As consumers, we all know what it’s like. You hop on a company’s website hoping to find answers — maybe some information that will help you make a purchase decision — only to find frustration and disappointment instead. Some consumers are willing to shrug this off, seemingly willing to accept diminished service and support in exchange for the convenience of shopping on the internet. But there doesn’t need to be a trade off.

With live online chat, someone can initiate a two-way, text-based conversation with the click of a button. Clicking on a chat icon at a website triggers a new window where people can ask questions, get answers and advice — all in real time.

Live online chat is nothing new. Some financial institutions, like American Airlines FCU, have deployed live chat since at least 2002. Netbanker wrote about it back in 2006, as did the Wall Street Journal. Yet many financial institutions have yet to embrace this simple customer service solution, seduced instead by the sexier promise of social media. It’s time to take a good look at the issues involved with developing a chat strategy — from people and processes to costs and technologies.

Banks and credit unions have invested millions into their online platforms, and millions more convincing consumers to adopt them, so why not do everything possible to encourage adoptions and reinforce usage? With relatively simple and inexpensive live chat technology, financial institutions can restore that vital “personal touch” that gets lost in the online experience.

“Banks are starting to see the need to inject that human element,” George Tubin, a senior analyst at research firm Tower Group told the WSJ.

“From a bank marketing standpoint, having live online chat would be a pretty important way of proving your story if your bank brand is built around ‘superior customer service,’” wrote financial branding expert Jeff Stephens, head of Creative Brand Communications, on his company’s blog. “For any bank advertising itself as responsive and customer-centric, a feature like online chat seems almost indispensable.”

Banks and credit unions — particularly smaller ones — can also benefit by using live chat to position themselves as tech-savvy. This not only makes the financial institution more attractive to a hyper-digital Gen-Y audience, it fosters continued usage of the online channel.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Big Benefits & Meaningful Measurements

Online chat increases conversions of both existing customers and shopping prospects, resulting in more completed applications and new relationships. Live chat is particularly effective for high-value financial services — e.g., loan, investment and deposit products — where shoppers usually seek more advice. Citbank says 90% of its live chat users complete a home-equity application. Similarly, BofA attributed an 8-fold increase in online mortgages and a doubling in home equity volume partly to live chat. For National City, the conversion rate for visitors using chat shot up six fold, and American Airlines FCU saw new memberships increase 15%.

For customers, live chat can improve loyalty and satisfaction levels. National City’s online visitors applauded their chat experiences, helping the bank achieve 95% customer satisfaction ratings along with exit surveys including comments like this: “This was my first experience with live chat on the Internet. It was great! Honestly, I think it was much faster than calling the local National City.”

With live chat, financial institutions can achieve increased sales and retention rates while simultaneously decreasing the cost of customer interactions. Since more customers can be served by the same or fewer customer service staff, live chat can result in meaningful operational savings. For example, American Airlines FCU says it realized a 20% savings compared to standard 800 and international phone charges

Also, with nearly any live chat system, you can generate comprehensive reports that reveal trends, summarize agent performance and track conversion rates. Plus, chat transcripts can be retained and used for training and audit trail purposes.

Why Consumers Love Live, Online Chat

Consumers continue to express a preference for online channels in greater numbers. A ComScore study from 2008 found that 25% of financial consumers were interested in having the ability to chat online with a bank representative.

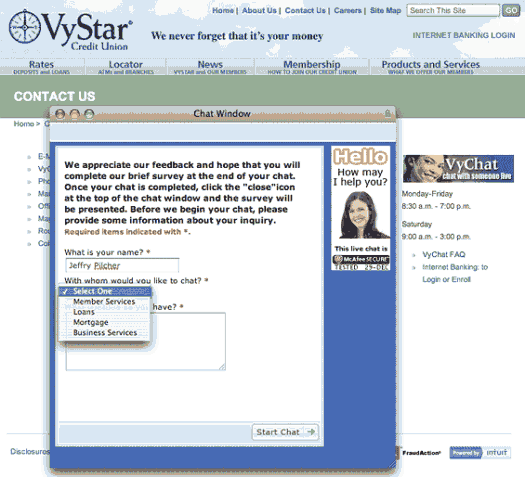

Why? For starters, it allows website visitors to stay in their channel of choice. They don’t have to go to a branch or pick up the phone. They are already at your website, so they don’t have to remember to do it later. This give people the feeling of convenience and immediacy. VyStar Credit Union said the organization’s average response time is under eight seconds. But even if someone has to wait a few minutes for their chat to initiate, there is still a sense of instant gratification.

