In the past, organizations used campaign-driven marketing programs to encourage customer engagement and to generate sales. Many banks and credit unions continue to use this strategy, sometimes improving results through improved targeting.

Unfortunately, as communication channels and data sources increase, it becomes harder to assimilate data from across the organization and to deliver consistent omnichannel messages. More importantly, because the timing and targeting of communications are usually based on batch processing, messages to customers lack personalization and don’t reflect real-time events.

The result is that the development and deployment of marketing campaigns are usually too slow and costly, with decreasing engagement and sales. Most communication does not speak to the intended audience at the best possible time or with the preferred communication channel.

Today’s consumers have higher expectations and more choices. According to the 2019 State of the Connected Customer study published by Salesforce, 53% of customers now expect the offers they receive to always be personalized, and 62% expect companies to anticipate their needs. Companies are challenged to not only rethink individual experiences, but engagement during every stage of the customer journey.

Increased consumer expectations don’t end there. According to Salesforce, 83% of consumers say that the experience a company provides is as important as its products and services. This means that marketers must not only improve personalization at the time of sale, but provide a level of engagement that far exceeds what was required in the past throughout the customer lifecycle. In addition, Salesforce found that:

- 69% of consumers say one extraordinary experience raises expectations for other companies.

- Almost two-thirds (59%) of consumers will pay more for a great experience.

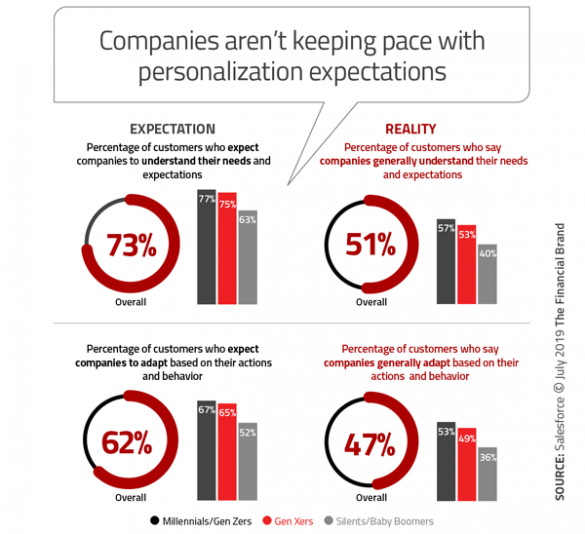

- Almost three-quarters (73%) of consumers expect companies to understand their needs and expectations.

- 62% of consumers expect companies to adapt to actions and behaviors.

- 71% of consumers expect communication in real time.

- 64% of consumers expect tailored engagement based on past interactions.

The good news is that consumers are still willing to share their personal data in exchange for a better experience. The research found that 61% percent of Millennials were willing to share their information if doing so resulted in an improved engagement. And 58% willing to share if they received better product recommendations.

Baby Boomers and older generations need more convincing (probably due to previous poor experiences). In these cases, Salesforce found that only 41% were willing to share data for personalized engagement.

Read More: The Psychology of Personalization In Banking

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Power of Personalization

People are becoming intolerant of being treated like a member of a segment or a persona. They know companies have access to massive amounts of data and expect this insight to be used to deliver a highly personalized experience in real time. This is especially true in financial services. Consumers want you to know them, look out for them and reward them.

Expectations for personalized engagement is not limited to consumers in high income or wealth classes, customers with long-term relationships or customers with digital engagement. Personalized engagement is expected by everybody. Unfortunately, the level of delivery of personalized engagement has not kept up with consumer expectations.

According to Salesforce, 73% of consumers expect companies to understand their needs and expectations. Interestingly, the expectations are lower for Baby Boomers (63%) than is it for Gen Xers (75%) and Millennials (77%).

While expectations are high, only slightly more than half of consumers say that companies meet their needs and expectations with even fewer saying that companies adapt to their actions and behaviors.

Power of Timely Engagement

While consumer expectations of personalization have increased, so has the desire for immediate response. Expectations for timeliness start when consumers begin their shopping process. Google and Amazon have raised the bar for the desire to find what people want with a minimal number of clicks. In fact, more than half of consumers (56%) expect to find what they need in three clicks or less.

Once a purchase is made, the expectations do not decrease. Seven in ten consumers say that connected processes, such as seamless hand-offs and contextualized engagement based on previous interactions, is important for winning business. Consumers are also 4.5X more likely to view real-time messaging as being important versus unimportant and are 4.8X more likely to desire self-service tools that can allow them to solve problems themselves.

Power of Channel Choice

Consumers don’t just expect to be able to engage on a highly personalized basis when they want, they also want engagement where they want. Multichannel engagement is a reality. And assumptions regarding age or income segments around preferred channels of engagement can be dangerous.

Not only do 40% of consumers say they won’t do business with a company if they can’t use their preferred channels, but Millennials actually use 50%+ more channels than Baby Boomer counterparts. This is despite the fact that they are significantly more likely to desire digital channels (even voice) than other segments.

To make matters more confusing, the preferred channel of every generation depends of the context of communication. More than three-quarters of consumers say they prefer different channels based on where they are and what they are doing, with only slightly fewer preferring different devices based on those two factors.

In other words, the customer journey is more complex than ever, fragmented across channels and devices. According to Salesforce, 71% have used multiple channels to start and complete a single process, with nearly two-thirds saying they have used multiple devices to start and complete a transaction. It is clear that promoting engagement is tougher than ever with nonlinear journeys.

Read More: 6 Insights To Get Your Digital Engagement Strategy Right

Importance of Connectivity

The consumer doesn’t give institutions a break just because their personal journey is often disjointed, across multiple channels and devices and in need of immediacy. The consumer wants what you know about them and what they have done in the past to be immediately available and deployable.

On other words, consumers want connected engagement.

“In customers’ minds, a service agent should know about a recently signed sales contract, or the details of a recent ecommerce transaction, and engage accordingly. In fact, 64% of customers expect tailored engagement based on past interactions.” In addition, 78% of consumers expect consistent interactions across departments and 72% expect all representatives to have the same (complete) information about them.

Privacy Imperative

Data and analytics is at the center of being able to increase engagement and improve customer experiences. The challenge is that a significant minority of consumers don’t want their personal information used for sales purposes and 51% of consumers believe companies do a bad job of protecting personal information.

Therefore, to succeed in building engagement and trust in an increasingly digital ecosystem, consumers must believe you will be transparent about the use of data, will protect their privacy, and provide value for the data that is used. In fact, 92% of consumers said that they would trust organizations more if they had control over the information collected and used.

Winning customers, improving engagement, building trust and generating revenue in a digital world is not easy. But the opportunity to differentiate your organization from a personalized perspective is at the foundation of future success in the financial services industry.

Read More: 94% of Banking Firms Can’t Deliver on ‘Personalization Promise’

Power of Personalization in Banking

The Power of Personalization in Banking 2018 report, sponsored by Pegasystems, provides insight into the progress financial institutions are making around personalization and contextual engagement. The report includes the results of a survey of more than 200 financial services organizations worldwide. The report includes 82 pages of analysis and 36 charts.

The Power of Personalization in Banking 2018 report, sponsored by Pegasystems, provides insight into the progress financial institutions are making around personalization and contextual engagement. The report includes the results of a survey of more than 200 financial services organizations worldwide. The report includes 82 pages of analysis and 36 charts.

Subscribers to The Digital Banking Report and those wishing to purchase the complete report can access it immediately by clicking here.