Is enjoyable banking just hype? What does enjoyment mean to consumers in the context of their relationship with retail banks and credit unions? New research from PeopleMetrics tackles these questions, and outlines a road map to create experiences that leave a lasting, positive impression in consumers’ minds, driving higher levels of loyalty and advocacy as a result.

According to Forrester Research a great customer experience must:

- Meet consumers’ needs

- Require little effort

- Be enjoyable

As more and more banks and credit unions try to differentiate on the strength of their customer experience — shooting for unparalleled, exceptional, incomparable, etc. — many are asking the question: “Can banking really be enjoyable?”

When we think about enjoyment, we think fun, social, engaging, amusing; it’s natural to wonder whether these adjectives can apply to financial institutions faced with the very serious responsibility of protecting people’s hard earned money. A study by PeopleMetrics, “Most Engaging Customer Experiences,” set out to tackle these questions: Do consumers really need — or even want — “enjoyment” from their bank? And, if so, what does “enjoyment” really mean in the banking context?

Capturing feedback from more than 900 customers of national, regional and community institutions, PeopleMetrics identified the three elements that result in consumers saying that they ‘love’ their bank and telling others about their positive experiences. What we discovered was that the most important aspect — above all others — was indeed enjoyment. Consumers by and large expect their banks to meet their needs and be easy to do business with, but it takes enjoyment to win their hearts.

Knowing this we wanted to further define ‘enjoyable experiences’ and layout a road map for how all banks and credit unions of any size can create experiences that leave someone feeling something positive, akin to enjoyment.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Taking the Personal Path: Moving From Transactions to Conversations

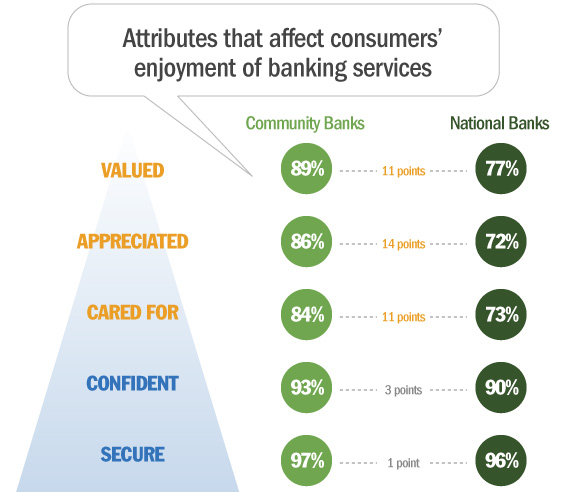

Our analysis uncovered the most common emotional tags that consumers associate with an enjoyable banking experience. Survey participants were presented with a number of different emotions such as “happy,” “energized,” “pleased,” “trusting,” “valued,” etc. The positive emotions that had the greatest impact on the banking relationship were “valued,” “appreciated,” “cared for,” “confident” and “secure.”

All banks in the study do a similar job at providing a sense of “confidence” and “security,” with a nominal 1 and 3 point gap separating national and community banks on those two respective themes. The real difference is when you look at the more personal emotions (indicated in orange in the illustration below). Community banks deliver feelings of being “valued,” “cared for” and “appreciated” to a greater degree than larger, national institutions.

These emotions are deeply personal. And the subject of “personal feelings” is a difficult area for an industry that’s focused on black-and-white facts, dollars and cents, rates and fees, columns and rows — for hundreds of years! But money is extraordinarily personal, and is tied up in a myriad of complicated emotions. For some consumers this may manifest as stress, for others embarrassment, for others pride. The secret to delivering enjoyment is to understand how your consumers are feeling. and design experiences that meet them where they are emotionally and psychologically. As Jeffrey VanDeVelde, SVP of Customer Experience and Loyalty from SunTrust Bank so eloquently explains:

“For years we have designed ways to drive down wait time in a branch, for example. You think that if consumers don’t have to wait in line a long time they will be satisfied. But that doesn’t make them happy. What makes them happy are emotional things they want to feel. What if I could take the two minutes spent waiting in line and reduce the stress a client might feel about money? What if that was a good two minutes you could spend? What if a client was willing to spend five minutes in line as long as the outcome was to reduce stress?”

When people think of situations where they feel cared for, valued and appreciated, they often think back to where their relationship was originally established. Unfortunately, purely transactional exchanges can never serve to create these powerful, personal emotions. In transactional interactions, people fail to see beyond the functional task and the efficiency of the process — either it’s done correctly or it isn’t, and you don’t get any love for doing it right… just punishment if you screw it up.

To make banking enjoyable we have to start with a mindset shift toward conversations and away from transactions. In short, we need to start by putting ourselves in our consumers’ shoes and joining them on their journey.

