At a time when consumers are doing more and more on digital platforms, they also have an increasing desire for human-like conversations that can resolve issues, provide advice, help them navigate increasingly complex platforms, and make life simpler. No longer are simple chatbots the desired resolution. Consumers want contextual engagement that reflects their situation at a specific point in time and allows them to make the choice between machine or human engagement.

Conversational banking is an extension of the chatbots that were originally used to respond to the most basic of inquiries. As data availability, analytic capability and digital technology improve, a more enhanced form of digital engagement will become both personalized and scalable. The objective is to improve the overall customer experience, increase engagement, provide insights into areas where consumers need more advice or assistance, and generate sales and revenues by delivering timely solutions.

What is Conversational AI?

The best marketing in the world connects with consumers by asking relevant questions and building engagement at the times of most need. Conversational AI helps facilitate conversations during the customer journey by allowing software to understand and interact with consumers naturally, using spoken or written language. Businesses can use conversational AI to automate customer-facing conversations on every platform — from a company website, to an app, via social media channels like Facebook and Twitter, or even on voice assistants like Alexa or Siri. With today’s technology, these conversations can occur almost anywhere, from in your home, to in your car, to on the street.

The original use of conversational AI was to reduce the cost of simple interactions in banking (like balance inquiries or bill payments), but the application of this technology has quickly expanded to much more complex engagements that may move conversations from automated text to human interactions. The newest wave of bots even have distinct personalities or names. As conversational bots get smarter, the tasks they’re handling continues to grow in complexity in conjunction with technology and data quality advances.

Read More:

- Secret To Digital Banking Success is AI With “Human-Like” Feel

- Banking Providers Must Leverage AI and Machine Learning (But Aren’t)

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Should Financial Institutions Consider Conversational AI?

Two of the primary benefits of conversational AI is that it’s simple and it’s timely. As opposed to requiring a consumer to navigate multiple pages of a website or mobile banking application to get to where they want to go, conversational AI allows the consumer to use simple human language commands to reach their preferred location, destination or solution.

The numbers speak for themselves. Gartner research indicates that 40% of mobile interactions will be managed by smart agents by 2020. As more businesses in every industry implement some form of chatbot communication option, consumers come to expect this form of engagement. In fact, 30% of consumers expect to see a live chat option on your website. Three out of 10 consumers would give up phone calls to use messaging. As more and more consumers begin expecting your company to have a direct way to contact you, it is important to have an easy option available.

According to IBM, “Good bot services encourage users to engage more deeply with software features that might otherwise go unnoticed, because they provide a richer, more natural experience. Customers can now simply ask a bot to take them where they want to go, or to enable a feature without having to hunt it down.”

Chatbots and conversational AI also allow for engagement … in real time, 24/7. In today’s on-the-go, multitasking lifestyle, consumers gravitate to those applications that can provide contextual answers to their questions. According to the Harvard Business Review, answering queries within an hour translates into seven times increase in the likelihood of converting a lead. If a consumer has a problem, the quicker that problem can be resolved, the happier the consumer will be.

A well-designed conversational AI platform also frees up customer support personnel to respond to more complex problems that are best resolved through human interaction. Conversational AI can handle a large volume of interactions without requiring any increase in team size. This is obviously helpful as changes are made to products, delivery channels or regulations that may result in a spike of customer inquiries.

Beginning the Process of Building a Conversational User Interface

Most financial institutions should start with a basic chatbot solution before moving to a more complex engagement approach that will blend both humans and bots on a real-time basis. The delivery of a well-designed chatbot experience for basic inquires still requires human involvement. Humans need to monitor the types of inquiries customers have and “train” the chatbot. Over time, the vast number of simple, most frequently asked questions can be determined, with valid responses developed. Variations on questions and responses can then expand the engagement platform as needed.

