Financial institutions were already undergoing tremendous changes due to market and competitive factors prior to the pandemic. Then drastic shifts in consumer behaviors during the crisis led many banks and credit unions to radically alter their customer experiences simply to deal with the extraordinary circumstances.

Beyond expediency the situation caused many financial institutions to explore new opportunities, pivoting from short-term solutions to embrace lessons about how their customers are served and what they want. A new report by Microsoft Dynamics 365 explores how the customer experience in financial services has changed in the past year and what the future of CX looks like for the industry.

The New Look of CX in Financial Services

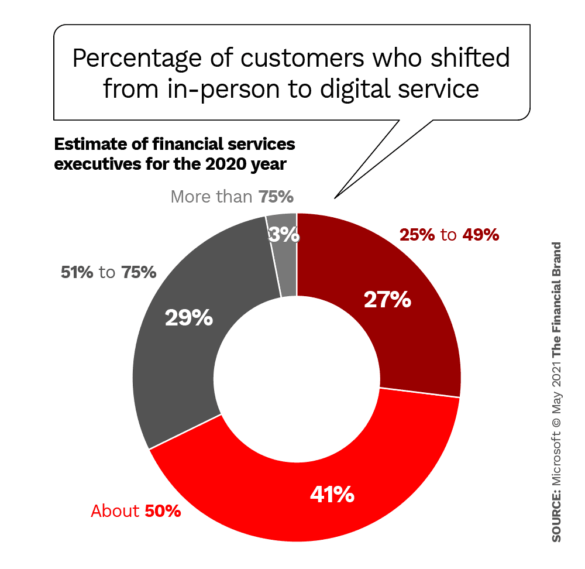

The most significant CX trend is the shift to digital. Nearly three-quarters of the financial services executives surveyed by Microsoft — from banking, insurance and capital markets — say at least half of their customers’ financial activities switched from in-person to digital services. Even seniors, who previously had low adoption rates, made the leap to digital banking because they had no other choice.

Keeping up with this pivotal shift is vital. Marketing and customer experience guru Jay Baer says that financial institutions are already losing business to firms that understand the permanent changes in consumer behavior since the pandemic. “Anything that requires an extra bit of time, thinking or effort to overcome, customers have very little patience for nowadays,” says Baer.

Fractional Marketing for Financial Brands

Services that scale with you.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

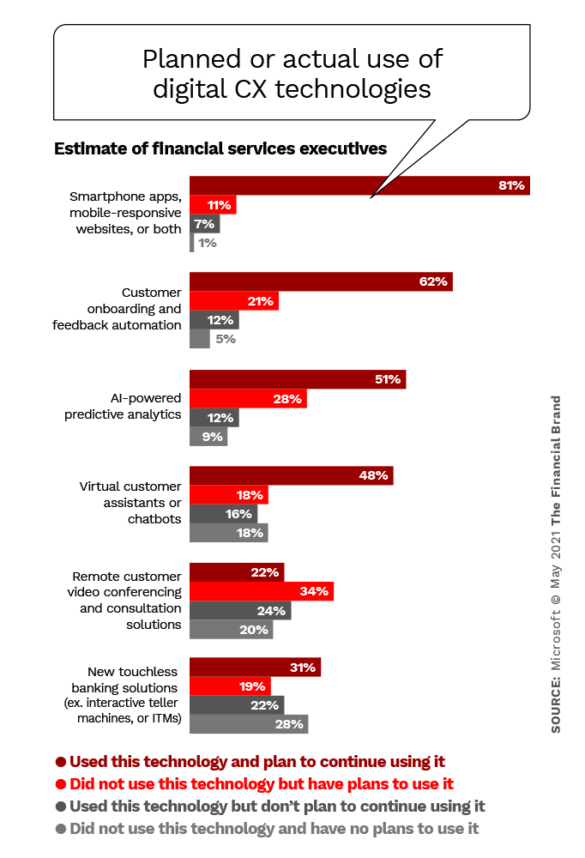

Sensing the permanency of some changes, and the benefits to operational efficiency, most financial institutions plan to continue using new CX technologies they unveiled during the pandemic. This included mobile websites and smartphone apps (81%), customer onboarding and feedback automation (62%) and AI-powered predictive analytics (51%), according to the survey. Others also plan to continue the use of virtual customer assistants that they adopted during the pandemic.

“These results suggest that most financial organizations are working to deploy these technologies as part of their CX strategies, even if they didn’t do so during the pandemic,” the report states. “It also suggests that the pandemic may have been a catalyst for CX programs that were already in the works.”

There are several CX developments banks and credit unions can’t ignore in 2021.

For one, “physical” and “digital” can no longer be viewed as two different things. For another, the line between customer experience and employee experience is blurring. Also, demand for contactless payments is driving more use of mobile payments. In addition, video-enabled interactive teller machines (ITMs) are helping optimize branch networks, especially those with drive-through facilities.

For many, however, the pandemic’s acceleration of digital banking exposed trouble spots. While consumer satisfaction at banks and credit unions generally increased during the pandemic, some digital-only consumers, particularly among Gen Z, said mobile channels were lacking, according to the latest Retail Banking Satisfaction Study from J.D. Power.

Many financial institutions expect consumers to return to some level of in-person financial activity when the pandemic subsides, and there is at least some anecdotal evidence to support this. Still, there’s growing recognition that digital must be an option in every consumer interaction. Financial institutions recognize the importance of building valuable and intuitive digital experiences ahead of time, so they can be flexible when challenges arise, according to the report.

