According to a report from BCG, a retail bank with $100 billion in assets could bring in up to $50 million in revenues daily simply by personalizing pricing and product offers.

But the overall effect of personalization is even more far-reaching: it can generate an estimated 30-40% sales bump in certain product areas, reduce customer churn rates by 10-30%, and double or triple customer engagement scores. In absolute terms, the hypothetical bank in BCG’s example can increase revenues by up to a whopping $345 million thanks to personalization across its functions.

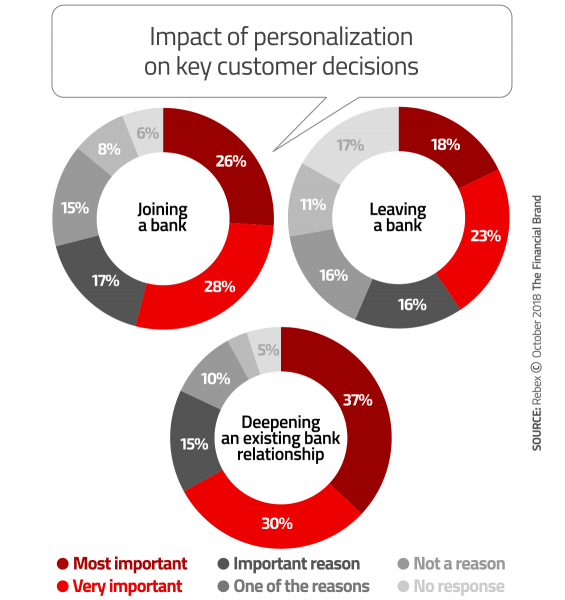

Yet many retail financial institutions are still slow to personalize their products and services. True, tailoring products to customer needs might require a fundamental change in operations throughout the entire value chain. But there’s no doubt that the gains are well worth the effort. About 68% of customers deepened their relationship with their existing bank, and purchased more products and services after the bank had rolled out a new, personalized approach, BCG research has found. And it’s just as telling that 41% had left a bank partially because they didn’t think they had received a sufficiently personalized treatment.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are Banks The Next Uber?

Offering custom banking experiences instead of pushing products has become the new mantra in financial services. Who really needs a credit card, a short-term loan or a mortgage? No one, really. In all honesty, they don’t need such “products” at all. What they really need is financing solutions that fit certain life events or life stages. But banking providers can only offer tailor-made solutions if they understand the specific needs of individual customers, and if they personalize their offers based on their behavior and habits.

Amazon, Google and other tech and retail giants have already mastered the art of personalizing offers. Just think of product recommendations customers receive based on their past purchases. Or take the example of Uber or Airbnb (or any other pioneer in the sharing economy) who have been at the forefront of personalizing customer journeys. No wonder that banking consumers expect the same first-class experience from their banks. Most financial institutions, however, still struggle with matching up to these expectations.

And it’s high time they did something about it. We live in the “Age of the Customer” and the “Era of the Segments of One,” where privileged players who can dominate the the financial services sector are a thing of the past. With today’s consumers demanding more than ever, it’s time financial institutions adopt a new mindset which puts their people’s needs first, instead of throwing sales pitches for banking “products” at them.

Why Get Personal?

Before jumping in and completely redrawing marketing strategies, financial institutions must first understand why people crave personalization. As explained in another article here on The Financial Brand, giving consumers the impression that they aren’t receiving some generic sales message makes them feel in control, which, in turn, makes them happier. They feel more satisfied with the end product when they feel it’s more tailored to their unique needs and preferences.

Personalized products, experiences and yes, even marketing messages, are welcome relief to consumers drowning in mass market brands where everything is generic, impersonal and cookie-cutter. Consumers actually like messages and offers that are specifically relevant to them.

Gone are the days when financial institutions could gin up results using “spray-and-pray” marketing campaigns. Financial marketers that insist on sustaining such strategies keep generating lackluster returns and conversions because customers are simply ignoring messages they deem irrelevant, and doing so with increasing frequency.

Geographic and demographic segmentation doesn’t do the trick anymore, either. How come? Such crude targeting strategies don’t yield greater insight into consumers, according to EY. More often than not, this elementary information has little- to no correlation with the actual needs of real people, who “are much more than the sum of their banking deposits and loans, and do not align neatly to basic or broad demographic characteristics,” as EY puts it.

Humanize With Machines

Banks shouldn’t forget that, as ironic as it sounds, technology is key in personalization. It is mostly an automated process that relies on collecting and analyzing customer data. AI tools and advanced analytics are just what banks and credit unions need to go one step further in customizing their marketing campaigns based on behavioral information and micro-segmentation.

With predictive targeting methods, financial institutions can map out customer behavior, ranging from sporting schedules, mobile usage and online entertainment preferences to eating out habits, shopping or even what days someone may like to go out for drinks. Setting up customer profiles based on these characteristics can accurately predict what products these customers are likely to buy.

A grocery shopping profile, for example, tells a financial marketer whether a customer has a big shopping day at the beginning of each month after their salary arrives or shops every Friday before the weekend kicks off. Once these profiles have been created, they also offer an opportunity for banking providers to cooperate with third-party merchants, as they also include information about the individual’s favorite brands and stores.

Mine Your Data

Financial institutions are sitting on a huge amount of traditional customer data. All they need to do is merge it with non-traditional information, like digital behavioral patterns, social media activities, geolocation and even weather forecasts, to create insight-driven campaigns. These campaigns are built on rich insights, which are processed and knitted together by artificial intelligence and advanced analytics tools.

The good news is that such insights don’t necessarily have to be overly complex. Even the simplest insights can make a huge difference. For example, studying digital usage patterns can reveal how individuals use online and mobile banking channels, when, what problems they had when performing certain functions, and what digital products or services they might also be interested in. With this information at hand, financial marketers can proactively offer assistance or send out the right offer at the right time.

Predictive analytics helps financial institutions foresee when a consumer will arrive at certain life events or need a financial service solution. And this is not something nice to have. This is the future of marketing in banking. This advanced form of needs analysis, once only accessible to the largest industry players, is now financially and operationally available to organizations of any size.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Up Your Sales Game

Having the right tools and solutions to boost digital sales has never been more important to banking providers. They’re grappling with rapidly increasing expectations and a new generation of consumers who demand convenience and 24/7 availability on their mobile devices. Incumbents in the financial industry also face fierce competition from digital-only challenger banks and tech giants, which have already ventured into financial services and are feared to enter mainstream banking in the very near future.

Digital disruptors are threatening to chip away at origination and sales income, the two most important profit drivers of incumbent banks. Customer loyalty is at an all-time low: clients can be gone in just three clicks, should they receive a better offer. And this will only get worse with the emergence of open banking, PSD2 regulations and competitors pushing ahead.

Stepping up digital sales and personalization efforts is essential to win new customers and keep the existing ones. Not to mention profitability.

Balazs Vinnai is the president of W.UP, the go-to digital sales company for banks. Before joining W.UP, he had served as chief digital officer and vice president of Finastra.