In the wake of the financial turmoil triggered by the failure of Silicon Valley Bank and Signature Bank, banking providers of all kinds — banks, credit unions, fintechs and more — must engage in proactive outreach to instill customer confidence.

People are feeling anxious about the safety of their deposits and about the banking industry in general. They will gravitate toward brands that offer ample support and provide reassuring answers.

So go beyond run-of-the-mill FAQ documents to ensure customer concerns are being handled with care. Brands make themselves more approachable during a crisis by educating and informing and by using a conversational and empathetic tone in their messaging.

What follows are three effective approaches to customer communications when navigating a crisis like the one that has been roiling the banking industry since deposit runs toppled two banks in two days.

It is a crisis where customer confidence matters more than ever, given the contagion that bank runs can create. So the communications strategy plays an outsize role.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Tactic #1: Ramp Up Social Media Engagement to Humanize Your Brand

One of the ripple effects from the Silicon Valley and Signature bank failures was the impact on other large regional banks. Though bank stocks in general fell in the days after the failures, large regionals plummeted.

A new emergency liquidity program created for banks and credit unions had many takers, as the threat of destabilizing bank runs continued to loom large.

It wasn’t just a matter of perception either. Across the industry, bank withdrawals were on the rise. Consumers moved their deposits to perceived safety — with the megabanks among the biggest beneficiaries.

In response to these dynamics, some banks stepped up their social media presence to prevent a self-fulfilling prophecy fueled by consumer concerns. By implementing a bootstrap approach and publicly addressing questions, many banks and fintechs provided active customer support during a time of immense pressure.

Their customer-facing communication tactics helped humanize their brands. With their actions, they reinforced a commitment to delivering customer service in a more personal manner.

This is crucial, as our research shows. Mintel Comperemedia found that nearly half of financial services customers cited poor customer service as a driving force in their decisions to switch to a new banking provider.

See below how social media helped Varo and First Republic Bank in San Francisco humanize their brands.

Varo, which started out as a neobank but now has a bank charter, used Twitter to not only offer its customers’ peace of mind by reassuring them that their money is always safe, but also to respond to questions and concerns.

First Republic, which, prior to the crisis, had not tweeted since November 2022, has been taking to Twitter to emphasize its commitment to its customers and actively engage with those who have shared positive sentiments of support. Given its specialization in wealth management and high level of uninsured deposits, the bank has been feeling the brunt of anxious investors and depositors in the wake of the two bank failures, so much so that roughly a dozen large banks have subsequently rushed to its aid with billions of dollars in deposits to help prevent it from running aground and, thus, causing further risk of a widespread panic.

See all of our latest coverage of social media in banking.

Tactic #2: Take a Conversational Approach and Share Lots of Information

JPMorgan Chase stood out for hosting a webinar for its customers. It emailed customers on Monday, March 13, the first weekday following the two bank failures, to invite them to a webinar titled, “What we know, and don’t know, about the recent bank developments.” The webinar took place Wednesday, March 15.

Such proactive customer support speaks to a brand’s customer care strategy.

Some brands utilized a newsletter or a tweet to educate customers about the events in an explanatory way or in a Q&A style.

Mercury, a fintech that focuses on offering banking services to startups, encouraged its Twitter followers to comment on its tweet with any questions about the Federal Deposit Insurance Corp. or “banking best practices.” It offered support from external experts to help answer the questions people had.

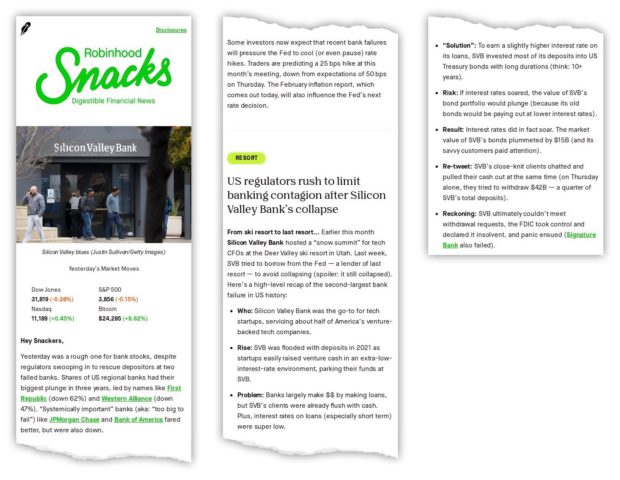

Robinhood, a fintech with a commission-free investing and trading app, used its newsletter alerts, called Robinhood Snacks, to engage with customers on the news about the two bank failures. It sent a descriptive newsletter explaining the economic situation in simple layman’s term, with the subject line “Silicon Valley spillover.”