Read More: 6 CX Developments Banks & Credit Unions Can’t Ignore

New CX Initiatives in Real-time Personalization

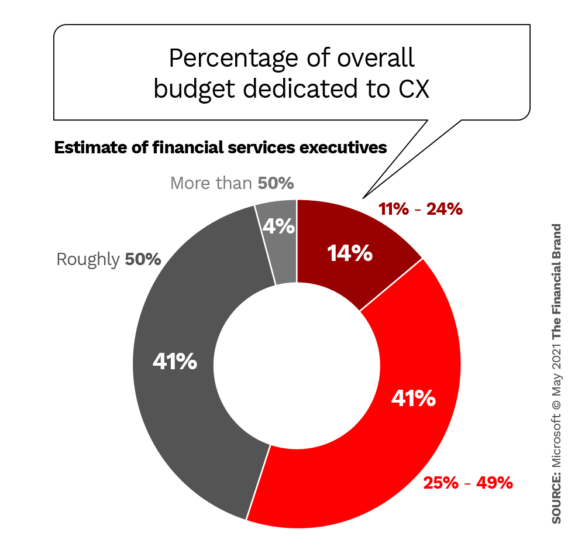

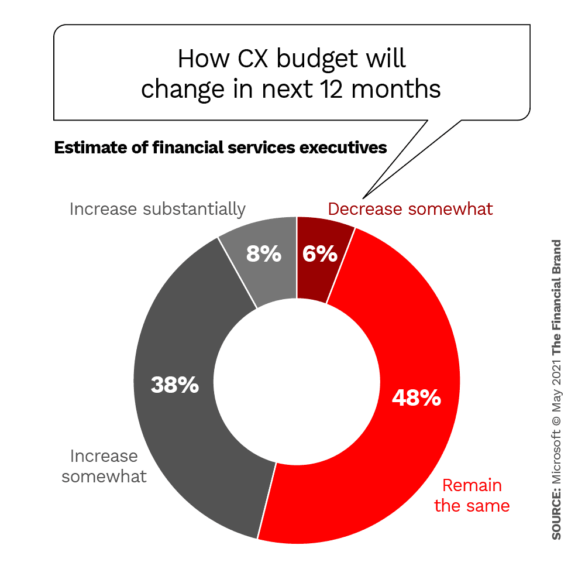

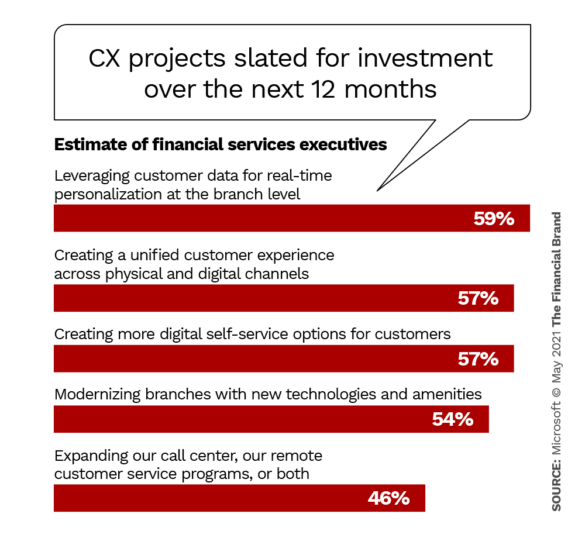

The Microsoft report found financial organizations are maintaining their CX budgets and prioritizing a wide range of initiatives.

While most organizations still place customer experience as a high priority, half of the respondents say their CX budgets will remain the same over the next year. Of those who are increasing their CX budgets, nearly two-thirds (60%) are working to leverage customer data for real-time personalization at the branch level.

“This reflects a strategy of merging some of the best aspects of digital financial activity with the in-branch experience,” the report states.

Powerful Combo:

By empowering associates and intelligent machines with real-time customer data, in-store financial activities can become just as personalized as online experiences.

“The future of CX will depend on how much a company can simplify finances for their customer,” says the head of a bank marketing department quoted in the report. “With this, the next big thing will be personalization, which will act as a major differentiator.”

In addition, half of the respondents plan to create a unified customer experience across physical and digital channels. A majority of those who are increasing their CX budget also say they plan to offer more digital self-service options and modernize their branches with new amenities and technologies.

Read More: Data Reveals a Surprise Driver of CX Satisfaction in Banking

A Growing Demand for Self-Service

Although some financial institutions are creating a more consistent customer experience across channels, many still struggle with providing self-service banking effectively. Technology has offered some solutions, but organizations have reached different maturity levels in their deployments.

Bijon Metha, Global Head of Financial Services at Twilio, observed in an earlier article that while the pandemic further increased demand for self-service, only one in ten issues reach a final resolution without the consumer having to resort to a live agent.

More than 60% of respondents in the Microsoft survey say they are challenged to provide enough self-service options for customers. Nearly half say they are challenged with creating a unified experience across channels, developing relationships through personalization or building trust and transparency in using data.

Financial services executives also note that consumers are no longer as interested in the friendly, person-to-person customer service that dominated the past. Instead, they want the ability to perform financial tasks quickly, efficiently and on their own terms.

“Customers are expecting a minimal touch, mobile-screen solution for their financial needs,” one institution’s IT director states in the report. “If a brand cannot offer this, they could lose to their competition instantly,”

What It Takes:

Self-service will likely remain a key driver of banking CX. However, when human interaction is needed, customers expect it to be fast and efficient.

“Customers no longer tolerate waiting in long lines to speak to an associate,” the report states, “when they can take care of their financial business on their own, either through a self-service device in the branch or via their smartphone at home.”