In the world of startups, heritage and history don’t count for much, but with traditional financial institutions they can still be tremendous assets when it comes to connecting with consumers. Longevity can communicate stability and provides confidence in institutions that have successfully weathered economic booms and busts. This incumbent advantage, however, can be squandered — sometimes very quick quickly — if reliance on tradition inhibits innovation to meet evolving consumer expectations.

This was the situation in which leaders of a 100-year-old full-service bank found themselves. Declines in customer satisfaction were beginning to manifest in poor customer acquisition and retention performance. The institution, with $75 billion in assets, was up against new market entrants and innovative technologies that were redefining customer expectations and desires. Even more troubling, poor satisfaction cited by existing customers limited the bank’s ability to expand share of wallet by upselling and cross-selling services.

Not to Mince Words:

The bank’s leadership — indeed, the entire organization — had lost touch with their most important assets: customers.

In the analysis that ensued, bank executives came to grips with the fact that they ranked last among peer institutions in customer satisfaction ratings, a factor that was steadily corroding a reputation that had been a century in the making.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Haphazard Feedback Methods Kept the Bank in the Dark

To understand why and how the institution had come to this point, leaders put together a team of internal analysts and external advisors to audit and assess the customer journey. It became clear early in the process that, when it came to customer experience, the bank was largely in the dark.

There was no focused effort around measuring and responding to the customer experience. The management team received email updates highlighting customer feedback only twice per month. The quality, quantity and format (spreadsheets shared via email) of this reporting process was determined to be wholly inadequate, contributing to an inability to take action and resolve customer issues in a timely manner.

While some customer feedback was being captured, it was inconsistent across departments. There was no systematic, enterprise-wide strategy for classifying and tracking metrics.

Moreover, the audit discovered that existing efforts to capture customer feedback were actually hampering — not improving — satisfaction levels. In providing consumers with the opportunity to identify problems, the bank had created the expectation that issues would be addressed. The absence of a response elevated frustration, further harming relationships with customers and damaging the reputation of the institution.

Read More:

- Satisfaction ‘Cheat Sheet’: How the Best Banks Earn High Scores

- Banking Must Measure Customer Experiences Across Entire Journey

- Online Reviews Reveal Blind Spots in Banking Transformation Strategies

Committing to a CX Maturity Model

With the problem now more clearly understood, the bank’s leadership team realized that poor customer satisfaction was an issue of strategic importance that would require dedicated executive attention.

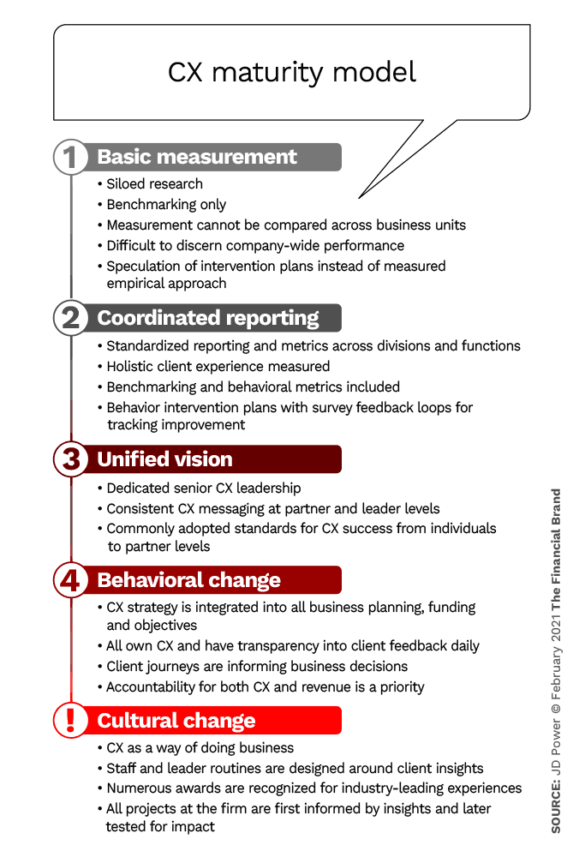

To that end, they created the role of VP Customer Experience and hired a veteran with a specific track record of improving customer engagement in the financial services industry. The executive’s mandate was to implement a change-management initiative to reverse the slide in customer satisfaction. The executive began by applying a CX maturity model to define the long-term objectives and short-term actions that would move the institution from the basic improvements to more advanced stages.

Next, a dedicated customer experience team was built and a new customer engagement research platform was implemented. In addition, an external Research-as-a-Service (RaaS) platform was leveraged to supplement the bank’s research resources, which included business analysts, architects, researchers and data scientists.

With the team in place, the bank undertook a complete redesign of existing customer engagement and tracking programs to create new listening posts, surveys, metrics and methodologies. Integrated processes were also implemented across the institution to respond to customer feedback and inquiries. In so doing, the cadence of reporting was accelerated to a cycle of ongoing daily reports, monthly management performance assessments, and quarterly impact analysis on how improvements were translating into specific business outcomes.

Sagging Satisfaction Turns the Corner

Since the launch of the CX transformation initiative, the bank has experienced sustained improvements in customer satisfaction levels that have affected all areas of the institution. Most importantly, the institutional culture has been transformed to focus on the customer experience, not just by proclamation, but through a methodology and technology infrastructure that delivers a consistent, responsive experience.

Essential Element:

All employees, down to the branch level, have access to real-time survey results and can connect instantly with customers who have had a less-than-stellar experience with the bank.

Further, the bank has identified and communicated a key set of behavioral benchmarks to the entire workforce to improve its Net Promoter Score ratings — the percentage of customers who are likely to recommend a company, a product, or a service to a friend. Specific customer engagement goals and objectives have been set for all employees across the bank.

Having started from the most initial steps of the “Basic Measurement” stage of the CX maturity model, the institution has already progressed through most of maturity Level 2 “Coordinated reporting” and the beginning stages of Level 3 “Unified vision.” Even this partial progression through the model’s stages has dramatically improved the bank’s position in customer satisfaction benchmark reports. The bank rose from the bottom of the pack among peer institutions to above average in the span of two years and is on a path to rank as a top-three performer in its category in 2021.

More importantly, improved customer satisfaction has elevated retention rates, improved share of wallet metrics and contributed to new business development stemming from recommendations and referrals by existing customers.