Live online chat is particularly appealing to the “no-I-don’t-want-to-talk-to-you” crowd. These people feel like they can get answers more quickly and are spending less time than they would on-hold… or worse, calling your IVR system. These people often multi-task while engaged in online chats. For instance, someone could sit at home wearing their comfies ping-ponging between Seinfeld reruns and their Facebook page while waiting for a service rep to respond to their question. It sure beats driving to the branch to stand in a line.

Consumers also like the convenience of being able to review what their service rep said by simply scrolling their screen. At the end, they have a written transcript of the entire conversation, complete with addresses, phone numbers and hotlinks to specific web pages on your website by serving up the relevant page.

Powerful & Flexible Features

Hosted vs. Install – Third-party solutions that are widely available will quickly and easily integrate with most bank and credit union websites. For hosted solutions, you will probably only need to insert a small block of code into your web template(s). You can host the system yourself, but installation and set-up can be more complicated and time-consuming. Most hosted solutions charge month-to-month or annually, whereas systems you install yourself typically involve a one-time cost (plus the cost of future upgrade).

Consumers usually do not need to download any special software or plug-ins to use online chat. This can help reassure wary visitors that their computer is safe and not exposed to security breaches. Of all the live online chat services tested by The Financial Brand, only one — Kentucky Neighborhood Bank — required users to download a stand-alone application.

Using Smart Tech to Create “Rules” – Some “self-aware” systems analyze traffic patterns in real time to identify and target site visitors most likely to benefit from chat interactions. Sensing when visitors might need assistance, a permission-based pop-up invites consumers to chat with a live agent. For National City, almost 20% of visitors who were proactively offered the opportunity to chat accepted the invitation.

Providers of live chat solutions offer varying levels of control over the conditions — the “rules” — that trigger pop-up invitations. For instance, you could specify that whenever a site visitor clicks on more than five pages, a window might pop up saying “Having trouble finding something? Chat with a service representative online right now. [Click here.]” Or you could tell the system to look for site visitors engaged in mortgage shopping behaviors. If someone clicked on your site’s home loan page then checked out your loan rates, it might trigger a window saying “Would you like to chat with one of our mortgage experts online?”

Hours – While it is reasonable to limit the availability of online chat — most financial institutions seem to stick to traditional bankers’ hours, M-F/9-5 — customers will see more value in the service during those times when other contact options are typically unavailable (i.e., after hours and weekends).

Service Credit Union, with $1.7 billion in assets, maintains its LiveChat24 online chat feature 24/7 for its military members stationed around the world. Air Force FCU does the same thing. KeyPoint Credit Union’s chat service is available 24/7, but only to online banking customers.

Tip: Provide alternate contact options whenever the chat service is unavailable. Allow customers to email their question or message, and promise a response time. Give site visitors your branch locations and phone numbers, or at least direct them to your contact page.

When Summit Credit Union’s chat service is unavailable, users aren’t given a lot of information or options. “Your request is queued?” What does that mean? There should be an option to leave a message or send an email. At the very least, a link to Summit’s Contact page.

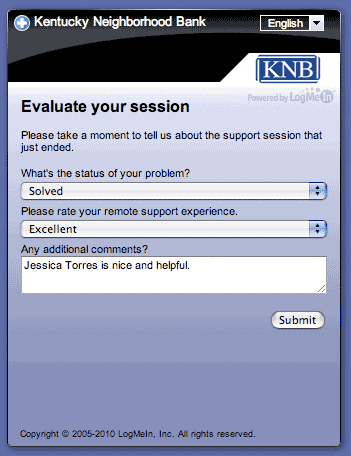

Exit Survey – When a user concludes their online chat, you can give them the option to review their experience. This helps you evaluate the success of individual service agents as well as the overall value of online chat.

