future potential of digital. Many times, consumers visit a branch because the digital experience is not as simple or as fast as desired. More than ever, consumers will simply abandon a purchase they want to make digitally as opposed to traveling to a branch. In fact, research by the Digital Banking Report found that abandonment of new digital account openings are as high as 60% to 80%.

Read More: Beyond Personalization: Three Reasons to Focus on Customer Journeys

Build Engagement and Trust Through Technology and Automation

Consumer’s preference for the use of their personal information is directly correlated to the value they receive in exchange for their personal information. Financial institutions must leverage insights, AI, machine learning, and predictive analytics to provide both ease of engagement and intelligent recommendations similar to Apple, Amazon, Spotify and Netflix. There also needs to be clarity as to how insights will be used on the customer’s behalf.

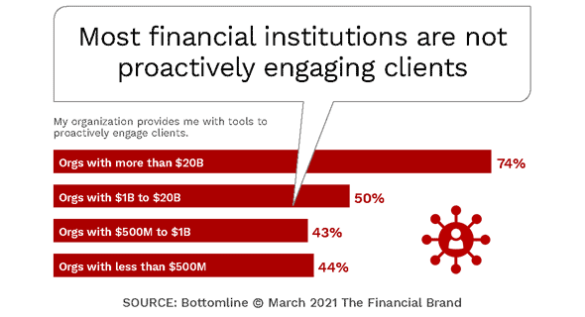

In a survey of banks and credit unions by Bottomline Technologies, it was found that many financial institutions are not optimizing the use of data and technology the way consumers prefer. Despite an overwhelming belief that proactive engagement and delivering personalized guidance were requirements for a positive customer experience, only three-fourths of respondents at large organizations, and less than 50% at smaller institutions, said they have the tools to achieve these goals.

The report, “The Rise of Intelligent CRM in Banking,” illustrates the importance of using data, analytics, automation and digital technology, it also found significant performance gaps in delivering the experiences consumers desire. The report also illustrates the large variance in deliverability between small and large financial institutions.

Financial Institutions are Uniform in Their Desire to Serve

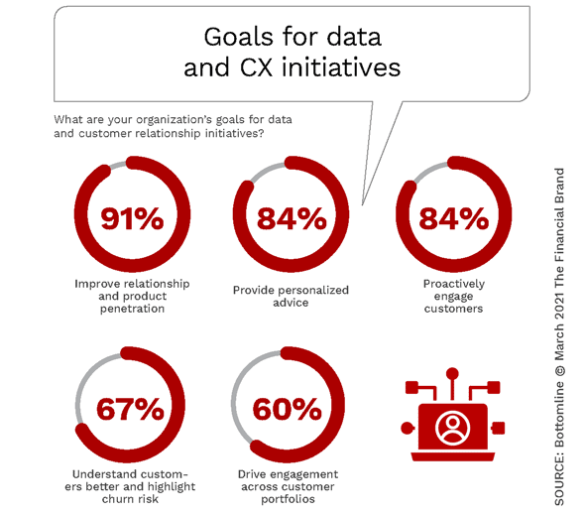

According to the Bottomline research, when discussing the goals for customer relationship initiatives, most financial institutions prioritize improving customer relationships, increasing product penetration, providing personalized advice and being able to proactively engage consumers. As consumers became even more familiar with digital-first organizations, they became aware of the level of personalization possible, even from small retailers and restaurants. Their tolerance for less that this level of personalized attention will definitely impact the success of organizations not meeting these expectations.

One of the major challenges in building a uniform 360-degree view of the consumer is the confidence within the organization that the data being used is accurate and complete. With data silos and data quality issues, a holistic view of the consumer, small business or corporate relationship is difficult to ascertain without a strong data governance process.

Ability to Leverage Customer Insights Differs by Asset Size

When Bottomline asked organizations whether they had the tools to effectively engage clients, there was a significant difference in capabilities between large and small financial institutions. For example, while almost 75% of organizations with over $20 billion in assets said they had the tools to proactively engage clients, the number plummeted to less than half of organizations under $20 billion. In addition, 55% of smaller financial institutions said their ability to monitor customer relationship health and identify growth opportunities was weak or far behind their competitors.

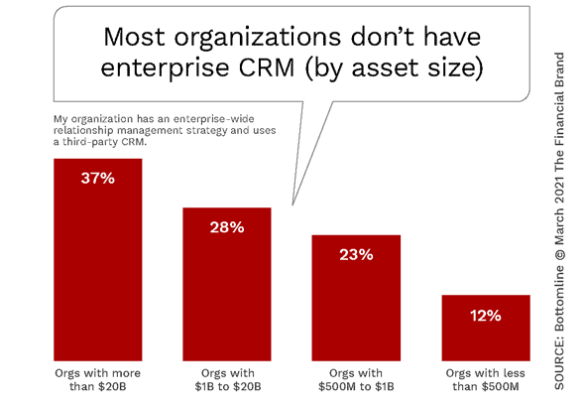

One of the primary reasons for the disparity in being able to understand and communicate effectively to customers is that most firms don’t have an enterprise CRM system. Making matters worse, the percentage of smaller financial institutions having an enterprise-wide CRM is significantly below their larger peers.

The impact of not having a robust CRM tool impacts both the confidence in data and recommendations, but also the speed to market for time-sensitive opportunities. The lack of both scalable solutions, and ability to deploy across multiple channels, places those firms without a sophisticated CRM system at a tremendous disadvantage from both a cost and revenue perspective.

Customer Experience Solutions Need an Upgrade

It is not just the technology that is stuck in the past, it is the way technology is being used as well. Most organizations continue to build marketing initiatives around products as opposed to consumers. Even with the best targeting, if the funding and marketing objectives are focused on product sales, the consumer loses. In addition, if digital engagement is focused on ‘making digital account opening possible’ as opposed to making the process fast and easy, the consumer will start their relationship elsewhere.

As can be seen below, most organizations continue to focus on legacy marketing and operational opportunities as opposed to leveraging data and technology for improved digital experiences.

Modern CRM systems do more than just drive sales. They can improve the customer experience by helping consumers manage their finances more effectively based on real-time insight and marketplace opportunities. Moreover, today’s CRM systems can build loyalty by using data and technology to drive product and service recommendations, improve customer service, improve response times, and personalize customer communications across all touchpoints.