A bank’s digital presence is the primary space for customer-facing interactions. In the last half-decade, banks and credit unions have managed to transform many routine transactions into simple, digital self-service tasks. But when the inevitable moment comes for banks to play a more hands-on role, human-led conversations are the first rule of engagement.

The ability to have an online conversation with customers is now a baseline requirement for any organization rolling out a digital offering. For most consumers, engagement via messaging channels is a service expectation of any brand.

This is an uncomfortable truth for financial institutions. Why? Too many customers have come to associate online conversations about their finances with chatbots that can’t answer complex questions and result in frustrating resolution times. Clearly, banks aren’t leveraging the true potential of conversational customer service.

Certainly, these types of interactions have tended to fall into a banking blind spot. While many have capitalized on the value of conversational technology as a way to cut service costs, there is less emphasis on using artificial intelligence (AI) and online conversations as a channel for building better customer relationships. The result is customer experience gaps—and the implication for banks and credit unions is lost revenue. Consider this:

88% of customers say the experience a company provides is as important as its product or services — a jump from 80% in 2020, according to the 2022 Salesforce State of the Connected Customer report.

Curbing these outcomes takes a considered approach. To start, financial institutions should reflect on their use of the chatbot.

The Key to Customer Happiness:

Nearly nine out of ten people say the customer experience matters more than both products and services.

Why Chatbots Are Not a Catch-All Solution

Problematically, chatbots and conversational banking have almost become synonymous. But here’s the difference: while conversational banking is better defined as an umbrella category, chatbots are only a subset of possible interactions. Furthermore, chatbots often are configured simply as an interactive FAQ page, unable to handle complex questions, which leads many chatbot deployments to get an underwhelming response from users.

Despite their limitations, chatbots do hold promise. The key for banks and credit unions is identifying how and where chatbots might genuinely be useful to customers. For simple inquiries, such as branch hours and locations, and other repetitive questions, chatbots can easily alleviate the burden on human support resources. However, for more complex questions, it becomes clear that chatbots need to support seamless integration with human support to deliver better customer experience.

4 Benefits of a Hybrid Approach to Conversational Banking

It’s easy to program a virtual assistant to start a simple conversation, but continuing a conversation is where technology falls short — and people thrive. This is precisely why a hybrid approach is more effective, recognizing that complex conversations require people on both sides, whether on a mobile app, e-banking portal or in-person.

In banking, dead-end conversations with chatbots have propagated the false division between quality customer service and cost-effective operations. Done right, conversational banking can stimulate both. A digital ecosystem that relays conversations between bots and human agents saves banks and credit unions time and money, and even adds value by enhancing the customer experience.

Hybrid conversational engagement can boost revenue and relationships in four key ways.

1. Two Key Dimensions of Personal Service

The past few years have seen a surge in use of self-service among banking customers. The rise of 24/7 customer service culture has mandated that financial institutions make routine transactions as accessible as possible, while the paradigm of “hyper-personalization” has also put pressure on institutions to actually anticipate customer needs and individualize offers accordingly.

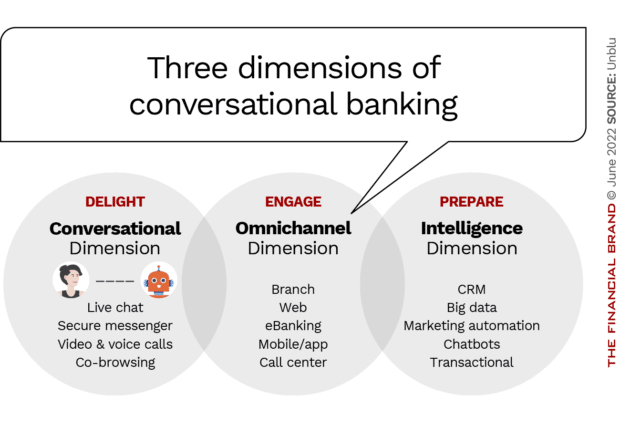

This level of customer service, which is now common among major banks, requires two “layers”: the intelligence dimension and the omnichannel dimension. The intelligence dimension functions as a repository of customer data and information, making it possible to offer a personalized experience.

The omnichannel dimension comprises applications and traditional channels that enable the fulfillment of transactions. The key offering of this dimension is the element of flexibility, giving customers the option to go into their app, connect to a call center, or even in-branch if they wish.

