Most financial institutions are focusing on digital banking transformation, responding to the impact of the pandemic when consumers and businesses had to move virtually all daily activities to digital channels. Unfortunately, providing digital accessibility is only the first step. Consumers want experiences that include fast, easy and personalized digital engagements.

In fact, this level of digital experience is becoming one of the key differentiators for brands in every industry … including banking. To succeed in the future, financial institutions will need to enhance personalized client experiences across all channels, throughout the customer journey. The five reasons for improving personalized experiences are both straightforward yet challenging to implement.

- Improve customer acquisition. Many financial institutions think a great customer experience begins after the first account is opened. In reality, the customer experience begins before any account is opened, as the consumer is shopping for a new financial institution. How easy it is to initiate a relationship often determines if an account is ever opened.

- Increase value of sales. According to the Harvard Business Review, “Customers who had the best experiences spend 140% more compared to those who had the poorest past experience.” This improves both the lifetime value and the customer return on investment (ROI).

- Enhance “halo effect.” When customers are satisfied, they not only buy more, but they also share their experiences with other family members, friends and followers on social media. This can positively impact sales both directly and indirectly. It is important to note that unfavorable experiences are also shared – sometimes with a greater negative impact.

- Higher loyalty and retention. Positive personalized experiences that boost customer satisfaction lead to greater engagement, loyalty and retention of relationships.

- Lower cost of servicing. The better the experience, the less likely the customer will need support from branches, call centers or other forms of engagement that drive costs higher.

So, the question becomes, how does a financial institution improve the process of acquiring, engaging, and retaining customers on a personalized level?

Read More: The Future of Customer Experience in Banking is Personalized

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Paradox of Personalization vs. Privacy

The balance of privacy and the desire for increased personalization creates an interesting paradox. As the use of data collection options becomes more limited, and as customers are increasingly aware of what can – and should not – be done with personalized messaging, the opportunities and challenges surrounding personalization have never been greater.

Balancing Act:

Marketers need to consider what consumers consider creepy, as 63% of respondents say they would stop purchasing products and services from companies that take personalized marketing too far. – SmarterHQ

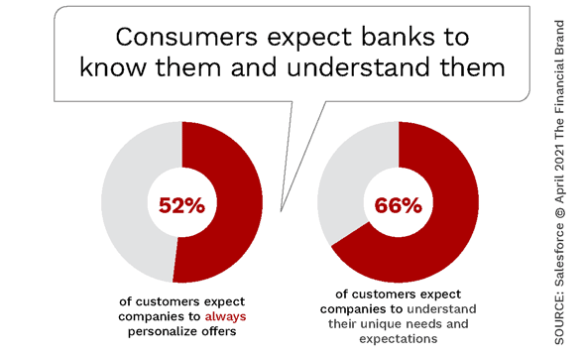

Financial institutions want to stand out in an increasingly competitive marketplace, while consumers want banks and credit unions that know them, understand them, and reward them with recommendations they value. This includes personalized offers reflecting a customer’s unique needs and expectations, according to Salesforce.

To succeed with this balancing act, Gartner recommends that marketers focus on the first-party data they collect directly from their customers. More importantly, consumers must receive customized value in return. According to Evan Bakker, research principal in the Gartner Marketing practice, “Marketers must obsess less over personalizing across the widest range of data sets, and instead leverage their immediately available first-party data sources. This will allow marketers to improve the customer experience across sites, apps and email in order to capitalize on an expanding digital audience.”

