Consumers are becoming increasingly dissatisfied with the level of support they are receiving from their financial institution around achieving financial wellness on a personalized level, according to the J.D. Power 2022 U.S. Retail Banking Satisfaction Study. Beyond helping save time and money, consumers expect their financial institution to provide personalized advice, hands-on help with problem resolution, and guidance on how to grow their money, states the report.

The challenge in meeting customer expectations was found to be even more acute with digital-centric customers. These customers represent 48% of the total retail banking customer base and have a significantly lower satisfaction score than branch-dependent customers. According to J.D. Power, digital-centric customers are significantly less likely to feel that they have a ‘personal relationship’ with their bank and are less likely to reuse their bank for additional products.

Interestingly, despite the ability to connect digitally with timely advice and offers, digital-centric customers rate their institutions lower than branch-dependent customers across all engagement categories.

“A customer’s definition of what support from their retail bank looks like is changing rapidly as we enter a new economic cycle and move further along the digital adoption curve.”

— Jennifer White, J.D. Power

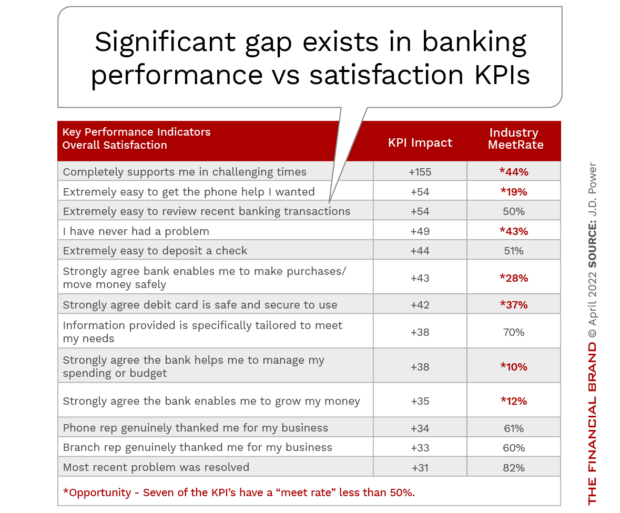

As shown below, it’s no longer predominately about being fast, efficient or convenient. The preeminent performance metric with the biggest influence on customer satisfaction is ‘supporting customer during challenging times,’ and that means customers are expecting a personalized mix of financial advice, hands-on help with problem resolution and guidance on how to grow their money. Failing to provide the level of engagement desired (the industry ‘meet rate’) will have a negative impact on trust and retention at a time when the competition for retail banking relationships has never been more intense.

Read More:

- Top Five Customer Experience Trends in Banking for 2022

- The 6 Process Pain Points that Kill Banking CX

- Why Most Banks Struggle to Deliver a Killer Customer Experience

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Consumers Want Personalized Help Reaching Goals

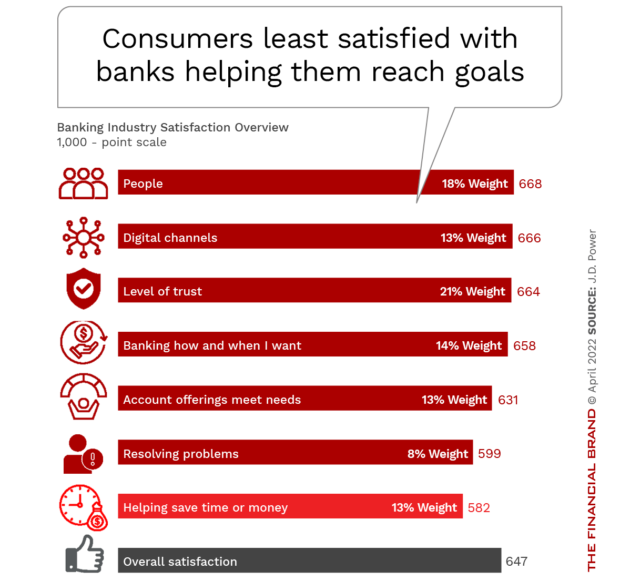

Across the seven factors that drive overall satisfaction, J.D. Power found that ‘helping save time or money’ received the lowest score (582 out of 1,000). Even though this component of satisfaction is a lower-weighted factor, when combined with other factors, such as resolving problems and offering personalized solutions, there is an opportunity for banks to differentiate themselves by focusing on consumer needs as opposed to simply selling services.