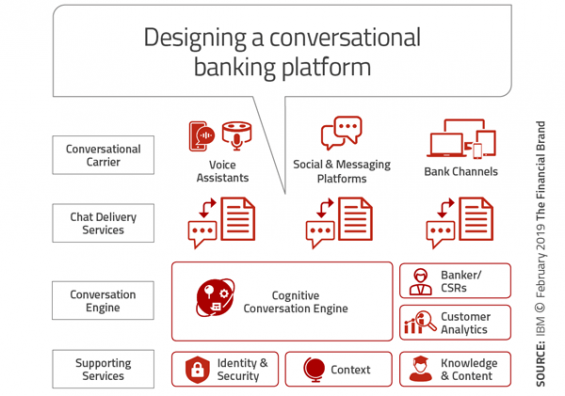

After the basic applications of a chatbot are delivered successfully to customers or members, a more robust conversational banking platform can be developed. This platform will be delivered across channels, using alternative delivery and conversation engines, ensuring security and privacy are maintained. The beauty of a strong conversational banking platform is that the consumer can get the information they seek in real-time, delivered as they prefer. This may be by in-app text, through a voice assistant, by video screen or by phone. Interestingly, most consumers will not opt for a phone or video interface … personalized text is often the preferred communication option.

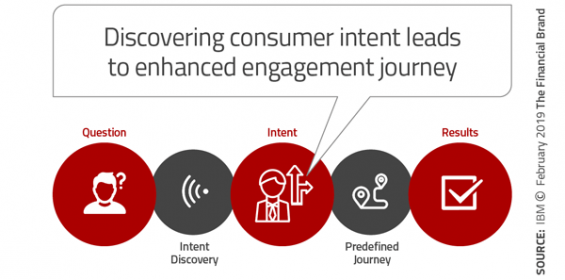

The key to successful development and delivery of a conversational banking solution is to understand the intent of the consumer, where the inquiry resides within the overall customer journey, and the correct response to the inquiry. Ultimately, conversational banking solutions will move beyond developing answers to questions and be able to build engagement that starts with the bank or credit union based on contextual insights. These proactive advisory recommendations will be the most powerful moving forward.

Despite the potential power of conversational banking, bots and conversational user interfaces won’t replace traditional online and mobile apps – at least not yet. Banks and credit unions must determine how this additional communication platform will coexist in a multichannel delivery solution. Remember that each consumer will want a journey that is different in some way to other consumers. The key is to provide engagement options that the consumer wants.

The Future of Conversational AI

Most financial institutions remain well short of providing a multichannel conversational banking solution with an integrated human-machine interface. However, with the advancements in data collection, analytics and AI development and digital technology deployment, we are quickly moving towards solutions that used to be seen only in science fiction movies. Those organizations that can move forward quickly will have a distinct competitive advantage as consumers become even more demanding of digital solution providers in every industry.

The future of conversational banking will quickly see improvements in the following areas:

- Smarter Interactions. Beyond delivering answers to simple inquiries, conversational AI will begin to support move complex questions and a broader range of nuances that include tone, consumer personality, previous engagements, stage of customer journey, etc. The result will be highly personalized conversations that are not highly mechanical in tonality.

- Consistent Engagements. Similar to the challenges most banks and credit unions have today with the hand-off of insights across channels, most conversational banking solutions today do not build over time, but run as if they were separate interactions. In the future, all insights collected will be retained and made part of the ongoing conversation and future deliver of solutions. In other words, rather than having the frustration of repeating what has happened in the past, the consumer will receive personalized engagement that recognizes the conversation flow of the past.

- Expanded Solutions. As the power of AI is applied to conversational banking, the array of responses to inquiries will become infinite based on every customer’s needs. Beyond expanded answers, there will be an expanded number of interaction channel flows from machine, to voice, to human, etc. with consumer defining the journey. With open banking solutions, the communication may even be handed off to external providers who are better equipped to respond to specific inquiries.

- Proactive Conversations. Finally, and potentially most exciting, conversational banking will eventually become a proactive platform that will provide advice based on real-time observations. This can range from telling a customer that their account balance may not be sufficient for a desired purchase to delivering offers that reflect a consumer’s previous activity. This will be similar to moving from a question-and-answer platform to a personal financial concierge who will look after each consumer’s financial position 27/7/365.

As consumers move towards organizations that provide the best customer experience, organizations that do not provide the latest in simple, smart and contextual engagement will fall behind – not only from a customer satisfaction perspective, but also with regard to revenues since sales and loyalty opportunities will be missed. Organizations that create excellent conversational banking solutions will enjoy the rewards of the most engaged and loyal consumers available.