2. Adding a Conversational Dimension

Conversational banking entails a third dimension that is underutilized by financial institutions. As a set of integrated conversational features, it represents a tremendous opportunity to define a personalized service and build stronger relationships with customers. Leveraging on an omnichannel presence, the conversational dimension could provide anything from AI-led chats to agent-advisor video calls.

The real value, however, is that adding a conversational dimension gives banks and credit unions the ability to turn run-of-the-mill transactions into interactions. In the absence of frequent contact with customers by default, this is vitally important. Human conversations are an opportunity to consolidate relationships and personalize service, driving long-term value and revenue.

3. Leveraging Hidden Opportunities

The digital world houses countless opportunities for customer conversations. For example, customers often desire the convenience of a digital channel but require the nuance and familiarity of a human conversation if a problem arises. This stage of the customer journey, often referred to as “the moment of truth,” is a hidden chance to deepen the bank-customer relationship by stepping in to assist at exactly the right time.

The hidden opportunities for human conversations also add value to a digital offering, which amounts to quantifiable value in terms of revenue. For instance:

- Customers served by omnichannel services are a valuable subset of banking clientele, according to McKinsey. Those who interact through multiple channels hold 80% more products with the bank and generate more than twice the revenue as customers who only interact through a single channel.

- Digital sales matter, states Deloitte, especially when it comes to complex products. By the beginning of 2021, 61% of total loan sales among U.S. banks were completed on digital channels, up from just 39% one year prior.

- More intuitive conversations create savings for financial institutions. Unblu has seen that implementations of conversational digital tools can reduce customer support costs by 50%, and acquisition costs by 60%.

The conversational dimension of digital banking is rich with opportunities — for both revenue and relationships. And, as the demand for humanized services suggests, the two are likely to go hand-in-hand.

4. Increasing Customer Satisfaction

In an environment riddled by fraud, mistrust of institutions and false information, banks today are under pressure to prove they have their customers’ best interests at heart. Hybrid banking experiences are the clear way to bridge this gap, notes Ernst & Young, and customers are specifically seeking services of this kind.

Conversational banking is a key feature of a hybrid customer experience, unifying the digital dimension with the human element of natural, real-time conversation.

Keep in Mind:

Without a human-led component of the banking experience, today’s customers are unlikely to grant banks their trust.

Equally, a conversational offering taps into the popular appetite for personalized services. By first leveraging the power of data and AI to generate tailored insights for every banking customer, banks and credit unions can then deliver individualized offers in their exchanges with customers — be it via video, messenger or phone call.

This represents the customer-centric evolution of the age-old blast email tactic. While a generalized communication is unlikely to get much engagement, a personalized message delivered on the customer’s terms simulates the everyday experience of picking up the phone when a text or call comes through. Needless to say, the outcome will be a more fulfilling client experience that lends itself to long-term value.

Optimizing Advisor and Agent Efficiencies

So, what about those who have client-facing roles? On the surface, it might seem that conversational banking creates more work for agents and advisors by raising the bar for customer interactions.

This is where the value of a hybrid approach to conversational banking comes into its own. A chatbot can handle the conversation with a customer up to a certain point, and then hand it over to a human agent once the content of the interaction becomes better suited to a conversation.

The assistance of a chatbot in the initial interaction — as an interactive FAQ-style system or as a “concierge” that qualifies the customer request — is enormously helpful for administrating customer support. Customers will likely be content to resolve basic requests through a powerful AI chatbot that is fit for purpose.

Fundamentally, a hybrid conversational banking strategy will ensure that agents are spending valuable time on qualified interactions. Not only does this limit the volume of requests, but it also ensures that every conversation between an agent and customer is meaningful.

In the long run, supporting customers with human-led advice should give them more substantive knowledge on personal banking, helping to avoid repeat calls. By freeing up agents’ time and satisfying customer queries with a conversation, banks and credit unions can expect to boost their bottom line.

Additional Resource: Whitepaper: Thinking Outside the Bots

Conversation: At the Heart of Customer Experience

In our rush towards technological transformation, the miscalculation made by many has been attempting to mechanize elements of customer service that used to be innately human.

It’s time that banks and credit unions dropped the idea that this will save them time and money, and flipped this approach on its head. Automation should be a considered, justifiable decision — and financial institutions should look to humanize their digital offerings as much as possible. For that, conversational banking might be the missing piece of a revenue-boosting digital strategy.