Acorns, a fintech that specializes in micro-investing and robo-advice, summarized the events in its weekly newsletter, with the subject line “How your money is protected.” The content of the newsletter elaborated on “what happened, how is my money protected, and where do we go from here.”

The investment banking giant Morgan Stanley uploaded a four-minute YouTube episode to its channel. Called “Mike Wilson: What Bank Wind-Downs Mean for Equities,” the video aimed to explain market pressures and their impact on the economy and equity.

First Citizens Bank in Raleigh, N.C. shared an update via a Twitter post, summarizing the regulatory response, and featuring information like rate charts, yields and spreads.

Read more: Why Silence Isn’t Golden on SVB and Signature Bank Failures

Tactic #3: Consider Extending Hours and Access

Two banks stand out for the way they have taken proactive steps to provide additional support to new and existing customers and they are both called Citizens.

One of the large regional banks, Citizens Bank in Providence, R.I., announced on Monday, March 13, that it would be temporarily extending branch hours across its footprint due to “higher than normal interest from prospective new customers over the past few days” and to “support potential new customers as they navigate ongoing uncertainty.”

In an Instagram Story post, Citizens, which is the 14th-largest bank in the country, said that it was “ready to serve our customers and communities,” with a link to the announcement.

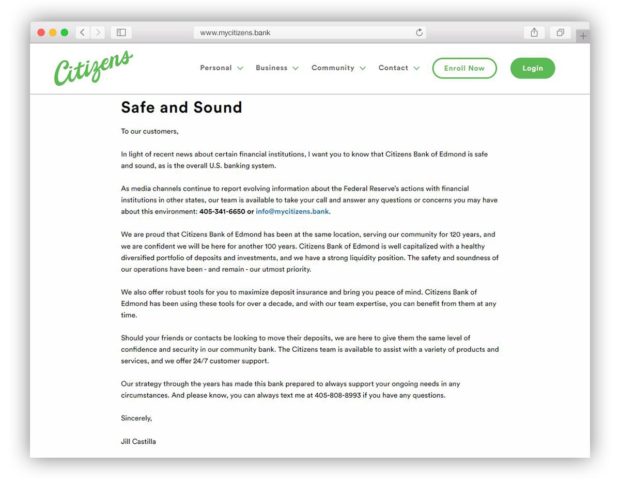

On that same day, another Citizens at the opposite end of the size spectrum, and far away in Oklahoma, was sending out similar messages. Jill Castilla, the chief executive officer of Citizens Bank of Edmond, published an open letter and video message to customers on its website. Castilla provided an email address that customers could use to get answers to “any questions or concerns you may have about this environment.” She even provided her personal cell phone number for customers to text her with questions.

On that same day, another Citizens at the opposite end of the size spectrum, and far away in Oklahoma, was sending out similar messages. Jill Castilla, the chief executive officer of Citizens Bank of Edmond, published an open letter and video message to customers on its website. Castilla provided an email address that customers could use to get answers to “any questions or concerns you may have about this environment.” She even provided her personal cell phone number for customers to text her with questions.

The $350 million-asset Citizens Bank of Edmond also welcomed new customers with open arms. Its message to existing customers was: “Should your friends or contacts be looking to move their deposits, we are here to give them the same level of confidence and security in our community bank.” The bank noted that it has options to ensure deposits beyond the FDIC limit of $250,000 as well.

What an Effective Customer Communication Strategy Looks Like

Communication is key for all banking providers right now.

Openly and honestly communicating with customers about the Silicon Valley and Signature bank failures and the fallout will help create a sense of trust. Just be sure to keep the messaging transparent and empathetic.

Offering resources and expressing a willingness to help resolve issues are the next steps, which will go a long way toward helping ease stress and anxiety for consumers.

All of this also will go a long way toward positioning your brand as a trusted adviser at a time when so many need one.

About the authors:

Nicole Bond is associate director for marketing strategy and Anjali Ambani is research manager for financial services at Mintel Comperemedia.