The First Step on the Road to Enjoyment:

Caring for Consumers

Every business talks about customer care, customers first and customer-centricity, but what does it mean to really and truly feel cared for? A person who feels cared for feels they are receiving serious and genuine attention, concern for their well being and situation, and protection. Below are some examples of how banks can build genuine care into the experience they deliver to their consumers.

| What | How | Example |

|---|---|---|

| Genuine Attention | Show the customer that you see them as an individual not an account number. Make them feel the opposite of anonymous | One customer in our study described how his community bank makes him feel cared for: “They have a small town feel to them. I like that they greet me by name before even having my account information in hand. I don’t ever feel like I am just a number to them. I don’t feel like they are lying in wait to take advantage of me at the first opportunity…” |

| Concern for Consumers’ Well-Being | Recognize their state of mind, and go out of your way to make their lives easier | USAA recognized that tax season is typically a stressful, angst-making time. Thus, they redesigned their home page during the weeks leading up to April 15th to present a calm visual landscape and simple to navigate content categories with easy to use support tools. The message was that USAA cared enough about their consumers’ state of mind and current situation that they took the time to redesign the site to help consumers through a stressful time. |

| Offering Protection | Protection through clarity, education and understanding | Wells Fargo believes that clarity will lead to customer success so they created a customized summary of every visit with a banker. This is given to the customer at the end of each meeting so that they can really understand what was discussed and what was agreed to thus protecting their interests. They also offer free credit reports to all of their consumers and spend time with them coaching them on the rating and what they can do improve – helping them to protect their credit for future needs. |

| Protecting Consumers from Themselves | Warning consumers when their actions could lead to lost funds | Huntington Bank immediately notifies consumers when they have overdrawn their account. They offer a 24 hour grace period for the customer to get sufficient funds into the account before the overdraft fee is charged. |

| Cultural Alignment | Provide front-line employees with the training and support needed to deliver human service; Align compensation and rewards to customer experience, not sales | At the heart of the UK’s Metro Bank’s success is its organizational culture. Co-founders, Anthony Thompson and Vernon Hill take their hiring and rewards practices and their company values extremely seriously. Staff is not remunerated on sales but on customer satisfaction. People are not hired for skills but for attitude. And their AMAZE values focused on relentless execution are reinforced everywhere. |

Next Stop: Valuing Consumers

Delivering a feeling of value requires the financial institution to make consumers feel they are respected and held in high esteem. There are a few ways that this can be delivered.

| What | How | Example |

|---|---|---|

| Respect | Open and transparent communications | Simple Bank’s customer experience is largely defined by its friendly and approachable brand voice. After opening a Simple account, consumers receive a concise welcome invitation with their new debit card – a stark contrast to the typical bundle of legalese and documents that accompany traditional account openings |

| Held in High Regard | Give time and support for the consumer’s success | Think Mutual Bank of Rochester, Minnesota encourages their bankers to spend time with consumers showing them how to establish a personal budget. This service is free – and often results in the bank recommending against a loan product – but delivers the clear message to the customer that their financial well being is important to the bank |

| Value Loyalty | Build loyalty programs that reward consumers for their balances and loans held with the bank | Marlborough Savings Bank has built a Customer Loyalty Program that their consumers love. Using a tiered system, consumers get benefits such as mortgage closing discounts; waiving of certain fees like stop payments and annual IRA fees as well as free services such as: wires, money orders, and cashier checks |

Final Leg: Customer Appreciation

The final emotion that is highly correlated with an enjoyable experience is feeling appreciated. Appreciation speaks to showing gratitude or thankfulness for the consumers’ business. Here are some ways that banks can show consumers they appreciate them – bringing higher levels of enjoyment along the way.

| What | How | Example |

|---|---|---|

| Give Thanks | Show consumers you appreciate their feedback and input, as well as their business | When the customer experience team from Central Pennsylvania’s Metro Bank began hearing from consumers that an overdraft protection fee was perceived as unfair, they changed it. Metro moved quickly to make the switch and offered a sincere thank you to consumers who had shared their feedback |

| Listen and Respond | Ask for- and respond to customer feedback | UMB captures feedback from consumers through a Voice of the Customer program – following recent interactions – and follows up with consumers to respond to their feedback – either resolving service issues or thanking them for their time. Not only do they respond to survey feedback but they actively manage social channels and their leadership team makes outbound calls to clients to learn more about their UMB experience and use that feedback to make improvements |

Fueling the Journey

Our research has proven that enjoyable experiences do make a difference to consumers’ levels of loyalty and advocacy for their bank. And, it has also helped to clarify that enjoyment in the context of retail banking depends upon being made to feel special, creating a personal relationship that meets people where they are, making them feel cared for, valued and appreciated.

But we also know that simply saying we’ll care for consumers is never enough. Unless the leadership of the bank shows through its behaviors, practices and protocols that customer enjoyment — care, value, appreciation — are paramount, enjoyable experiences are just words on the wall. An internal culture of customer and employee care, and the right people front and back stage working together are essential to creating enjoyable experiences that are long-remembered, and oft talked about, by consumers.