Using digital services has become second-nature in daily life — especially when it comes to buying and paying for things. And in recent years, especially 2020, we’ve witnessed digital processes become a standard part of how we manage our finances.

Even in 2019, 84% of retail bank customers said they’d had at least one digital interaction with their bank within three months. Now, that number is even higher amid the COVID-19 pandemic, which has catalyzed digital banking adoption due to people not being able to, or wanting to, visit branches and heightened fears over handling cash.

As digital banking continues to gain momentum, banks and credit unions are realizing the importance of user experience (UX). With a broader range of consumer segments embracing digital banking, and a much wider range of functions being used, features need to be optimized to include varying degrees of technical literacy and trust.

With that in mind, here are some of the current best and worst practices in digital banking UX that we have seen.

Examples of Best UX Practices

1. Build a personalized “news feed”

A digital banking experience should be simple, intuitive and frictionless — enabling consumers to not only see the bigger picture but also have all key information readily available. One of the most effective ways to provide such an overview is with a “news feed” on the institution’s home page. A news feed gives users quick access to important information like their account details, bank balance and a snippet of recent transactions; plus it lets them select customized widgets that display information around things like real-time exchange rates, finance news, and inbox messages.

This level of personalization helps build trust, retain customers, and improve app efficiency. For instance, Starling Bank gives customers the option to display personal finance statistics about their spending so they have greater transparency and feel in control of their finances. By encouraging users to tailor their digital experience, Starling Bank reassures them that their priorities matter.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

2. Design apps to work on multiple platforms and devices

Another best practice is to design UX from an omnichannel perspective. The average person owns more than three connected devices, so banks and credit unions can’t assume that they always access digital banking services from the same place. Financial institutions have to be interoperable and work with a number of devices and platforms to make UX seamless.

They even have to accommodate outside third-party applications. Brazilian bank Itaú Unibanco, for instance, has developed a specialized banking keyboard that can be used within WhatsApp or Facebook Messenger and lets users securely send transfers while texting. During the first month of the keyboard’s launch, $20 million was transferred via this functionality.

3. Be creative with your design approach

People establish a mental map in their mind when interacting with any digital service, which is what they refer to when they need to answer a question or find information. This visualization is why modern banking apps are moving away from the typical somber graphics and colors and are opting for a colorful, minimalist, even playful aesthetic.

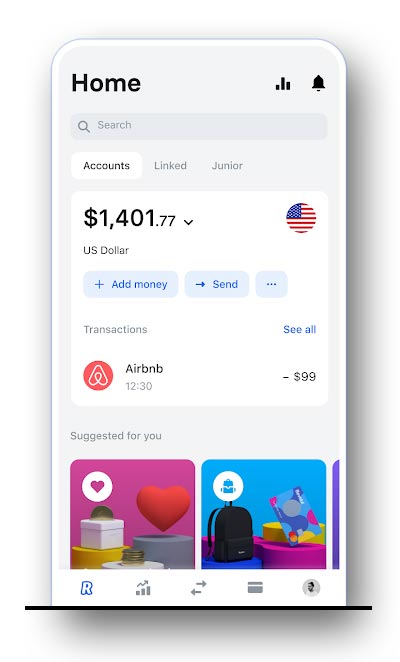

Revolut is a prime example. The fast-growing challenger bank sticks to shades of pink, blue, and black that it uses to differentiate currencies, accounts, and options. These colors contrast well with the abundant white spaces in Revolut’s interface, which make navigation clean and paves a shorter learning curve for users.

Read More:

- Digital Account Opening: Hot Trend, But Kinks Hinder Speed

- 5 Digital-First Strategies That Can Turn Banks Into UX Disruptors

- Why Designing Digital Banking Strategies Only for Gen Z is a Big Mistake

- 16 Must-Have Mobile Banking Features that Raise the CX Bar

Examples of Worst UX Practices

1. Lack of real-time data hurts confidence

The role of UX in digital banking is to make the experience less scary for the users by demonstrating that the bank understands their needs and worries, and that it can deliver a consistent experience both offline and online.

Not updating transaction information in real-time can prompt users to panic that there are flaws in digital banking. If they check their account after a payment and the amount has not been removed, they may be concerned that there’s no connection between the physical transaction and the digital record. Likewise, not providing sufficient information around successful transactions may cause users to doubt if they made the transaction at all, and fear that there is fraudulent activity on their account.

In addition, banks and credit unions that fail to acknowledge the often daunting processes consumers face with banking (particularly people new to digital banking) or institutions that don’t simplify overly-complicated steps quickly lose user engagement. Complex and hard-to-understand features have been shown to negatively impact customer satisfaction.

2. Failure to integrate physical and digital channels

Neglecting physical channels when designing UX is a mistake too, as the customer experience is still heavily determined by this mode of banking. Not providing a phone number, address, opening times, waiting times and available services separates digital banking from the traditional banking that some consumers are accustomed to, and can therefore make the experience intimidating.

At the same time, because banking is so highly regulated, digital systems require more inputs from users (approving terms and conditions, biometric set-up) in order to protect their data. This input can feel foreign compared to in-person processes, and so banks have to take care to integrate digital security requests in a seamless manner.

3. Avoid becoming a content swamp

Be wary of overwhelming users with content. As mentioned, the best UX is intuitive — it enables users to find solutions by themselves, quickly. Banks and credit unions that display too many hints and tips actually have the reverse of the desired effect because they don’t allow users to come to grips with the features in their own way.

To facilitate consumers’ understanding, financial institutions should use cards (design elements similar to physical business cards) and small segments to present digestible information that best fits small mobile screens. Chase is a prime example of good content presentation, as its homepage has a series of cards that state the name and balance of each account. To get more statements and further details, users are prompted to tap the card and view more. There’s no pop-up telling users to click the card, the steps are implied and empower users rather than hand-holding them.

As with any user experience, digital banking UX has to be based on feedback testing sessions with representative, targeted user groups. These sessions need to focus on things like how easy a product is to find, how long it takes a consumer to complete a transaction and should include quantitative and qualitative scoring of processes. This feedback ensures that the consumer is always placed front-and-center as digital banking continues to evolve.