Banks and credit unions scramble to forge personal relationships with consumers as more and more interactions migrate to online and self-service channels. Consumers are receptive to virtual channels, and say they are willing to provide more personal info if it will help improve service.

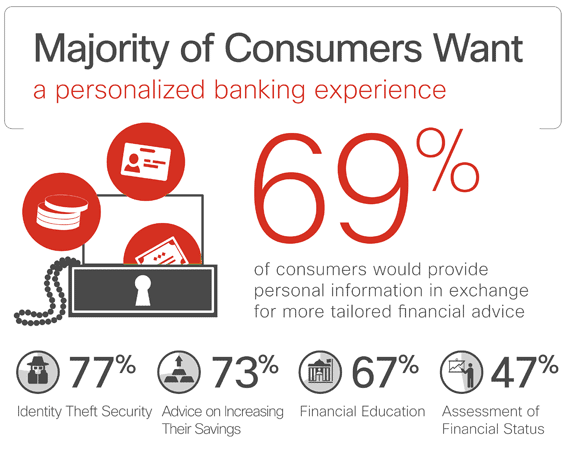

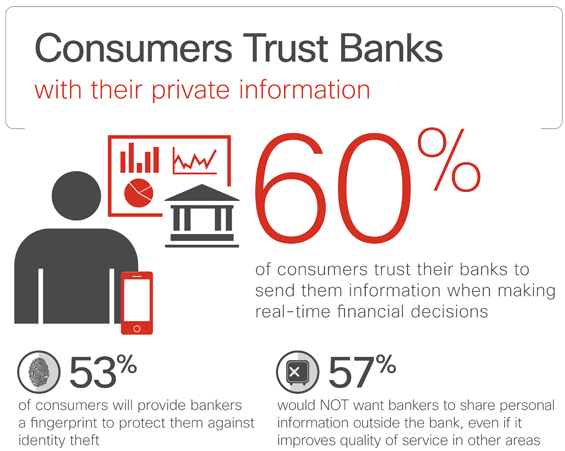

Financial consumers say they are willing to forego traditional channels and surrender more personal details if it will enhance virtual interactions with their bank or credit union. According to a study from Cisco, 60% of U.S. consumers would provide more personal information to their financial provider. There’s only one hitch… it has to make their lives easier. The overwhelming majority of U.S. consumers (69%) said they crave a more simplified banking experience.

This is critically important for financial institutions to keep in mind as they transition consumers from face-to-face interactions to online and self-service channels. New technologies may yield a lower cost structure to financial providers, but at what cost? Consumers clearly don’t want new solutions that make their lives more complex, nor do they necessarily want an increase in technology to come at the expense of personal service.

The global report from Cisco, conducted in early 2013, surveyed 1,514 consumers and 405 bank professionals. The report studied the views of how and when consumers want to engage with their banks across multiple channels for activities ranging from account monitoring to acquiring financial advice.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

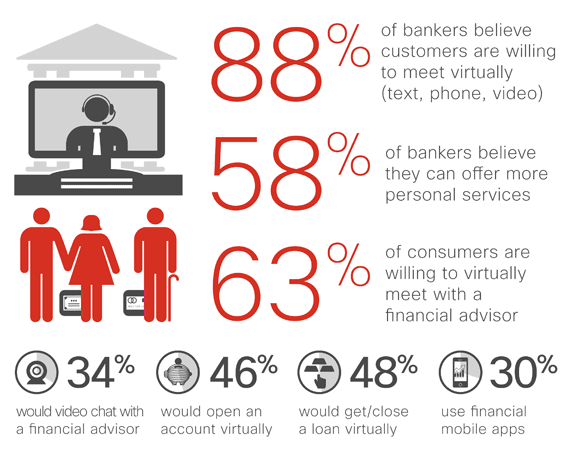

Consumers Open to Cyber Relationships

Globally 7 in 10 consumers and 92% of bankers are comfortable communicating with one another using virtual technology (such as texting, email or video), although that number drops to only 63% of consumers in the U.S. Screen size is important though. Only 21% of U.S. consumers would favor a smartphone for video conversations with bankers, with most (79%) preferring laptop or desktop computer.

Consumers think that even mortgages and loans could be managed virtually. Almost half of consumers in U.S. (48%) would be comfortable entirely securing a loan or mortgage using technology like video to communicate with their bank.

46% of U.S. consumers would open an account with a bank that is completely virtual if it offered the best and more secure services, but a physical presence is still important to the remaining 54%.

Let’s Get Up Close and Personal

Only 46% of U.S. consumers feel their bank has enough information to offer them personal services, while 58% of U.S. bankers believe they have enough personal information on their customers.

Consumers indicated a willingness to exchange more details about their financial habits and having banks be more active advisors.

Interestingly, bank managers thought consumers’ desire for these services would be roughly 20% higher than they really were.

What kind of private information are consumers willing to share with financial institutions in exchange for a more personalized experience? 53% of U.S. consumers said they would provide their bank with a fingerprint or other biometrics to verify financial transactions to protect against risks such as identity theft. However, banks and credit unions would be expected to keep personal information “in the vault,” so to speak. 57% of U.S. consumers would not want their bank to share their personal information outside the bank, even if it improves quality of service in other areas.

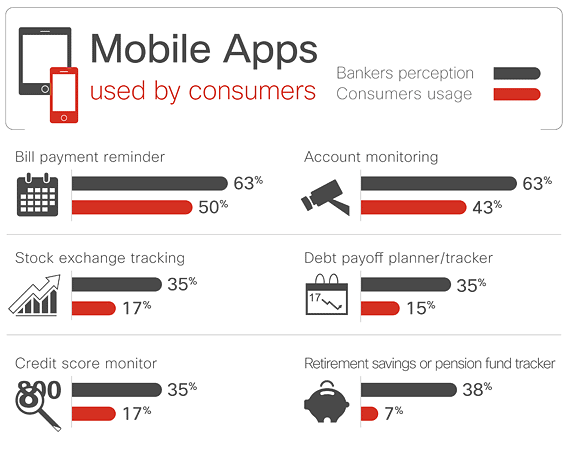

Bankers Think Mobile Banking is Farther Along Than it Really Is

“The battle for the financial consumer has begun,” observes Jorgen Ericsson, VP/Global Financial Services Practice, Cisco Internet Business Solutions Group. “Retail banks that succeed in providing a seamless customer experience across all channels to market — branch, mobile, online, contact center — will be the winners of the future.”