Consumers are Willing to Share Personal Information

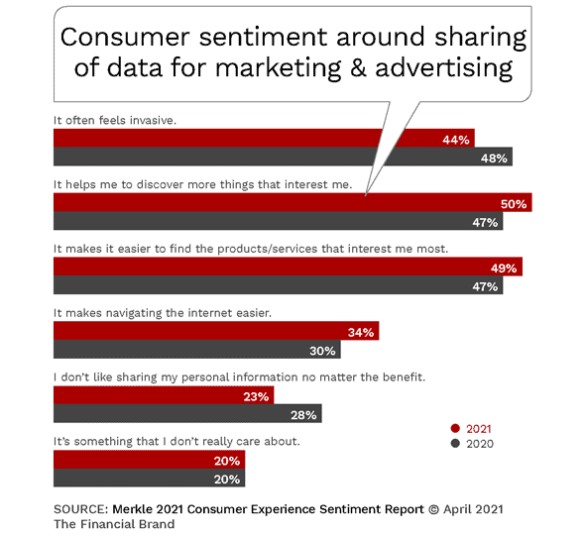

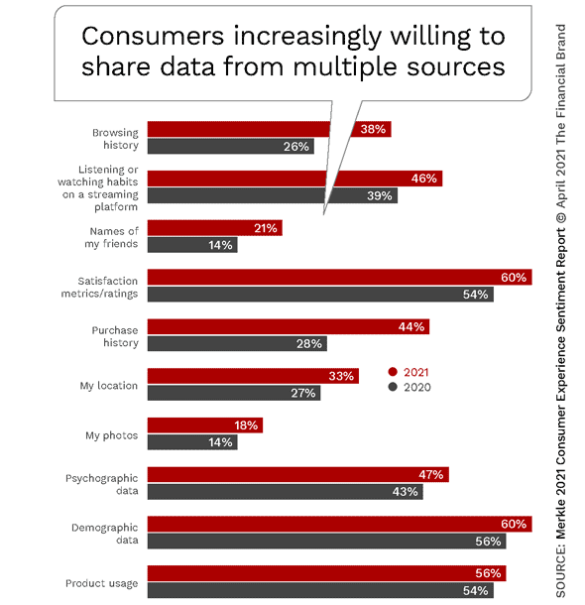

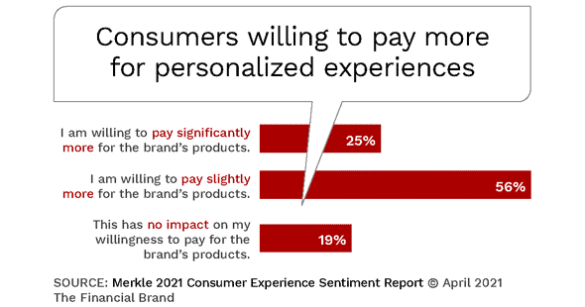

According Merkle’s second annual 2021 Customer Experience Sentiment Report, while roughly half of consumers feel brands know too much about them already, they are still willing to give their information in return for more personalized experiences. In fact, the percentage of respondents who are uncomfortable sharing personal information, regardless of the benefits, decreased from 28% in 2020 to 23% in 2021.

Marketing Tip:

Consumers are more willing to share data if the brand is transparent about how it will be used and if there is an exchange of value for its use.

In addition, 76% of consumers said they would take a brief survey upon visiting a website for the first time in order to have a more personalized experience in 2021, compared to 71% in 2020. Respondents even said they were more comfortable giving out their behavioral data to allow brands to enhance their experiences. “As we begin to approach a post-pandemic world, brands that are able to personalize experiences, while still striking the balance of respecting consumer wants and needs, will be the ones who succeed,” said Jennifer Wolf, director of experience strategy at Merkle.

Read More: Beyond Personalization: Three Reasons to Focus on Customer Journeys

The Connection Between Empathy, Loyalty and Revenue

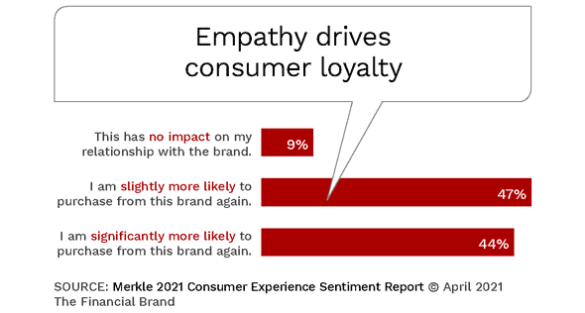

Personalization must go beyond simply knowing the product(s) the consumer owns, the balances in an account, the last transaction or what the customer may have viewed online; it’s about asking for and listening to their dialogue to understand their needs. Once you understand a consumer’s behavior and what they desire, you can personalize communication in a way that exhibits empathy.

According to the Merkle research, 91% of consumers say that “feeling like their needs are being heard” will drive repurchase and loyalty. This relates to higher consumer spending per transaction, more repeat purchases, and more positive brand recognition. Merkle also found that increased engagement and loyalty can also occur when the brand a consumer engages with represents their personal values.

In numerous recent studies, there is evidence of a strong revenue argument to be made in favor of customer personalization. In fact, as personalization increases, a financial institution’s revenue on a customer level tends to increase as well. This is similar to what has been seen in other industries, where Amazon and Netflix have respectively derived 35% and 60% of their sales from personalized recommendations, and where Starbucks’ incremental revenue increased three-fold, via personalized offer recommendations.

With so many reasons to personalize experiences, why has the industry had so many challenges using data, advanced analytics and AI to drive greater personalization? In many instances, it may be because banks and credit unions are trying to solve a bigger problem than actually exists. For instance, as opposed to gathering data from inside and outside the organization, it may be better to focus on data that is already easily accessible.

Key Takeaway:

With heightened expectations about privacy, first party data has become one of the most valuable assets that financial marketers have.

According to Deloitte, banks and credit unions do not need more data to drive better actions … they need to generate more insight from the data they already have, and leverage the insights for improved customer experiences. Simplifying the amount of data used and insights derived will allow banks to create a single view of each customer, micro-segment their customers and make decisions based on real-time data.