Post-chat evaluation survey from Kentucky Neighborhood Bank.

Partial Rollout – Some financial institutions are extremely conservative with any new technology, in which case it might be better to test online chat with a limited pilot program. The availability of live chat can be restricted to specific areas of your website — say for instance, the online account opening process — but this isn’t ideal. If your institution chooses to embrace online chat, it should aim to address 100% of the exact same type of inquiries you would typically encounter through the call center.

You may, however, successfully limit live chat to online banking customers. Just be aware that if you do, you are essentially creating a pure tech-support platform and will be missing out on the additional sales and service opportunities created by a system that is more widely deployed.

Info Page & FAQ – Some site visitors who aren’t familiar with live online chat may have some questions before choosing to try the service. You can create a chat landing page with basic information and answers:

- What is live chat?

- Is it secure?

- Do I need an account number or password to use live chat?

- What services are available through live chat?

- What if there are no chat representatives available?

- What if I am accidentally disconnected?

Tip: Don’t forget to add live online chat as one of the options on your Contact page. If you create a special chat page, don’t forget to include it on your website’s sitemap.

What About Security?

Most of the questions posed via online chat are innocuous and require no sort of authentication at all. “What is your routing number?” “Is the rate on the 12-month CD also available on 6-month CDs?”

When customer need to discuss account details, online chat operators should use the same security precautions when working in a live chat session as they would if taking the call on a phone.

“Verify first and last name, ask for their account number, ask two challenge questions and follow whatever identification guidelines your bank or credit union follows,” advises Jason Sherrill of InetSolution, a provider of tech solutions like online chat for financial institutions. “And don’t forget, you’re using SSL to secure the chat conversation.”

Staffing

Banks use different strategies to staff their live-chat operations. Because the service is internet-based, chat operators can work from corporate headquarters, remote offices or even from home. Some smaller banks simply have call-center employees field electronic inquiries in addition to phone calls. SunTrust houses its “e-group” as a separate unit within the bank’s call center.

“If you have people answering the telephone to provide support, then you most likely have all the manpower you need to provide live chat,” observes InetSolution’s Sherrill. “It can actually require less manpower to provide customer support via live chat than on the telephone.”

“A single customer service representative can service one customer at a time on the phone,” Sherrill continues. “However, that same customer service rep can chat with two, three, four or even more customers simultaneously using live chat.”

“With our chat system, any number of operators can be signed-in and waiting for chat requests,” Sherrill explains. “Incoming chat requests can be directed to specific reps based on the nature of the inquiry, or the reps can accept chat requests on an as-available basis.”

“If a rep needs to step away for a break, to perform other duties or to go home for the day, he simply signs out,” explains Sherrill. “If all of the reps sign-out, then our system automatically hides the live chat button on the website. Alternatively, we can show a message to tell customers that live chat is unavailable at the moment.”

BofA says it staffs each section of its website with chat employees who have undergone the same sales training as specialists working in branches. “You’re not chatting with a customer-service rep, you’re chatting with a mortgage specialist,” says Sanjay Gupta, BofA’s consumer and small-business e-commerce executive.

VyStar Credit Union has chat users select a topic before initiating a chat. This allows the financial institution to (A) direct the user to a service agent trained in that specific area, and/or (B) bring up the relevant information on the service agent’s screen.

Providers of Live Online Chat Services

InetSolution’s subscription-based services range from $79.95 to $500 per month, depending on the number of operators, security and auditing options you require. For larger banks and credit unions who have their own data center and connectivity, solutions can range from $800 to $4,000 initially, with annual maintenance of usually 20% to 30% of the initial cost.

In addition to InetSolution, other providers of online chat services specifically for financial institutions include LivePerson.com and SightMax.

The Financial Brand tried using the online chat service at LivePerson’s website to answer some questions for this article, but two separate chat reps told The Financial Brand they were unable to help, even with the most basic, common questions. The Financial Brand was instructed to contact the company’s PR department… via phone or email. Ironically, the PR department’s voicemail box was full, and no reply was received via email, proving that technology isn’t the secret to excellent service, even when your company specializes in customer service technology.

At the end of the day, customer service is still ultimately about people.