Consumers can get unsecured loans much easier these days than they could in the past. No longer do they need to go — hat in hand — to their local banker and beg for money. The online marketplace gives consumers the power to research options, pit one lender against another, and learn directly from other borrowers about their experiences. The digital landscape has opened up options for consumers while allowing savvy lenders to engage with them at multiple stages in the buying process.

To improve conversion rates for unsecured loans, financial institutions need to plug into the customer journey. It’s about being in the right place at the right time and saying the right things to help the right prospective customers move through the process.

Consumers’ Needs Dictate Their Behavior

It’s important to first understand the nature of consumers’ needs, and the different types of consumers in the market for a loan. The need for an unsecured loan comes in two basic flavors. The first is the “planned need,” such as a home improvement or the consolidation of debt. This person has typically given some thought to the loan, and considered the process and approach they will take. The second type of need is the “unplanned need.” Things like unexpected medical expenses or car repairs can force consumers to look at a wide range of options to access quick cash.

The need behind the loan is important because it typically determines the criteria consumers will use when choosing a lender. In the case where the loan was anticipated, the customer can be more thoughtful, patient, and thorough in their process. They can require that a lender meet all or most of their criteria before taking out the loan. When a borrower needs emergency cash, they can’t afford to be as selective, so they usually opt for the lender who can most quickly provide the funds needed.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Types of Borrowers

In the simplest sense, there are two types of borrowers — high credit quality and low credit quality — and these two different types generally approach the borrowing process very differently.

High credit quality. These borrowers have more options and are not concerned with being approved for the loan. They are typically more financially sophisticated, and focus on the economic terms of a loan — rate, term, etc. — and expect the loan process to be straightforward, streamlined and easy.

Lower credit quality. These borrowers are most concerned with getting approved. This borrower focus on loan amount, size of payment and how quickly they will be able to access funds. Oftentimes, the lower quality borrower has an unplanned or emergency need.

4 Ways to Classify Borrowers Based on Need

Armed with an understanding of borrower need and a sense of credit standing, lenders can refine their approach to improve the chances for success. Here are four ways to glean insights into the need and nature of the customer:

1. Financial-based search terms. Terms such as “low rates” or “low payments,” can give lenders clues about what a borrower is looking for. You can leverage search data from your website as well as Google (e.g., a paid search campaign).

2. Needs-based search terms. Potential borrowers provide insight into their needs based on search terms like, “car repair,” “home improvement,” or “medical expenses.” By looking at these indicators, lenders can work backwards — how the customer will use the loan.

3. Online browsing behavior. A prospect’s online history can provide valuable insight into what borrowers are seeking. Using web analytics and tracking tools, you can see what pages a visitor on your website views before deciding to proceed with an unsecured loan. Monitoring activity at this level can yield insights into the customer journey, and help financial marketers refine their targeting.

4. Social media. Oftentimes people seek the advice of their online community to help them solve their problems.

Understanding the Customer Journey

The final piece of this puzzle is understanding the customer journey and how potential borrowers navigate through it. In its most basic form, the customer journey typically follows this path:

- Need – The consumer realizes they need a loan.

- Awareness – The potential borrower identifies you as a possible lender.

- Consideration – The borrower evaluates your suitability for the situation.

- Selection – The borrower chooses you for the loan.

- Conversion – The borrower obtains the loan through you.

It’s important to understand that not all customers navigate the journey the same way, nor at the same pace. Some, who have no idea what their options are, will go through the process from start to finish. Others with past experience will have a pre-determined set of lenders and will begin in the middle. The most savvy and confident customers usually have a specific decision criteria (interest rate, brand reputation, etc.); they know exactly what they want and with whom they would prefer to do business.

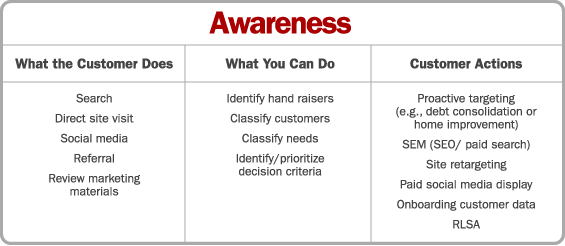

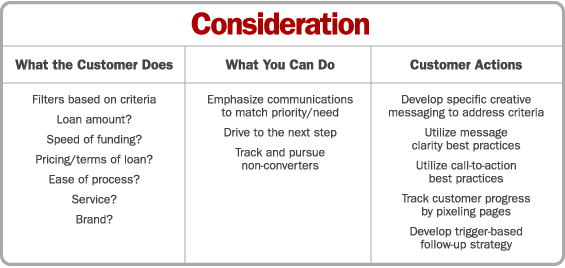

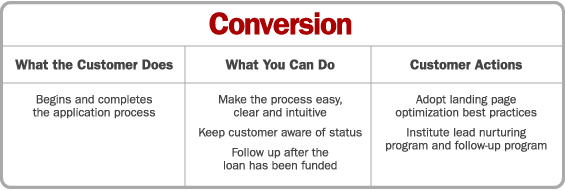

For lenders, the key to success is understanding the varied journeys, participating in the relevant steps to the greatest extent possible, and communicating the right message. The chart below provides guidance for lenders.

Today’s marketing ecosphere is offering lenders unprecedented opportunity to connect with potential customers. However, it is ultimately the customer’s decision on who they’d like to do business with. They have unlimited access to valuable information such as satisfaction reviews, pricing information, and geographic reach. The winners in this space will be those lenders who understand the borrower, his or her needs, and can communicate the ability to meet those needs on the borrower’s terms.