When consumers were asked how they would like their bank to personalize their banking engagement, the top responses are related to ‘advice’ and ‘alerts,’ including alerts that could help avoid fees. Customer data-driven digital engagement (SMS texts, mobile banking messages and online banking warnings) provides the most common ways to achieve this level of targeted messaging.

It should be noted that J.D. Power found that different customer segments desire different types of personalized messages, ranging from ways to save money, to contextual offers, to just knowing the customer’s name.

7 Ways to Exceed Customer Experience Expectations

To deliver the experiences customers expect, financial institutions must do more than just invest in technology upgrades. Increasingly, organizations must improve back-office execution that allows for business efficiency, customer experience improvement, and value creation. In other words, the focus on the customer requires starting from within the organization as opposed to simply providing a sleek app.

When deployed in conjunction with improved back-office automation, the combination of customer data and artificial intelligence (AI) can create new opportunities for personalization at scale. Unfortunately, as financial marketers and customer service teams turn to data-driven systems to gain deeper insights, automate decision-making and personalize brand experiences, there’s often a disconnect between the technology’s potential and what it delivers. This speed to market must improve.

Here are 7 proven ways to improve the customer experience at speed and scale:

1. Start Small. The best approach to delivering personalized experiences is to start small and stay focused with your data and AI implementation. Collecting and analyzing customer data is only a starting point. You also need to develop content and strategies that match the customer at the key point of their journey in a personal and contextually relevant way.

2. Believe in Bots. Compared to the chatbots of yesterday, today’s bots use natural language processing to translate requests to intent and AI-enabled knowledge to converse more naturally. This creates better conversations and more powerful conversational intelligence.

3. Move from Transaction to Engagement. To understand the solution that should be offered is not enough. You need to understand how, when and where a customer prefers to engage. You need to leverage the desired mix of digital and physical channels that the customer prefers and the communication channels that will reach customers to drive engagement (web, email, mobile, social media, SMS text, etc.).

4. Understand the Customer’s Destination. To provide the tools needed to help your customer meet their financial goals, you need to understand their desired destination and the path they prefer to take to get there. Similar to a GPS system, you need to help the customer reach their destination with the least amount of detours and friction along the journey.

5. Deploy Insights Across the Organization. The potential of data and AI is reached when organizations move beyond creating great reports to delivering exceptional experiences. This can only be achieved when the data and insights are shared across the entire organization, assisting all departments with enhanced customer engagement and improved innovation.

6. Deliver Instant Gratification. More than ever, financial institutions must leverage technology, data and analytics, and cloud solutions to deliver insights with speed and accuracy. This requires the real-time processing of data to deliver instant engagement using the right channel(s) – seamlessly.

7. Illustrate Empathy. Customers want you to know them, understand them and reward them with solutions that meet their unique needs. This requires that the design and implementation of AI consider empathy across all channels. While some of the listening and understanding skills can be automated, organizations must help agents create empathetic engagements that lead to brand loyalty and share of wallet.

Adding Value Across the Entire Customer Journey

Differentiating based on technological capabilities is becoming more difficult as digital tools increasingly look the same. The key is to find a way to create a unique identity and brand value on the internet.

As shown in the J.D. Power research, financial institutions must go beyond the basics of digital convenience to create increasingly better engagement opportunities. Banks and credit unions must predict customer needs, deliver proactive and personalized solutions, and add value at each step of the customer journey. All this must be achieved with hyper-personalized products and seamless interactions that are supported by a streamlined back-office.

Digital-centric customers should not be ranking financial institutions lower than branch-dependent customers. As stated in an article in the MIT Sloan Management Review, “By mining every touch point; aggregating structured data from customer profiles along with unstructured data from phone and chat logs, emails, and snail mail; and analyzing larger-scale patterns of customer behavior, it’s possible to create a level of personalization that would have been impossible to achieve in the offline world.”

The power of data and insight for delivering personalized engagement has increased exponentially, changing the dynamics of brand advocacy forever.