As more companies and consumers take advantage of mobile, the financial industry now finds itself at a crossroads. Research from Zipwhip shows that consumers attempted to send more than 400,000 text messages to Fortune 100 companies’ toll-free numbers during a one-year period.

Of those attempted messages, 50% were sent to Fortune 100 financial services companies. Considering the number of customers attempting to contact financial institutions via SMS using their toll-free phone numbers, there is an enormous amount of pressure on these companies to support this “mobile-first” mindset by text enabling their toll-free numbers for customer support.

Mobile has become the new normal and is shifting the customer engagement paradigm. Customers expect to receive information at the right time, on the right device. To continue to provide superior experiences and retain customers long-term, it is crucial for financial institutions to create strategies that incorporate mobile messaging into the communication channels that customers prefer using.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Changing Marketplace, Changing Expectations

Millennials now outnumber baby boomers in the marketplace and bring an entirely new set of communication expectations when it comes to financial institutions. In the past, customers preferred traditional methods such as face-to-face interactions. Today, more and more consumers are looking for digital communications from companies they do business with.

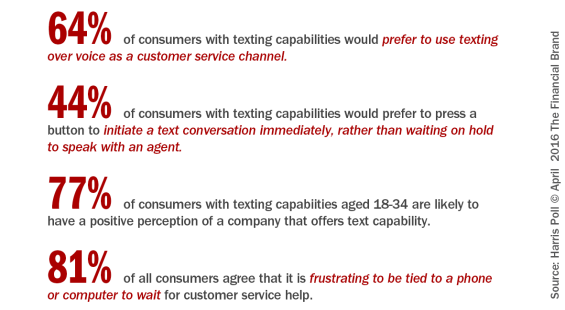

According to Harris Poll research done on behalf of OneReach, 64% of millennials prefer text messages to voice for customer service. Millennials are also early adopters of executing peer-to-peer money transfers using their mobile phones.

Based on an IDC study, 88% of the financial institutions already incorporating mobile messaging believe doing so has greatly impacted customer experience. Better yet, research from Harris Poll shows 77% of millennials look favorably on companies that offer text messaging communications.

A few ways financial institutions can incorporate text messages into their communication strategies include bank appointment reminders, real-time deposit or fraud alerts, sending online gift cards and providing bill reminders. For example, before a customer’s pre-authorized bill payment is due, the customer could receive a text message from their bank or credit union reminding them of the upcoming payment. Then, once the customer’s payment has been processed, the financial institution could send another text message informing the customer that the payment has been processed.

Another example is when banks offer to send text message alerts to customers when a particular dollar amount is withdrawn from their accounts. In this case, customers would receive a message alerting them of the action and asking them if the withdrawal was indeed done by them. Customers can then simply text back “yes” or “no” to resolve or continue the conversation.

Using SMS Texts for a Better UX

Even if financial institutions implement a “mobile first” communication strategy, they can still fail to keep customers engaged if messaging is irrelevant. The key to a better user experience (UX) is personalization and market segmentation.

With money on the line, it is no surprise that high value customers are demanding consistent one-on-one conversations versus uniform responses. Luckily, financial institutions collect a lot of information on who their customers are and what their financial situation is.

Incorporating relevant customer information into messaging not only provides customers with a sense of security, but personalized communications also strengthens their sense of brand loyalty. When customers receive messages that are generic or too promotional, the financial advisor-customer relationship is adversely affected and the financial institution’s reputation is often tarnished.

When personal information is included, text messages are perceived as highly valuable and the financial institution is positioned as the customer’s financial guardian. This type of messaging includes alerting customers of suspicious transactions, providing tips on better interest rates, or sharing updates on investments.

But how do financial institutions provide this personalized experience to their entire network? With technologies like machine-learning virtual assistants (sometimes referred to as ‘chat bots’), financial institutions can ensure customers have natural, back-and-forth automated messaging conversations. Using digital communications, the virtual assistant recognizes the intent of customer questions and provides instant, intelligent responses based on those conversations.

For example, if a customer texts a bank asking for their balance, the virtual assistant will pick up on the word “balance” and respond with a message similar to, “Hello Linda, I believe you are wondering what your balance is.” When the customer replies ‘YES,’ the virtual assistant would then provide Linda with her balance. Not only does using virtual assistants help financial institutions quickly answer a large volume of customer inquiries, they also cater to customers’ growing preferences for solving problems via a digital communications channel rather than talking to a customer service agent, which is typically a lengthy time consuming process.

Another example would be following up a customer service phone call with a short SMS survey to learn about the customer’s experience. At the end of the call, the customer service representative would ask the customer if they’d be interested in rating their experiences. If the customer said ‘yes,’ the representative would push the survey to their mobile device. Upon completing the text survey, the customer would receive a message thanking them for their time. When asked, 47% of financial institutions considered text messages an effective or very effective way to survey customers.

A Mobile-First Future

If done properly, SMS campaigns can build a strong relationship with your customer base. According to Jabez LeBret, there are some rules to follow when texting your customers. The risk of disregarding these rules is customers getting frustrated with your service or disengaging themselves from your brand.

- Always ask for permission. The more specific the opt-in authorization, the better, since a customer service opt-in differs from opting-in for marketing messages.

- Be prepared for immediate two-way communication. SMS is used to avoid calling or emailing, often because we are looking for a quick answer. When you interact with your customer by SMS, be ready to interact in the moment.

- Provide an easy opt-out. Make it simple and obvious for a person to stop receiving SMS communication from your company.

When it comes to providing superior customer experiences and strengthening customer loyalty, a “mobile first” strategy is becoming a necessity. Text messaging is the modern day communication tool that is here to stay, especially for the tech-savvy millennials and increasingly digital consumers in other demographic segments.

Although, there is not a “one size fits all” solution for providing exceptional experiences, catering to customers’ preferences and remaining personal is mandatory. When financial institutions incorporate text messaging into their engagement strategies, they have the ability to enhance communication, develop personal relationships, and keep customers coming back for years to come.